Udaan

Founded Year

2016Stage

Series G - II | AliveTotal Raised

$2.154BValuation

$0000Last Raised

$39M | 1 mo agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+52 points in the past 30 days

About Udaan

Udaan is a B2B e-commerce platform focused on the trade ecosystem for small businesses across various sectors. The company operates in categories FMCG, Staples, fruits and vegetables, and pharmaceutical, providing a platform for supply chain and logistics operations. It was founded in 2016 and is based in Bengaluru, India.

Loading...

Loading...

Research containing Udaan

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Udaan in 2 CB Insights research briefs, most recently on Jan 31, 2024.

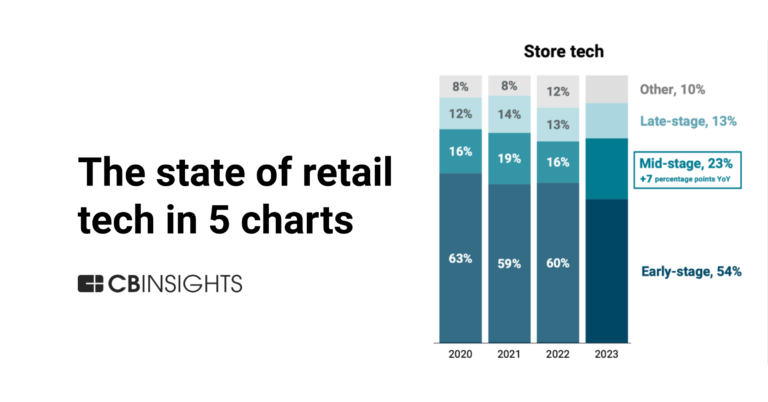

Jan 31, 2024

Retail tech in 5 charts: 2023Expert Collections containing Udaan

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Udaan is included in 7 Expert Collections, including E-Commerce.

E-Commerce

11,341 items

Companies that sell goods online (B2C), or enable the selling of goods online via tech solutions (B2B).

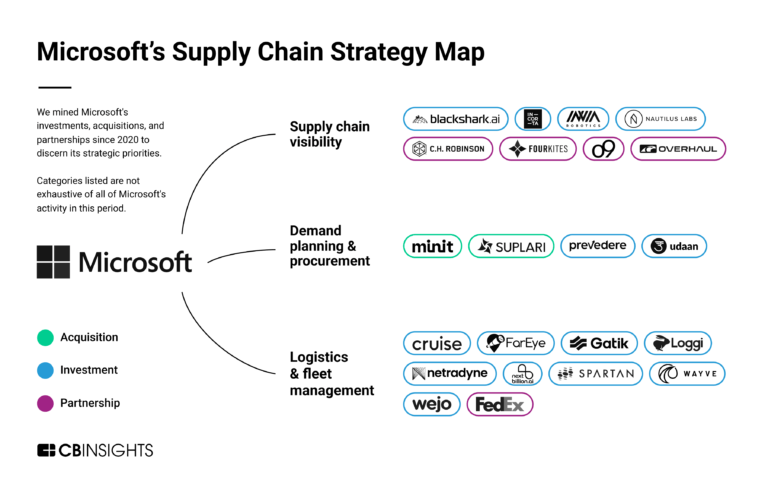

Supply Chain & Logistics Tech

4,573 items

Companies offering technology-driven solutions that serve the supply chain & logistics space (e.g. shipping, inventory mgmt, last mile, trucking).

Unicorns- Billion Dollar Startups

1,276 items

Grocery Retail Tech

648 items

Startups providing B2B solutions to grocery businesses to improve their store and omni-channel performance. Includes customer analytics platforms, in-store robots, predictive inventory management systems, online enablement for grocers and consumables retailers, and more.

SMB Fintech

1,231 items

Retail Tech 100

200 items

The most promising B2B tech startups transforming the retail industry.

Latest Udaan News

Jul 10, 2025

Sowmya Ramasubramanian 5 min read10 Jul 2025, 05:30 AM IST Flipkart’s wholesale marketplace has invested significantly in its same-day and next-day delivery capabilities in recent months, with over 6,000 products now reaching clients faster. Summary Quicker deliveries have become crucial for supply chain companies to strengthen loyalty and keep up with the growing competition in the marketplace ecosystem. Faster deliveries compress the procurement cycle and trigger invoicing sooner, which in turn accelerates cash flow across the supply chain. Gift this article Subscribe to enjoy similar stories. Subscribe now Bengaluru: E-commerce startups that cater to enterprise clients and retailers in the country are boosting their ability to shorten delivery timelines, hoping that same-day and next-day deliveries will enhance buying experience and result in improved cash flow in the supply chain. Tiger Global-backed unicorn Moglix, which supplies industrial tools and equipment, now delivers more than 10,000 stock-keeping units (SKU) by the next day, within a few months of rolling out quicker deliveries. This is in contrast to its previous timeline of 96 hours prior to August 2024, according to its founder and chief executive Rahul Garg. All of the firm’s 5,000 monthly orders are now fulfilled the very next day. Bengaluru-based staples and vegetables supplier Udaan , too, is shipping a higher number of orders within 24 hours over the past few months, with emphasis on kirana stores and HoReCa (hotels, restaurants, catering) businesses. “Years of focused investment in supply chain intelligence and operational execution have enabled us to balance speed with sustainability and scale with efficiency," a spokesperson for Udaan said. Flipkart’s wholesale marketplace has invested significantly in its same-day and next-day delivery capabilities in recent months, with over 6,000 products now reaching clients faster. “The move towards faster deliveries was driven by a combination of evolving customer expectations and shifting industry dynamics. In the B2B [business-to-business] segment, clients increasingly demanded quicker replenishment cycles to reduce their inventory holding and respond faster to market demand," Dinkar Ayilavarapu, vice-president and head of Flipkart Wholesale told Mint. Quicker deliveries have become crucial for supply chain companies to strengthen loyalty and keep up with the growing competition in the marketplace ecosystem. Faster deliveries compress the procurement cycle and trigger invoicing sooner, which in turn accelerates cash flow across the supply chain. Business-to-business marketplaces that are online-first and technology-enabled are expected to represent a market opportunity of $200 billion by 2030 from $20 billion in 2022, according to estimates by Bessemer Venture Partners. “Faster deliveries mean that the B2B customers can keep lower inventories at their end. This will make them more capital efficient, akin to how Just-In-Time (JIT) revolutionized the automobile industry," according to Madhur Singhal, managing partner (consumer and internet) at global consulting firm Praxis Global Alliance. Faster deliveries also help companies respond to changing market demands more efficiently, minimizing loss to a reasonable extent. Just-In-Time is an inventory management system pioneered by Toyota in the 1970s, which relies on daily deliveries of supplies with the aim of eliminating waste due to overproduction and lowers warehousing costs. It is said to have simplified supply chain management for large automakers globally. Some categories lend themselves to quick commerce better than others. High-demand, fast-moving categories—grocery, personal care and general merchandise—where inventory turnover and fulfilment infrastructure are stronger are relatively easier to scale, according to Flipkart Wholesale’s Ayilavarapu. Moglix’s Garg added that high-frequency industrial consumables, PPE (personal protective equipment), and MRO (maintenance, repair and operations) items are also well-suited to quick deliveries. Unlike quick commerce in consumer-facing companies, faster deliveries in B2B don’t hurt a firm’s profit significantly as these companies are inherently equipped to handle complexities including higher costs and volumes. “Moglix has absorbed a 1–2% increase in fulfilment cost to maintain customer pricing. Several levers are helping optimize costs—hyperlocal deliveries ensure that the distance travelled per shipment remains minimal and since we are operating on a 100% prepaid model our RTOs (return to origin) do not exceed 5% mark, and it also helps in eliminating credit risk," said Moglix’s Garg. However, firms will have to store supplies closer to customer clusters, batch process orders across a wider set of customers, maintain robust and standardized item masters and lower costs in manpower and vehicle running costs to be able to keep costs in control, said Praxis Global Alliance’s Singhal. Firms like Moglix are even willing to explore delivery within minutes, subject to strong demand and sustainable unit economics. “Moglix plans to scale next-day delivery across more geographies and products first. Moving to sub-hour delivery would require heavy investments in micro-fulfilment, a possibility only if supported by strong demand and unit economics." Credit challenges While faster deliveries provide convenience and value addition, enterprise clients see the feature as a mixed bag. A Gurugram-based grocery retailer—who works with a major B2B startup—said that shorter delivery timelines have resulted in shorter credit repayment cycles, making it challenging to meet the obligations. “Our credit cycle has reduced from 30 days to 14 days in some categories like general merchandise. It’s manageable in festival months where products get sold faster, but other times it is challenging," this person said, asking not to be identified. Another business owner who deals in industrial equipment said that he is indifferent to quicker deliveries and would prefer stable repayment periods. “Requirements in our business remain more or less steady throughout the year. I don’t see value in quicker deliveries like individual consumers would for essential items like grocery and food." However, firms are trying to be mindful. “If done systematically and predictably, faster deliveries almost have no impact on credit or repayment cycles. It is unpredictability which can disturb our customer’s working capital cycles—if we deliver faster than the customer expects, they may have previously-purchased unsold stock and also may not have the capital to buy our stock; and if we are slower then they may stock out," said Flipkart Wholesale’s Ayilavarapu.

Udaan Frequently Asked Questions (FAQ)

When was Udaan founded?

Udaan was founded in 2016.

Where is Udaan's headquarters?

Udaan's headquarters is located at 14th Main Sector 3, HSR Layout, Bengaluru.

What is Udaan's latest funding round?

Udaan's latest funding round is Series G - II.

How much did Udaan raise?

Udaan raised a total of $2.154B.

Who are the investors of Udaan?

Investors of Udaan include Lightspeed Venture Partners, M&G Investments, InnoVen Capital, Trifecta Capital, Lighthouse Canton and 27 more.

Who are Udaan's competitors?

Competitors of Udaan include Infra.Market, SOLV, CredAble, Flipkart, Lazada and 7 more.

Loading...

Compare Udaan to Competitors

Khatabook operates as a financial technology company that facilitates business management. It offers a software-as-a-service (SaaS) accounting platform for managing credit via a digital ledger application. It helps small and medium businesses with inventory management, billing and accounting, and tracking transactions. The company was founded in 2018 and is based in Bengaluru, India.

Kaymu is an online shopping platform that provides products across various categories, including electronics, fashion, home appliances, and groceries. The company serves individual consumers and corporate clients. Kaymu was formerly known as Azmalo. It was founded in 2012 and is based in Karachi, Pakistan.

Dastgyr is a B2B e-commerce marketplace that provides a platform for buyers to access products from local and international sellers. The platform includes price comparisons and delivery options. Sellers can utilize services related to demand generation, payment processing, and logistics. Dastgyr serves sectors including FMCG, construction, chemicals, and agricultural goods. It was founded in 2020 and is based in Karachi, Pakistan.

Dukaan is an online marketplace that provides tools for businesses to establish and manage their online stores. The company offers services including online store themes, payment gateway integration, and third-party plugins. Dukaan serves the ecommerce industry by providing solutions for order management, analytics, and multi-warehouse shipping. It was founded in 2020 and is based in Bengaluru, India.

Jumbotail offers a B2B marketplace and a retail platform that focuses on the food and grocery sector. The company connects mom-and-pop grocery retailers with brands and staples producers, offering a wide selection of products, supply chains, and logistics. Jumbotail also provides fintech solutions, including payment services, access to working capital credit, and a cloud-based retail operating system for small grocery stores. It was founded in 2015 and is based in Bengaluru, India.

Bikayi is a comprehensive e-commerce enabler that specializes in providing a platform for businesses to create and manage their online stores. The company offers a suite of services including customizable store themes, integrated payment gateways, multi-vendor support, and delivery partner integration, as well as advanced features for digital marketing, SEO, and social media engagement. Bikayi's solutions cater to a wide range of sectors, including food and beverages, jewelry, fashion, electronics, and groceries, enabling entrepreneurs and startups to scale their online presence and sales. It was founded in 2019 and is based in Gachibowli, India.

Loading...