Tractable

Founded Year

2014Stage

Series E | AliveTotal Raised

$184.83MLast Raised

$65M | 2 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-104 points in the past 30 days

About Tractable

Tractable focuses on artificial intelligence in the automotive and property insurance sectors. The company provides solutions for damage appraisal, assisting in the assessment and protection of vehicles and homes. Tractable's technology aims to improve claims processes, from reporting to settlement, and to support the appraisal of automotive parts. It was founded in 2014 and is based in London, United Kingdom.

Loading...

Tractable's Product Videos

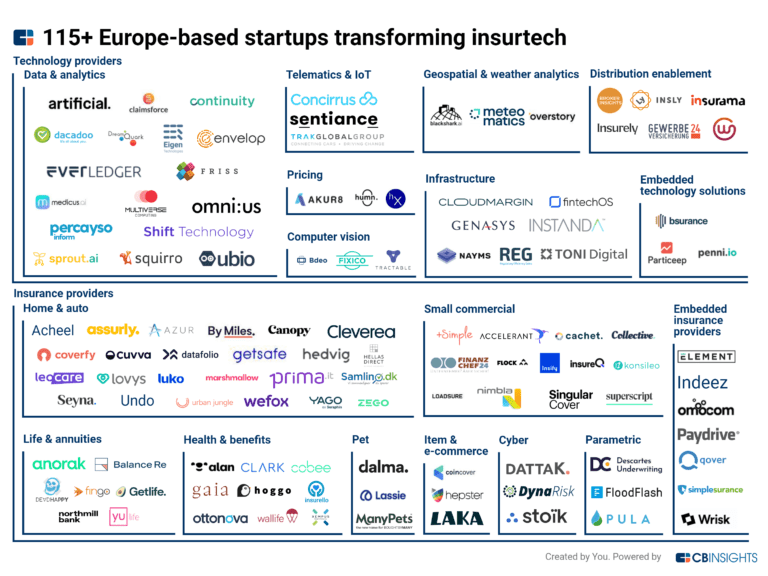

ESPs containing Tractable

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

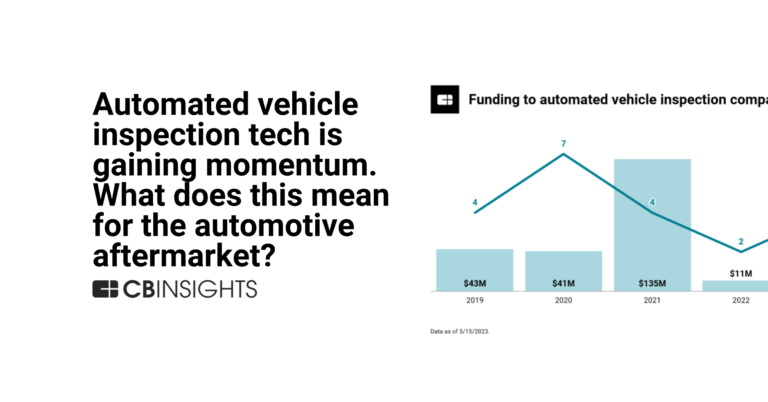

The automated vehicle inspection market provides AI-powered technology solutions for assessing vehicle condition and detecting damage without manual intervention. These systems use computer vision, sensors, and machine learning to evaluate vehicles for insurance claims, fleet management, automotive retail, and safety compliance. Key capabilities include damage detection and classification, repair …

Tractable named as Leader among 14 other companies, including CCC Intelligent Solutions, UVeye, and Landing AI.

Tractable's Products & Differentiators

AI Insant Quote

Instantly provide instant quotes to customers looking to understand how much it would cost to fix their vehicle. A Tractable link for a free estimate is placed on bodyshop website and customers can then input their info to begin the process, which requires 7 photos of the vehicle and a few pieces of information entered via a web app. Customer will then receive a quote on what the vehicle would cost to get repaired and can call the shop to schedule the repair, if they so please.

Loading...

Research containing Tractable

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Tractable in 8 CB Insights research briefs, most recently on Jul 2, 2024.

Jul 2, 2024 team_blog

How to buy AI: Assessing AI startups’ potential

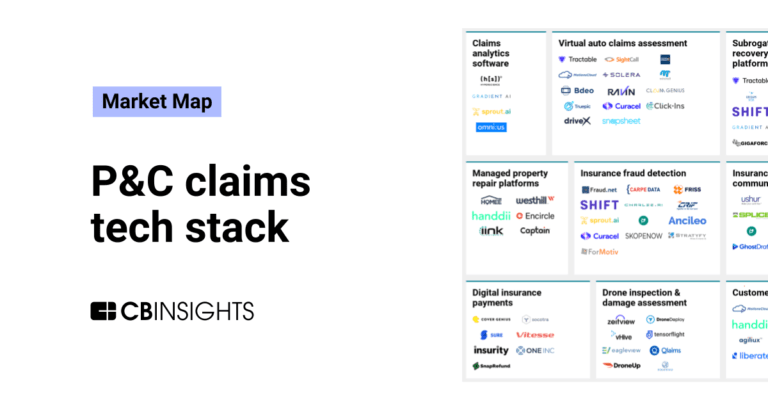

Dec 18, 2023

The P&C claims tech stack market map

Aug 1, 2023

Customer perspectives on the Insurtech 50

Expert Collections containing Tractable

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Tractable is included in 8 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,276 items

AI 100 (All Winners 2018-2025)

399 items

Winners of CB Insights' annual AI 100, a list of the 100 most promising AI startups in the world.

Insurtech

4,553 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Artificial Intelligence

12,322 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Fintech

13,978 items

Excludes US-based companies

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Tractable Patents

Tractable has filed 22 patents.

The 3 most popular patent topics include:

- insurance

- machine learning

- classification algorithms

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

2/11/2022 | 12/10/2024 | Marxian economics, Marxist terminology, Communist terminology, Socialism, Insurance | Grant |

Application Date | 2/11/2022 |

|---|---|

Grant Date | 12/10/2024 |

Title | |

Related Topics | Marxian economics, Marxist terminology, Communist terminology, Socialism, Insurance |

Status | Grant |

Latest Tractable News

Jun 10, 2025

The Business Research Company’s Latest Report Explores Market Driver, Trends, Regional Insights - Market Sizing & Forecasts Through 2034” EINPresswire.com / -- The application of artificial intelligence AI in the insurance claims processing field has recently seen rapid growth, and the predictions for its market size show its potential to transform the industry. With a compound annual growth rate CAGR of 16.8%, the market size is projected to rise from $0.39 billion in 2024 to $0.46 billion in 2025. The factors attributing to this growth include increasing fraud detection needs, rising insurance claims volumes, advancements in machine learning algorithms, digital transformation regulations, and the growing adoption of automation in insurance. This advancement in the field is not expected to slow down anytime soon. In fact, the AI in insurance claims processing market size is slated to experience even faster growth over the next few years, reaching $0.85 billion by 2029 at a CAGR of 16.6%. This forecasted growth can be ascribed to the increasing integration of AI with blockchain technology, the rising demand for real-time claims processing, the growing use of AI-powered chatbots, the expansion of predictive analytics for risk assessment, and an increasing adoption of cloud-based AI solutions. Get Your Free Sample Market Report: https://www.thebusinessresearchcompany.com/sample_request?id=23623&type=smp What’s Driving The AI In Insurance Claims Processing Market Growth? One of the driving forces behind the forecasted growth in ai in insurance claims processing market is the rising demand for personalized claims assistance. This refers to AI-driven solutions that provide tailored support, real-time claim tracking, and automated recommendations based on policyholder needs. The increasing demand for such services has seen insurers focus on enhancing customer experience through personalized communication and service. What Key Player Strategies Are Driving The AI In Insurance Claims Processing Market? Prominent players in the AI in insurance claims processing market include ICICI Lombard General Insurance Company Ltd, CCC Intelligent Solutions Inc., Quantiphi, Sapiens International, Blue Prism Limited, ScienceSoft USA Corporation, Harbinger Group, Newgen Software Technologies Limited, Vlink Inc., LeewayHertz, Astera Software, Damco Group, Ravin AI Ltd., ZestyAI, Tractable Ltd., Sprout.ai, CLARA Analytics Inc., V7 Ltd., Alula Technologies Ltd., Simplifai Systems Limited, Perceptiviti Data Solutions Private Limited. Order Your Report Now For A Swift Delivery:

Tractable Frequently Asked Questions (FAQ)

When was Tractable founded?

Tractable was founded in 2014.

Where is Tractable's headquarters?

Tractable's headquarters is located at 5 Appold Street, London.

What is Tractable's latest funding round?

Tractable's latest funding round is Series E.

How much did Tractable raise?

Tractable raised a total of $184.83M.

Who are the investors of Tractable?

Investors of Tractable include Insight Partners, Georgian, SoftBank, Ignition Partners, K5 Global Technology and 12 more.

Who are Tractable's competitors?

Competitors of Tractable include DriveX, UVeye, Trueclaim, Fixico, Bdeo and 7 more.

What products does Tractable offer?

Tractable's products include AI Insant Quote and 4 more.

Who are Tractable's customers?

Customers of Tractable include https://kirmac.com/ and MS&AD.

Loading...

Compare Tractable to Competitors

Inspektlabs provides AI-powered digital vehicle inspections within the automotive and insurance industries. The company offers services including damage detection, claim assessment, and fraud detection using photos and videos, for vehicle inspection. Inspektlabs serves sectors such as motor insurance, fleet management, car rental/leasing, and repair networks. It was founded in 2019 and is based in Middletown, Delaware.

Trueclaim focuses on vehicle damage detection within the automotive insurance and collision repair sectors. The company offers a platform utilizing machine learning and computer vision to automate the vehicle appraisal process, providing damage estimates and workflows for insurance companies and repair shops. It primarily serves the automotive industry. The company was founded in 2021 and is based in Laval, Canada.

UVeye serves as a computer vision technology company specializing in the development of automated inspection systems for vehicles within the automotive industry. The company's main offerings include AI inspection systems that utilize proprietary hardware to detect vehicle issues and security threats, particularly in the undercarriage. UVeye primarily serves sectors such as vehicle manufacturers, dealerships, fleet companies, and various security-sensitive facilities. It was founded in 2014 and is based in Teaneck, New Jersey.

My Gutachter specializes in vehicle damage assessment and claims management within the automotive industry. The company offers a range of services including repair cost calculations, independent claims management, and comprehensive damage reports for various vehicle classes. My Gutachter primarily serves sectors such as insurance companies, leasing firms, car rental services, fleet managers, and damage managers. It was founded in 2021 and is based in Herford, Germany.

ControlExpert provides services for the digitalization and acceleration of manual processes in the vehicle damage management sector. The company processes over 18 million reports, estimates, invoices, and maintenance documents annually, using a mix of human and artificial intelligence to enable assessments. ControlExpert's clients include insurers, leasing companies, and automotive dealerships. It was founded in 2002 and is based in Langenfeld, Germany.

Snapsheet specializes in insurance technology solutions. It enables a claim process starting with virtual estimations all the way to final repairs and payment by generating communication between consumers, shops, and carriers. The company offers a range of services, including appraisals, claims management, and payments, all aimed at managing the insurance claims process. It primarily serves the insurance industry. It was founded in 2011 and is based in Chicago, Illinois.

Loading...