Two

Founded Year

2020Stage

Series A - II | AliveTotal Raised

$30.96MLast Raised

$19.4M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-27 points in the past 30 days

About Two

Two specializes in B2B Buy Now Pay Later (BNPL) payment solutions within the e-commerce sector. The company offers services that enable merchants to provide high net term credit limits, manage credit and fraud risks, and streamline the checkout process for business customers. Two's solutions cater to various sectors, including construction, wholesale, B2B marketplaces, and SaaS. Two was formerly known as Tillit. It was founded in 2020 and is based in Oslo, Norway.

Loading...

Two's Product Videos

ESPs containing Two

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The buy now pay later (BNPL) — B2B payments market allows businesses to acquire goods and services immediately and pay for them in installments over time, helping to increase purchasing power and manage working capital and cash flow. These solutions provide streamlined application processes, quick approvals, and transparent terms. They typically include online platforms, embedded finance tools, or…

Two named as Challenger among 15 other companies, including Affirm, PayPal, and Mondu.

Two's Products & Differentiators

Guest Checkout

Enables B2B buyers to complete a purchase online in under 60 seconds without creating an account. Designed for one-off and infrequent buyers with an AOV of €650.

Loading...

Research containing Two

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Two in 4 CB Insights research briefs, most recently on Jun 6, 2025.

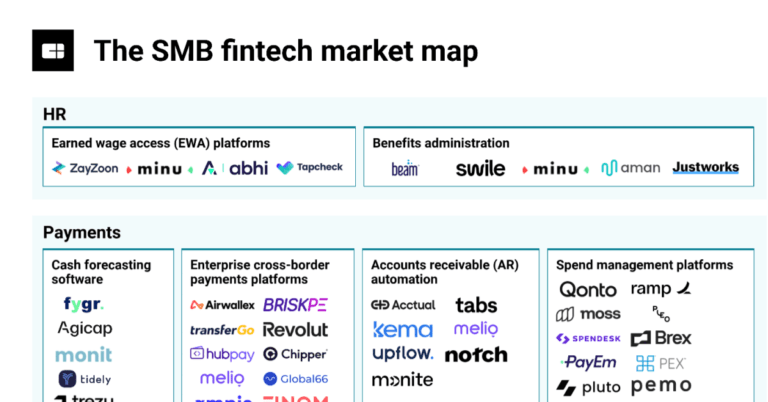

Jun 6, 2025

The SMB fintech market map

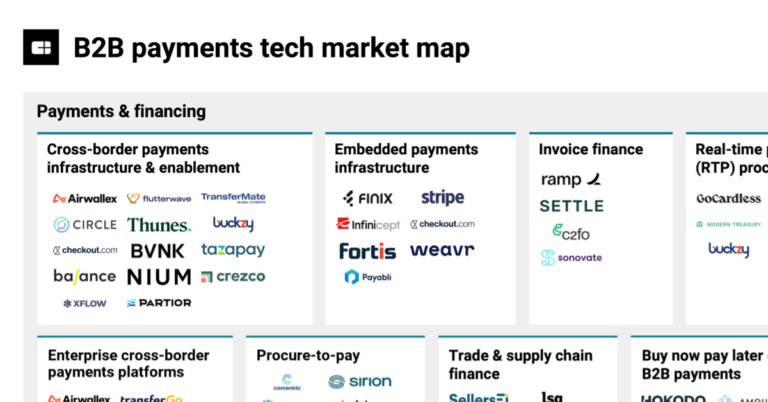

Aug 23, 2024

The B2B payments tech market map

May 8, 2024

The embedded banking & payments market map

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023Expert Collections containing Two

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Two is included in 4 Expert Collections, including Digital Lending.

Digital Lending

2,661 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Payments

3,198 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,978 items

Excludes US-based companies

Fintech 100

100 items

Two Patents

Two has filed 16 patents.

The 3 most popular patent topics include:

- babycare

- fluid dynamics

- infancy

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

9/28/2018 | 10/1/2024 | Pelvis, Interventional radiology, Medical equipment, Catheters, Implants (medicine) | Grant |

Application Date | 9/28/2018 |

|---|---|

Grant Date | 10/1/2024 |

Title | |

Related Topics | Pelvis, Interventional radiology, Medical equipment, Catheters, Implants (medicine) |

Status | Grant |

Latest Two News

Apr 30, 2025

Qliro and Two integrate B2B BNPL for Nordic SMEs Wednesday 30 April 2025 12:50 CET | News Qliro has integrated B2B Buy Now, Pay Later (BNPL) capabilities into its checkout service through a new partnership with payments technology firm Two . This move is aimed at expanding financing options for small and medium-sized enterprises (SMEs) in the Nordic region. The new service enables Qliro’s merchant partners to offer delayed payment terms of up to 90 days for business customers. The integration of Two’s solution into Qliro’s existing checkout is designed to support business buyers with more flexible terms while maintaining real-time risk assessment and instant credit decisions. A representative from Qliro described the development as a way to simplify enterprise-level payment experiences for smaller merchants without requiring additional system integration. They noted that the company aims to streamline the B2B purchasing process in a way that mirrors the user-friendly interfaces typically found in consumer payments. Addressing growth in B2B ecommerce According to the official press release, the B2B ecommerce segment in the Nordics continues to expand, with expectations for the global BNPL market in this sector to reach approximately USD 669.5 billion by 2029. This projected growth, at an annual rate of 27.4%, has led providers to explore new solutions that match the flexibility of consumer-facing platforms. Officials from Two noted that embedding their system within Qliro’s checkout infrastructure creates a unified experience for both consumer and business transactions. They added that the approach is intended to help merchants improve conversion rates and increase order values, particularly among recurring business customers. Under the partnership, Two assumes responsibility for credit and fraud risks associated with the B2B transactions. Their system also supports instant verification of company details and credit approvals, with Qliro facilitating a simplified onboarding process for participating merchants. The move also aligns with Two’s strategy to expand its merchant base by offering integrated payment capabilities that do not compromise the specific requirements of B2B transactions. Free Headlines in your E-mail Every day we send out a free e-mail with the most important headlines of the last 24 hours.

Two Frequently Asked Questions (FAQ)

When was Two founded?

Two was founded in 2020.

Where is Two's headquarters?

Two's headquarters is located at Kongens gate 6, Oslo.

What is Two's latest funding round?

Two's latest funding round is Series A - II.

How much did Two raise?

Two raised a total of $30.96M.

Who are the investors of Two?

Investors of Two include Phoenix Court, Sequoia Capital, Antler, Visionaries Club, Shine Capital and 8 more.

Who are Two's competitors?

Competitors of Two include Hokodo, Kriya, Ledyer, Balance, Biller and 7 more.

What products does Two offer?

Two's products include Guest Checkout and 4 more.

Loading...

Compare Two to Competitors

Mondu specializes in Buy Now, Pay Later (BNPL) solutions for B2B transactions within the financial services sector. The company offers a suite of payment solutions that allow businesses to provide their customers with various deferred payment options, including flexible payment terms, installment plans, and digital trade accounts. Mondu primarily serves the ecommerce industry, B2B marketplaces, and multichannel sales sectors. It was founded in 2021 and is based in Berlin, Germany.

Hokodo is a digital trade credit platform that provides B2B payment solutions. The company offers payment terms, trade accounts, and payment plans for B2B transactions. Hokodo's services include credit protection, collections management, and integration options for both online and offline sales channels. It was founded in 2018 and is based in London, United Kingdom.

Fluid provides checkout solutions for B2B businesses. The company offers a range of flexible payment options, allowing buyers to either pay immediately or select credit terms that fit their specific needs. Fluid primarily serves the B2B sector in Asia. It was founded in 2023 and is based in Singapore.

Credit Key specializes in providing B2B credit solutions within the financial services sector. The company offers instant business credit at the point of purchase, enabling merchants to increase revenue and improve cash flow by providing their customers with flexible payment options such as net terms and pay over time. Credit Key primarily serves the eCommerce industry, offering a standalone module that integrates with various shopping cart platforms to facilitate real-time credit decisions and financing. It was founded in 2015 and is based in Los Angeles, California.

Slope specializes in B2B workflow automation within the financial technology sector. The company offers solutions for online payment processing, and flexible payment terms, and automates the entire order-to-cash cycle using its software and APIs. Slope primarily caters to businesses looking to streamline their financial operations and payment systems. It was founded in 2021 and is based in San Francisco, California.

PayPay is a fintech company that provides QR code-based payment solutions and digital wallet services. The company offers a platform for users to make payments at various retail locations, online, and for public utilities, as well as facilitating peer-to-peer money transfers. PayPay primarily serves the consumer goods retail, dining, and public utility payment sectors. It was founded in 2018 and is based in Tokyo, Japan.

Loading...