Varo

Founded Year

2015Stage

Series G | AliveTotal Raised

$1.07BLast Raised

$28.98M | 5 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+92 points in the past 30 days

About Varo

Varo is a digital bank that provides financial services. The company offers savings accounts, credit-building tools, and borrowing options like cash advances and personal lines of credit. Varo primarily serves individuals seeking banking solutions. Varo was formerly known as Ascendit Holdings. It was founded in 2015 and is based in San Francisco, California.

Loading...

Varo's Products & Differentiators

Varo checking

standard checking acct

Loading...

Research containing Varo

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Varo in 2 CB Insights research briefs, most recently on Apr 10, 2025.

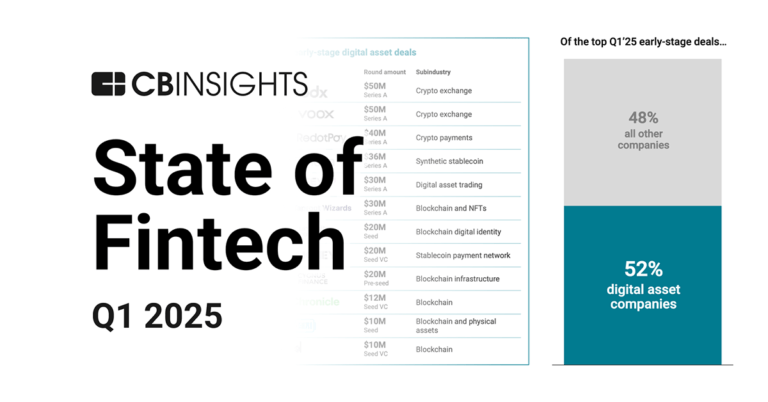

Apr 10, 2025 report

State of Fintech Q1’25 ReportExpert Collections containing Varo

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Varo is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,276 items

Financial Wellness

245 items

Track startups and capture company information and workflow.

Fintech

9,653 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Digital Banking

1,153 items

Challenger bank offer digitally native banking products (checking and savings account at the most basic) and either leverage partner banks or are fully-licensed banks themselves.

Tech IPO Pipeline

257 items

The tech companies we think could hit the public markets next, according to CB Insights data.

Varo Patents

Varo has filed 1 patent.

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

9/12/2018 | 11/28/2023 | Sodium compounds, Papermaking, Boilers, Potassium compounds, Chemical processes | Grant |

Application Date | 9/12/2018 |

|---|---|

Grant Date | 11/28/2023 |

Title | |

Related Topics | Sodium compounds, Papermaking, Boilers, Potassium compounds, Chemical processes |

Status | Grant |

Latest Varo News

Jul 1, 2025

Getty Images Looking for a great place to stash your rainy-day emergency funds? There are still savings accounts offering rates of up to 5.00% APY, but they can be hard to find. When inflation rates started cooling off last year and the Federal Reserve eased monetary policy, savings rates declined from the nearly two-decade highs seen in 2022 and 2023. Today, the outlook on inflation and the U.S. economy is less clear, so more rate cuts are unlikely for the time being. That strongly suggests that interest rates on savings accounts should remain where they are for a while longer. Fortune has teamed up with Curinos, an expert team of financial industry consultants, to bring you the highest savings account rates available today. Today’s best savings account rates: Earn up to 5.00% APY The best high-yield savings account interest rate today is 5.00%, offered by Varo Money . Fortune monitors the top rates offered by leading U.S. financial institutions to help readers obtain the best possible return on their savings. Here are today’s highest savings account rates: FDIC average national deposit rates: January 2020 to present Determining if you’re getting a strong rate of return on your savings account is easy when you take a look at the national average savings rate, which currently sits at 0.38%. This is down from a historic high of 0.47% in March 2024, before the Fed’s three consecutive rate cuts. Savings account news in 2025 Fed monetary policy choices have a direct impact on average savings account rates. When the central bank increases its benchmark rate, financial institutions typically respond by raising the interest offered on savings accounts to stay competitive. When the Fed cut rates, yields on savings accounts tend to decrease. When it comes to the savings account rates offered by individual financial institutions, other considerations are in play. Banks adjust APYs based on various factors, including their own financial strategies, efforts to attract new customers, and overall market conditions. Note that banks can and do change the interest rates on savings accounts at any time, for any reason. Changes frequently occur following Fed meetings, which are held approximately eight times per year. For example, the Fed implemented three rate cuts in late 2024. Almost immediately, numerous banks began reducing their savings account APYs. It’s possible that savings account rates will decrease further in the coming months, but not certain since inflation is on the rise again and additional rate cuts may remain paused. Keep your eyes open for high-yield savings accounts Technically speaking, there isn’t a special banking deposit product called a “high-yield savings account.” The term is commonly applied to accounts that offer the highest APYs, commonly orders of magnitude greater than the average. While the national average savings rate stands at 0.38% today, many high-yield accounts offer rates exceeding 4%. Traditional accounts often provide physical branch access with lower rates, while high-yield accounts are typically offered by online banks and feature higher rates, but limited in-person services. But regardless of what savings account you use, you can expect to pay taxes on any interest earned . Consider opening a high-yield savings account for these advantages: Significantly higher interest rates compared to traditional savings accounts Often free from minimum balance requirements or monthly fees Easy access to your funds Ideal for emergency funds or short-term savings goals FDIC-insured, providing the same protection as traditional banks When evaluating savings accounts, seek competitive APYs to maximize your earnings. Many high-yield accounts have no minimum balance requirements nor monthly maintenance fees, but make sure to read the fine print. You should also ensure the account provides easy access to withdrawals or transfers when needed (bonus points for accounts that waive foreign ATM fees ). Remember to verify FDIC insurance coverage, and don’t forget that some banks offer attractive welcome incentives for new customers. Check Out Our Other Daily Rates Reports

Varo Frequently Asked Questions (FAQ)

When was Varo founded?

Varo was founded in 2015.

Where is Varo's headquarters?

Varo's headquarters is located at 222 Kearny Street, San Francisco.

What is Varo's latest funding round?

Varo's latest funding round is Series G.

How much did Varo raise?

Varo raised a total of $1.07B.

Who are the investors of Varo?

Investors of Varo include 8VC, Warburg Pincus, The Rise Fund, Gallatin Point Capital, HarbourVest Partners and 13 more.

Who are Varo's competitors?

Competitors of Varo include MoneyLion, Revolut, Monzo, Atom Bank, Ant Group and 7 more.

What products does Varo offer?

Varo's products include Varo checking and 1 more.

Loading...

Compare Varo to Competitors

Atom bank is a digital bank that provides financial services such as savings accounts, mortgages, and business loans. The company offers savings products with various interest rates, mortgage solutions, and business financing options, all managed through a mobile app. Atom bank serves individuals and small to medium-sized enterprises seeking banking solutions. It was founded in 2014 and is based in Durham, England.

ONE serves as a financial technology company that provides banking services through a digital platform. The company focuses on financial services for employees, provided via their employer. These solutions include earned wage access (EWA) as well as savings and budgeting. ONE was formerly known as Even. It was founded in 2019 and is based in New York.

Bancacao is a developer of banking products. The company's Tzune is a digital financial services platform that offers fair, contactless, and personal solutions.

Tandem Bank provides digital banking services in the financial sector. The company offers financial products including savings accounts, green home improvement loans, energy-efficient mortgages, and motor finance for eco-friendly vehicles. Tandem Bank serves individuals making environmentally conscious financial decisions. It was founded in 2013 and is based in Blackpool, England.

Moven provides digital banking experiences within the financial technology sector. The company offers digital banking solutions, including financial wellness tools, customer engagement analytics, and personalized insights for financial institutions. Moven primarily serves banks, credit unions, and fintech companies aiming at their digital offerings and customer engagement. It was founded in 2010 and is based in New York, New York.

Monzo engages as a digital bank that operates in the financial services sector, offering various banking products and services through its mobile app. The company provides personal and business accounts, savings and investment options, and credit and loan products. Monzo primarily serves individual consumers and businesses. Monzo was formerly known as Mondo. It was founded in 2015 and is based in London, United Kingdom.

Loading...