Xendit

Founded Year

2014Stage

Option/Warrant - II | AliveTotal Raised

$515.01MLast Raised

$16.2M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-65 points in the past 30 days

About Xendit

Xendit is a financial technology company that specializes in payment solutions within the fintech sector. The company offers a range of services, including a payment gateway that enables businesses to accept various payment methods, disburse funds through automated and on-demand systems, and manage operations with tools for marketplaces, financing, and mobile applications. It was founded in 2014 and is based in South Jakarta, Indonesia.

Loading...

Xendit's Products & Differentiators

xenplatform

A solution for marketplaces and platforms, where customers can manage payments for sub-merchants, franchises or different branches. The feature allows Platform businesses to more simply monetize when offering payments. Merchants can charge a flat or percentage fee that will be automatically transferred to their platform account when payment has settled. Xendit is the first company in Indonesia to provide this feature, enabling marketplaces and platforms to launch and scale very quickly. For example, Xendit’s customer launch for xenplatform saw 100,000 sub-merchants in one weekend.

Loading...

Research containing Xendit

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Xendit in 2 CB Insights research briefs, most recently on Mar 14, 2023.

Mar 14, 2023 report

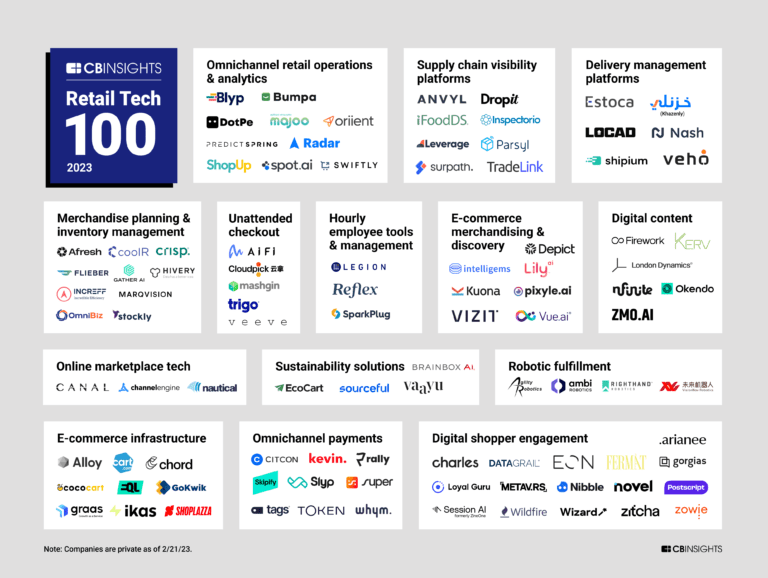

Retail Tech 100: The most promising retail tech startups of 2023Expert Collections containing Xendit

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Xendit is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,277 items

Payments

3,198 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,978 items

Excludes US-based companies

Fintech 100

499 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Retail Tech 100

100 items

The most promising B2B tech startups transforming the retail industry.

Latest Xendit News

Jun 4, 2025

Behind the Unicorn: The Startup Struggles You Don’t See Ft. Tessa Wijaya, Xendit Get the hottest Fintech Malaysia News once a month in your Inbox In this episode of Fintech Fireside Asia, I sit down with Tessa Wijaya, Co-founder and COO of Xendit, one of Southeast Asia’s leading fintech unicorns. Known by many as the “Stripe of Southeast Asia,” Xendit has raised over $500 million and powers billions in annual payments across Indonesia, the Philippines, and beyond. But behind the billion-dollar valuation lies a much grittier story. Tessa opens up about: What it really took to build payment infrastructure in Southeast Asia The system crash that nearly broke Xendit

Xendit Frequently Asked Questions (FAQ)

When was Xendit founded?

Xendit was founded in 2014.

Where is Xendit's headquarters?

Xendit's headquarters is located at Jalan Sultan Hasanudin No.47, South Jakarta.

What is Xendit's latest funding round?

Xendit's latest funding round is Option/Warrant - II.

How much did Xendit raise?

Xendit raised a total of $515.01M.

Who are the investors of Xendit?

Investors of Xendit include Accel, Amasia, Tiger Global Management, Goat Capital, Coatue and 13 more.

Who are Xendit's competitors?

Competitors of Xendit include LinkAja, Maya, Shinhan Indonesia Bank, Red Dot Payment, PayMongo and 7 more.

What products does Xendit offer?

Xendit's products include xenplatform and 4 more.

Who are Xendit's customers?

Customers of Xendit include Papaya Tree Farms, KESAN and IndonesiaPastiBisa.

Loading...

Compare Xendit to Competitors

Maya is a financial services platform operating in the digital banking and payments sector. The company offers services including digital banking, cryptocurrency trading, personal loans, and a credit card. Maya serves consumers and businesses seeking financial services and digital payment options. Maya was formerly known as Voyager Innovations. It was founded in 2013 and is based in Mandaluyong City, Philippines.

GCash is a provider of mobile financial services in the fintech industry. The company offers a digital wallet that facilitates various financial transactions, including bill payments, online shopping, and remittances, as well as services for investing in stocks and minting non-fungible tokens (NFTs). GCash serves individual consumers and businesses seeking financial services. It was founded in 2004 and is based in Taguig, Philippines.

Boost is a financial technology company that offers a spectrum of digital financial services across various sectors. The company provides an application for personal finance management, business financing, and enterprise payment solutions. Boost primarily serves the e-commerce industry and small and medium businesses and aims to expand its footprint in the digital banking sector. It was founded in 2017 and is based in Kuala Lumpur, Malaysia.

Flobiz is a neobank that provides financial solutions for small and medium businesses. Its main product, myBillBook, offers a GST billing and accounting solution that includes features for invoicing, inventory management, business analytics, and payment processing. The company's services are intended to support the digitization and growth of SMBs. It was founded in 2019 and is based in Bengaluru, India.

Transportasi Jakarta is a public transportation provider focused on bus services. The company offers a range of bus transit services designed to facilitate urban mobility. Its main offerings include regular bus routes, ticketing information, and transit infrastructure development. It was founded in 2004 and is based in Jakarta, Indonesia.

PayMongo is a financial technology company that specializes in online payment processing for businesses. The company provides a suite of tools that enable merchants to accept various payment methods, including e-wallets, credit cards, and buy now, pay later options, through customizable checkout experiences and integration APIs. PayMongo primarily serves businesses looking to streamline their payment systems and enhance their e-commerce capabilities. It was founded in 2019 and is based in Taguig City, Philippines.

Loading...