Uala

Founded Year

2017Stage

Series E - II | AliveTotal Raised

$1.039BLast Raised

$66M | 4 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+276 points in the past 30 days

About Uala

Uala provides a financial technology platform for the digital payment services sector. It offers a mobile application that allows users to manage their finances by purchasing, transferring, investing, and earning interest on funds. It serves consumers looking for financial services. Uala was formerly known as Bancar Technologies. It was founded in 2017 and is based in Caba, Argentina.

Loading...

Uala's Products & Differentiators

Payments

We offer a core transactional product base which includes: bill payments, prepaid services, purchases, money transfers.

Loading...

Research containing Uala

Get data-driven expert analysis from the CB Insights Intelligence Unit.

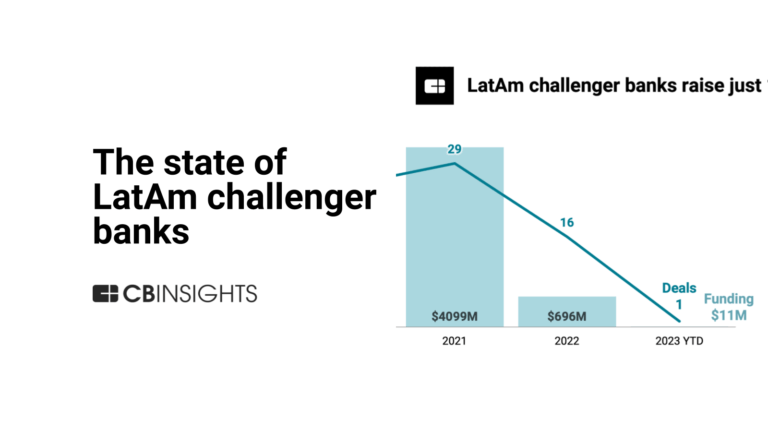

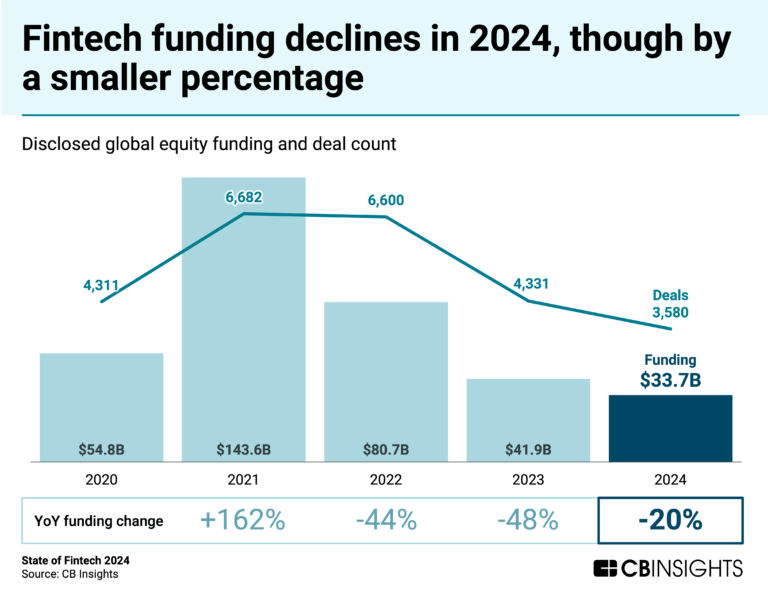

CB Insights Intelligence Analysts have mentioned Uala in 4 CB Insights research briefs, most recently on Jan 14, 2025.

Jan 14, 2025 report

State of Fintech 2024 Report

Expert Collections containing Uala

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Uala is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,276 items

Fintech 100

1,099 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Future Unicorns 2019

50 items

Fintech

13,978 items

Excludes US-based companies

Digital Banking

1,153 items

Challenger bank offer digitally native banking products (checking and savings account at the most basic) and either leverage partner banks or are fully-licensed banks themselves.

Latest Uala News

Jun 20, 2025

The prepaid card and digital wallet market in Argentina is expected to grow by 16.6% on annual basis to reach US$ 9.84 billion in 2025. The prepaid card and digital wallet market in the country has experienced robust growth during 2020-2024, achieving a CAGR of 20.2%. This upward trajectory is expected to continue, with the market forecast to grow at a CAGR of 13.9% during 2025-2029. By the end of 2029, the prepaid card and digital wallet market is projected to expand from its 2024 value of US$ 8.43 billion to approximately US$ 16.55 billion. The prepaid card market in Argentina is undergoing significant transformation, supported by the rapid expansion of digital payment platforms, fintech-driven financial solutions, and regulatory efforts promoting cashless transactions. The increasing adoption of instant payment systems, such as Pix through Mercado Pago, reflects a broader shift towards digital finance, catering to both domestic users and international visitors. Meanwhile, fintech companies such as Uala are addressing financial inclusion challenges by providing prepaid card solutions to unbanked and underbanked populations, further driving market growth. Over the next two to four years, the prepaid card sector is expected to become a more integral part of Argentina's financial system. Continued fintech investment, growing e-commerce activity, and government-backed initiatives will encourage wider consumer and business adoption of prepaid solutions. As regulatory frameworks evolve to enhance transparency and security, prepaid cards will be critical in modernizing the country's payment ecosystem, providing users with more efficient and accessible financial tools. Prepaid Card Market Analysis Metrics Assessed: The study examines the prepaid card market through various lenses, including transaction value, transaction volume, average transaction value, load value, and the total number of cards in circulation. Card Types: A distinction is made between open-loop and closed-loop prepaid cards, providing insights into their respective market shares and growth trajectories. Usage Categories: The report segments the prepaid card market into various categories such as general-purpose cards, business and administrative expense cards, travel forex cards, and meal cards. Business Segmentation: Further segmentation is provided based on business size and type, including small-scale businesses, mid-tier businesses, enterprise-level businesses, government entities, and retail consumers. Sector-Specific Applications: The analysis extends to specific sectors utilizing prepaid cards, including transit and toll payments, healthcare and wellness services, social security and other government benefit programs, fuel purchases, utilities, and more. Digital Wallet Market Insights Key Segments: The digital wallet market is dissected across five primary spending categories: retail shopping, travel, entertainment and gaming, dining establishments, and recharge and bill payments. Performance Metrics: For each segment, the report evaluates transaction value, transaction volume, and average transaction value, offering a granular view of consumer spending behaviors. Retail Spend Breakdown: An in-depth analysis is provided for retail spending via digital wallets, covering categories such as food and grocery, health and beauty products, apparel and footwear, books, music and video, consumer electronics, pharmacy and wellness, gas stations, restaurants and bars, toys, kids and baby products, services, and other miscellaneous categories. Key Players and Market Share Argentina's prepaid card market is highly competitive, with a mix of traditional banks and fintech companies expanding their offerings. Established players such as Mercado Pago have leveraged their extensive networks to introduce prepaid card solutions, making digital transactions more accessible for consumers. Their integration with e-commerce platforms and digital wallets strengthens their dominance, further embedding prepaid cards into Argentina's payment ecosystem. Fintech startups such as Uala have emerged as key players, disrupting the market with mobile-first prepaid card solutions. These companies cater to unbanked and underbanked populations by offering accessible financial services without requiring traditional bank accounts. As fintech adoption increases, competition is expected to intensify, pushing banks and startups to innovate and refine their prepaid card offerings. Recent Launches and Partnerships Strategic collaborations and acquisitions have significantly shaped the prepaid card market in Argentina. Mercado Pago's integration of Brazil's Pix payment system highlights the increasing cross-border cooperation in digital payments. This move aims to facilitate seamless transactions for Brazilian tourists in Argentina, reinforcing the role of prepaid cards in international financial transactions. Fintech companies are also securing substantial investments to scale their operations and expand their prepaid card services. Uala's recent $300 million funding round, backed by major investors such as Allianz X and Alan Howard, demonstrates the strong market confidence in fintech-driven prepaid solutions. These partnerships and financial commitments indicate sustained market growth, with companies focusing on expanding their customer base and service offerings. Scope Argentina Prepaid Payment Instrument Market Size and Forecast Transaction Value Trend Analysis Transaction Volume Trend Analysis Average Value per Transaction Market Share Analysis by Prepaid Card vs. Digital Wallet Argentina Digital Wallet Market Size and Forecast Transaction Value Trend Analysis Transaction Volume Trend Analysis Average Value per Transaction Market Share Analysis by Key Segments Argentina Digital Wallet Market Size and Forecast by Key Segments Retail Shopping (Value, Volume, Avg. Value) Travel (Value, Volume, Avg. Value) Restaurant (Value, Volume, Avg. Value) Entertainment and Gaming (Value, Volume, Avg. Value) Recharge and Bill Payment (Value, Volume, Avg. Value) Argentina Digital Wallet Retail Spend Dynamics Food and Grocery - Transaction Value Health and Beauty Products - Transaction Value Apparel and Foot Wear - Transaction Value Books, Music and Video - Transaction Value Consumer Electronics - Transaction Value Pharmacy and Wellness - Transaction Value Gas Stations - Transaction Value Restaurants & Bars - Transaction Value Toys, Kids, and Baby Products - Transaction Value Services - Transaction Value Others - Transaction Value Argentina Prepaid Card Industry Market Attractiveness Load Value Trend Analysis Transaction Value Trend Analysis Transaction Volume Trend Analysis Average Value per Transaction Number of Cards Market Share Analysis by Functional Attributes - Open Loop vs. Closed Loop Market Share Analysis by Prepaid Card Categories Argentina Open Loop Prepaid Card Future Growth Dynamics Transaction Value Trend Analysis Transaction Volume Trend Analysis Average Value per Transaction Number of Cards Argentina Closed Loop Prepaid Card Future Growth Dynamics Transaction Value Trend Analysis Transaction Volume Trend Analysis Average Value per Transaction Number of Cards Argentina Prepaid Card Consumer Usage Trends By Age Group By Income Group By Gender Argentina Prepaid Card Retail Spend Dynamics Food and Grocery - Transaction Value Health and Beauty Products - Transaction Value Apparel and Foot Wear - Transaction Value Books, Music and Video - Transaction Value Consumer Electronics - Transaction Value Pharmacy and Wellness - Transaction Value Gas Stations - Transaction Value Restaurants & Bars - Transaction Value Toys, Kids, and Baby Products - Transaction Value Services - Transaction Value Others - Transaction Value Argentina General Purpose Prepaid Card Market Size and Forecast Argentina Gift Card Market Size and Forecast Gift Card Market Size and Forecast by Functional Attribute By Open Loop Gift Card By Closed Loop Gift Card Gift Card Market Size and Forecast by Consumer Segments By Retail Consumer Segment By Corporate Consumer Segment Gift Card Market Share Analysis by Retail Categories Gift Card Market Share Analysis by Gifting Occasion Gift Card Market Share Analysis by Purchase Location Argentina Entertainment and Gaming Prepaid Card Market Size and Forecast Argentina Teen and Campus Prepaid Card Market Size and Forecast Teen and Campus Prepaid Card Market Size and Forecast by Functional Attribute By Open Loop Teen and Campus Prepaid Card By Closed Loop Teen and Campus Prepaid Card Argentina Business and Administrative Expense Prepaid Card Market Size and Forecast Business and Administrative Expense Prepaid Card Market Size and Forecast by Consumer Segments By Small Scale Business Segment By Mid-Tier Business Segment By Enterprise Business Segment By Government Segment Argentina Payroll Prepaid Card Market Size and Forecast Payroll Prepaid Card Market Size and Forecast by Consumer Segments By Small Scale Business Segment By Mid-Tier Business Segment By Enterprise Business Segment By Government Segment Argentina Meal Prepaid Card Market Size and Forecast Meal Prepaid Card Market Size and Forecast by Consumer Segments By Small Scale Business Segment By Mid-Tier Business Segment By Enterprise Business Segment By Government Segment Argentina Travel Forex Prepaid Card Market Size and Forecast Travel Forex Prepaid Card Market Size and Forecast by Consumer Segments By Retail By Small Scale Business Segment By Mid-Tier Business Segment By Enterprise Business Segment By Government Segment Argentina Transit and Tolls Prepaid Card Market Size and Forecast Argentina Social Security and Other Government Benefit Programs Prepaid Card Market Size and Forecast Argentina Fuel Prepaid Cards Market Size and Forecast Argentina Utilities, and Other Prepaid Cards Market Size and Forecast Argentina Virtual Prepaid Card Industry Market Attractiveness Transaction Value Trend Analysis Transaction Volume Trend Analysis Average Value per Transaction Market Share Analysis by Key Virtual Prepaid Card Categories Argentina Virtual Prepaid Card Market Size by Key Categories General Purpose Prepaid Card - Transaction Value Gift Card - Transaction Value Entertainment and Gaming Prepaid Card - Transaction Value Teen and Campus Prepaid Card - Transaction Value Business and Administrative Expense Prepaid Card - Transaction Value Payroll Prepaid Card - Transaction Value Meal Prepaid Card - Transaction Value Travel Forex Prepaid Card - Transaction Value Transit and Tolls Prepaid Card - Transaction Value Social Security and Other Government Benefit Programs Prepaid Card - Transaction Value Fuel Prepaid Cards - Transaction Value Utilities, and Other Prepaid Cards - Transaction Value Key Attributes: Report Attribute Details No. of Pages Forecast Period Estimated Market Value (USD) in 2025 $9.84 Billion Forecasted Market Value (USD) by 2029 $16.55 Billion Compound Annual Growth Rate Regions Covered Argentina For more information about this report visit https://www.researchandmarkets.com/r/hqxuvi About ResearchAndMarkets.com ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends. View source version on businesswire.com: https://www.businesswire.com/news/home/20250620418187/en/ Contacts ResearchAndMarkets.com Laura Wood, Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Uala Frequently Asked Questions (FAQ)

When was Uala founded?

Uala was founded in 2017.

Where is Uala's headquarters?

Uala's headquarters is located at Nicaragua 4677, Caba.

What is Uala's latest funding round?

Uala's latest funding round is Series E - II.

How much did Uala raise?

Uala raised a total of $1.039B.

Who are the investors of Uala?

Investors of Uala include TelevisaUnivision, Soros Fund Management, Ribbit Capital, Tencent, SoftBank and 31 more.

Who are Uala's competitors?

Competitors of Uala include Klar, Aplazo, Albo, Stori, Neon and 7 more.

What products does Uala offer?

Uala's products include Payments and 3 more.

Loading...

Compare Uala to Competitors

Neon is a fintech company that provides digital banking services. The company offers a digital account, a credit card, CDBs, personal loans, and rewards, which can be accessed through a mobile application. Neon serves individual consumers and microentrepreneurs with its products. Neon was formerly known as ControlY. It was founded in 2016 and is based in Sao Paulo, Brazil.

Klar is a financial services company specializing in credit, savings, and investment products. The company offers services including credit cards, personal savings accounts, and investment opportunities. It was founded in 2019 and is based in Mexico City, Mexico.

Bnext operates as a financial technology company that offers a range of financial management services. The company provides an online banking platform with features such as international money transfers, virtual cards, expense tracking, and a marketplace for various financial products. Bnext also supports cryptocurrency transactions and integrates with mobile payment services. It was founded in 2016 and is based in Madrid, Spain.

Agibank is a financial institution that operates in the banking sector. The company offers a range of financial services, including personal loans, consigned loans, and investment services, all designed to facilitate the economic lives of its customers. It primarily serves individuals, offering solutions for various financial needs. It was founded in 1999 and is based in Campinas, Brazil.

Cuenca offers electronic funds payment accounts within the digital banking sector. Its services include easy account opening, SPEI bank transfers, bill payments, and 24/7 access to funds through a mobile app. Cuenca provides various account levels to meet different customer needs, from those making cash deposits to those receiving regular transfers. Cuenca was formerly known as Cuenca Health. It was founded in 2018 and is based in Mexico City, Mexico.

Digio is a digital banking platform that provides financial services. The company offers products including a digital bank account, credit card management, personal loans, and a rewards program, all accessible via a mobile application. Digio serves individuals who manage their finances through digital means. It was founded in 2013 and is based in Barueri, Brazil.

Loading...