Continue the conversation…

Log in to your account or start a free trial to continue your conversation and access history.

We track and compare the world’s companies.

You stay ahead of changing markets and competitors

Fortune favors the data-driven. The top

10 Fortune 500 firms trust CB Insights.

Fortune favors the data-driven. The top 10 Fortune 500 firms trust CB Insights.

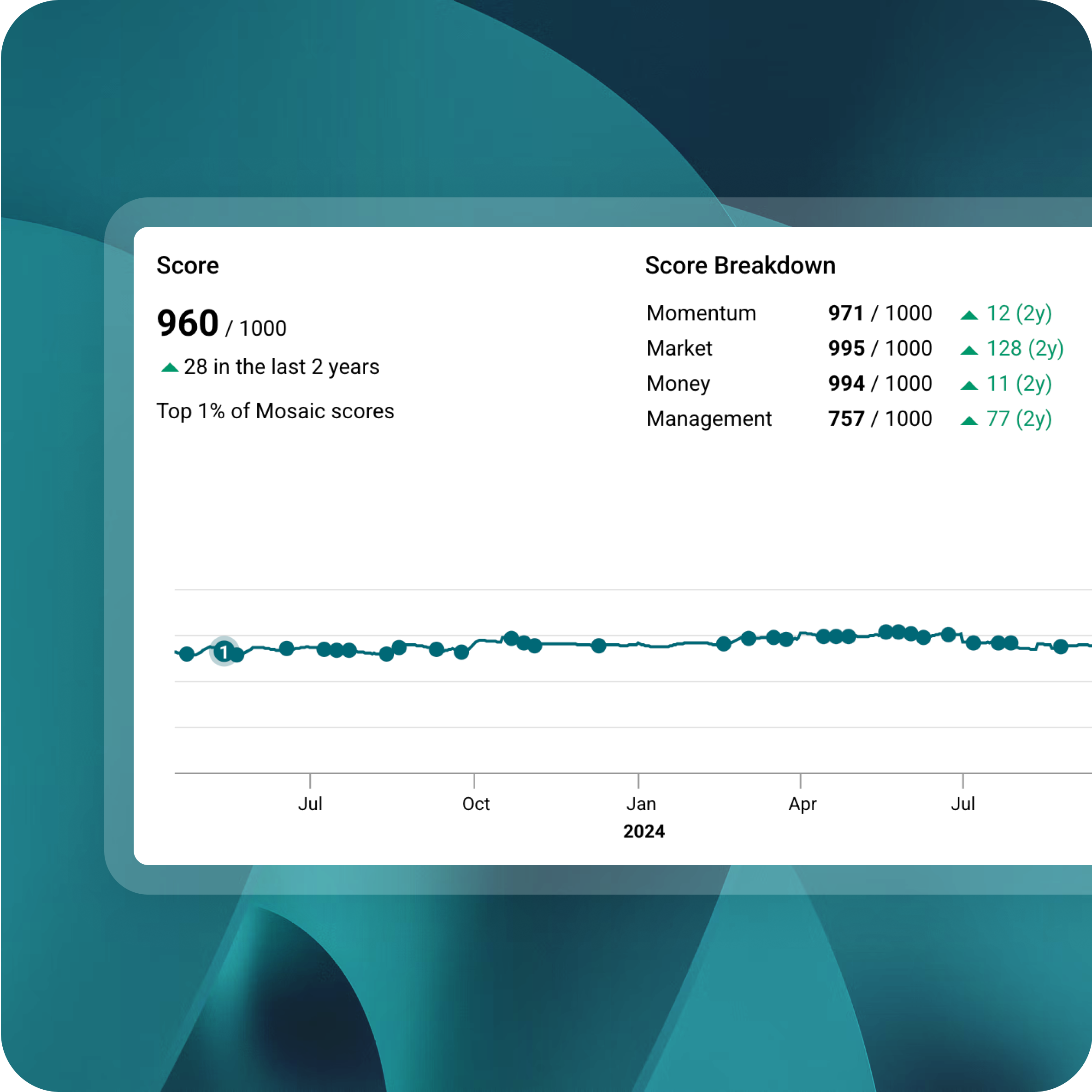

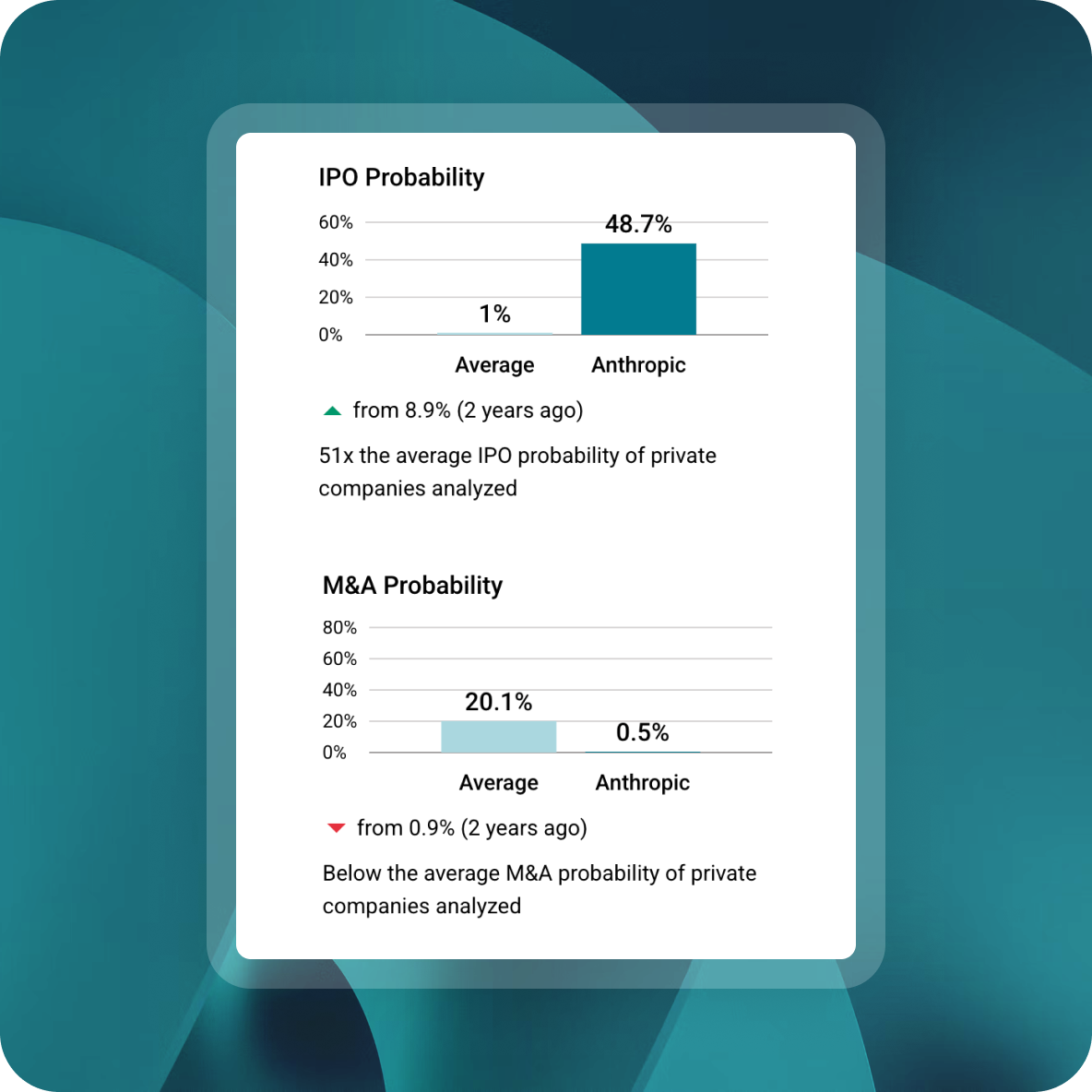

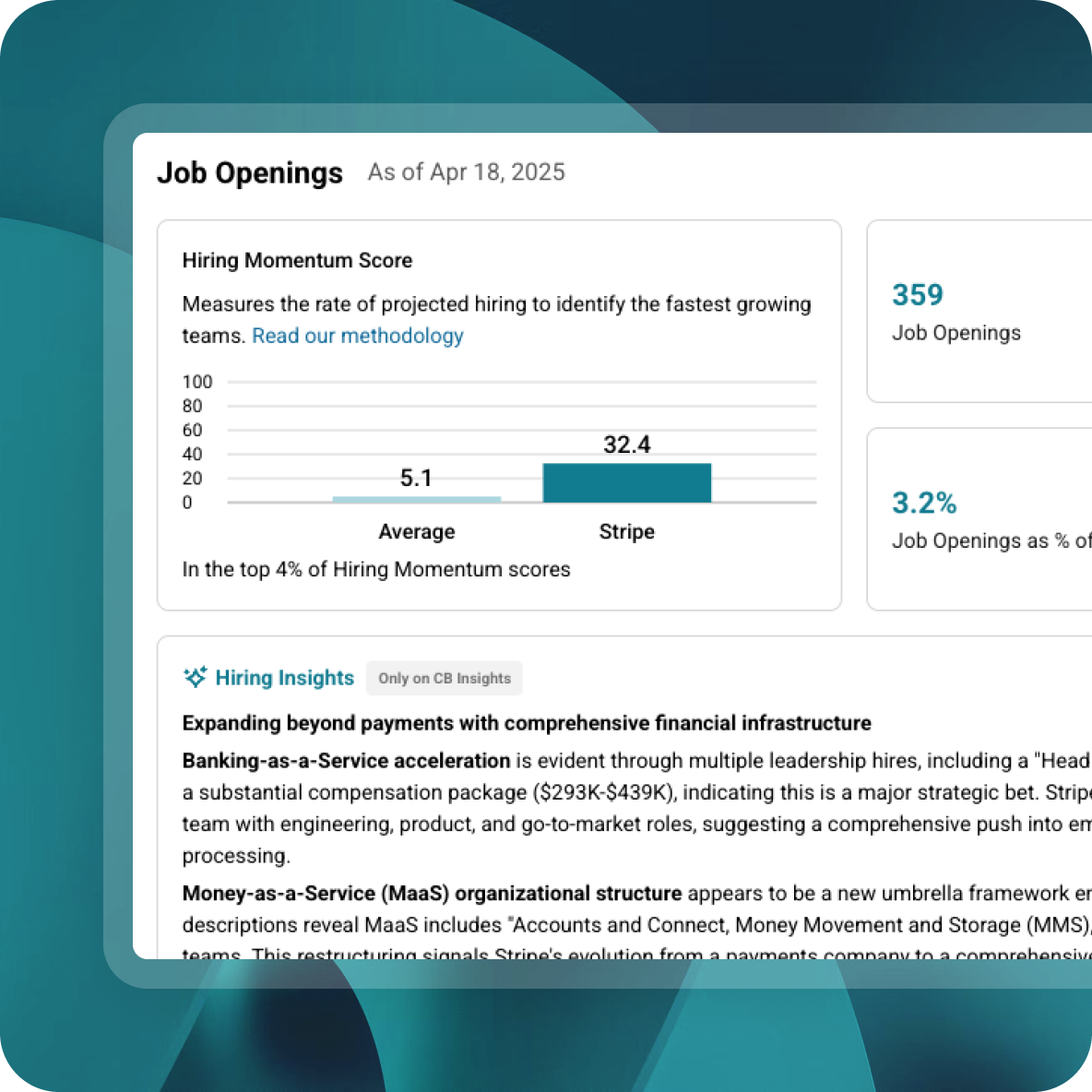

The Business Graph is our predictive model of the world’s companies and markets. Compare and contrast strengths, weaknesses, likelihood of success, management team quality, customer relationships, financial health, and more. Beyond historical data — see what’s next.

From signal discovery to confident action. Get the insight you need at every step.

“Real-time visibility into every emerging tech market.”

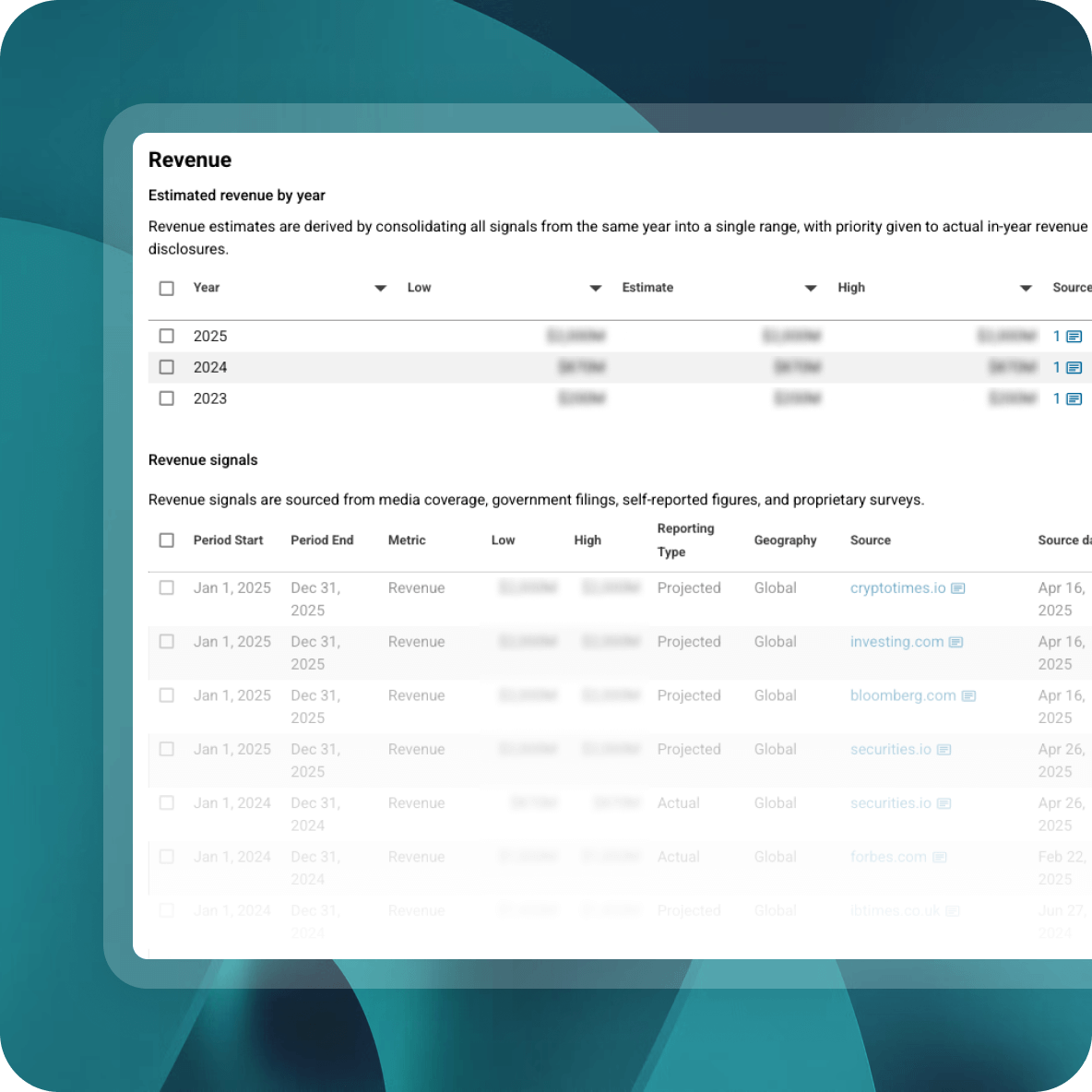

We aggregate and verify data, transforming it into insights you can trust.

Rigorous data collection through automated and manual processes

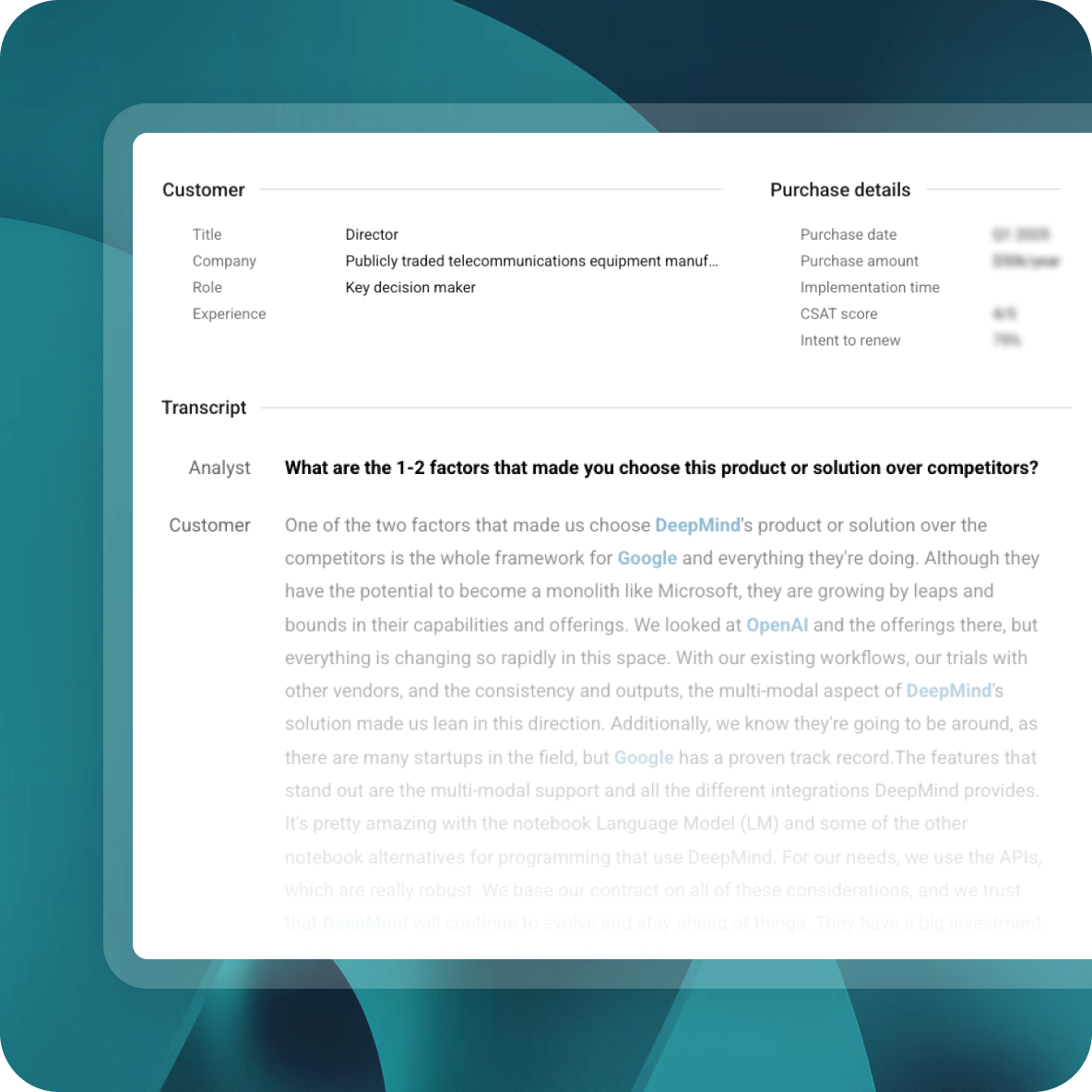

Rich data sources across primary and secondary sources

Automated checks with machine learning and automation

Human oversight by data analysts and an expert research team

“We’ve taken the guesswork out of innovation.”

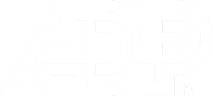

Evaluates overall health and growth potential of private companies based on performance, financial stability, market conditions, and management strength.

“Helps us compress our time-to-decision.”

Transform how your organization makes strategic decisions. Our customers grow revenue 48% faster, develop ideas and turn them into strategy and execution more than 3X faster, and save millions on preventing misguided investments.