Synctera

Founded Year

2020Stage

Series A - IV | AliveTotal Raised

$94MLast Raised

$15M | 7 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+33 points in the past 30 days

About Synctera

Synctera is a banking and payments platform that provides technology infrastructure and a compliance framework for companies to launch FinTech and embedded banking products. The company offers services including APIs for digital wallets, debit and charge cards, and money movement experiences, supporting financial solutions. Synctera primarily serves FinTechs, embedded banking providers, and banks looking to build their sponsor banking programs. It was formerly known as Entangle. It was founded in 2020 and is based in Palo Alto, California.

Loading...

Synctera's Product Videos

ESPs containing Synctera

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

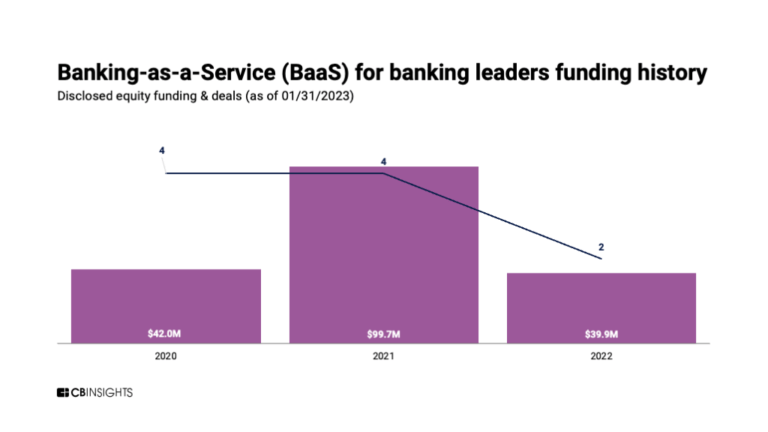

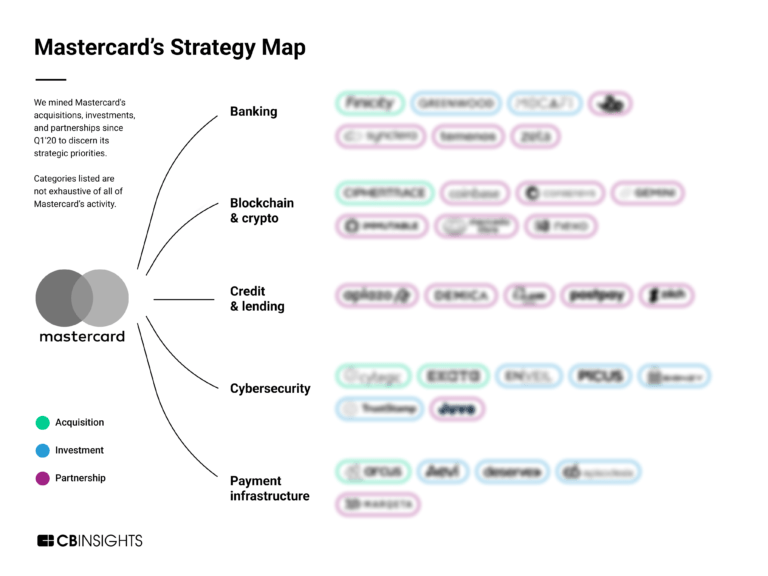

The banking-as-a-service (BaaS) market provides infrastructure platforms for banks and fintechs to modernize their services and expand their customer base through embedded banking and payment options. These providers offer APIs that enable businesses to integrate banking capabilities such as account opening, transaction processing, card issuance, payment rails, and compliance tools. BaaS solutions…

Synctera named as Challenger among 15 other companies, including Stripe, FIS, and Plaid.

Synctera's Products & Differentiators

Synctera Platform

Synctera provides the infrastructure companies need to launch FinTech and embedded finance products, including accounts, cards, and money movement. Additionally the Synctera Platform enables sponsor banks to compliantly manage and have oversight over their FinTech partners.

Loading...

Research containing Synctera

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Synctera in 5 CB Insights research briefs, most recently on May 8, 2024.

May 8, 2024

The embedded banking & payments market map

Jan 4, 2024

The core banking automation market map

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023Expert Collections containing Synctera

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Synctera is included in 4 Expert Collections, including Fintech.

Fintech

9,653 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Digital Banking

1,016 items

Fintech 100

200 items

Fintech 100 (2024)

100 items

Latest Synctera News

Jun 19, 2025

Fintech Synctera has tapped a former Fed and OCC examiner as CRCO, as the firm pursues growth with a focus on regulatory compliance. Published June 18, 2025 Deb Bonosconi, Synctera's chief risk and compliance officer Permission granted by Synctera Synctera’s compliance-first attitude is a differentiator among fintechs where compliance tends to take a backseat for not being “a money maker,” said Deb Bonosconi, the fintech’s new chief risk and compliance officer. Having joined the San Francisco-based firm in May, Bonosconi said her role at Synctera involves engaging with various teams on product development and technology and onboarding new fintech clients. Bonosconi intends to ask some tough questions during sales discussions to gain a clear understanding of potential clients. A former examiner at the Federal Reserve and the Office of the Comptroller of the Currency, Bonosconi has been skeptical of fintech job opportunities due to the lack of priority given to compliance, in her opinion. Bonosconi is replacing Tana Rugel, Synctera’s outgoing risk chief, who is stepping down to join a bank. Bonosconi brings more than 25 years of industry experience in anti-money laundering, risk management, governance, and regulatory matters while working at IBM, Citi, PayPal, HSBC, GE and KPMG. “Sometimes the assumption is that, if it's not profitable, then it really doesn't need to have a seat at the table. But nothing could be furthest from the truth,” Bonosconi said. It’s an unfortunate notion because many fintechs could benefit from a robust compliance program, which they can show to their sponsor banks to “open the door much easier,” she said. At Synctera, Bonosconi believes there is room for greater proactiveness in organizational planning to ensure the fintech has the right people and compliance procedures in place to manage risk effectively. Synctera, a banking technology platform, serves as an intermediary, providing fintech clients with the tools to build innovative banking products while offering solutions to sponsor banks to manage their partnerships with fintechs. The surge in financial innovation in recent years has led to increased risk and compliance complexities. Since its inception in 2020, Synctera’s client base has grown exponentially from a small client base to more than 40 companies, notably, Bolt, Webull, BTG Pactual, Float, and Mazlo. Bonosconi plans to keep that growth in mind while developing a compliance framework for Synctera, as growth creates additional demands, she said. In March, Synctera raised $15 million in funding, bringing the total raised to $94 million. The latest round was co-led by Fin Capital and Diagram, who were joined by its other existing investors, including First & Main, Evolution, and True Equity. The firm plans to continue to “build, scale, and grow with the same core principles of effective compliance, operational excellence, and flexible design,” CEO Peter Hazlehurst said in a blog post. Synctera has continued to invest in its platform over the past year and launched new tools. As the firm pursues profitability in 2026, Synctera hired its first CFO , Matias Pino, earlier this year. Navigating bank-fintech partnerships “Fintechs are in the business to grow. There's no question that they have the ultimate goal of becoming big, bigger and best,” Bonosconi said. While creating Synctera’s framework for strategic planning, Bonosconi said she plans to ensure the company has sufficient resources, systems, and processes; understands risks by analyzing recent consent orders and enforcement actions; and identify failures in the industry to proactively manage risk. Lineage Bank, one of Synctera’s partner banks, was hit with a Federal Deposit Insurance Corp. consent order in early 2024 related to its BaaS business . Under the consent order, the Franklin, Tennessee-based lender was required to implement an enhanced risk management program overseen by its board of directors, increase capital levels, and terminate some fintech partnerships, including that with Synctera. Bonosconi is focused on role clarity, ensuring a clear delineation of responsibilities among fintech clients, sponsor banks, and Synctera, and learning more about clients’ plans. Some clients “want to offer new products and new services and a new client base and even potentially a new geography,” Bonosconi said. “So it's really understanding what their plans are and incorporating that into your overall strategy for the compliance program.” Data reconciliation, another area she’s focused on, enables banks to verify that the transaction data in their core systems aligns with the data received from transaction sources, of which Synctera is one. The bankruptcy of middleware firm Synapse illuminated how fintechs and banks manage reconciliation within their partnerships. Bonosconi wants to conduct due diligence on banks and fintech clients, as it is essential to understand the processes the sponsor banks have in place when taking on a new client. In the classic bank-fintech model, failures in data reconciliation processes can be a problem, “because the minute a regulator sees that the formalized structure of [performing data reconciliation] is not in place, or they, in fact, have irregularities in it, integrity is lost in terms of the bank,” Bonosconi said. ‘Kick the tires’ Fintechs commonly believe their compliance programs are robust, which often proves unfounded, creating potential problems, Bonosconi noted. She recommends regular gap analysis by hiring independent consultants or organizations to “kick the tires.” Gap analysis is a process that companies use to compare their current performance with their desired performance, enabling them to formulate an improvement plan. Such an analysis can help to identify internal weaknesses before they impact sponsor banks or fintechs, she said. Many fintechs rely heavily on in-house systems but lack independent data validation. The latter can verify that systems are functioning as designed, according to the risk chief. Plus, independent audits demonstrate initiative from the fintech, when issues are self-identified and remediated before formal audits, according to Bonosconi. The banking industry appears to be “sitting on its axle” as the fintech world evolves rapidly and traditional banks experience an identity crisis, she said. “We are at sort of a crossroads where you are looking at these organizations becoming very different from what they were originally designed to do,” Bonosconi said. “The traditional banks are facing that right now, and to some extent it's causing them some angst, because they are still trying to figure out how do we operate in this world with profitability, but managing the risk effectively.”

Synctera Frequently Asked Questions (FAQ)

When was Synctera founded?

Synctera was founded in 2020.

Where is Synctera's headquarters?

Synctera's headquarters is located at 228 Hamilton Avenue, Palo Alto.

What is Synctera's latest funding round?

Synctera's latest funding round is Series A - IV.

How much did Synctera raise?

Synctera raised a total of $94M.

Who are the investors of Synctera?

Investors of Synctera include Lightspeed Venture Partners, Diagram Ventures, NAventures, Fin Capital, Mana Ventures and 22 more.

Who are Synctera's competitors?

Competitors of Synctera include Sandbox Banking, BM Technologies, ASA, Bond, Rize and 7 more.

What products does Synctera offer?

Synctera's products include Synctera Platform.

Loading...

Compare Synctera to Competitors

Unit is a financial technology company that specializes in embedded finance and financial infrastructure within the banking and lending sectors. The company offers a platform that enables tech companies to integrate banking services, such as storing, moving, and lending money, into their products. Unit's services are designed to facilitate compliance and simplify technical integration for businesses looking to offer financial services. It was founded in 2019 and is based in New York, New York.

Treasury Prime is an embedded banking platform that specializes in connecting businesses with a network of banks and financial service providers. Its main offerings include API banking integrations that enable companies to develop and launch financial products such as FDIC-insured accounts, payment processing solutions, and debit card issuance. Treasury Prime's platform is designed to support compliance program integration and multi-bank operations, facilitating the creation of investment vehicles and instant payout ecosystems for various industries. It was founded in 2017 and is based in San Francisco, California.

Productfy is a platform that specializes in the embedding of financial products within various business sectors. The company offers a suite of services, including branded card programs, digital banking solutions, secured charge card issuance, and disbursement mechanisms, all designed to be integrated seamlessly into clients' applications. Productfy primarily serves sectors such as community banks, credit unions, real estate, financial services, and insurance. It was founded in 2018 and is based in San Jose, California.

NovoPayment specializes in providing Banking as a Service (BaaS) platforms and focuses on digital financial and transactional services. The company offers a suite of bank-grade solutions, including digital banking, payment processing, card issuing, and risk management services, all designed to integrate with existing systems for financial operations and customer experiences. NovoPayment primarily serves banks, financial institutions, merchants, and other financial service providers looking to digitize and modernize services. It was founded in 2007 and is based in Miami, Florida.

Hydrogen operates as a no-code embedded finance company. It offers United States dollar (USD) banking services, wealth management, personal financial management (PFM), and cryptocurrency payments solutions. The company was founded in 2017 and is based in Miami, Florida.

Agora Financial Technologies specializes in modular banking platforms and operates within the financial technology sector. The company provides digital banking solutions that allow banks, credit unions, and fintech companies to integrate new fintech products without overhauling their existing core banking systems. Agora's services include white-label solutions, APIs for developers, and a challenger bank platform. Agora Financial Technologies was formerly known as Agora Services. It was founded in 2018 and is based in New York, New York.

Loading...