Moniepoint

Founded Year

2015Stage

Series C - II | AliveTotal Raised

$177.5MLast Raised

$10M | 6 mos agoRevenue

$0000About Moniepoint

Moniepoint is a financial technology company that provides digital financial services for businesses. The company's services include payment solutions, banking services, credit provision, and business management tools that assist in financial transactions and operations. Moniepoint was formerly known as TeamApt. It was founded in 2015 and is based in Lagos, Nigeria.

Loading...

Moniepoint's Products & Differentiators

Monnify

sent Today at 9:27 AM Monnify is a payment gateway for businesses to accept payments from customers, either on a recurring or one-time basis. Monnify offers an easier, faster and cheaper way for businesses to get paid on their web and mobile applications using convenient payment methods for customers with the highest success rates obtainable in Nigeria.

Loading...

Research containing Moniepoint

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Moniepoint in 2 CB Insights research briefs, most recently on Apr 10, 2025.

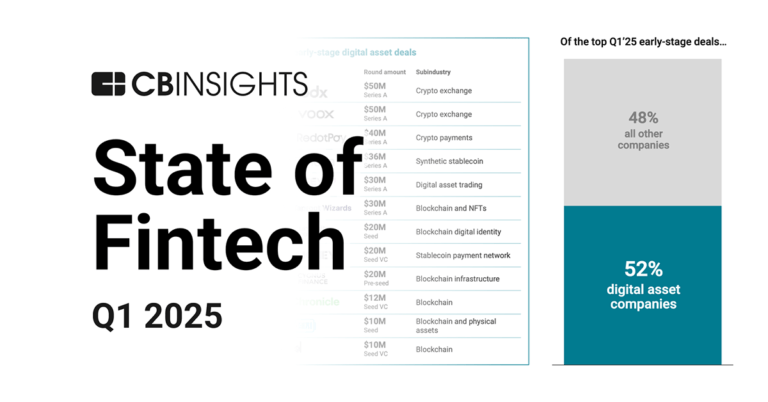

Apr 10, 2025 report

State of Fintech Q1’25 Report

Oct 4, 2022 report

The Fintech 250: The most promising fintech companies of 2022Expert Collections containing Moniepoint

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Moniepoint is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,276 items

Fintech

13,978 items

Excludes US-based companies

Fintech 100

449 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Digital Banking

908 items

Fintech 100 (2024)

100 items

Latest Moniepoint News

Jul 6, 2025

Amid inflation, income volatility, and rising cost of living, young Nigerians are turning to fintech in growing numbers. However, the latest Nigeria Financial Habits Survey 2025 reveals that while adoption is widespread, usage remains shallow, and expectations are rapidly evolving. The report, compiled by research studio Column and based on responses from over 1,100 young, mobile-first Nigerians, offers a revealing picture of how fintech tools are used across the country and what users want. From automated savings to unified dashboards, the message is clear: digital finance is not just an app. It has become a lifeline. Opay leads, but fintech usage is fragmented A striking 96.9% of respondents use at least one financial app, with over a third juggling two or more. Dominating the space is Opay , used by nearly 64% of respondents, followed by PalmPay (15.3%), Kuda (9.75%), and Moniepoint (6.5%). Traditional bank apps like GTBank and Zenith trail far behind, each capturing less than 1% of responders. Yet, despite the high usage, only 23.4% of respondents save through fintech apps. Instead, 79.3% continue to stash their money in traditional bank accounts, highlighting either a trust deficit in fintechs or a disconnect between app usage and financial engagement. “Fintech apps are everywhere, but financial engagement is still rare,” the report notes. “They are used, but not deeply yet.” Automation, integration, and simplicity top users’ wishlist According to the report, what users want from fintech is no longer speed or convenience: they want control. It shows that a massive 75.2% of users want to see all their financial activity in one place. That includes bank balances, wallet activity, savings, and even spending behaviour. Currently, most respondents use multiple apps and platforms to manage money, which creates cognitive and logistical friction. The top-requested features include: Financial reminders (20%) These preferences point to a broader desire for “set-it-and-forget-it” tools that help users save and budget without micromanaging every naira. Expense tracking: A gaping need and opportunity Despite the appetite for financial control, 36.9% of respondents say they do not track expenses at all. Among those who do, most rely on notebooks, memory, or basic notes apps. Only 5.2% use dedicated budgeting apps, and just 12.7% consult their bank statements. This low uptake of digital tracking tools reflects both usability issues and a broader socioeconomic context. In a country where prices can shift dramatically from week to week, budgeting may feel futile. Many respondents are students or freelancers with irregular incomes, making structured planning difficult. “There is a big opportunity for fintech to fill this gap,” the report states. “Not with complex dashboards, but with simple, automated tracking that works quietly in the background.” The desire for a single, unified financial view plays directly into the promise of open banking; its adoption in Nigeria remains sluggish. Although the Central Bank of Nigeria (CBN) released an open banking guideline in 2023, the implementation has lagged. Banks, for their part, risk becoming “passive storage lockers” unless they adapt. The report encourages traditional institutions to evolve into “financial command centres” by adopting features like real-time dashboards, automated savings plans, and integrated expense insights. “Open banking could power smarter apps and real-time insights. Without it, users are left juggling incomplete pictures of their finances.” The findings underscore a clear truth: fintech in Nigeria is no longer about onboarding users. It is about serving them better. As young Nigerians navigate financial precarity, they are not just looking for tools; they are seeking allies. To become that, fintech firms must: Embed smart defaults like auto-saving and bill prediction Provide low-data, mobile-first experiences Collaborate with telcos, retailers, and banks to offer bundled savings or rewards With over 46% of users spending significant monthly income on airtime and data, the report also highlights opportunities for telcos to offer micro-savings, reward bundles, or broadband discounts as financial services, not just connectivity. Overall, the Nigeria Financial Habits Survey 2025 makes one thing clear: Young Nigerians are not financially reckless; they are under pressure. Most want to save. Many already use fintech tools. But without better design, deeper integration, and a more empathetic understanding of user needs, even the best apps will fall short. Fintech companies and the broader financial ecosystem must now step into the gap, not just as service providers, but as partners in survival and upward mobility. Technext Newsletter

Moniepoint Frequently Asked Questions (FAQ)

When was Moniepoint founded?

Moniepoint was founded in 2015.

Where is Moniepoint's headquarters?

Moniepoint's headquarters is located at Off Adeola Odeku, Victoria Island, Lagos.

What is Moniepoint's latest funding round?

Moniepoint's latest funding round is Series C - II.

How much did Moniepoint raise?

Moniepoint raised a total of $177.5M.

Who are the investors of Moniepoint?

Investors of Moniepoint include Visa, Lightrock, Development Partners International, Google for Startups Accelerator, Black Founders Fund and 18 more.

Who are Moniepoint's competitors?

Competitors of Moniepoint include FairMoney, PalmPay, OurPass, TechFusion, Rex Africa and 7 more.

What products does Moniepoint offer?

Moniepoint's products include Monnify.

Who are Moniepoint's customers?

Customers of Moniepoint include Fair Money and Konga.

Loading...

Compare Moniepoint to Competitors

Kuda operates in the financial services sector. The company offers a range of services, including money transfers, savings and investment options, and credit facilities such as overdrafts and term loans. Kuda primarily serves individuals and businesses, providing solutions for personal finance management and business operations. Kuda was formerly known as Kudimoney Bank. It was founded in 2018 and is based in Lagos, Nigeria.

OPay is a financial services platform that operates in the digital banking sector. The company offers several services such as transactions, fund transfers, cashback on airtime and data top-ups, and a savings product that accrues daily interest. OPay also provides a debit card and customer support available at all times. It was founded in 2018 and is based in Lagos, Nigeria.

Flutterwave provides payment solutions for businesses and individuals within the financial technology sector. The company offers services including online payment processing, cross-border transactions, and e-commerce solutions. Flutterwave serves enterprises, small businesses, and individuals who conduct online and offline transactions. It was founded in 2016 and is based in San Francisco, California.

Rex Africa operates as a neobank with a focus on providing digital financial services in the financial sector. The company offers a secure platform for individual financial management and banking solutions tailored to small businesses. The services cater to the needs of the digital economy, facilitating financial transactions and management for users and enterprises. It was formerly known as Savyt. It was founded in 2021 and is based in Lagos, Nigeria.

Interswitch is a company that operates in the electronic payment and digital commerce solutions sector. The company provides services including payment processing and transaction switching, as well as digital payment products for individuals, SMEs, and large corporations. Interswitch's solutions are used across different industries to facilitate transactions and business operations. It was founded in 2002 and is based in Lagos, Nigeria.

Cellulant develops an electronic payment service connecting customers with banks and utility services to create a payment ecosystem. It offers a single application program interface payments platform that provides locally relevant and alternative payment methods for global, regional, and local merchants. Its platform enables businesses to collect payments online and offline while allowing anyone to pay from their mobile money, local and international cards, and directly from their bank. It was founded in 2004 and is based in Nairobi, Kenya.

Loading...