Tabby

Founded Year

2019Stage

Series E | AliveTotal Raised

$1.804BValuation

$0000Last Raised

$160M | 5 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+12 points in the past 30 days

About Tabby

Tabby is a financial technology company that operates in the consumer financing sector, offering buy now pay later services. The company allows consumers to split their purchases into four monthly payments, with no fees for timely payments. Tabby provides services such as a rewards program, purchase protection, and a shopping assistant app. It was founded in 2019 and is based in Riyadh, Saudi Arabia.

Loading...

Tabby's Product Videos

ESPs containing Tabby

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The buy now pay later (BNPL) — B2C payments market offers a flexible payment solution for consumers, allowing shoppers to make purchases and split the cost into multiple installments, typically interest-free. BNPL solutions provide an alternative to traditional credit cards and enable customers to make purchases without upfront payment or the need for a credit check. BNPL solutions typically offer…

Tabby named as Leader among 15 other companies, including Klarna, Affirm, and PayPal.

Tabby's Products & Differentiators

Split in 4

Provide customers the freedom to split their purchase into 4 equal payments billed every month at no interest.

Loading...

Research containing Tabby

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Tabby in 6 CB Insights research briefs, most recently on Apr 10, 2025.

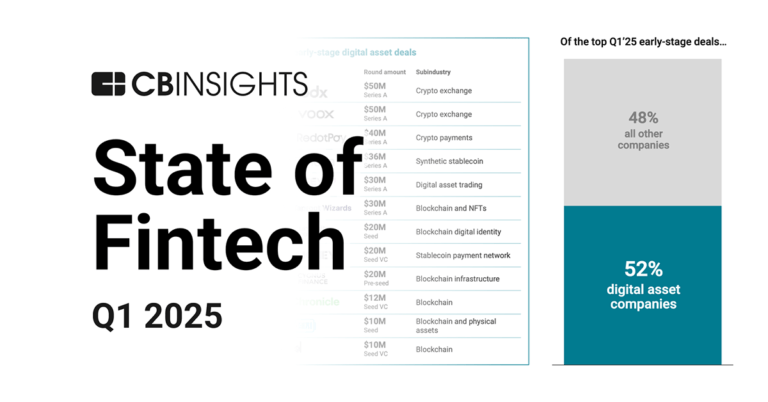

Apr 10, 2025 report

State of Fintech Q1’25 Report

May 8, 2024

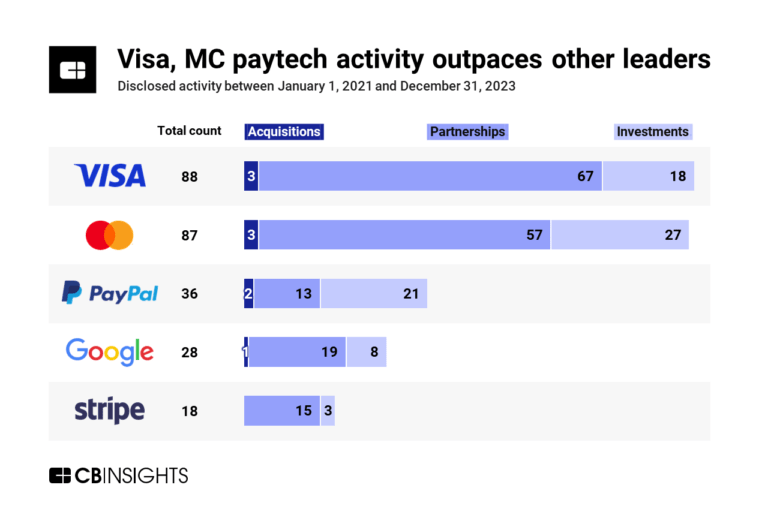

The embedded banking & payments market map

Jan 31, 2024

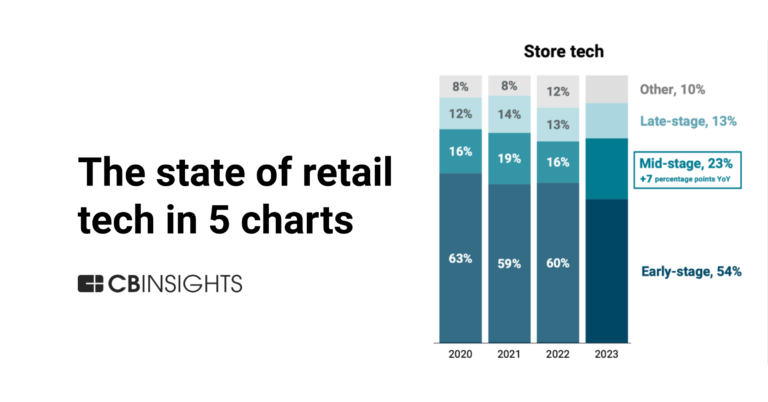

Retail tech in 5 charts: 2023

Jan 18, 2024 report

State of Fintech 2023 Report

Jan 4, 2024 report

State of Venture 2023 ReportExpert Collections containing Tabby

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Tabby is included in 8 Expert Collections, including E-Commerce.

E-Commerce

11,558 items

Companies that sell goods online (B2C), or enable the selling of goods online via tech solutions (B2B).

Store tech (In-store retail tech)

1,796 items

Companies that make tech solutions to enable brick-and-mortar retail store operations.

Unicorns- Billion Dollar Startups

1,276 items

Payments

3,198 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Artificial Intelligence

12,337 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Fintech

13,978 items

Excludes US-based companies

Latest Tabby News

Jul 4, 2025

The report report provides detailed analysis of market trends in the Saudi cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including cash, card, credit transfer, direct debits, and cheques during the review-period (2021-25e). The report also analyzes various payment card markets operating in the industry and provides detailed information on the number of cards in circulation, transaction values and volumes during the review-period and over the forecast-period (2025e-29f). It also offers information on the country's competitive landscape, including market shares of issuers and schemes. The report brings together the analyst's research, modeling, and analysis expertise to allow banks and card issuers to identify segment dynamics and competitive advantages. The report also covers detailed regulatory policies and recent changes in regulatory structure. The report provides top-level market analysis, information and insights into the Saudi cards and payments industry, including: Current and forecast values for each market in the Saudi cards and payments industry, including debit, credit and charge cards. Detailed insights into payment instruments including cash, card, credit transfer, direct debits, and cheques. It also, includes an overview of the country's key alternative payment instruments. Ecommerce market analysis. Analysis of various market drivers and regulations governing the Saudi cards and payments industry. Detailed analysis of strategies adopted by banks and other institutions to market debit, credit and charge cards. Comprehensive analysis of consumer attitudes and buying preferences for cards. The competitive landscape of the Saudi cards and payments industry. Key Highlights Saudi Arabia is a regional pioneer in the adoption of contactless payments. Its position has been driven by the introduction of mada POS-supporting NFC payments (also known as mada atheer payments) by the national payment scheme mada, as well as the launch of contactless payments for public transport. In February 2025, the Royal Commission for Riyadh City introduced Apple Pay's Express Transit mode for fare payments on the Riyadh Metro and Bus networks. This functionality allows commuters to seamlessly pay fares at metro and bus entry gates using their iPhone or Apple Watch. Aligned with its Vision 2030 strategy, the government has launched initiatives to support ecommerce growth. In August 2024, the General Authority for Small and Medium Enterprises (Monsha'at) organized E-commerce Week to familiarize entrepreneurs with the importance of ecommerce and its impact on SMEs. Monsha'at collaborated with government and private entities to host the event in Riyadh, Madinah, Jeddah, and Al-Khobar. The main objective was to facilitate communication and the exchange of experiences among entrepreneurs, experts, and relevant government entities via workshops, entrepreneurial meetings, consultations, and guidance sessions with specialists and experts from various fields. Buoyed by the growing ecommerce market, the adoption of BNPL solutions is steadily increasing in Saudi Arabia. BNPL firms are raising significant funding and expanding their offerings to strengthen their presence in the country. In February 2025, the BNPL and financial services provider Tabby raised Saudi riyal (SAR) 600 million ($160 million) in a series E financing round led by the existing investors Blue Pool Capital and Hassana Investment Company, as well as the new investors STV and Wellington Management. The funding valued the company at SAR12.4 billion ($3.3 billion). As of February 2025, Tabby had more than 15 million registered users and partnered with over 40,000 merchants. Key Topics Covered:

Tabby Frequently Asked Questions (FAQ)

When was Tabby founded?

Tabby was founded in 2019.

Where is Tabby's headquarters?

Tabby's headquarters is located at 7259 Jabal Ashaqir, Riyadh.

What is Tabby's latest funding round?

Tabby's latest funding round is Series E.

How much did Tabby raise?

Tabby raised a total of $1.804B.

Who are the investors of Tabby?

Investors of Tabby include STV, Blue Pool Capital, Wellington Management, Hassana Investments, J.P. Morgan Chase and 22 more.

Who are Tabby's competitors?

Competitors of Tabby include Atome, Khazna, Klarna, Zilch, Happy Pay and 7 more.

What products does Tabby offer?

Tabby's products include Split in 4 and 4 more.

Loading...

Compare Tabby to Competitors

Tamara serves as a shopping and payment platform. It operates in the financial technology sector. The company provides a mobile application offering flexible payment solutions and allows customers to divide their bills into multiple installments without delay fees, in compliance with Islamic law. Tamara primarily serves the e-commerce industry, with global and regional brands to local small and medium businesses. It was founded in 2020 and is based in Riyadh, Saudi Arabia.

Postpay is a financial services company that provides buy now pay later solutions. The company offers a service that allows customers to make purchases and pay for them in three installments without interest. Postpay primarily serves the retail sector and partners with various brands to provide payment options to consumers. It was founded in 2019 and is based in Dubai, United Arab Emirates.

MNT Halan operates as a fintech company that focuses on digitizing traditional banking and cash-based markets. The company offers a range of services, including digital payment solutions, lending services to the unbanked and underbanked, and an e-commerce platform. It primarily serves the financial sector and the e-commerce industry. It was founded in 2017 and is based in Cairo, Egypt.

Khazna is a financial technology company specializing in digital financial services. The company offers a financial super app that provides underbanked Egyptians with access to smartphone-based financial services. Khazna primarily serves the corporate sector by offering financial solutions to employees through a mobile application that allows them to access a portion of their earned salary as needed. It was founded in 2019 and is based in Cairo, Egypt.

Cashew specializes in flexible payment solutions within the financial services sector. The company offers a range of products, including buy now, pay later options, interest-free installment plans, and comprehensive financial management services. Cashew primarily caters to individual consumers seeking manageable payment options for their purchases. It was founded in 2020 and is based in Dubai, United Arab Emirates.

Shahry is a digital financial services company that specializes in buy-now-pay-later (BNPL) solutions within the consumer finance sector. The company provides a mobile credit card and wallet that enables consumers to purchase goods and services in installments over a period of up to 36 months. Shahry primarily serves individual consumers looking for payment options and merchants aiming to increase sales through BNPL services. It was founded in 2019 and is based in cairo, Egypt.

Loading...