Singlife

Founded Year

2014Stage

Acquired | AcquiredTotal Raised

$365.1MValuation

$0000About Singlife

Singlife operates in the insurance and investment sectors. The company offers a range of insurance products including life, medical, critical illness, disability, maternity, accident, car, travel, and home insurance, as well as investment-linked plans and savings accounts. Its primary customers are individuals seeking insurance coverage and investment opportunities. It was founded in 2014 and is based in Singapore. In December 2023, Sumitomo Life acquired a majority stake in Singlife for $1.21B.

Loading...

Loading...

Research containing Singlife

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Singlife in 1 CB Insights research brief, most recently on Feb 9, 2024.

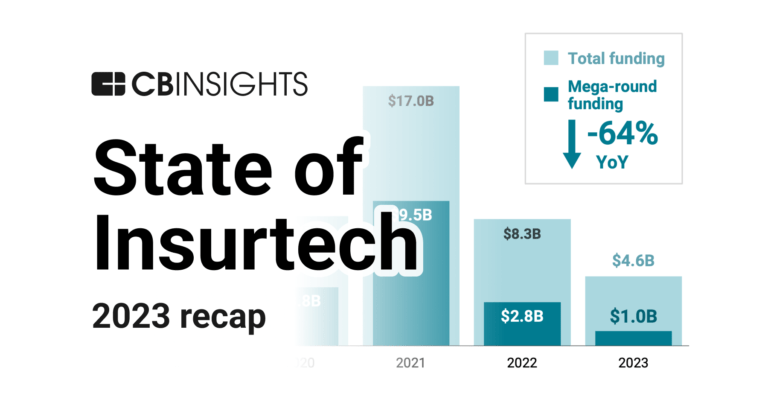

Feb 9, 2024 report

State of Insurtech 2023 ReportExpert Collections containing Singlife

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Singlife is included in 2 Expert Collections, including Insurtech.

Insurtech

3,347 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

13,978 items

Excludes US-based companies

Latest Singlife News

Jun 27, 2025

Get the hottest Fintech Singapore News once a month in your Inbox In Singapore, wealthtech solutions are rapidly reshaping the wealth management industry by enhancing accessibility, affordability, and customization. W hile new digital native entrants, such as robo-advisors and neobrokers, are rapidly gaining market share, established financial institutions are racing to digitalize their services across the wealth management value chain, according to a new report by Quinlan and Associates, and Allfunds Asia. The report, released earlier this month, notes that Singaporean investors are increasingly turning to digital channels for wealth management. 85% of investors said they have accessed digital wealth services in the past two years, with 59% using robo-advisors and 27% engaging with AI-powered guidance tools. The report highlights that while face-to-face meetings with wealth managers or advisors remains important, these meetings are increasingly being deprioritized in favor of digital channels, particularly self-service options via Internet platforms (49%), mobile apps (39%), and online chats (30%). Use of digital channels among Singapore and Hong Kong investors, Source: Quinlan and Associates, and Allfunds Asia, Jun 2025 Recognizing the growing market demand for a digital experience, an increasing number of wealth management service providers, banks, and insurance companies are adopting wealthtech solutions, accelerating efforts to implement data-driven and automated capabilities. Wealthtech Singapore Players For example, Phillip Securities, a well-respected name in the financial services industry, introduced in 2017 SMART Portfolio, a robo-advisory platform offering digital risk profiling and automated portfolio rebalancing. In 2021, DBS Bank launched Client Connect, an all-in-one, AI- and data-driven customer relationship management (CRM) platform to help frontline managers and investment consultants prioritize their call lists based on data and algorithms. Finally, Singlife, a Singaporean insurance company, offers GROW, an integrated investment platform formerly known as Navigator Investment Services that’s designed to help advisors deliver more personalized advice. Finance and insurance incumbents wealthtech adoption timeline, Source: Quinlan and Associates, and Allfunds Asia, Jun 2025 In parallel, the report notes that fintech startups are rapidly gaining market share in the wealth management industry. These players appeal to a broad range of investors by providing cost-efficient, accessible, and user-friendly platforms. Endowus, for example, saw its revenue increase 15-fold between 2020 and 2023, surging from US$0.4 million to US$6.6 million. Endowus is a fund management platform and fiduciary advisor to individuals, family offices, charities, endowments, and institutions, helping them invest in major asset classes. The company is licensed in both Singapore and Hong Kong. Similarly, StashAway saw its revenue grow nearly fourfold during the same period, rising from US$2.3 million in 2020 to US$9.5 million in 2023. StashAway is a licensed retail fund manager that has gained a global reach, and which now caters to both retail and professional investors in Singapore, Malaysia, Thailand, Hong Kong, and the United Arab Emirates (UAE). Notable independent robo-advisors with a presence in Hong Kong and Singapore, Source: Quinlan and Associates, and Allfunds Asia, Jun 2025 Development of Wealthtech in Singapore In Singapore, the rise of digital wealth management is being fueled by investors dissatisfaction with traditional wealth management services, particularly due to operational inefficiencies and limited personalization. According to the report, investors face several challenges across the wealth management journey, including low accessibility, high fees, limited automation, and a lack of tailored services. Onboarding processes are often cumbersome, with inefficiencies in documentation, and know-your-customer (KYC) and anti-money laundering (AML) verification. Other common frustrations include a lack of transparency in portfolio allocation decisions, outdated reporting formats such as PDFs, and mailed statements, and non-transparent fee structures. Notably, 64% of investors expressed dissatisfaction with the fees charged by their wealth managers, while 65% were unaware of how those managers are compensated, highlighting a lack of transparency that undermines trust and overall customer satisfaction. Wealth management fees, Source: Quinlan and Associates, and Allfunds Asia, Jun 2025

Singlife Frequently Asked Questions (FAQ)

When was Singlife founded?

Singlife was founded in 2014.

Where is Singlife's headquarters?

Singlife's headquarters is located at 4 Shenton Way, Singapore.

What is Singlife's latest funding round?

Singlife's latest funding round is Acquired.

How much did Singlife raise?

Singlife raised a total of $365.1M.

Who are the investors of Singlife?

Investors of Singlife include Sumitomo Life, Aviva Singlife, Aflac, Abrdn Property Income Trust, Ion Pacific and 6 more.

Who are Singlife's competitors?

Competitors of Singlife include New York Life Insurance Company, Insurance 360, AIA Group, Tokio Marine, Tower Insurance and 7 more.

Loading...

Compare Singlife to Competitors

New York Life Insurance Company operates as a financial services firm in the insurance and investment sectors. The company offers a range of insurance products, including term life, whole life, universal life, and long-term care insurance, as well as individual disability insurance. Additionally, it provides investment services such as mutual funds, exchange-traded funds, and annuities, along with retirement and wealth management advisory services. It was founded in 1845 and is based in New York, New York.

State Farm Insurance provides various insurance and financial services. The company offers products such as auto, homeowners, and life insurance, along with financial services like investment planning and retirement savings. State Farm Insurance serves individual customers and small businesses with their insurance and financial needs. It was founded in 1922 and is based in Bloomington, Illinois.

Mutual of Omaha is a provider of insurance and financial services. The company offers a range of products, including Medicare Supplement Insurance, various types of life insurance, and financial services such as annuities and investment products. It primarily serves individuals, businesses, and groups with its financial planning and insurance products. Mutual of Omaha was formerly known as Mutual Benefit Health & Accident. It was founded in 1909 and is based in Omaha, Nebraska.

Securian Financial is a company that provides insurance and retirement solutions across various sectors. Its main offerings include life insurance, annuities, and employee benefits. Its products cater to the needs of individuals, families, and businesses. It was founded in 1880 and is based in Saint Paul, Minnesota.

Great Eastern General Insurance specializes in providing a range of general insurance products across various sectors. The company offers insurance solutions for motor vehicles, homes, personal accidents, health, travel, and business needs. Great Eastern General Insurance caters to both individual and corporate clients, offering them protection for their assets and activities. It was founded in 1908 and is based in Singapore, Singapore.

ABC Life focuses on providing insurance services within the financial sector. The company offers a range of products including life insurance, accident insurance, and healthcare insurance, as well as wealth management and retirement planning services. ABC Life primarily serves individual and corporate clients with a variety of insurance and financial planning needs. It was founded in 2005 and is based in Dongcheng, China.

Loading...