Uptake

Founded Year

2014Stage

Incubator/Accelerator - II | AliveTotal Raised

$317MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-38 points in the past 30 days

About Uptake

Uptake specializes in industrial intelligence and predictive analytics within the software-as-a-service (SaaS) sector. The company offers solutions that translate data into insights for predictive maintenance, asset failure prediction, and optimization of maintenance strategies. Uptake primarily serves sectors that require maintenance analytics, such as transportation and heavy industry. It was founded in 2014 and is based in Chicago, Illinois.

Loading...

ESPs containing Uptake

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The fleet maintenance platforms market provides software solutions that enable predictive and preventive vehicle maintenance to optimize fleet operations and prevent breakdowns. These platforms integrate with telematics devices, IoT sensors, and diagnostic systems to collect real-time vehicle data, using AI and machine learning to predict maintenance needs, schedule services, and track repairs. Ke…

Uptake named as Outperformer among 15 other companies, including Palantir, Fleetio, and Samsara.

Uptake's Products & Differentiators

Uptake Fusion

Uptake Fusion streamlines movement, storage, and curation of OT data, accelerating the transfer to the cloud while ensuring data integrity and security. The data is organized in the customer’s cloud environment on Microsoft Azure. Users across an organization, from multiple business units, have free rein to analyze the data, model the data, and customize it for a wide range of use cases that suit their specific needs.

Loading...

Research containing Uptake

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Uptake in 5 CB Insights research briefs, most recently on Mar 21, 2024.

Aug 16, 2023

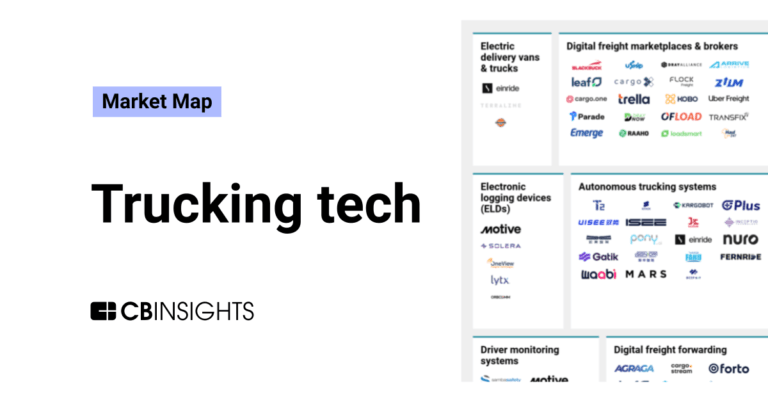

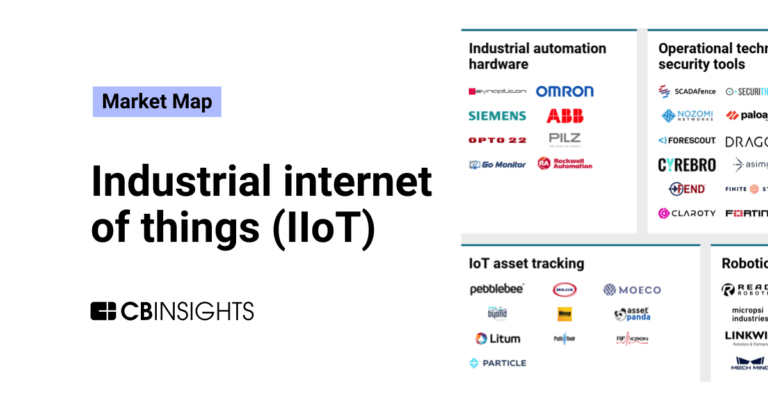

The industrial internet of things (IIoT) market map

Nov 18, 2022

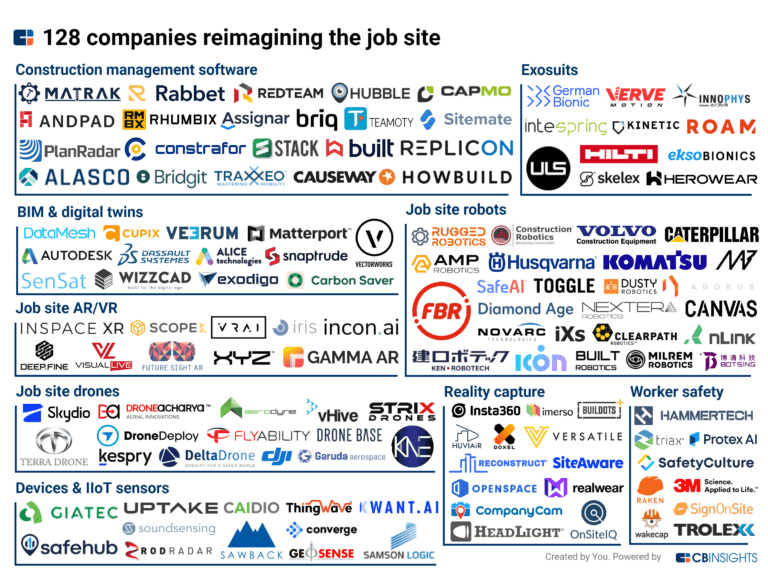

128 companies building the future of the job siteExpert Collections containing Uptake

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Uptake is included in 9 Expert Collections, including Construction Tech.

Construction Tech

1,490 items

Companies in the construction tech space, including additive manufacturing, construction management software, reality capture, autonomous heavy equipment, prefabricated buildings, and more

Supply Chain & Logistics Tech

4,574 items

Companies offering technology-driven solutions that serve the supply chain & logistics space (e.g. shipping, inventory mgmt, last mile, trucking).

Unicorns- Billion Dollar Startups

1,276 items

Oil & Gas Tech

4,980 items

Companies in the Oil & Gas Tech space, including those focused on improving operations across upstream, midstream, and downstream sectors, as well as those working on sustainable fuels.

Tech IPO Pipeline

286 items

Energy Management Software

677 items

Companies creating software to help manage, optimize, and automate energy management and optimization.

Uptake Patents

Uptake has filed 91 patents.

The 3 most popular patent topics include:

- lung disorders

- reliability engineering

- respiratory therapy

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

1/24/2022 | 12/24/2024 | Machine learning, Covariance and correlation, Dimension reduction, Classification algorithms, Linear algebra | Grant |

Application Date | 1/24/2022 |

|---|---|

Grant Date | 12/24/2024 |

Title | |

Related Topics | Machine learning, Covariance and correlation, Dimension reduction, Classification algorithms, Linear algebra |

Status | Grant |

Latest Uptake News

Jun 24, 2025

The smart railways market is estimated to be USD 36.49 billion in 2025 and is projected to reach USD 54.31 billion by 2030 at a CAGR of 8.3% The shift toward cloud and edge computing is revolutionary in the management of railway networks. These technologies enable rail operators to process huge amounts of operational data closer to the source, such as signals, locomotives, or ticketing gates, while enabling real-time decision-making and response to disruptions. Cloud computing allows data management, route optimization, and multi-operator coordination, which is especially important in interconnected or cross-border rail networks. Meanwhile, edge computing minimizes latency in mission-critical applications such as automatic signaling, surveillance, and emergency response systems. This combination improves scalability, cybersecurity, and data analytics capacities. With increasing passenger expectations for smooth and safe journeys and governments pushing for smarter transportation infrastructure as part of their national digitalization agendas, cloud and edge computing are becoming integral to smart rail strategies. Vendors are now providing platform-as-a-service (PaaS) and AI-powered edge solutions focused on rail operators, which makes this trend the core of the digital rail transformation. Training, support, and maintenance services segment will witness the highest growth during the forecast period Training, support, and maintenance services help users or customers gain operational working knowledge. These services include 24/7 customer support, repairs, upgrades, and proactive assistance of smart railway solutions, which cannot be utilized to the optimum level until employees are trained properly to leverage their benefits. Training is a costly affair for an organization, but it helps in the proper execution of the collaboration strategy and thus increases employee productivity by enabling employees to generate and consolidate ideas. Furthermore, rigorous training also helps in the increased adoption of smart railway solutions, as employees become aware of their various uses and benefits. Timely support and maintenance reduce the chances of issues in the overall performance of smart railway solutions. Vendors offering support and maintenance services focus on improving the performance of the solutions, reducing Capital Expenditure (CAPEX) and Operational Expenditure (OPEX), and ensuring end-to-end smart railway solution delivery and multi-vendor support. The support and maintenance teams help government and railway authorities reap benefits from their investments in implementing smart railway solutions. Multimedia information and entertainment solution segment is expected to have the largest market size during the forecast period Multimedia information and entertainment solutions fulfill the passenger’s demand for information and entertainment while traveling in trains. These solutions consist of advanced software solutions and applications for managing and delivering all types of digital media content to railway passengers to make the travel experience comfortable. These solutions also help travelers communicate inside the train so that they can efficiently respond to emergency matters while traveling. The growth of the multimedia information and entertainment solutions segment is characterized by the growing demand for high-definition digital media content and real-time updates about train journeys. Asia Pacific is expected to record the highest growth rate during the forecast period The smart railway market in the Asia Pacific region is expected to experience the fastest growth during the forecast period. This growth is driven by the aggressive implementation of advanced technologies and significant investments in digital transformation initiatives by emerging economies. Countries such as China, India, South Korea, Singapore, and Australia are at the forefront, dedicating substantial funds to modernizing their rail networks. The high population density in this region increases the urgent need to expand and improve the existing rail infrastructure to meet the rising demands for transportation. In addition, government schemes to support smart infrastructure and digital communications are serving as powerful drivers of market growth. The increasing freight traffic across various industries, along with positive economic trends and a supportive regulatory environment, are key factors contributing to the smart railways market’s rapid growth in the Asia Pacific region during the projected period. Major investments in autonomous trains and AI-driven traffic systems in countries such as Japan or China also strengthen the region’s position in the market. Key Attributes: S: Digital Transformation and Connectivity S-Present: AI-Driven and Autonomous Railways Ecosystem Analysis Case Study Analysis Case Study 1: Luxembourg Railways Equipped 34 New Coradia Trains with Alstom’s Automatic Train Operation System Case Study 2: Vtg Rail Europe Collaborated with Siemens to Innovate Rail Freight Transport Case Study 3: Uptake Automated Maintenance Work Order of a North American Freight Railway Company Case Study 4: Thales Provided Train-To-Ground Broadband Data Communication Solution to Brescia Metro Case Study 5: Comboios De Portugal Implemented Solutions by Fujitsu to Innovate Its Ticketing Infrastructure Case Study 6: Siemens Provided Maintenance Services to Govia Thameslink Railway Case Study 7: Assetic Helped Sydney Trains Visualize Rail Assets for Optimized Asset Management Technology Analysis

Uptake Frequently Asked Questions (FAQ)

When was Uptake founded?

Uptake was founded in 2014.

Where is Uptake's headquarters?

Uptake's headquarters is located at 2045 West Grand Avenue, Chicago.

What is Uptake's latest funding round?

Uptake's latest funding round is Incubator/Accelerator - II.

How much did Uptake raise?

Uptake raised a total of $317M.

Who are the investors of Uptake?

Investors of Uptake include Plug and Play, GreatPoint Ventures, Revolution, Plug and Play Milan, Valor Equity Partners and 6 more.

Who are Uptake's competitors?

Competitors of Uptake include On3, AspenTech, Preteckt, Amygda, Coddi and 7 more.

What products does Uptake offer?

Uptake's products include Uptake Fusion and 4 more.

Who are Uptake's customers?

Customers of Uptake include PepsiCo, Ensign Drilling and APS/Palo Verde Nuclear Generating Station.

Loading...

Compare Uptake to Competitors

Falkonry specializes in time series artificial intelligence (AI) for smart manufacturing, focusing on operational efficiency and decision-making in sectors such as metals, defense and intelligence, chemicals, electronics and semiconductors, oil and gas, automotive, and pharmaceuticals. The company provides solutions that analyze operational time series data to enable condition-based actions, predictive maintenance, quality assessment, and process optimization. It was founded in 2012 and is based in Cupertino, California.

Avathon specializes in industrial artificial intelligence (AI), focusing on extending infrastructure life and facilitating the transition to autonomous systems within heavy industry. The company offers a technology platform to improve commercial and government operations by optimizing asset life and safety and enhancing operations through AI solutions. Avathon serves sectors such as energy, manufacturing, transportation, and government. Avathon was formerly known as SparkCognition. It was founded in 2013 and is based in Pleasanton, California.

DINGO provides predictive maintenance solutions for the mining industry, addressing asset health management and reliability. The company offers software that predicts equipment failures and optimizes maintenance workflows for asset-intensive operations. It was founded in 1991 and is based in Wilston, Australia.

Cognite provides industrial software solutions that focus on data contextualization and operational analytics for asset-intensive industries. The company offers products that aim to unify and analyze operational, engineering, and IT data, allowing for the development and deployment of data and AI use cases. Cognite serves sectors including oil and gas, power and utilities, renewable energy, and manufacturing. It was founded in 2016 and is based in Tempe, Arizona.

Imubit offers AI optimization solutions for the heavy process industries, focusing on sectors such as oil and gas, chemicals, and mining, minerals, and metals. Their offerings include AI technology that utilizes deep domain expertise and reinforcement learning to enhance operational efficiency by improving yield and minimizing resource use. Imubit serves sectors that require process optimization and control, including the oil and gas industry and the chemical manufacturing sector. It was founded in 2016 and is based in Houston, Texas.

Predictronics provides AI-based predictive analytics solutions within the industrial sector. The company offers services that include predictive maintenance, predictive quality, and condition-based maintenance, facilitated by their software platform, PDX. Its services monitor critical assets, reduce unplanned downtime, and improve product quality for various industries. It was founded in 2013 and is based in Norwood, Ohio.

Loading...