Together AI

Founded Year

2022Stage

Series B | AliveTotal Raised

$533.5MValuation

$0000Last Raised

$305M | 5 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+79 points in the past 30 days

About Together AI

Together AI focuses on the development, training, fine-tuning, and deployment of generative artificial intelligence (AI) models. The company provides services including AI model training, inference, and utilizes a cloud-based infrastructure. Together AI serves various sectors by offering solutions that cover the generative AI process from research to production. It was founded in 2022 and is based in San Francisco, California.

Loading...

ESPs containing Together AI

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The small language models (SLMs) tools & development market focuses on creating, optimizing, and deploying compact language models that prioritize efficiency and specialized functionality. These models require fewer computational resources than large language models while offering advantages in speed, cost, and on-device deployment capabilities. Companies in this market provide tools for developin…

Together AI named as Leader among 15 other companies, including Mistral AI, Hugging Face, and DeepSeek.

Together AI's Products & Differentiators

GPU Clusters

High-performance, scalable infrastructure for AI training and fine-tuning.

Loading...

Research containing Together AI

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Together AI in 11 CB Insights research briefs, most recently on May 16, 2025.

May 16, 2025 report

Book of Scouting Reports: 2025’s AI 100

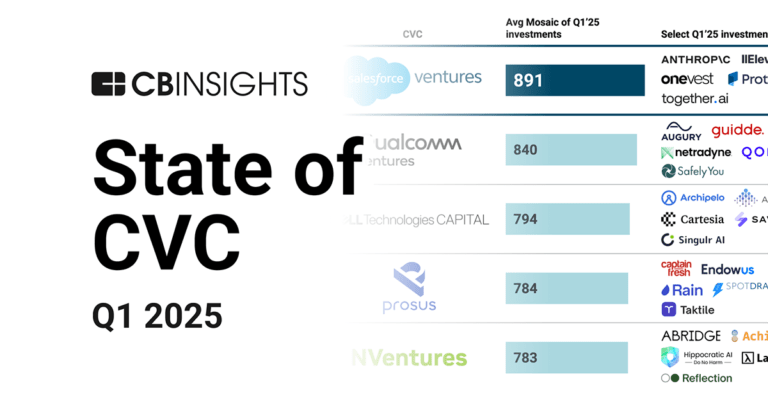

Apr 29, 2025 report

State of CVC Q1’25 Report

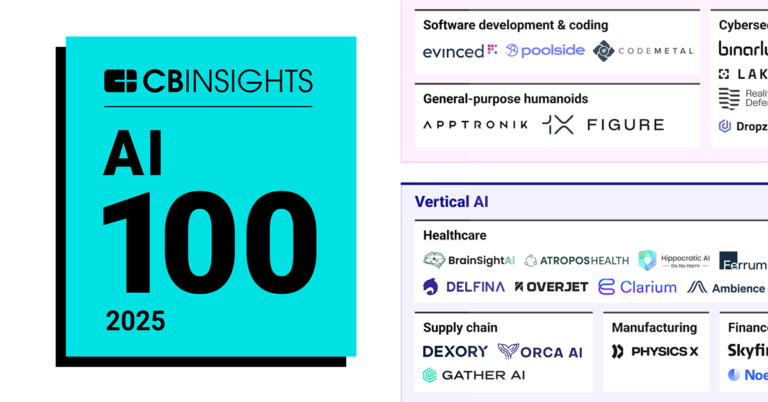

Apr 24, 2025 report

AI 100: The most promising artificial intelligence startups of 2025

May 24, 2024

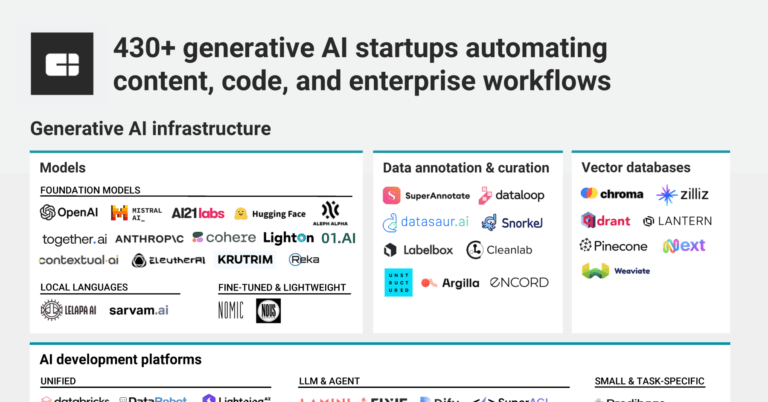

The generative AI market map

May 8, 2024 report

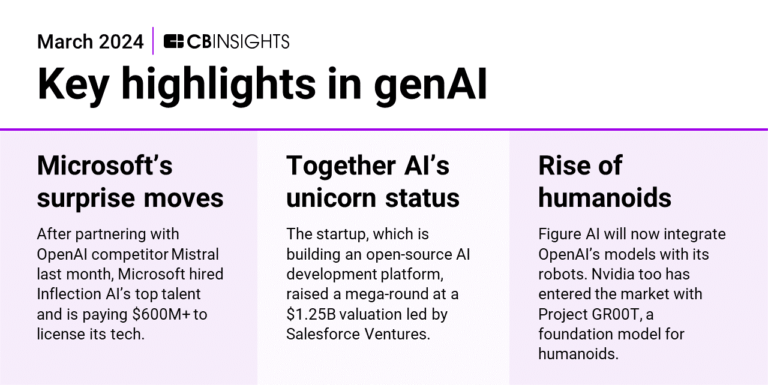

State of AI Q1’24 Report

Feb 1, 2024 report

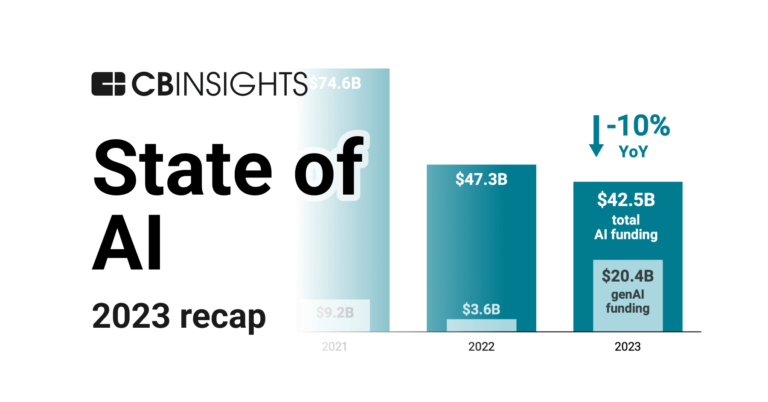

State of AI 2023 ReportExpert Collections containing Together AI

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Together AI is included in 6 Expert Collections, including Generative AI.

Generative AI

2,249 items

Companies working on generative AI applications and infrastructure.

AI 100 (2024)

100 items

Unicorns- Billion Dollar Startups

1,277 items

Artificial Intelligence

9,911 items

AI 100 (2025)

100 items

AI 100 (All Winners 2018-2025)

200 items

Latest Together AI News

Jun 27, 2025

Jun 27, 2025 • Robert Lavine Kaweewut Temphuwapat, newly installed CEO of Siam Commercial Bank's venture arm, is targeting US startups to build on partnerships with the likes of Ripple and Together AI. Kaweewut Temphuwapat has been CEO of SCB 10X, Siam Commercial Bank (SCB)’s $600m corporate VC arm, for just a few weeks. But he already has some definitive plans in place. “The first thing is investment,” Temphuwapat tells Global Corporate Venturing. “We are doubling down on AI and frontier tech. And I think in the next couple of years, we expect to see a return from our funds. Those are the first key metrics.” Temphuwapat has replaced former CEO and GCV Powerlist mainstay Tai Panich at SCB 10X, having been chief innovation officer at Thailand-based SCB’s fintech arm, SCB X, for two years. The unit’s main focal areas are AI and Web3, and his background in innovation means he is actively looking to build on its partnership model, particularly for startups looking to move into Southeast Asia. “That’s our pitch. We’ve done that with startups in Israel, in the US – we help them grow the business here, and that’s very much when we invest,” he says. “We have all the networks here in Southeast Asia – 10 countries speaking 10 languages, so we can give them a good intro throughout those areas. We can be their reference customer as well, and that’s part of helping the startups.” SCB 10X has a history of helping US startups in particular break into Asia. In 2020, for example, it invested in Ripple, which powers SCB’s local cross-border remittance service. Six of the unit’s last eight investments have been in US-based companies, and Temphuwapat just got back from a trip to Silicon Valley, where he met local VC funds as well as researchers from Stanford (his alma mater). Temphuwapat says this focus has been a response to US success with AI technology and its ability to foster an attractive startup system. “We know that all the good AI startups are coming from the US.” “It’s a conscious decision because we know that all the good AI startups are coming from the US,” he says. And getting your feet on the ground there is crucial. “Silicon Valley is a closed place, so I would say we have to be there more, make our presence known and pitch ourselves, and you’re getting to know more of the ecosystem there. Once we go more earlier stage, it’s really about the relationships with founders, so we have an approach where we have to be there more often and get into the right network.” Image courtesy of Siam Commercial Bank One key example of that partnership strategy is Typhoon, a large language model developed by SCB X specifically for the Thai language, which is hosted by US-based AI cloud provider and portfolio company Together AI. It is using open-source models to train the LLM, which currently has 100,000 users, and struck a deal earlier this month to pilot its use within Thai governmental departments. “I think it’s very important, because we deal with 20 million customers every day and all of them speak Thai,” says Temphuwapat. “They are not going to interact with anything in English. We also know that Thai is a lower-resource language. A big company or big model will not focus on developing [for] our language.” SCB 10X took part in Together’s $20m seed round two years ago and Temphuwapat says using the startup’s cloud-based generative AI platform cuts the cost of inference – running data through an AI model live – by some 70%. The startup’s most recent valuation was more than $3.3bn. “There’s a synergy between what we build and what we invest in,” he adds. “We’ll be like that first user, and we are about to do a use case together. We are actually [Together AI’s] first user in Asia, so we got to help them grow their business here as well.” Being a banking CVC in 2025 doesn’t just mean fintech Typhoon fits in with one of SCB 10X’s key focus areas: seeing how a bank can use AI to optimise how it runs. “In this era where AI is thriving, we see financial institutions using AI to enhance their operations and then create new types of service,” Temphuwapat says. “We did that a lot in my other role as chief innovation officer – try to bring in AI to streamline processes, getting better at fraud detection, lending and classifying customers, those types of things.” SCB 10X’s interest in AI goes beyond pure fintech and has expanded the field of startups it targets. Five years ago, the unit probably wouldn’t have invested in the likes of Jimini Health, which is using generative AI to help clinicians improve their mental health coverage, or Spacely AI, which is applying the same technology to helping interior designers map indoor spaces. But both are recent-ish portfolio companies, and Temphuwapat says SCB 10X is mostly interested in the idea of AI infrastructure. This is partly because the valuations are more affordable than the pure-play AI startups, but also because even if the software doesn’t directly relate to what SCB does right now, it may do so in the future. “We’re not investing in chips and the hardware anymore, because we think it’s too risky for us and because of the cheque size.” “We are investing in infrastructure and all those software and application layers,” he says. “We’re not investing in chips and the hardware anymore, because we think it’s too risky for us and because of the cheque size. But we will keep doubling down on the AI application use case. “To be honest, we haven’t seen the killer use case for gen AI yet. People are not just going to chat on OpenAI, there will be a killer use case,” he adds. “Those are some things we are keeping an eye on. It doesn’t have to be fintech-related.” Playing the long game on Web3 SCB 10X is also bullish about Web3. Tokenisation service Token X is already part of the broader SCB X group, and SCB 10X’s most recent investment was in Theo, a startup connecting capital stored on blockchains to the main financial markets. “We are really into this long-term game of Web3. We went in very early five years ago and we still believe in it,” says Temphuwapat. “First of all, I think Web3 infrastructure is here to stay, it’s getting better and better. It’s whether regulation can catch up with that or not, but Web3 in terms of payments and other types of financial services is something we believe in.” SCB X is also actively developing additional Web3 products, some in partnership with portfolio companies. The investment arm took part in Fireblocks’ $310m series D round in 2021, and three years on the parent company launched a digital wallet app called Rubie that uses the startup’s wallet infrastructure and facilitates QR payments using a stablecoin linked to the Thai Baht. Another portfolio company, Rakkar, is the crypto custodian for SCB X’s online investment platform, InnovestX, and Temphuwapat says it is planning to expand its Web3 offering, as soon as Thailand’s regulators catch up with the sector’s potential. “There will definitely be a bunch of lending products in the future,” he says. “Right now, I don’t think regulation is ready yet, but it’s something we are getting ready in terms of infrastructure. So, we have all of it, and the SCB X group also has an ICO portal licence doing tokenisation. “It’s just a matter of the market size. It’s not that big but we see it getting bigger right now, and I think Southeast Asia is a place where most of fintech thrives. You know, people love trying things here.” Robert Lavine

Together AI Frequently Asked Questions (FAQ)

When was Together AI founded?

Together AI was founded in 2022.

Where is Together AI's headquarters?

Together AI's headquarters is located at 251 Rhode Island Street, San Francisco.

What is Together AI's latest funding round?

Together AI's latest funding round is Series B.

How much did Together AI raise?

Together AI raised a total of $533.5M.

Who are the investors of Together AI?

Investors of Together AI include Lux Capital, Scott Banister, Long Journey Ventures, Emergence Capital, Prosperity7 Ventures and 43 more.

Who are Together AI's competitors?

Competitors of Together AI include Fractile and 1 more.

What products does Together AI offer?

Together AI's products include GPU Clusters and 4 more.

Loading...

Compare Together AI to Competitors

FuriosaAI specializes in artificial intelligence (AI) accelerators and operates within the technology sector. The company provides AI inference solutions for large language models and multimodal applications, using its Tensor Contraction Processor architecture. Its products are aimed at the data center industry, focused on the deployment of AI models with low latency and high throughput. It was founded in 2017 and is based in Seoul, South Korea.

Recogni develops multimodal generative AI inference systems for the data center industry. The company's offerings include a logarithmic number system that improves AI model inference and a set of hardware and software solutions for computational processes related to generative AI. Recogni's technologies are designed for hyperscalers, cloud service providers, and enterprises that use AI. It was founded in 2017 and is based in San Jose, California.

Aleph Alpha specializes in generative artificial intelligence (AI) technology for enterprises and governments within the artificial intelligence sector. The company offers language models and multimodal AI solutions for human expertise, compliance, and AI applications. Aleph Alpha's technology is tailored for various architectures and value chains. It was founded in 2019 and is based in Heidelberg, Germany.

AI Planet specializes in generative AI orchestration and integration for various business sectors. The company offers a platform for building and deploying custom large language models (LLMs) efficiently within secure enterprise environments, along with an AI marketplace for additional resources. AI Planet's solutions are designed to be secure, private, and cloud-agnostic, catering to enterprises looking to integrate AI into their operations. It was founded in 2020 and is based in Leuven, Belgium.

MatX designs chips for large language models within the AI hardware industry. Its products are engineered for performance in AI models, providing computing power for training and inference processes. MatX serves the AI research and development sector, providing hardware that supports advanced AI models. It was founded in 2022 and is based in Covina, California.

Numenta operates within the AI and computing technology sectors and focuses on neuroscience-based principles. It offers an AI platform designed for deep learning performance on CPUs, which seeks to enhance the functionality of large AI models while addressing power consumption. Numenta participates in the Thousand Brains Project, an open-source initiative exploring AI paradigms inspired by the human brain's neocortical structure. It was founded in 2005 and is based in Redwood City, California.

Loading...