Thrive Capital

Founded Year

2010Stage

Angel | AliveTotal Raised

$175MValuation

$0000Last Raised

$175M | 2 yrs agoAbout Thrive Capital

Thrive Capital is a venture capital investment firm with a focus on Internet, software, and technology-enabled companies within the investment sector. The company specializes in providing capital to businesses that operate in these domains, supporting their growth and development. Thrive Capital primarily caters to startups and established companies in the technology and internet sectors. It was founded in 2010 and is based in New York, New York.

Loading...

Loading...

Research containing Thrive Capital

Get data-driven expert analysis from the CB Insights Intelligence Unit.

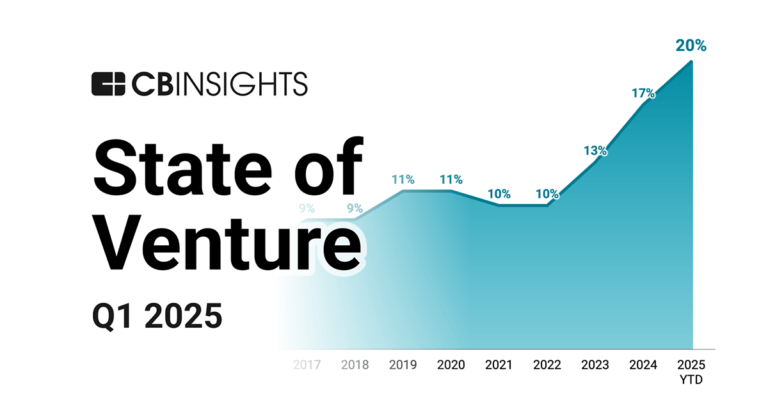

CB Insights Intelligence Analysts have mentioned Thrive Capital in 1 CB Insights research brief, most recently on Apr 3, 2025.

Apr 3, 2025 report

State of Venture Q1’25 ReportLatest Thrive Capital News

Jul 2, 2025

George Hammond / Financial Times: VC firms Thrive Capital and General Catalyst are adopting the “roll-up” strategy from the PE playbook, as Khosla Ventures, 8VC, and others explore similar moves — Thrive Capital's backing of Savvy Wealth is part of growing effort to fund groups that go on to buy similar companies

Thrive Capital Frequently Asked Questions (FAQ)

When was Thrive Capital founded?

Thrive Capital was founded in 2010.

Where is Thrive Capital's headquarters?

Thrive Capital's headquarters is located at 295 Lafayette Street, New York.

What is Thrive Capital's latest funding round?

Thrive Capital's latest funding round is Angel.

How much did Thrive Capital raise?

Thrive Capital raised a total of $175M.

Who are the investors of Thrive Capital?

Investors of Thrive Capital include Mukesh Ambani, Xavier Niel, Henry Kravis, Jorge Paulo Lemann, Robert Iger and 3 more.

Who are Thrive Capital's competitors?

Competitors of Thrive Capital include Upload Ventures, 3M Ventures, bp Ventures, Canapi, Composite Ventures and 7 more.

Loading...

Compare Thrive Capital to Competitors

Redpoint Ventures operates as a venture capital firm. The company invests in startups at various stages, including seed, early, and growth phases, to create new markets and redefine existing ones. The firm's main customers are startups across various sectors of the economy. It was founded in 1999 and is based in San Francisco, California.

Accel is a venture capital firm that invests in and partners with teams from the inception of private companies through their growth phases, primarily in the technology sector. Accel was formerly known as Accel Partners. It was founded in 1983 and is based in Palo Alto, California.

Sequoia Capital is a venture capital firm that focuses on supporting startups from inception to initial-public offering (IPO) within sectors. They provide investment funding and strategic support to help companies grow and succeed. Sequoia Capital primarily serves technology-driven sectors and businesses aiming to become market leaders. It was founded in 1972 and is based in Menlo Park, California.

QED Investors is a boutique venture capital firm. It invests in early-stage startups. It primarily invests in financial services firms in the US, UK, and Latin America. The company was founded in 2008 and is based in Alexandria, Virginia.

MetaVC Partners is a venture capital firm that invests in startups across various sectors. The company focuses on entrepreneurs who develop technologies utilizing advanced materials, such as metamaterials, to address challenges in imaging, sensors, energy, sustainability, communications, and computer processing. MetaVC Partners serves the technology and materials sectors. It was founded in 2020 and is based in San Francisco, California.

Lightspeed Venture Partners operates as an early-stage venture capital firm. It focuses on accelerating disruptive innovations and trends in the enterprise and consumer sectors. It was founded in 2000 and is based in Menlo Park, California.

Loading...