Zilch

Founded Year

2018Stage

Line of Credit | AliveTotal Raised

$581.36MLast Raised

$64.8M | 9 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+53 points in the past 30 days

About Zilch

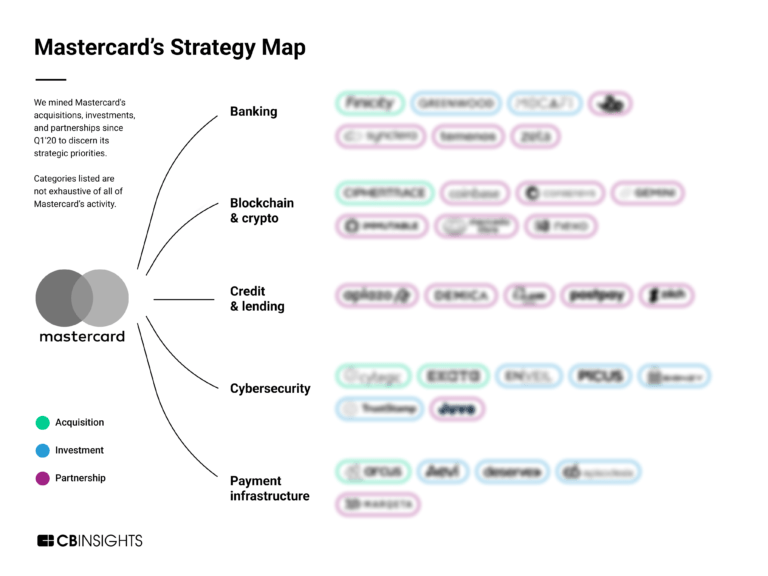

Zilch provides buy now pay later services across various online retail sectors. The company offers a payment solution that allows customers to make purchases and pay for them over six weeks. It primarily serves the ecommerce industry with its virtual Mastercard. The company was founded in 2018 and is based in London, United Kingdom.

Loading...

Zilch's Product Videos

ESPs containing Zilch

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The buy now pay later (BNPL) — B2C payments market offers a flexible payment solution for consumers, allowing shoppers to make purchases and split the cost into multiple installments, typically interest-free. BNPL solutions provide an alternative to traditional credit cards and enable customers to make purchases without upfront payment or the need for a credit check. BNPL solutions typically offer…

Zilch named as Challenger among 15 other companies, including Klarna, Affirm, and PayPal.

Zilch's Products & Differentiators

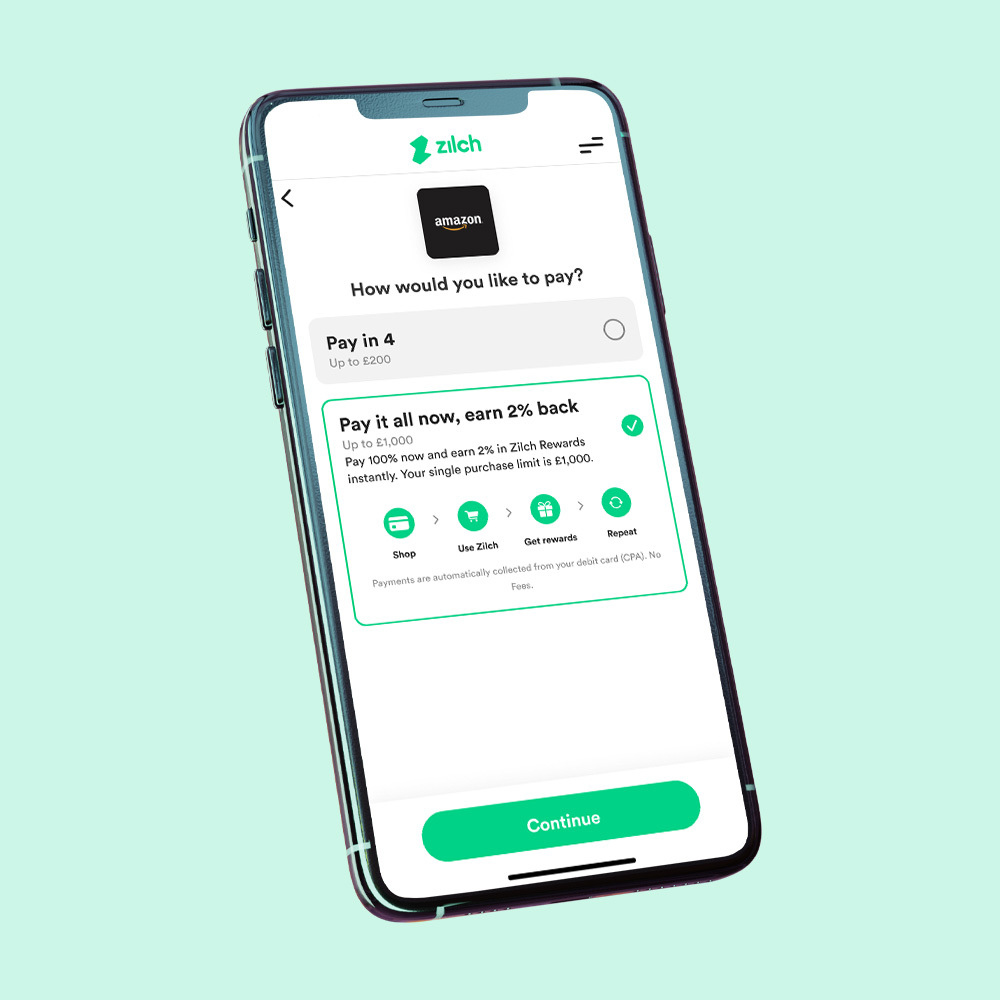

Pay in 1

Pay online or Tap & Pay anywhere in one and receive immediate cash back

Loading...

Research containing Zilch

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Zilch in 1 CB Insights research brief, most recently on Aug 22, 2022.

Expert Collections containing Zilch

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Zilch is included in 6 Expert Collections, including E-Commerce.

E-Commerce

11,558 items

Companies that sell goods online (B2C), or enable the selling of goods online via tech solutions (B2B).

Unicorns- Billion Dollar Startups

1,276 items

Digital Lending

2,661 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Payments

3,198 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,978 items

Excludes US-based companies

Fintech 100

249 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Zilch Patents

Zilch has filed 6 patents.

The 3 most popular patent topics include:

- credit cards

- merchant services

- online payments

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

10/28/2020 | 12/31/2024 | Payment systems, Payment service providers, Merchant services, Online payments, Credit cards | Grant |

Application Date | 10/28/2020 |

|---|---|

Grant Date | 12/31/2024 |

Title | |

Related Topics | Payment systems, Payment service providers, Merchant services, Online payments, Credit cards |

Status | Grant |

Latest Zilch News

Jun 21, 2025

66% of UK Shoppers Still Carrying a Physical Card Despite Digital Wallet Popularity Like Read Time: min Digital wallets have changed the commerce industry in the last couple of years. They provide numerous features that users are looking for, such as safety and convenience, and the number of users has been rising for a while now. However, the integration isn’t quite complete, and research shows that many users still prefer physical cards. This is an interesting statistic that the commercial industry should be aware of and act upon, even as it continues to push for digitalization. In this article, we’ll delve into the details of this statistic and explore how it informs both users and service providers. The Research A study conducted among the UK Generation Z revealed an interesting phenomenon. The youngest generation of shoppers prefers using physical cards when shopping and uses them on almost a daily basis. As many as 63 percent of Gen Z shoppers prefer to use a card over a digital wallet. The number is even higher for boomers at 77 percent. The research also shows that users insist on using the cards, not just prefer them. This is an interesting development, given that this generation is the most tech-savvy. The poll also shows that only one percent of Gen Z shoppers use digital wallets as their preferred payment method. Use of Digital Wallets At this point, there are approximately 3.4 billion digital wallet users worldwide. That’s approximately 43 percent of the world’s population. It’s supposed to rise to 60 percent by 2026. However, some predict that it won’t, as it’s the younger generations that are starting to refuse it. Global transaction volume is approximately $9 trillion per year, and it’s expected to rise, potentially tripling that amount by 2028. An average US user spends approximately $3,600 a year using their digital wallet alone. Crypto Wallets As of the time of ]writing, there are approximately 220 million users of crypto wallets. The numbers are also increasing every year as cryptocurrency becomes more widely accepted. About 30 percent of users make daily transactions using their wallets. Even the world of cryptocurrency mining is no longer tied to expensive physical equipment. Instead, it, too, is digital, and the best Bitcoin miners use apps that pool the resources of different investors. Such an approach is far less expensive and less damaging to the environment, as crypto mining consumes a significant amount of energy. Gen Z Complaints about Digital Wallets Gen Z members have a few different complaints about the use of digital wallets, most of which are somewhat justified. Some of these are about the attitudes that generations have toward finance, and others are about their attitudes toward technology. Many have noticed that, in both regards, Gen Zers are different from previous generations in that regard. Fear of Hacking Many Generation Z claim that they don’t trust digital wallets as they are afraid of hacking and losing their assets and personal information. Hacks pose a threat to digital wallets, but wallet providers employ numerous security measures to mitigate this risk. Users can also implement safe practices to increase their overall security. Distrust in New Tech Many have observed that Gen Z is less tech-savvy than previous generations and less inclined to adopt new technology. They also show distrust towards new technology in general, and digital wallets are included in this. Skepticism of Biometrics Digital wallets often utilize biometrics to enhance security for their users. Biometrics are also more convenient than using any other password to protect the assets. However, Gen Z users often prefer not to provide their fingerprints or any other biometric data to a digital wallet provider. As biometrics become more invasive, with the use of eye scanners and even blood samples, the distrust will increase. Digital Wallets Introduce Physical Cards Some digital wallet companies have adopted a new business model in response to the behavior of their Gen Z users. They used to be digital products only, but they wanted to branch out and find a customer base among younger demographics. This has led them to introduce physical cards connected to their wallets as a part of their overall offer. Such an approach makes Gen Z users more comfortable, and as they become a larger part of the market, the companies will continue to adjust to their needs. Joe Zender, Chief Product Officer at Zilch, commented: “Digital payments have been transformational for shoppers, but consumers of every generation are holding onto their physical cards. People still love to know they can buy what they need even if their phone’s battery runs flat. That’s why we’re giving people the option of having a new physical card, so they can get the full benefit of using Zilch whichever way they pay.” Environmental and Ethical Concerns When digital wallets were first introduced, they initially appeared to be an environmentally friendly option, as they neither required nor generated plastic waste. A completely digital product never had to be replaced and couldn’t be thrown away. However, the day-to-day use of digital products and public awareness of how they work changed this outlook. Digital wallets consume a significant amount of energy, especially when designed for cryptocurrencies. This creates a bigger environmental issue than plastic in the long run. Gen Z users care deeply about the environment, which leads them to abandon the product or at least to have strong reservations about it. What Will Retailers Do? Retailers and developers have taken note of the Gen Zers and their approach to digital wallets. They will have to adapt and change to it, as retailers must, in order to attract new users and customers. It is likely that they will initiate the hybrid approach. This means they will provide their services for both those who use physical cards and those who pay with digital wallets. The costs of setting up and running both systems will likely be passed on to users and customers, at least in the long run. The Future Digital wallet technology is relatively new, and it’s challenging to predict how it will evolve and change in the future; however, it’s likely to do so rapidly. The future of digital payments will likely have nothing to do with cards or phones. Some of the innovative approaches to payments include wearables (such as bands or watches) and voice-activated payment systems. These are already in use, and they’ll continue to improve in the years to come. At the same time, no one knows what new systems may emerge as technology improves. To Sum Up As many as 66 percent of Gen Z users say that they prefer physical cards to digital wallets as a payment method. This occurs with both cryptocurrency and fiat money payments. Young users believe that digital wallets aren’t safe and that they have a negative impact on the environment. Some digital wallets have introduced physical cards as a way to connect with Gen Z. In the coming years, the entire field may undergo significant changes with the introduction of novel payment methods. Retailers will also adapt and offer multiple payment options, allowing them to tailor their offerings.

Zilch Frequently Asked Questions (FAQ)

When was Zilch founded?

Zilch was founded in 2018.

Where is Zilch's headquarters?

Zilch's headquarters is located at 111 Buckingham Palace Road, London.

What is Zilch's latest funding round?

Zilch's latest funding round is Line of Credit.

How much did Zilch raise?

Zilch raised a total of $581.36M.

Who are the investors of Zilch?

Investors of Zilch include Deutsche Bank, Leading European Tech Scaleups, eBay Ventures, Gauss Ventures, Ventura Capital and 7 more.

Who are Zilch's competitors?

Competitors of Zilch include Hokodo, The Very Group, BharatX, Tabby, Klarna and 7 more.

What products does Zilch offer?

Zilch's products include Pay in 1 and 2 more.

Loading...

Compare Zilch to Competitors

Klarna provides payment solutions and shopping services. The company offers price comparison, installment payments, and consumer financing for online shopping. Klarna serves the ecommerce industry, providing services to both consumers and retailers. Klarna was formerly known as Kreditor . It was founded in 2005 and is based in Stockholm, Sweden.

Payl8r is a company that provides retail finance solutions in the financial services sector. It enables businesses to offer payment options that allow customers to finance purchases over time. Payl8r serves the ecommerce and retail sectors. It was founded in 2014 and is based in Manchester, England.

PayItLater is a financial services company specializing in deferred payment solutions for the e-commerce sector. The company offers consumers the ability to make online purchases and pay for them over time through interest-free installment plans, with instant credit approvals and no impact on credit scores. PayItLater also provides merchants with plugins for major e-commerce platforms, enabling them to offer live deferred payments to customers. It is based in New South Wales, Australia.

SplitIt provides card-linked installment payment solutions within the financial technology sector. The company offers a platform that allows merchants to provide consumers with the ability to pay for purchases in installments using their existing credit cards, without the need for new loans or applications. SplitIt serves various industries, including automotive, consumer electronics, education, and healthcare, by providing services such as e-commerce installments, omnichannel payment solutions, and a 'pay after delivery' option. SplitIt was formerly known as PayItSimple. It was founded in 2012 and is based in Atlanta, Georgia.

Butter focuses on financial services in the e-commerce sector. It offers a service that allows customers to make online purchases and pay for them over time, including for items such as travel, fashion, tech, and home goods. The company primarily serves the e-commerce industry. Butter was formerly known as Awaymo. It was founded in 2017 and is based in London, United Kingdom.

Atome provides payment services within the financial technology sector. The company allows consumers to split purchases into installment payments without interest. Atome serves the retail industry by partnering with various online and offline merchants to facilitate consumer spending. It was founded in 2019 and is based in Singapore.

Loading...