Socure

Founded Year

2012Stage

Unattributed VC | AliveTotal Raised

$743.25MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+15 points in the past 30 days

About Socure

Socure is a platform in the digital identity verification and trust sector, utilizing artificial intelligence and machine learning within the financial services, government, gaming, healthcare, telecom, and e-commerce industries. The company offers a predictive analytics platform that employs AI and machine learning techniques to verify identities in real time, using online and offline data intelligence such as email, phone, address, intellectual property, device, and velocity. Socure's clientele includes a range of sectors, primarily focusing on financial services, government, and technology-driven industries. It was founded in 2012 and is based in Incline Village, Nevada.

Loading...

Socure's Product Videos

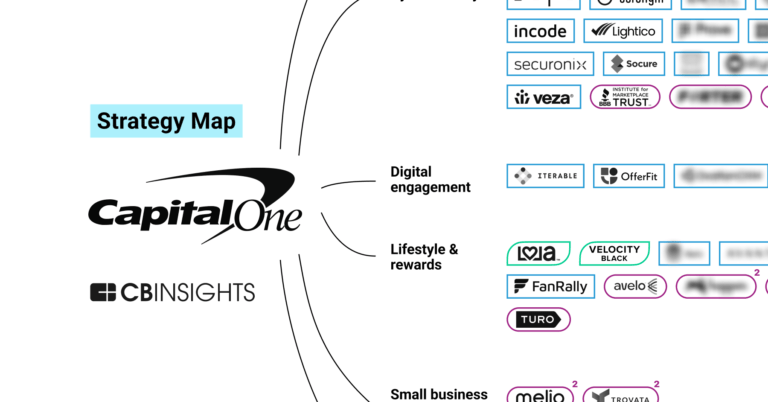

ESPs containing Socure

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The know your customer (KYC) software market provides solutions that automate customer identity verification and due diligence processes to meet regulatory compliance requirements. These platforms help financial institutions, fintech companies, and other regulated businesses verify customer identities, conduct background checks, screen against sanctions and PEP lists, detect suspicious activities,…

Socure named as Outperformer among 15 other companies, including Jumio, Sumsub, and Onfido.

Socure's Products & Differentiators

Socure KYC

Socure KYC automates customer identity verification, enabling businesses to auto-approve up to 98% of customers while satisfying compliance requirements. KYC is powered by the industry-leading ID graph and uses advanced ML and search analytics to achieve the highest match accuracy in the industry including Gen Z, millennials, credit invisible, new to country and thin file consumers. Socure offers the deepest multi-dimensional view of any consumer along with detailed risk and reason codes for each identity element that provide actionable intelligence.

Loading...

Research containing Socure

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Socure in 10 CB Insights research briefs, most recently on Jan 14, 2025.

Jan 14, 2025 report

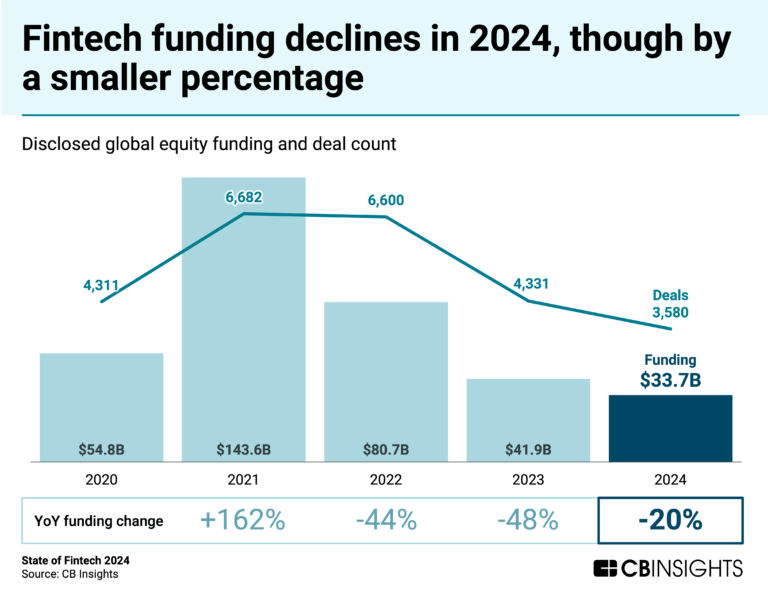

State of Fintech 2024 Report

Mar 14, 2024

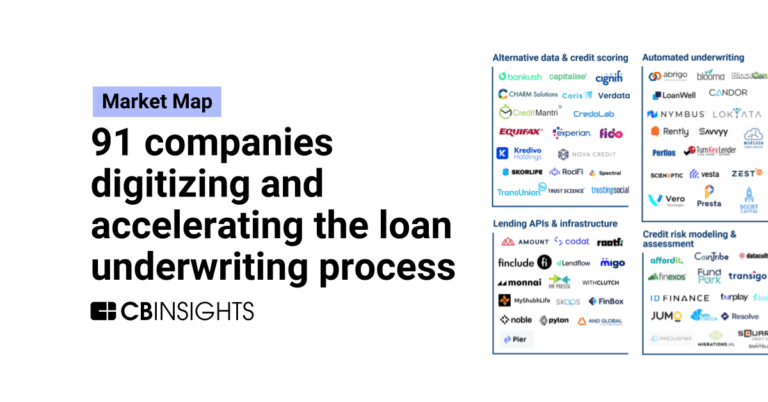

The retail banking fraud & compliance market map

Jan 4, 2024

The core banking automation market map

Aug 14, 2023

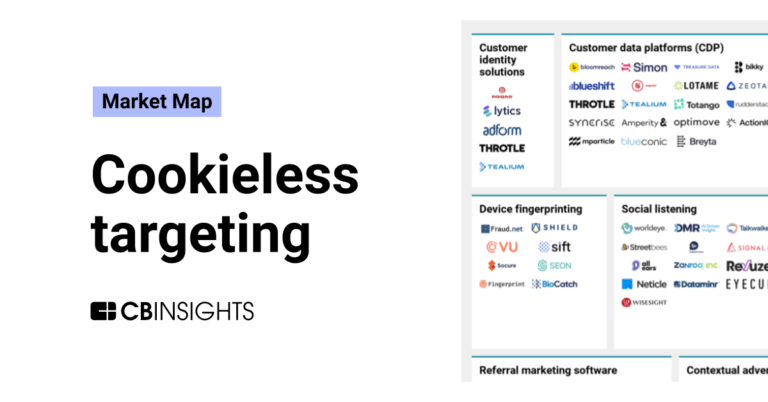

The cookieless targeting market mapExpert Collections containing Socure

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Socure is included in 13 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,276 items

Regtech

1,921 items

Technology that addresses regulatory challenges and facilitates the delivery of compliance requirements. Regulatory technology helps companies and regulators address challenges ranging from compliance (e.g. AML/KYC) automation and improved risk management.

Fintech 100

997 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

AI 100 (All Winners 2018-2025)

99 items

Winners of CB Insights' annual AI 100, a list of the 100 most promising AI startups in the world.

Digital Lending

2,661 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Payments

3,198 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Socure Patents

Socure has filed 18 patents.

The 3 most popular patent topics include:

- payment systems

- data management

- machine learning

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

10/4/2023 | 1/16/2024 | Barcodes, Diagrams, Typography, Software design patterns, Identifiers | Grant |

Application Date | 10/4/2023 |

|---|---|

Grant Date | 1/16/2024 |

Title | |

Related Topics | Barcodes, Diagrams, Typography, Software design patterns, Identifiers |

Status | Grant |

Latest Socure News

Jul 1, 2025

Jul 1, 2025, 5:00 am EDT Socure has unveiled a sweeping set of generative AI features across its RiskOS platform and internal operations. Under an “AI Everywhere” strategy, the company is embedding advanced models, from explainable machine learning LLMs to legal and compliance chatbots, to help clients detect evolving fraud threats and maintain regulatory readiness at scale. “At Socure, we believe AI should be responsible, explainable, and above all useful,” says Johnny Ayers, founder and CEO of Socure. “These initiatives aren’t just experiments; they are foundational investments in the way we build, support, and deliver value for our customers across all of their identity, risk and compliance needs.” This includes GenAI Explainability, a new capability now running across RiskOS and ID+ platforms. The feature provides natural-language descriptions of model decisions, helping fraud and compliance teams to resolve cases in plain language. For products like Sigma Identity Fraud , Synthetic Fraud, Verify+ and Global Watchlist Monitoring, the feature surfaces top risk signals and each explanation is stored immutably, creating audit-ready records for compliance. It promises to speed up workflows. At the end of March, Socure launched its Compliance AI Copilot that’s integrated into the Global Watchlist Screening and Monitoring solution. This gen AI-assistant slashes case-review times by over 90 percent, Socure claims, as it reads sanctions and conducts PEP screening, summarizes key match signals, identifies false positives and explains outcomes. Internally, Socure has built SocureBuddy, a genAI assistant that makes all company knowledge instantly accessible, according to the company. SocureBuddy is designed to break down silos and enhance collaboration. Building on SocureBuddy there’s also LegalBuddy, an AI assistant for fast, reliable legal guidance. Earlier this year, Socure hosted a company-wide AI hackathon that saw 72 team members across 16 teams participating. Armed with tools ranging from PyTorch and Sagemaker to ChatGPT and Google’s Gemini, employees prototyped AI tools ranging from auto-generated workflows to fully embedded hosted flows — several of these projects have been incorporated into Socure’s roadmap, according to the company. Related Posts

Socure Frequently Asked Questions (FAQ)

When was Socure founded?

Socure was founded in 2012.

Where is Socure's headquarters?

Socure's headquarters is located at 885 Tahoe Boulevard, Incline Village.

What is Socure's latest funding round?

Socure's latest funding round is Unattributed VC.

How much did Socure raise?

Socure raised a total of $743.25M.

Who are the investors of Socure?

Investors of Socure include Liquid 2 Ventures, Silicon Valley Bank, KeyBanc Capital Markets, J.P. Morgan, Commerce Ventures and 27 more.

Who are Socure's competitors?

Competitors of Socure include Persona, ZignSec, Deduce, Identomat, Daon and 7 more.

What products does Socure offer?

Socure's products include Socure KYC and 4 more.

Who are Socure's customers?

Customers of Socure include Betterment, Lili and Public.

Loading...

Compare Socure to Competitors

Veriff specializes in artificial intelligence (AI) powered identity verification within the fraud prevention and compliance sectors. The platform offers services to verify user identities, which are used to prevent fraud and ensure compliance with regulations. Veriff's solutions are utilized across various industries, including financial services, mobility, crypto, gaming, education, and healthcare. It was founded in 2015 and is based in Tallinn, Estonia.

Tactical Information Systems provides complete identity solutions that meet the needs of governments, law enforcement, border security, and identity communities. It is based in Austin, Texas.

HYPR focuses on identity security and passwordless authentication solutions across various sectors. The company provides an identity assurance platform that includes multi-factor authentication, risk mitigation, and identity verification. HYPR's solutions are utilized in the financial services, critical infrastructure, energy, and retail sectors. It was founded in 2014 and is based in New York, New York.

BIOWATCH focuses on wearable biometric authentication technology within the security and access control industry. Their product, LeBracelet, serves as an alternative to traditional forms of authentication like badges, cards, and passwords with a wrist-worn device that allows access to various systems and services. The company serves sectors that require secure access control solutions, including corporate environments, financial services, and personal security. It was founded in 2015 and is based in Lausanne, Switzerland.

Trulioo focuses on global online identity verification and operates within the technology and security sectors. The company offers services such as individual and business identity verification, watchlist screening, and identity document verification, all aimed at ensuring know-your-customer (KYC) and know-your-business (KYB) compliance. Trulioo primarily serves sectors such as banking, cryptocurrency, online trading, and wealth management. It was founded in 2011 and is based in Vancouver, Canada.

Prove Identity focuses on digital identity verification and authentication across several business sectors. The company provides services such as consumer verification, identity management, and passwordless authentication solutions. Prove's services are applicable to industries like banking, healthcare, insurance, and e-commerce. Prove Identity was formerly known as Payfone. It was founded in 2008 and is based in New York, New York.

Loading...