Investments

34Portfolio Exits

11Partners & Customers

10About SK Telecom Ventures

SK Telecom Ventures (SKTVC) is the North America-focused venture capital arm of SK telecom. The fund makes strategic investments in the areas of mobile platforms and infrastructures, semiconductors and enterprise solutions including computing, storage, and networking. SKTVC invests in early to mid-stage companies who are seeking to raise their first or subsequent rounds of strategic capital.

Research containing SK Telecom Ventures

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned SK Telecom Ventures in 1 CB Insights research brief, most recently on Apr 29, 2025.

Apr 29, 2025 report

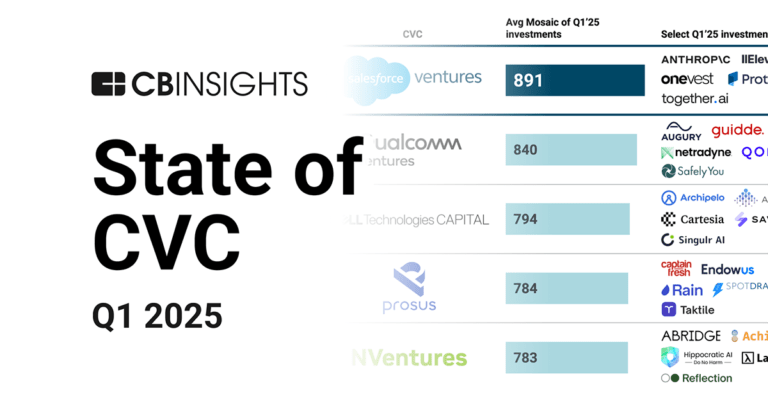

State of CVC Q1’25 ReportLatest SK Telecom Ventures News

Feb 20, 2014

A Summary: This is the age of seed-stage funding and the incubator/accelerator model. But for those trying to invent a new optical interconnect or chip architecture, funding is harder to find than ever. SK Telecom’s new incubator wants to help. photo: S. Higginbotham These days, everyone seems to have an accelerator or incubator devoted to helping entrepreneurs get from idea to product. I’ve visited hardware accelerators, connected devices accelerators, cloud accelerators and more. But the latest to join this crowded field offers an interesting twist on the model — one that is either a way to push more investment into the underfunded and capital-intensive core technology space or a depressing admission of how wary investors have become when it comes to funding new chip technology or deep tech. SK Telecom Americas on Thursday launched the SKTA Innovation Accelerator to fund and help create essential data center and technologies needed to meet modern computing demands. The SKTA model is less like a traditional exchange of equity for expertise and space and more of a corporate spin-in model . The idea is that entrepreneurs approach SKTA with their plans and, if those plans seem feasible, SKTA find a corporate strategic partner to match with the entrepreneur. The future startup gets up to $1 million in financing, space in the SK Telecom Americas offices in Sunnyvale, Calif. and marketing and business expertise. In exchange they don’t just give up equity — ideally, they will eventually negotiate a valuation for their technology with the strategic partner that SKTA has found, and sometime after the company reaches a set milestone, the corporate partner will acquire it. So if a startup with an awesome chip technology comes in, SKTA might pair the company with Google. SKTA provides the seed funding and accelerator while the chip engineers work on their technology. When it’s time to raise a Series A, they likely have a chip ready to be taped out and will negotiate the funding round with VCs working with SKTA. At the Series A, the spin-in path dictates that if the milestones are met, Google acquires the company at a set valuation. If Google doesn’t think the company is worth that much, the entrepreneur has an option to try to get to that valuation in a set period of time, sell off the IP to Google or try to shop the deal to someone else who is willing to invest or buy the tech. The entrepreneur can apparently try for a more traditional VC route, but in my meeting with the folks at SKTA, that option was never discussed. The chart below shows both options. Min Park (pictured, left), president of SK Telecom Americas of SKTA, says VCs like the spin-in model because it takes a lot of the risk out of hardware investments. But it also limits their potential return. A truly disruptive hardware or core technology investment can still generate some lofty return, as investors in Fusion-io and Nicira have discovered. Park says SKTA is already working with a few undisclosed VCs so far. Park says the company has two deals at the moment: Pavilion Data Systems , which believes it has found a way to deliver rapid IOPs at scale, and Etopus Technology Inc., which is doing a high-speed interconnect for the data center. Another deal is in the process of closing. Park is unsure how many deals SKTA will do a year, and is also vague about all the different “core technologies” the accelerator hopes to support. SK Telecom Americas is the U.S. business unit of SK Telecom, a South Korean conglomerate that includes a telecommunications company as well as a memory manufacturer. SK Telecom also has a venture arm that may play in deals. As incubators go, I’m intrigued by the model and cheered by the focus on core technology. I’m eager to see what happens next. Related research Subscriber Content ? Subscriber content comes from Gigaom Research, bridging the gap between breaking news and long-tail research. Visit any of our reports to learn more and subscribe.

SK Telecom Ventures Investments

34 Investments

SK Telecom Ventures has made 34 investments. Their latest investment was in Together AI as part of their Series B on February 20, 2025.

SK Telecom Ventures Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

2/20/2025 | Series B | Together AI | $305M | Yes | Brave Capital, Cadenza Ventures, Coatue, DAMAC Group, Definition Capital, Emergence Capital, General Catalyst, Greycroft, John Chambers, Kleiner Perkins, Long Journey Ventures, Lux Capital, March Capital, NVIDIA, Prosperity7 Ventures, Salesforce Ventures, Scott Banister, SE Ventures, and Undisclosed Investors | 4 |

2/15/2024 | Series C | Lambda | $320M | Yes | 1517 Fund, B Capital, Bloomberg Beta, Crescent Cove Advisors, Gradient Ventures, Mercato Partners, Super Micro Computer, T. Rowe Price, Undisclosed Investors, and US Innovative Technology Fund | 9 |

7/19/2023 | Seed VC - II | GGWP | $10M | Yes | 1 | |

5/23/2023 | Series C | |||||

7/20/2022 | Series A |

Date | 2/20/2025 | 2/15/2024 | 7/19/2023 | 5/23/2023 | 7/20/2022 |

|---|---|---|---|---|---|

Round | Series B | Series C | Seed VC - II | Series C | Series A |

Company | Together AI | Lambda | GGWP | ||

Amount | $305M | $320M | $10M | ||

New? | Yes | Yes | Yes | ||

Co-Investors | Brave Capital, Cadenza Ventures, Coatue, DAMAC Group, Definition Capital, Emergence Capital, General Catalyst, Greycroft, John Chambers, Kleiner Perkins, Long Journey Ventures, Lux Capital, March Capital, NVIDIA, Prosperity7 Ventures, Salesforce Ventures, Scott Banister, SE Ventures, and Undisclosed Investors | 1517 Fund, B Capital, Bloomberg Beta, Crescent Cove Advisors, Gradient Ventures, Mercato Partners, Super Micro Computer, T. Rowe Price, Undisclosed Investors, and US Innovative Technology Fund | |||

Sources | 4 | 9 | 1 |

SK Telecom Ventures Portfolio Exits

11 Portfolio Exits

SK Telecom Ventures has 11 portfolio exits. Their latest portfolio exit was Movella on February 13, 2023.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

2/13/2023 | Reverse Merger | 2 | |||

4/29/2022 | Acquired | 3 | |||

4/22/2022 | Asset Sale | 8 | |||

Date | 2/13/2023 | 4/29/2022 | 4/22/2022 | ||

|---|---|---|---|---|---|

Exit | Reverse Merger | Acquired | Asset Sale | ||

Companies | |||||

Valuation | |||||

Acquirer | |||||

Sources | 2 | 3 | 8 |

SK Telecom Ventures Partners & Customers

10 Partners and customers

SK Telecom Ventures has 10 strategic partners and customers. SK Telecom Ventures recently partnered with Ericsson on February 2, 2019.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

2/28/2019 | Partner | Sweden | 1 | ||

1/8/2019 | Partner | United States | SK Telecom : and Sinclair Broadcast Group Sign Joint Venture Agreement SEOUL , South Korea and BALTIMORE , Jan. 7 , 2019 / PRNewswire / -- SK Telecom and Sinclair Broadcast Group , one of the largest TV broadcasting companies in the U.S. , announced today in Las Vegas that the companies signed a joint venture agreement to lead the next-generation broadcasting solutions market in the U.S. and globally . | 5 | |

12/13/2018 | Partner | United States | `` Based on this partnership , SK Telecom will continue to drive technology innovations to provide customers with differentiated 5G services . '' | 3 | |

11/21/2018 | Partner | ||||

10/22/2018 | Partner |

Date | 2/28/2019 | 1/8/2019 | 12/13/2018 | 11/21/2018 | 10/22/2018 |

|---|---|---|---|---|---|

Type | Partner | Partner | Partner | Partner | Partner |

Business Partner | |||||

Country | Sweden | United States | United States | ||

News Snippet | SK Telecom : and Sinclair Broadcast Group Sign Joint Venture Agreement SEOUL , South Korea and BALTIMORE , Jan. 7 , 2019 / PRNewswire / -- SK Telecom and Sinclair Broadcast Group , one of the largest TV broadcasting companies in the U.S. , announced today in Las Vegas that the companies signed a joint venture agreement to lead the next-generation broadcasting solutions market in the U.S. and globally . | `` Based on this partnership , SK Telecom will continue to drive technology innovations to provide customers with differentiated 5G services . '' | |||

Sources | 1 | 5 | 3 |

SK Telecom Ventures Team

6 Team Members

SK Telecom Ventures has 6 team members, including current Vice President, Jerry(Jinchul) Yang.

Name | Work History | Title | Status |

|---|---|---|---|

Jerry(Jinchul) Yang | SK Telecom, and Samsung | Vice President | Current |

Name | Jerry(Jinchul) Yang | ||||

|---|---|---|---|---|---|

Work History | SK Telecom, and Samsung | ||||

Title | Vice President | ||||

Status | Current |

Loading...