Skyfire

Founded Year

2024Stage

Seed VC - II | AliveTotal Raised

$10MLast Raised

$1M | 9 mos agoAbout Skyfire

Skyfire focuses on providing financial services for the machine economy. The company offers a financial stack that enables artificial intelligence agents to perform transactions without the need for credit cards or bank accounts and allows businesses to monetize their products, services, and data to AI agents. It primarily sells to sectors that involve AI technology and digital transactions. The company was founded in 2024 and is based in San Francisco, California.

Loading...

ESPs containing Skyfire

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The AI agent payments infrastructure market enables secure financial transactions between AI agents, humans, and businesses without requiring traditional banking infrastructure. Vendors in this space provide APIs, SDKs, and specialized protocols that allow developers to build AI systems that can autonomously initiate, authenticate, and complete financial transactions online. These solutions levera…

Skyfire named as Highflier among 9 other companies, including Stripe, Coinbase, and Nevermined.

Skyfire's Products & Differentiators

The Financial Stack for AI Agents

Powering autonomous transactions for developers, services, websites and LLMs across the AI Economy. Skyfire is the payment network built specifically for AI.

Loading...

Research containing Skyfire

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Skyfire in 3 CB Insights research briefs, most recently on May 16, 2025.

May 16, 2025 report

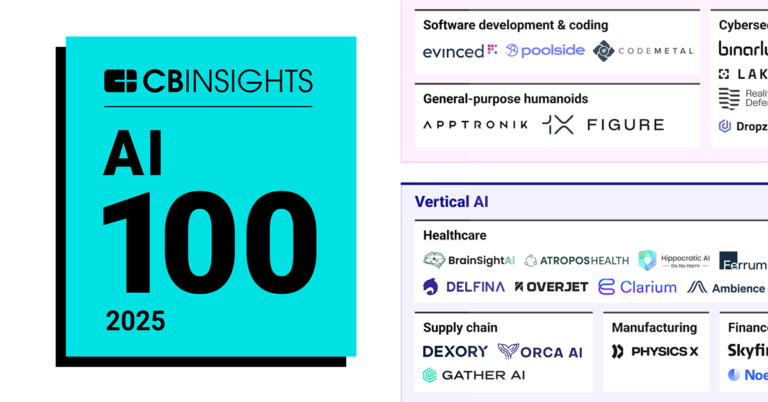

Book of Scouting Reports: 2025’s AI 100

Apr 24, 2025 report

AI 100: The most promising artificial intelligence startups of 2025

Mar 6, 2025

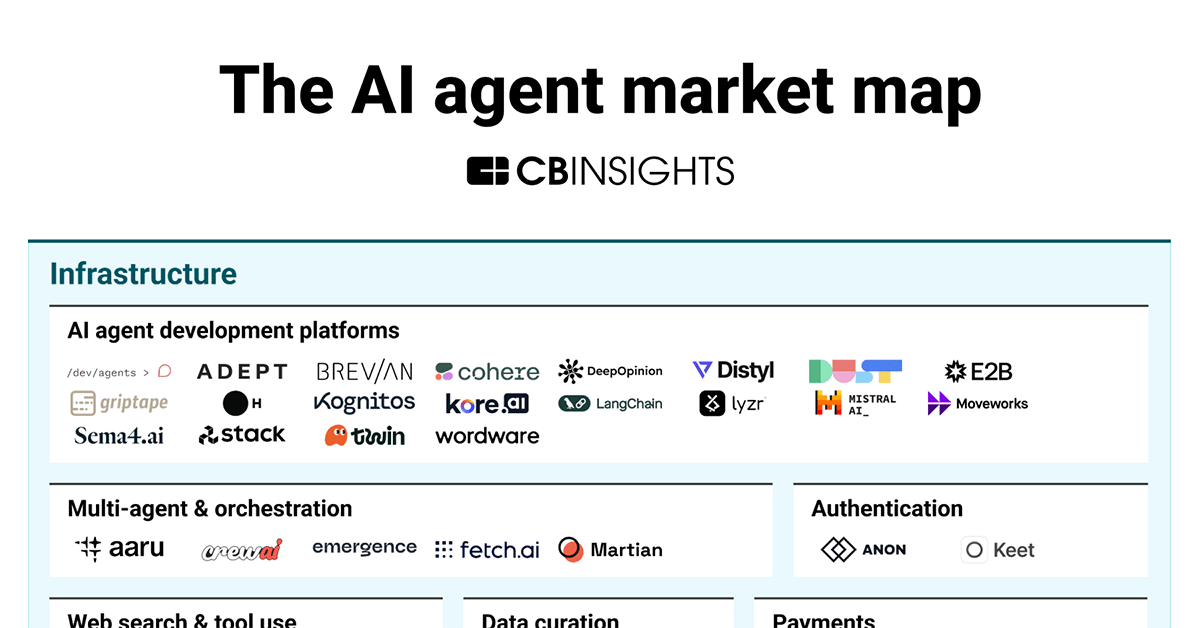

The AI agent market mapExpert Collections containing Skyfire

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Skyfire is included in 5 Expert Collections, including Artificial Intelligence.

Artificial Intelligence

10,050 items

AI agents

374 items

Companies developing AI agent applications and agent-specific infrastructure. Includes pure-play emerging agent startups as well as companies building agent offerings with varying levels of autonomy. Not exhaustive.

AI 100 (2025)

100 items

Generative AI

2,332 items

Companies working on generative AI applications and infrastructure.

AI 100 (All Winners 2018-2025)

100 items

Latest Skyfire News

Jun 27, 2025

June 26, 2025 Skyfire, the payment network built for the AI Agent economy, has launched Agent Checkout, built on top of KYAPay, an open protocol that turns AI agents into full participants in the digital economy. With the number of AI agents quickly growing, now generating over half of all online traffic, Skyfire has launched the Agent Checkout, to enable agents to authenticate themselves and ensure businesses can accept verified agents as genuine paying customers. Amir Sarhangi , CEO and co-founder of Skyfire “The protocol delivers an open standard solution that doesn’t force you into new auth stacks or walled gardens,” explained Amir Sarhangi, CEO and co-founder of Skyfire. “We’re building the connective tissue for the agent economy that benefits agents, businesses, and developers equally. Our platform, Agent Checkout, isn’t just a vision for agent-native commerce ; we’ve delivered the ecosystem, the protocol, and the partnerships to make it the default operating layer for autonomous agents.” Despite breakthroughs like MCP and A2A, agents still need humans to manually hand them credentials for access. Agents cannot autonomously sign up for accounts, log in, or pay for the premium services and content they need to get tasks completed. Services and merchants still require a human to manually access a service’s website and generate credentials before any agentic work can take place. Because there are no ways to verify, permission, or monetise this new agent consumer class, businesses have either blocked agent traffic or tolerated it as a costly necessity, closing off a massive new market. Recognising this as a significant issue, Skyfire Agent Checkout plans to give AI agents the tools to authenticate themselves, demonstrate trustworthiness, create accounts, and pay for access, so businesses can welcome them as actual digital consumers rather than bots to be managed or blocked. Monetising agentic AI With this release, Skyfire hopes to deliver the first production-ready system for agent-native payments and identity, solving a fundamental gap as agents and AI platforms become the new interfaces for commerce. Delivering the payment and identity layer for the AI agent economy with Know-Your-Agent (KYA), multi-rail programmable payments, and OAuth2/OIDC compatibility. Agent Checkout boasted a standardised signed JSON Web Token (JWT) that includes the verified information on the agent owner that a service needs to create account credentials, as well as a standardised signed JWT containing an authorised spend amount in USDC, or tokenised credit/debit card, that can be captured by a service or merchant. Both agents and enterprises will also be able to fund wallets via credit/debit cards, ACH, or USDC, enabling autonomous spending across digital services. Through the launch, Skyfire promises digital businesses and content providers a straightforward path to manage, monetise, and support AI agent-driven transactions. Agent Checkout will also provide updated quick-start guides that include clear code samples and templates, enabling teams to transition from prototype to production with ease. Demo and reference applications will be available for hands-on experimentation, while the live Agent Playground simulates real-world transactions for rapid testing and iteration. Author

Skyfire Frequently Asked Questions (FAQ)

When was Skyfire founded?

Skyfire was founded in 2024.

Where is Skyfire's headquarters?

Skyfire's headquarters is located at San Francisco.

What is Skyfire's latest funding round?

Skyfire's latest funding round is Seed VC - II.

How much did Skyfire raise?

Skyfire raised a total of $10M.

Who are the investors of Skyfire?

Investors of Skyfire include Crypto Startup Accelerator, Coinbase Ventures, Draper Associates, Crossbeam Venture Partners, DRW Trading Group and 15 more.

Who are Skyfire's competitors?

Competitors of Skyfire include Visa.

What products does Skyfire offer?

Skyfire's products include The Financial Stack for AI Agents and 3 more.

Loading...

Compare Skyfire to Competitors

Blackhawk Network (BHN) specializes in financial technology and operates within the payment solutions and technology sectors. The company offers products and services to improve sales, productivity, and customer loyalty through an integrated network that connects clients with their employees, sales channels, and customers across various platforms including in-store, online, and mobile. Blackhawk Network was formerly known as Blackhawk Marketing Services. It was founded in 2001 and is based in Pleasanton, California.

PayU is a company in global payments and fintech, focusing on enabling local and cross-border payments as well as providing financial services. The company offers a payment platform that facilitates online payment processing and payment gateway services. PayU primarily serves sectors such as e-commerce, hospitality, and marketplace solutions. It was founded in 2002 and is based in Hoofddorp, Netherlands. PayU operates as a subsidiary of Naspers.

Stripe provides services for businesses to manage online and in-person payments. It offers products including payment processing application programming interfaces (APIs), payment tools, and solutions for handling subscriptions, invoicing, and financial reports. It serves sectors such as electronic commerce (e-commerce), Software as a Service (SaaS), platforms, marketplaces, and the creator economy. It was formerly known as DevPayments. It was founded in 2010 and is based in South San Francisco, California.

UnionPay is an international company that operates in the financial services sector and provides digital wallet and account services. Users can store, convert, invest, and donate their digital assets. UnionPay provides access and adoption of digital assets through its services for individual and corporate clients. It is based in Campinas, Brazil.

Alternative Payments provides alternative payment solutions within the financial services industry. The company offers local payment methods and open banking solutions to facilitate transactions and cater to diverse consumer preferences. Alternative Payments serves the e-commerce sector and facilitates international transactions. It was founded in 1999 and is based in Pasadena, California.

InComm Payments is a provider of payment technology solutions across various industries. The company specializes in cash digitization, card solutions, account funding, and payment services, including healthcare benefits, gifting, and incentives. InComm Payments serves sectors such as retail, healthcare, and transit with its suite of payment products and services. It was founded in 1992 and is based in Atlanta, Georgia.

Loading...