Tradeshift

Founded Year

2009Stage

Series H | AliveTotal Raised

$1.173BLast Raised

$70M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-31 points in the past 30 days

About Tradeshift

Tradeshift operates as a supply chain network for e-invoicing and accounts payable automation. It provides accounts payable, e-procurement, and strategic finance. The company offers a business-to-business marketplace platform for e-procurement, an application programming interface, supplier collaboration and analytics, and more. It was founded in 2009 and is based in San Francisco, California.

Loading...

Loading...

Research containing Tradeshift

Get data-driven expert analysis from the CB Insights Intelligence Unit.

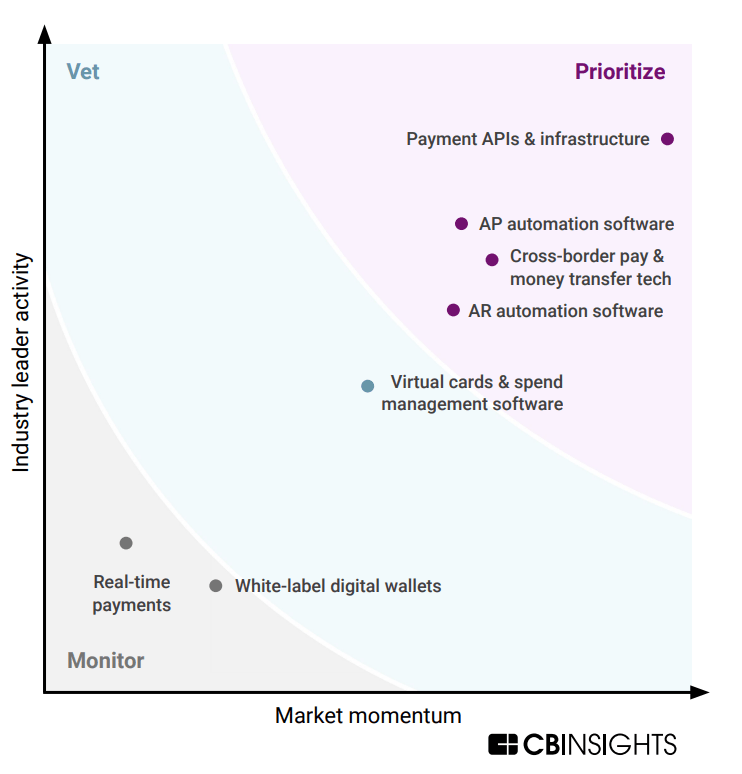

CB Insights Intelligence Analysts have mentioned Tradeshift in 4 CB Insights research briefs, most recently on Aug 23, 2024.

Aug 23, 2024

The B2B payments tech market mapExpert Collections containing Tradeshift

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Tradeshift is included in 8 Expert Collections, including Supply Chain & Logistics Tech.

Supply Chain & Logistics Tech

4,573 items

Companies offering technology-driven solutions that serve the supply chain & logistics space (e.g. shipping, inventory mgmt, last mile, trucking).

Unicorns- Billion Dollar Startups

1,276 items

Fintech 100

748 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Digital Lending

2,464 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

SMB Fintech

2,003 items

Payments

3,198 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Latest Tradeshift News

Jun 24, 2025

24, 2025 / EINPresswire.com Tradeshift , leader in payables automation and e-Invoicing compliance solutions, today announced the launch of its new Analytics app, an advanced business intelligence solution designed for buyers to transform payables data into actionable insights within seconds. Powered by Amazon QuickSight and featuring Amazon Q's generative AI capabilities, the app delivers enterprise-grade reporting and analytics at a fraction of traditional BI costs. The Analytics app empowers payables teams and finance leaders to overcome the complexity of data analysis. Buyers can now generate comprehensive reports in seconds, access 11 reports and dashboard templates covering a wide range of payables and procurement metrics, and so make data-driven decisions faster than ever before – all without technical expertise. "Throughout my career, I've often seen teams struggle with expensive, complex BI tools that require extensive training. Our Analytics app is different. Powered by Amazon QuickSight and Amazon Q, we deliver sophisticated intelligence at a fraction of the cost while being intuitive enough for anyone to use. Our solutions are about empowering payables teams to save time and be more strategic and the new Analytics app is another big step forward in this regard." – Mike Cowles, CEO, Tradeshift. Tradeshift developed the Reporting & Analytics platform in close collaboration with Amazon Web Services (AWS), building it on AWS's QuickSight business intelligence technology. This strategic partnership ensures enterprise-grade scalability, speed, and security. It makes Tradeshift one of the first AP automation platforms to offer integrated conversational analytics in its solution. "Our next gen analytics platform powered by QuickSight marks a significant step forward for payables, procurement and finance professionals," said Raphael Bres, Chief Product & Technology Officer, Tradeshift. "We are providing ultra-fast, embedded, AI-powered advanced analytics over high volumes of transactions. We are empowering our customers to make faster, data-driven decisions, uncover opportunities and focus on the most critical areas. This is what modern B2B SaaS BI should be: powerful enough for complex analysis, simple enough for everyday use at the lowest total cost of ownership possible." Tradeshift's Analytics app is available to all customers now. Transformative Capabilities for Buyers: Rapid Payable and Procurement Intelligence - Zero set up - Analyse all your invoices, purchase orders and credit notes in seconds - Access 11 pre-built reports and dashboards covering all aspects of your AP - Advanced self-service designer dashboard functionality Ask Anything, Understand Everything - Natural language queries through Amazon Q - Answers, including visual representations, in seconds - Machine learning for predictive insights Enterprise Power, Low Pricing - Embedded into customers' existing Tradeshift platform - Export capabilities for cross-team collaboration Out-of-the-Box Datasets, Reports and Dashboards include - Number and location of connections (suppliers), and trading status - Suppliers by connection status - Suppliers by document (invoice, PO, credit notes) volume - Suppliers by document volume, type and source - Document value by month - Invoices by cost centre - AP document workflow reporting - Purchase order lifecycle dashboard - Users, roles, teams reports To see a demo of the Analytics app go to www.tradeshift.com About Tradeshift Tradeshift is a leader in procure-to-pay (P2P) solutions, specialising in AP automation and global e-Invoicing compliance. The company's platform helps enterprises eliminate manual processes, reduce transaction costs by up to 90%, and ensure compliance in 69 countries. With 15 years of operations and processing 10 million AP documents monthly, Tradeshift serves global enterprises including Air France, DHL, Société Générale, and Schaeffler. The company's innovative features include first-invoice supplier onboarding, AI-powered tools and analytics, and seamless ERP integration, making it the trusted partner for finance teams seeking digital transformation. David Hardy, VP Marketing Tradeshift email us here Visit us on social media: LinkedIn Legal Disclaimer: EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Tradeshift Frequently Asked Questions (FAQ)

When was Tradeshift founded?

Tradeshift was founded in 2009.

Where is Tradeshift's headquarters?

Tradeshift's headquarters is located at 447 Sutter Street, San Francisco.

What is Tradeshift's latest funding round?

Tradeshift's latest funding round is Series H.

How much did Tradeshift raise?

Tradeshift raised a total of $1.173B.

Who are the investors of Tradeshift?

Investors of Tradeshift include Notion Capital, Fuel Venture Capital, LUN Partners Capital, The Private Shares Fund, IDC Ventures and 31 more.

Who are Tradeshift's competitors?

Competitors of Tradeshift include JAGGAER, Coupa, Basware, Scanmarket, BirchStreet Systems and 7 more.

Loading...

Compare Tradeshift to Competitors

Varisource provides a technology buying and management platform. The company offers a platform for businesses for technology purchases, compare vendor options, and manage technology-spent data. It serves various sectors including information technology (IT), procurement, finance, and private equity. The company was founded in 2021 and is based in Orlando, Florida.

Coupa operates in the business technology sector and offers a platform that analyzes spending data and automates business decisions. The company serves businesses that manage their spending. It was founded in 2006 and is based in San Mateo, California. In February 2023 Coupa was acquired by Abu Dhabi Investment Authority and Thoma Bravo at a valuation of $8B.

GEP provides procurement and supply chain solutions. The company provides artificial intelligence (AI)-enabled software, strategy consulting, and managed services. Its main offerings include procurement software, supply chain management solutions, and strategic consulting services, all designed to help businesses streamline their operations and increase efficiency. It was founded in 1999 and is based in Clark, New Jersey.

Ivalua provides cloud-based procurement and spend management software within the technology sector. The company offers a source-to-pay platform that includes supplier management, spend analysis, strategic sourcing, contract management, eProcurement, invoicing, payments, and environmental impact initiatives. Ivalua's solutions serve industries such as automotive, construction, financial services, healthcare, manufacturing, and the public sector. It was founded in 2000 and is based in Redwood City, California.

JAGGAER focuses on intelligent source-to-pay and supplier collaboration platforms. The company offers AI-powered tools designed to automate procurement processes, manage spend, and enhance supplier collaboration. JAGGAER's solutions cater to various industries, including education, manufacturing, healthcare, and more, providing analytics, strategic sourcing, spend management, and supply chain collaboration services. JAGGAER was formerly known as SciQuest. It was founded in 1995 and is based in Durham, North Carolina.

Zycus provides cognitive procurement software, with an integrated Source-to-Pay (S2P) suite powered by Generative AI. The company's offerings include eProcurement, eInvoicing, and Source-to-Contract solutions, which aim to automate procurement processes, analyze spending, and manage supplier relationships. Zycus serves large global enterprises across sectors such as automotives, banking and financial services, consumer packaged goods, and healthcare. It was founded in 1998 and is based in Princeton, New Jersey.

Loading...