Viva Wallet

Founded Year

2010Stage

Shareholder Liquidity | AliveTotal Raised

$287.53MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-67 points in the past 30 days

About Viva Wallet

Viva Wallet is a cloud-based neo-bank using Microsoft Azure with branches in twenty-three countries in Europe. It is a principal member of Visa and Mastercard for acquiring and issuing services with direct connectivity to the card schemes, providing processing services through its own platform. Viva Wallet provides businesses of all sizes with card acceptance services through POS terminals and the new Android Viva Wallet POS app, as well as through advanced payment gateways in online stores. It also offers business accounts with local IBAN and business Viva Wallet Mastercard cards. The company was founded in 2010 and is based in Athens, Greece.

Loading...

Viva Wallet's Product Videos

ESPs containing Viva Wallet

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

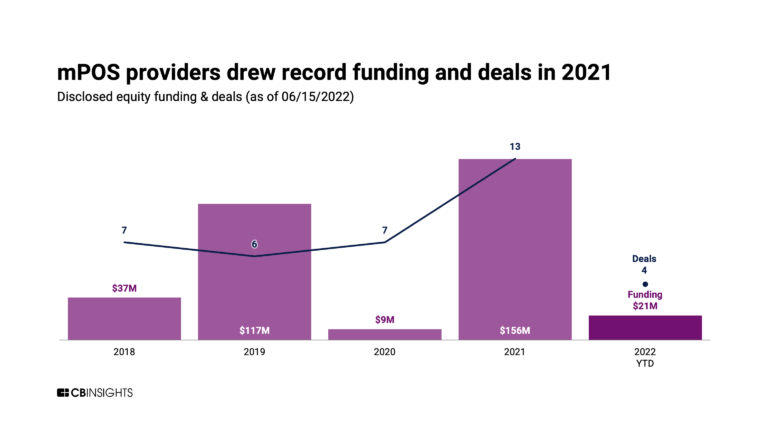

The mobile point-of-sale (mPOS) market offers a range of solutions for merchants to accept payments and engage with customers through mobile devices. These solutions include ordering, payment, and loyalty programs, as well as the ability to accept new payment form factors such as contactless and mobile wallets. The market also offers solutions for legacy POS systems to integrate with mobile platfo…

Viva Wallet named as Leader among 15 other companies, including Fiserv, FIS, and Block.

Viva Wallet's Products & Differentiators

Independent Hardware Vendor & Independent Software Vendor Partnership Programs

We enable payments on any smart device and we can integrate with any software or hardware provider through our cutting-edge software platform. We enable consolidation and less hassle for all businesses that accept payments, while introducing new innovative payment use cases across any industry. All that harnessing the power of our in-house omnichannel technologies, namely Viva Terminal App and Smart Checkout payment gateway.

Loading...

Research containing Viva Wallet

Get data-driven expert analysis from the CB Insights Intelligence Unit.

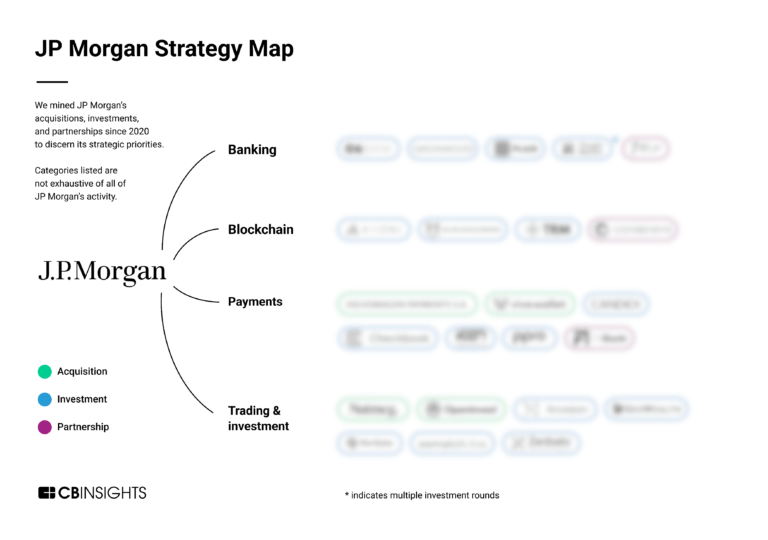

CB Insights Intelligence Analysts have mentioned Viva Wallet in 2 CB Insights research briefs, most recently on Sep 13, 2022.

Expert Collections containing Viva Wallet

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Viva Wallet is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,276 items

Payments

3,198 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,978 items

Excludes US-based companies

Fintech 100

250 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest Viva Wallet News

Jun 23, 2025

Sediul central: Atena, Grecia Total finanţări: peste 950 de milioane de dolari Evaluare curentă: aproximativ 1,5 miliarde de dolari, în ianuarie 2022, după ce JPMorgan a preluat aproape jumătate din companie Model de business: B2B — platformă cloud pentru plăţi, POS-uri tap on phone, gateway e-commerce, conturi IBAN locale, carduri de debit, servicii de creditare IMM (Merchant Advance, lending) Cifre cheie: prezenţă în circa 24 de ţări europene; aproximativ 420 de angajaţi. Povestea Viva Wallet pe larg În 2010 - 2011, Haris Karonis şi Makis Antypas fondază Viva Payments, ca instituţie de plată autorizată în spaţiul EEA, odată cu implementarea PSD2, scrie pe site-ul companiei. În 2014, compania finalizează o finanţare de seria A, condusă de Latsis Family Office, în valoare de aproximativ 6 milioane de euro, scrie emeastartups.com. În 2015, Viva Payments devine Viva Wallet se mută în cloud (Microsoft Azure) şi devine membru principal Visa/Mastercard, arată sursa citată anterior. În 2016, compania deschide birouri în Belgia şi UK şi atrage o rundă de finanţare serie B de circa 15 mil. euro, potrivit emeastartups.com. În 2019, Viva Wallet se extinde la nivel european şi începe activitatea pe 19 pieţe – printre care România şi Portugalia, arată informaţiile publicate pe site-ul companiei. Tot în 2019, compania încheie o rundă de finanţare seria C cu Hedosophia, în valoare de 75 mil. euro pentru consolidarea poziţiei europene, potrivit Crunchbase. În mai 2021, Viva Wallet mai atrage 80 mil.de dolari (circa 66 mil. euro) în seria C de la Tencent, EBRD şi Breyer Capital, conform TechCrunch. În ianuarie 2022, JP Morgan achiziţionează 48,5 % din Viva Wallet pentru 800 mil. de dolari, oferind o infuzie de 100 mil. euro, scrie Reuters. În decembrie, se finalizează actiziţia în urma căreia Viva Wallet devine un unicorn fintech, cu evaluare de 1,5 miliarde de dolari şi potenţial de a atinge o evaluare de peste 5 mld. euro, potrivit greekreporter.com. Pentru alte știri, analize, articole și informații din business în timp real urmărește Ziarul Financiar pe WhatsApp Channels Citește și

Viva Wallet Frequently Asked Questions (FAQ)

When was Viva Wallet founded?

Viva Wallet was founded in 2010.

Where is Viva Wallet's headquarters?

Viva Wallet's headquarters is located at Avenue Halandri Maroussi 18-20, Athens.

What is Viva Wallet's latest funding round?

Viva Wallet's latest funding round is Shareholder Liquidity.

How much did Viva Wallet raise?

Viva Wallet raised a total of $287.53M.

Who are the investors of Viva Wallet?

Investors of Viva Wallet include DECA Investments, Hedosophia, J.P. Morgan Chase, Latsis Family, Tencent and 5 more.

Who are Viva Wallet's competitors?

Competitors of Viva Wallet include SumUp and 6 more.

What products does Viva Wallet offer?

Viva Wallet's products include Independent Hardware Vendor & Independent Software Vendor Partnership Programs and 2 more.

Loading...

Compare Viva Wallet to Competitors

Vibrant provides unified payment solutions for in-store and online transactions within the financial services industry. The company offers a platform that facilitates various payment methods such as in-store payments, online payments, payment links, and invoice payments, integrated into existing business tools for updates and insights. Vibrant serves sectors that require payment processing, such as hospitality and healthcare. It was founded in 2020 and is based in Aarhus, Denmark.

EasyTransac provides digital payment processing solutions across various sectors. The company offers services including NFC payments via smartphones, e-commerce transaction management, in-store and remote payment processing, and business-to-business payment facilitation. EasyTransac serves sectors such as retail, events, hospitality, and e-commerce. It was founded in 2015 and is based in Strasbourg, France. EasyTransac operates as a subsidiary of Inevents.

Treinta is a digital platform that focuses on providing business management solutions for small businesses, merchants, and entrepreneurs. The company offers a suite of tools that enable users to digitize and monitor their finances, manage inventory, create virtual catalogs, sell online, and process various forms of digital payments. Treinta's software facilitates business operations across multiple devices, allowing for efficient management from any location. It was founded in 2020 and is based in Bogota, Colombia.

YAN is a company focused on creating a fusion of digital banking and ecommerce, operating in the financial technology and ecommerce sectors. The company offers a 'Super App' that provides a range of banking services such as payments, direct debits, saving accounts, and budgeting tools, along with features like currency exchange, digital coins, utility payments, and a marketplace for online shopping. YAN primarily targets the fintech, finance, and ecommerce markets. It was founded in 2020 and is based in London, England.

Novo is a fintech company that provides online business banking solutions for small businesses. The company offers checking accounts, business credit cards, bookkeeping services, and tools for invoicing, budgeting, and financial integrations. Novo serves small businesses, freelancers, self-employed individuals, and consultants with various financial management tools. It was founded in 2016 and is based in Miami, Florida.

Rise focuses on enhancing financial inclusion in emerging markets through technology. It offers services that facilitate access to financial resources for individuals and businesses. Rise's products include options that allow customers to shop for items and pay for them at a later time. Rise was formerly known as Deall. It was founded in 2023 and is based in Cairo, Egypt.

Loading...