Solaris

Founded Year

2016Stage

Series G | AliveTotal Raised

$693.83MLast Raised

$93.41M | 6 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+42 points in the past 30 days

About Solaris

Solaris is a technology company with a banking license that provides Banking-as-a-Service solutions in the financial services sector. The company offers a platform for businesses to integrate digital banking, payment services, and lending options into their products through APIs. Solaris serves sectors that require embedded finance solutions, including mobility, travel, and wealth management. Solaris was formerly known as Solarisbank. It was founded in 2016 and is based in Berlin, Germany.

Loading...

ESPs containing Solaris

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The lending APIs & infrastructure market provides end-to-end solutions for digital lending operations, including loan management systems, risk management tools, and compliance management capabilities. These platforms enable financial institutions to originate, process, and service loans through API-driven architecture that supports integration with existing systems. The market encompasses core ban…

Solaris named as Challenger among 15 other companies, including Oracle, Fiserv, and FIS.

Solaris's Products & Differentiators

Digital Banking

White-labeled bank accounts

Loading...

Research containing Solaris

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Solaris in 4 CB Insights research briefs, most recently on May 8, 2024.

May 8, 2024

The embedded banking & payments market map

Apr 18, 2024 report

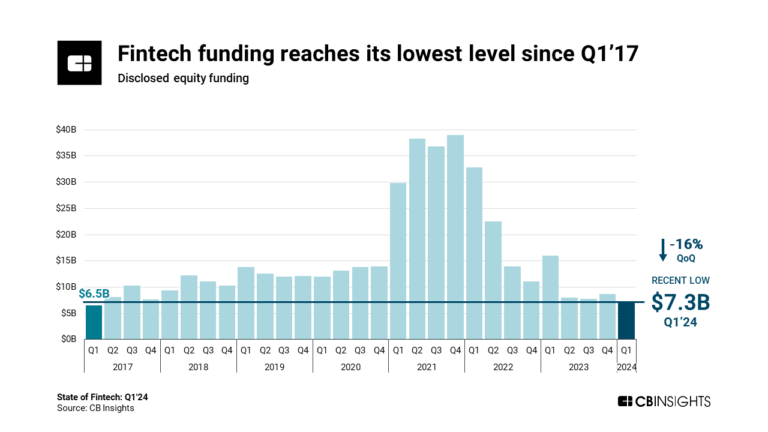

State of Fintech Q1’24 Report

Jan 4, 2024

The core banking automation market mapExpert Collections containing Solaris

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Solaris is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,276 items

Fintech 100

747 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Digital Lending

2,464 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Fintech

13,978 items

Excludes US-based companies

Digital Banking

1,016 items

The open banking ecosystem is facilitated by three main categories of startups including those focused on banking-as-a-service, core banking, and open banking startups (i.e. data aggregators, 3rd party providers). These are primarily B2B companies, though some are also B2C.

Blockchain

125 items

Crypto payments refers to the use of cryptocurrency as a means of payment for goods and services. It also includes the use of fiat or other traditional payment methods to purchase cryptocurrency. This market includes cryptocurrency payments acceptance for merchants/retailers, cry

Solaris Patents

Solaris has filed 10 patents.

The 3 most popular patent topics include:

- fluid dynamics

- hydraulic fracturing

- arm architecture

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

4/7/2022 | 2/18/2025 | Sensors, Gibson electric guitars, Hydraulic fracturing, Gas technologies, Fluid dynamics | Grant |

Application Date | 4/7/2022 |

|---|---|

Grant Date | 2/18/2025 |

Title | |

Related Topics | Sensors, Gibson electric guitars, Hydraulic fracturing, Gas technologies, Fluid dynamics |

Status | Grant |

Latest Solaris News

Jun 20, 2025

+++ Autodoc +++ Utopian Founders +++ Tractive +++ Cycle +++ Solaris +++ +++ #StartupTicker +++ Autodoc peilt beim IPO 2,4 Milliarden Bewertung an +++ gridX-Gründer startet Venture Studio Utopian Founders +++ Tractive verkauft seine Versicherungstochter +++ Cycle verlässt Italien +++ Solaris muss Bußgeld zahlen +++ Share Artikel vor/zurück VonTeam Was gibt’s Neues? In unserem #StartupTicker liefern wir eine kompakte Übersicht über die wichtigsten Startup-Nachrichten des Tages (Freitag, 20. Juni). November findet unsere zweite STARTUPLAND statt. Es erwartet Euch wieder eine faszinierende Reise in die Startup-Szene – mit Vorträgen von erfolgreichen Gründer:innen, lehrreichen Interviews und Pitches, die begeistern. Mehr über Startupland #STARTUPTICKER Autodoc +++ Eine ganz große Nummer! Der Berliner Auto-Ersatzteilhändler Autodoc, 2008 gegründet, strebt bei seinem geplanten Börsengang eine Bewertung von bis zu 2,4 Milliarden Euro an. Insgesamt sollen einschließlich der Mehrzuteilungsoption Aktien für bis zu 464 Millionen Euro auf den Markt gebracht werden – wie das Unternehmen mitteilt. Die Papiere des Unternehmens (1,3 Milliarden Umsatz) sollen am 25. Juni erstmals im Prime Standard an der Frankfurter Börse gehandelt werden. Beim Börsengang trennen sich die Firmengründer und der US-Finanzinvestor Apollo von Anteilen. Der amerikanische Finanzinvestor Apollo erwarb 2024 “neben anderen institutionellen Investoren” eine Minderheitsbeteiligung am Hidden Champion. Das Berliner Autoteile-Unternehmen wurde dabei mit 2,3 Milliarden Euro bewertet. Mehr über Autodoc Utopian Founders +++ Mit Utopian Founders startet gridX-Gründer Andy Booke ein Venture Studio, das sich gezielt an KI-basierte Jungfirmen richtet. Ziel ist es “Unternehmer und Gründer, die mit KI skalieren wollen – schneller, effizienter und mit klarer Systematik” zu unterstützen. “Zentrales Element” dabei ist “ein eigens entwickeltes AI Operating System: eine modulare Plattform aus intelligenten Software-Agenten, die Gründungsteams bei Analyse, Planung, Umsetzung und Skalierung unterstützen”. Dazu gibt es “gezieltes Frühphasen-Kapital und ein operatives Team, das aktiv mitarbeitet – weit über klassische Venture Capital-Investitionen hinaus”. Zum Team von Utopian Founders gehören neben Andy Booke, der mit FundX weiter in aufstrebende Startups investiert noch Lara Booke, Fabian Haedge und Joel Hermanns. “First wins, fails, and ventures coming soon”, schreibt Booke bei Linkedin . Mehr über gridX Israel +++ Israel bleibt auch in Krisenzeiten ein attraktiver Investitionsstandort – vor allem wegen der einzigartigen Kombination aus Innovationsdichte, Fachkräften mit tiefem technischem Know-how und einer ausgeprägten Startup-Kultur. Mehr im Gastbeitrag von Marc Jacob #LESENSWERT Tractive – Cycle – Solaris +++ Fokus, Fokus, Fokus! Haustier-Tracking-Scaleup Tractive verkauft seine britische Versicherungstochter ( Brutkasten ) +++ Arrivederci! Der Berliner Mobility-Anbieter Cycle, früher als GetHenry bekannt, zieht sich aus Italien zurück ( Linkedin ) +++ Obergrenze für Großkredite nicht eingehalten: Bafin verhängt 500.000 Euro Bußgeld gegen FinTech Solaris ( Bafin , Handelsblatt ) +++ Startup-Jobs: Auf der Suche nach einer neuen Herausforderung? In der unserer Jobbörse findet Ihr Stellenanzeigen von Startups und Unternehmen. Foto (oben): Bing Image Creator – DALL·E 3

Solaris Frequently Asked Questions (FAQ)

When was Solaris founded?

Solaris was founded in 2016.

Where is Solaris's headquarters?

Solaris's headquarters is located at Cuvrystrasse 53, Berlin.

What is Solaris's latest funding round?

Solaris's latest funding round is Series G.

How much did Solaris raise?

Solaris raised a total of $693.83M.

Who are the investors of Solaris?

Investors of Solaris include SBI Holdings, Boerse Stuttgart, Yabeo Capital, BBVA, HV Capital and 20 more.

Who are Solaris's competitors?

Competitors of Solaris include Plaid, Griffin, Swan, Klarna, Codat and 7 more.

What products does Solaris offer?

Solaris's products include Digital Banking and 3 more.

Who are Solaris's customers?

Customers of Solaris include American Express and Vivid .

Loading...

Compare Solaris to Competitors

Railsr is a global embedded finance platform that provides Banking as a Service (BaaS) and Cards as a Service (CaaS) in the financial technology sector. The company offers services including digital wallets, banking, and card solutions, which are integrated into customer experiences for financial transactions. It serves fintech startups, scale-ups, sports clubs, and brands that implement embedded finance experiences. Railsr was formerly known as Embedded Finance Limited. It was founded in 2016 and is based in London, United Kingdom. In April 2025, Railsr merged with Equals Money.

Productfy is a platform that specializes in the embedding of financial products within various business sectors. The company offers a suite of services, including branded card programs, digital banking solutions, secured charge card issuance, and disbursement mechanisms, all designed to be integrated seamlessly into clients' applications. Productfy primarily serves sectors such as community banks, credit unions, real estate, financial services, and insurance. It was founded in 2018 and is based in San Jose, California.

ClearBank provides regulated banking infrastructure and payment processing services for the financial services industry. The company offers a cloud-based application programming interface (API) that allows financial institutions to access regulated banking services, including account management and payment clearing. ClearBank serves fintechs, banks, credit unions, digital asset platforms, and other financial institutions. ClearBank was formerly known as CB Infrastructure. It was founded in 2015 and is based in London, United Kingdom.

Modulr specializes in embedded payments within the financial technology sector. The company offers a platform that enables businesses to integrate payment processing, account management, and card issuance into their systems. Its services cater to a variety of sectors including travel, lending, merchant services, and investment management. The company was founded in 2015 and is based in London, United Kingdom.

Teller provides APIs for bank account connectivity within the financial technology sector. Its offerings include services that allow applications to connect with users' bank accounts for verifying ownership, checking balances, accessing transaction histories, and facilitating payments. The API supports a wide range of financial institutions. It was founded in 2014 and is based in London, United Kingdom.

Swan is a fintech company that provides embedded banking solutions through APIs. The company offers banking features such as accounts, cards, and payments that can be integrated into other businesses' products. Swan serves the financial management, real estate tech, HR tech, and travel industries with its banking services. It was founded in 2019 and is based in Montreuil, France.

Loading...