The Sandbox

Founded Year

2011Stage

Unattributed VC - II | AliveTotal Raised

$115.5MAbout The Sandbox

The Sandbox is a user-generated virtual-gaming world within the gaming industry, where players can build and monetize their gaming experiences. The company offers a Voxel editor software (VoxEdit), a Marketplace, and a Game Maker, allowing users to create and animate three-dimensional (3D) objects and develop games with in-game visual scripting. The Sandbox serves the gaming industry, focusing on enabling users to develop and own content through blockchain technology and non-fungible tokens. The Sandbox was formerly known as Pixowl. It was founded in 2011 and is based in St. Julians, Malta. The Sandbox operates as a subsidiary of Animoca Brands.

Loading...

ESPs containing The Sandbox

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The virtual worlds market encompasses the development and operation of immersive digital environments that simulate real-world or fictional settings. These virtual worlds can be accessed through various platforms such as computers, gaming consoles, and virtual reality headsets. Users can engage in social interactions, explore virtual landscapes, participate in activities, and even create their own…

The Sandbox named as Leader among 15 other companies, including Roblox, Meta, and Ubisoft.

Loading...

Research containing The Sandbox

Get data-driven expert analysis from the CB Insights Intelligence Unit.

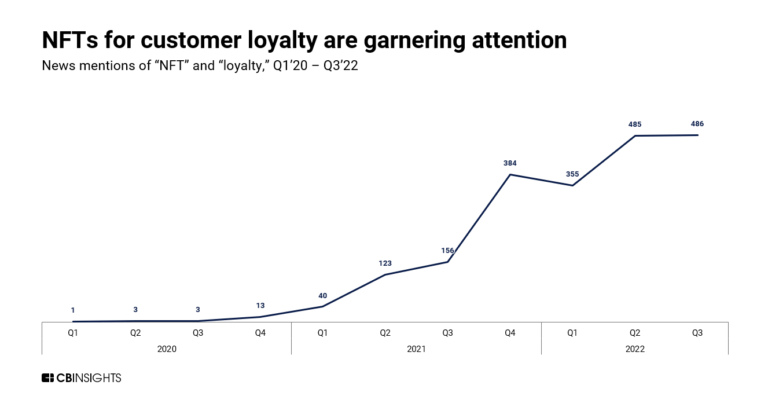

CB Insights Intelligence Analysts have mentioned The Sandbox in 5 CB Insights research briefs, most recently on Dec 14, 2022.

Dec 14, 2022

What L’Oréal, Nike, and LVMH are doing in Web3

Expert Collections containing The Sandbox

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

The Sandbox is included in 3 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,276 items

Blockchain

13,088 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Gaming

5,749 items

Gaming companies are defined as those developing technologies for the PC, console, mobile, and/or AR/VR video gaming market.

Latest The Sandbox News

Jul 3, 2025

Atención coiners No todo es Bitcoin: seis monedas para invertir y ganar hasta 45% en dólares antes de fin de mes Mientras el ecosistema cripto observa un posible repunte en medio de la disminución de la volatilidad macroeconómica, los inversores institucionales y los grandes holders (más popularmente conocidos como " ballenas ") empezaron a rotar su capital hacia activos digitales específicos. Con Bitcoin en u$s109.000 al momento y muy cerca de su pico histórico de u$s112.000 de mayo, las miradas apuntan a monedas alternativas que pueden pegar el gran salto. Los datos on-chain revelan una acumulación notoria en Ethereum (ETH), ONDO y Chainlink (LINK), a medida que estos actores se posicionan para buscar ganancias en el transcurso de este mes. Ethereum: qué pasa con el precio Ethereum mantiene su estatus como un objetivo primordial para las grandes billeteras. A pesar del rendimiento algo "lento" de la altcoin durante la última semana, los grandes holders aprovecharon la oportunidad para acumular. Las entradas netas de este grupo de inversores aumentaron de forma considerable, en claro movimiento de posicionamiento para una potencial alza en las próximas semanas. De hecho, el precio avanzó 8% en las últimas 24 horas, hasta los u$s2.600. El flujo neto de grandes holders de ETH se incrementó 95% en la última semana, según cifras de IntoTheBlock. Este dato es reflejo de la creciente demanda de este segmento de inversores, que se define como aquellos que poseen más del 0,1% del suministro circulante de un activo. Las mejores opciones de inversión en dólares para todos los perfiles Cuando este indicador aumenta, es síntoma de una fuerte acumulación. Esta acción podría incitar a los traders minoristas a seguir la corriente, impulsando el valor de ETH en un horizonte cercano. "En el corto plazo, si la tendencia de acumulación por parte de las ballenas persiste, vemos a ETH con potencial para testear la zona de los u$s2.900", revela a iProUP Enrique Nievas, experto en criptomonedas. Es decir, le quedaría resto para crecer cerca de 15%. ONDO y Chainlink: dos opciones con peso propio El token ONDO , vinculado a activos del mundo real (RWA), vio un repunte notable en la tenencia de ballenas que poseen entre 100 y 100.000 tokens ONDO, según datos de Santiment. Solo en la última semana, este grupo acumuló 3 millones de tokens, que opera en los 0,80 dólares, un claro indicio de confianza en su rendimiento a corto plazo. Para el analista de mercados Emiliano Luque, "ONDO puede quebrar la resistencia clave de u$s0,92, con una proyección razonable de alcanzar los u$s1 o incluso los u$s1,15 en un escenario optimista para julio". Es decir, un potencial de crecimiento de hasta 45%. Chainlink (LINK) tampoco se quedó atrás. El token registró un alza significativa en la actividad de transacciones de ballenas, lo que también invita a pensar en un futuro cercano muy promisorio. Datos de Santiment revelan un incremento constante en el número de transacciones de LINK que superan los u$s100.000. El activo cotiza a 13,75 dólares. "De ratificarse esta tendencia alcista y con una demanda fuerte, LINK podría impulsar una mayor presión al alza y llevar su precio a los u$s15.53, con expectativas de alcanzar los u$s16.50 a u$s17.00", completa Luque. Esto equivale a una posible suba de 25%. Nievas completa que "la actividad de las grandes manos suele ser un precursor de movimientos de precios, y observar sus huellas es fundamental para entender hacia dónde se dirige el capital", completa su mirada Nievas. Las monedas "tapadas" con potencial a corto plazo Las mencionadas no fueron las únicas alternativas con movimientos notorios de ballenas durante los últimos días. Uniswap (UNI) captó gran parte de esta atención institucional, con un flujo neto de grandes holders que se disparó un 190%. Para Emiliano Luque, "UNI podría romper la barrera de los u$s8" desde los u$s7,50 actuales (+8%). Otro activo en el radar es Worldcoin (WLD), el token creado por el fundador de ChatGPT Sam Altman. En este caso, los monederos de ballenas que tienen entre 100.000 y 1 millón de WLD acumularon 1,72 millones de tokens, con un valor cercano los u$s1,7 millones (u$s0,92 cada uno). "WLD puede saltar por encima de los u$s0,99, pero el riesgo de una caída hacia los u$s0,57 si se toman ganancias no desaparece", advierte Luque. Cerrando el trío de interés ballenero, The Sandbox (SAND), el token del metaverso, también figura en la lista de compras. Inversores que manejan entre 1 millón y 10 millones acumularon 7,45 M de tokens en la última semana de junio. Esta fuerte acumulación catalizaría un alza hasta los u$s0,30. Así, avanzaría 25% desde los u$s0,26 actuales. Temas relacionados

The Sandbox Frequently Asked Questions (FAQ)

When was The Sandbox founded?

The Sandbox was founded in 2011.

Where is The Sandbox's headquarters?

The Sandbox's headquarters is located at Church Street, St. Julians.

What is The Sandbox's latest funding round?

The Sandbox's latest funding round is Unattributed VC - II.

How much did The Sandbox raise?

The Sandbox raised a total of $115.5M.

Who are the investors of The Sandbox?

Investors of The Sandbox include Bossa Invest, LG Technology Ventures, True Global Ventures, Kingsway Capital Partners, Animoca Brands and 16 more.

Who are The Sandbox's competitors?

Competitors of The Sandbox include Digital Entertainment Asset, Vault Hill, Upland, Ristband, Planetarium Labs and 7 more.

Loading...

Compare The Sandbox to Competitors

Decentraland is a decentralized virtual reality platform that allows users to create, explore, and interact within a three-dimensional digital world. The platform includes tools and applications for creating 3D content, games, and applications, which are hosted on a decentralized infrastructure. Users can customize their digital identity with wearables, manage virtual real estate, and participate in events and a decentralized autonomous organization (DAO). It was founded in 2015 and is based in Carlsbad, California.

Somnium Space focuses on creating a virtual environment and operates in the technology and entertainment sectors. The company offers a digital platform where users can explore a world not limited by reality, providing opportunities for various experiences and interactions. It was founded in 2017 and is based in Prague, Czech Republic.

Axie Marketplace is a marketplace where users can trade tokens earned through playing Axie Infinity.

Sky Mavis integrates blockchain technology into the gaming industry. Its offerings include Axie Infinity, a game where players battle and collect digital creatures, and Ronin, an Ethereum Virtual Machine (EVM) blockchain for developers to create games with player-owned economies. Sky Mavis also offers tools for game developers within the Mavis Ecosystem to build blockchain games. It was founded in 2018 and is based in Singapore.

Axie Infinity is a Pokemon-inspired universe where users can earn tokens through skilled gameplay and contributions to the ecosystem. Players can battle, collect, raise, and build a land-based kingdom for their pets. The company was founded in 2018 and is based in Ho Chi Minh City, Vietnam.

Reality Makers is a freelancing platform dedicated to the metaverse industry. The company offers a platform where metaverse professionals can offer their services, covering areas from extended reality creation to blockchain development and business consulting. The company primarily serves brands looking to build projects in the metaverse. It was founded in 2020 and is based in Lyon, France.

Loading...