Spendesk

Founded Year

2016Stage

Incubator/Accelerator | AliveTotal Raised

$300.59MRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+102 points in the past 30 days

About Spendesk

Spendesk provides financial management tools for businesses. It offers tools including corporate cards, automated invoice handling, procure-to-pay solutions, integrated budgeting features, virtual cards for payments, and expense claim management. It serves various sectors of the economy, including manufacturing, retail, green energy, and marketing. It was founded in 2016 and is based in Paris, France.

Loading...

ESPs containing Spendesk

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

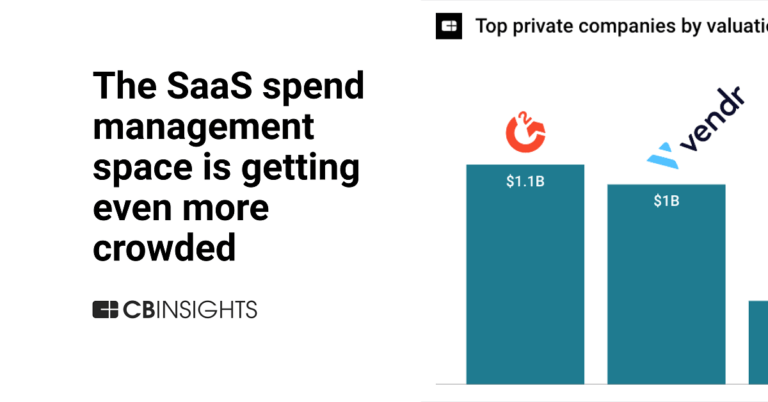

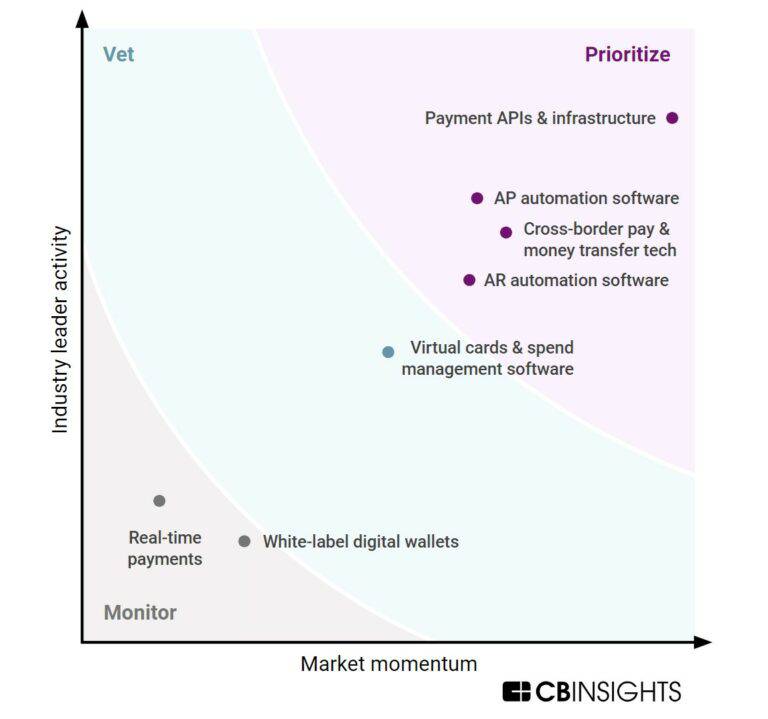

The spend management platforms market helps businesses control and optimize their expenditures through integrated software solutions, including corporate cards, expense management systems, procurement software, accounts payable automation, and budget tracking tools. These platforms use APIs, cloud-based infrastructure, and AI-powered analytics to provide real-time visibility into spending patterns…

Spendesk named as Challenger among 15 other companies, including Coupa, Ramp, and Pleo.

Loading...

Research containing Spendesk

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Spendesk in 9 CB Insights research briefs, most recently on Jun 6, 2025.

Jun 6, 2025

The SMB fintech market map

Aug 23, 2024

The B2B payments tech market map

Oct 26, 2023

The CFO tech stack market map

Oct 12, 2023

The procurement tech market map

Oct 25, 2022

The Transcript from Yardstiq: Toppling Salesforce

Oct 4, 2022

The Transcript from Yardstiq: Ramp vs. BrexExpert Collections containing Spendesk

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Spendesk is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,276 items

Payments

3,198 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,978 items

Excludes US-based companies

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest Spendesk News

Jun 26, 2025

Contributed by: Business Wire Spendesk , the AI-powered spend management and procurement platform, today announces a major milestone: it has achieved profitability, marking one full quarter in the black. This achievement makes Spendesk the first European spend management and procurement platform to reach profitability, a bold step forward in the industry's evolution. This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250625179880/en/ Since its €2 million seed round in 2017, Spendesk has rapidly evolved from a disruptive startup to a profitable market leader. The company surpassed €1 billion in spend under management by 2021, then secured a €100 million Series C+ round in 2022 to reach unicorn status and €10 billion managed on the platform. Following the launch of Spendesk Financial Services, its regulated payment institution, and a strategic procurement acquisition , Spendesk doubled spend under management to €20 billion in 2024. Spendesk now processes tens of billions in purchases annually across more than 200,000 business users. The company's successful drive to profitability fulfills its publicly stated objective for 2025, ahead of schedule, while maintaining double-digit growth. “Spendesk has proven that it's possible to lead the spend management category while balancing growth with profitability,” said Axel Demazy, CEO of Spendesk. “When I became CEO in 2024, we focused on three priorities: deepening our procurement offering, driving new revenue with Spendesk Financial Services, and accelerating internal efficiency with AI . These priorities have enabled us to achieve profitability ahead of schedule, while delivering even greater value and innovation to our customers.” Rodolphe Ardant, founder of Spendesk, added: “We set out to transform how companies manage spending in Europe. Since 2017, we've integrated AI into our technology, and today thousands of customers rely on Spendesk's AI to validate receipts and invoices, automate spend allocation in bookkeeping, and flag potential errors. Now, thanks to our new milestone of profitability, we can invest even further in the innovation our customers expect, increasing their efficiency through agentic assistants and providing deeper insights to optimise spend.” As Spendesk enters this next chapter, it remains committed to continuing its double-digit growth by driving the next wave of transformation for finance teams. The company will invest beyond spend management, exploring AI-first opportunities in areas such as FP&A and ESG, where real-time insights and smarter decision-making will empower customers to excel. “Profitability means more value for our customers,” continued Demazy. “Our customers can be confident they are partnering with a sustainable provider, here for the long term. Profitability allows Spendesk to keep investing in new features, put AI at customers' fingertips, and help them make smarter decisions, ultimately optimising their P&L.” Spendesk operates in the €70 billion Office of the CFO software industry, expected to grow at 13 percent annually through 2028. By combining advanced technology with financial discipline, Spendesk is uniquely positioned to sustain profitable, double-digit growth as the category continues to expand. About Spendesk Spendesk is the AI-powered spend management and procurement platform that transforms company spending. By simplifying procurement, payment cards, expense management, invoice processing, and accounting automation, Spendesk sets the new standard for spending at work. Its single, intelligent solution makes efficient spending easy for employees and gives finance leaders the full visibility and control they need across all company spend, even in multi-entity structures. Trusted by thousands of companies, Spendesk supports over 200,000 users across brands such as SoundCloud, Gousto, SumUp, and Bloom & Wild. With offices in the United Kingdom, France, Spain, and Germany, Spendesk also puts community at the heart of its mission. For more information: www.spendesk.com/press View source version on businesswire.com: Media contacts Mary Barthe - Communications Manager - mary.barthe@spendesk.com Michyl Culos - Director of Brand & Communications - michyl.culos@spendesk.com Logo Images Tags Technology Payments Finance Fintech Banking Accounting Professional Services Software Artificial Intelligence technology

Spendesk Frequently Asked Questions (FAQ)

When was Spendesk founded?

Spendesk was founded in 2016.

Where is Spendesk's headquarters?

Spendesk's headquarters is located at 51 rue de Londres, Paris.

What is Spendesk's latest funding round?

Spendesk's latest funding round is Incubator/Accelerator.

How much did Spendesk raise?

Spendesk raised a total of $300.59M.

Who are the investors of Spendesk?

Investors of Spendesk include Leading European Tech Scaleups, Index Ventures, FundersClub, Eight Roads Ventures, General Atlantic and 12 more.

Who are Spendesk's competitors?

Competitors of Spendesk include Pliant, Glean AI, Yokoy, IPaidThat, Qonto and 7 more.

Loading...

Compare Spendesk to Competitors

Pleo focuses on business spend management within the financial technology sector. The company offers company cards with individual spending limits and provides a platform to manage expenses, reimbursements, invoices, and budgets. It serves businesses looking to manage their spending and financial processes. The company was founded in 2015 and is based in København N, Denmark.

Soldo provides spend management solutions within the financial services sector. The company offers a platform that connects with financial systems to manage corporate spending through company cards, a mobile app for tracking expenses, and tools for financial compliance. Soldo serves businesses that need to manage their expense processes and gain insights into their spending. Soldo was formerly known as PX Technology. It was founded in 2014 and is based in London, United Kingdom.

Payhawk provides corporate spend management solutions within the financial technology sector. It offers a platform that includes corporate cards, expense management, accounts payable, and accounting software for business payments and financial control. Payhawk's services aim to automate expense reporting and reconciliation and provide visibility and control over company spending, while also integrating with existing financial systems. It was founded in 2018 and is based in London, United Kingdom.

Brex provides spend management solutions across various sectors. The company offers products including corporate cards, expense management, travel, bill pay, and banking services aimed at assisting businesses in managing spending and financial processes. Brex serves startups, mid-size companies, and enterprises with its range of financial products. Brex was formerly known as Veyond. It was founded in 2017 and is based in Salt Lake City, Utah.

Mooncard operates as a software-as-a-service (SaaS) company that focuses on business expenses and corporate spend management. The company offers smart payment cards linked to accounting and management software, which automate expense reports and simplify the daily lives of employees. It primarily serves companies of all sizes across various sectors. The company was founded in 2016 and is based in Paris, France.

Haslle is a company specializing in finance management solutions within the corporate sector. It offers a suite of tools for managing expenses, corporate payment cards, and automated reporting to streamline accounting processes. The company primarily serves businesses looking to optimize their financial operations and increase control over spending. It was founded in 2019 and is based in Vilnius, Lithuania.

Loading...