Sila

Founded Year

2011Stage

Series G | AliveTotal Raised

$1.406BLast Raised

$375M | 1 yr agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+58 points in the past 30 days

About Sila

Sila focuses on battery materials within the energy sector. Its main offerings include nano-composite silicon anodes, which aim to improve the performance and energy density of lithium-ion batteries, used in industries such as automotive, consumer electronics, and cell manufacturing. Sila's products are designed as replacements for traditional graphite anodes. It was founded in 2011 and is based in Alameda, California.

Loading...

ESPs containing Sila

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The battery anode developers market encompasses companies that research, develop, and produce advanced anode materials for lithium-ion and other rechargeable batteries. These companies focus on improving traditional graphite anodes and developing next-generation materials including silicon-based composites, silicon oxide, pure silicon, lithium-metal, and zinc-based anode technologies. The market s…

Sila named as Highflier among 15 other companies, including Group14, Amprius Technologies, and Enovix.

Loading...

Research containing Sila

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Sila in 2 CB Insights research briefs, most recently on Aug 13, 2024.

Aug 13, 2024 report

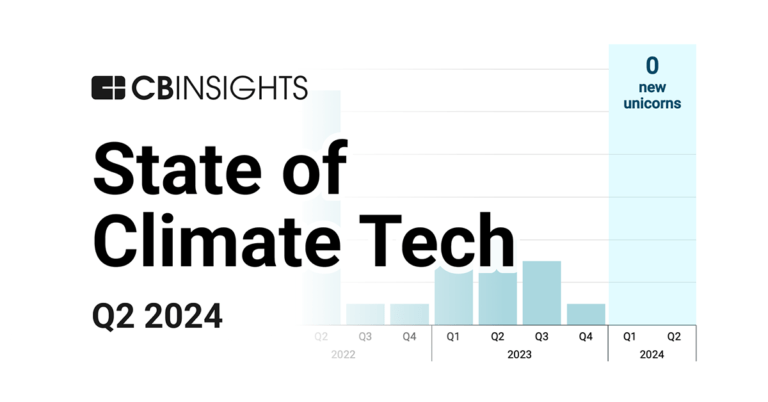

State of Climate Tech Q2’24 Report

Mar 12, 2024

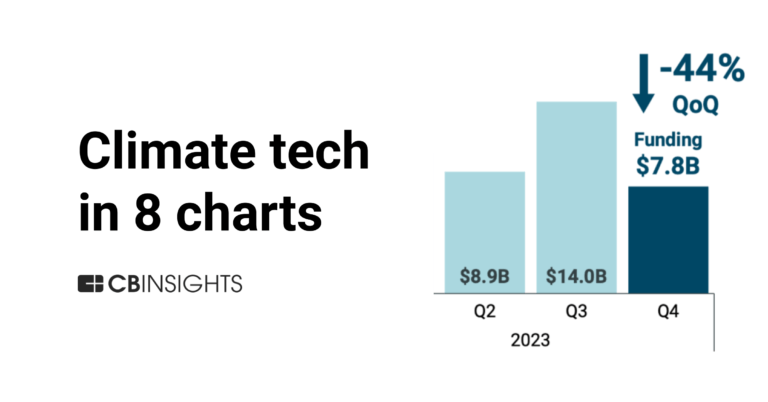

Climate tech in 8 charts: 2023Expert Collections containing Sila

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Sila is included in 4 Expert Collections, including Auto Tech.

Auto Tech

3,978 items

Companies working on automotive technology, which includes vehicle connectivity, autonomous driving technology, and electric vehicle technology. This includes EV manufacturers, autonomous driving developers, and companies supporting the rise of the software-defined vehicles.

Unicorns- Billion Dollar Startups

1,276 items

Energy Storage

5,350 items

Companies in the Energy Storage space, including those developing and manufacturing energy storage solutions such as lithium-ion batteries, solid-state batteries, and related software for battery management.

Advanced Materials

1,420 items

Companies in the advanced materials space, including polymers, biomaterials, semiconductor materials, and more

Sila Patents

Sila has filed 137 patents.

The 3 most popular patent topics include:

- lithium-ion batteries

- rechargeable batteries

- energy storage

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

8/16/2023 | 4/1/2025 | Fluorides, Metal halides, Fluorinating agents, Nonmetal halides, Nanomaterials | Grant |

Application Date | 8/16/2023 |

|---|---|

Grant Date | 4/1/2025 |

Title | |

Related Topics | Fluorides, Metal halides, Fluorinating agents, Nonmetal halides, Nanomaterials |

Status | Grant |

Latest Sila News

Jul 2, 2025

The House and Senate have passed slightly different versions of the tax-and-spending cuts mega bill. On the energy front, the variations are mostly around timelines for ending tax breaks that support the growth of clean energy companies and the deployment of clean power plants. “When it comes to the all-out assault on clean energy in this bill, even [Tesla founder and former head of the Department of Government Efficiency] Elon Musk understands the plain facts of the matter — Republicans' cuts are ‘utterly insane and destructive' and will ‘destroy millions of jobs in America,'” said Sen. Patty Murray, D-Wash., citing comments from Musk. Murray issued the statement following the Senate's split vote on the bill Tuesday morning, which required Vice President JD Vance to cast the tie-breaking vote. Trump and other GOP leaders defend the bill as cutting wasteful spending on clean energy subsidies approved under the Biden Administration. U.S. lawmakers now need to reconcile the differences in the legislation to get it to President Trump's desk. Business and nonprofit leaders in Washington state are waiting to see how the bill shakes out. The Pacific Northwest is home to dozens of climate-related businesses large and small that operate in Republican- and Democratic-leaning communities. That includes companies in next-gen battery materials, sustainable aviation, nuclear fission and fusion, carbon removal and other technologies. The legislation “harms the economy, slashes jobs, and increases costs for consumers,” said Michael Mann, executive director of the climate-focused nonprofit Clean & Prosperous Washington . “It undermines Washington's competitiveness on a global scale, and cedes innovation and clean energy leadership to other countries.” Energy installations imperiled Seattle-based Ever.green has software to match corporations looking reduce their carbon footprints with developers that need funding to build clean energy plants. Passage of this bill “would be a significant setback for the clean energy transition,” said Ever.green CEO Cris Eugster, by email, who called it “a direct attack on the wind and solar industries in the United States.” “This comes at a time when renewables are the only new generation source that can scale quickly enough to meet rising electricity demand,” he added. “We are already off-track on our climate goals, and this would only accelerate tipping points towards worst-case scenarios.” Electricity use is rising, driven in part by the rapid expansion of power-hungry data centers needed to support the artificial intelligence boom. The bill's energy provisions include: Quickly phasing out tax credits for large-scale wind and solar projects, and more slowly removing those for nuclear, geothermal and battery deployments. Quickly cancelling tax credits for companies making clean hydrogen fuel. Eliminating tax credits for consumers for installing rooftop solar, electric heat pumps and other energy-saving technologies by the end of the year. Nixing the $7,500 electric vehicle credit by September in the Senate bill, or the year's end in the House version; removing the commercial clean vehicles credit. Extending the credit for clean biofuel production. LevelTen Energy is also in the business of helping corporations, utilities, universities and others provide funding for new clean energy projects on its global platform. “Right now is a meaningful moment for the clean energy industry,” said Rob Collier, LevelTen's senior vice president of marketplaces, by email. “As with any major policy shift, developers are reassessing project timelines, costs, and long-term viability. We're seeing increased urgency around projects that remain viable under current rules.” The Seattle startup launched in 2016, shortly before President Trump started his first term. Collier emphasized that the clean energy transition “is a long game” and that the company is focused on navigating market change. Mixed results for batteries Electric vehicles took multiple hits in the legislation, removing incentives for individuals and companies looking to buy EVs. That, combined with the phasing out of tax credits for big battery installations, threatens to dampen demand for battery materials. Next-gen battery materials company Group14 Technologies this week laid off an undisclosed number of workers as it's slowing the start of production at a giant facility in Eastern Washington's Moses Lake. The company cited “shifts in demand and uncertainties in global trade relationships” as the cause. But battery competitor Sila is moving ahead with the commissioning of its mass-scale plant in Moses Lake and aims to start production by year's end. Sila and Group14 are manufacturing their own unique silicon anode materials for better performance in lithium-ion batteries. Helena Schwarz, director of government affairs for the company, had an upbeat take on the legislation's impacts, noting that silicon anode materials are used to replace graphite, which is primarily supplied by China. “The current legislative package aims to reduce reliance on China for battery components and critical minerals by limiting federal support to U.S. production [that is] free of Chinese influence,” Schwarz said by email. “Sila is well-positioned for success under the legislation.” Impacts on carbon removal Innovators in carbon removal — which pulls CO2 from the air or captures it from industrial operations — were glad for measures in the Senate version of the bill that restored incentives helping the nascent sector. A spokesperson for CarbonQuest , a Spokane, Wash., startup building carbon capture devices, said the Senate's legislation supports a variety of uses for captured carbon, including its use in synthetic fuels that replace oil and gas and trapping it in concrete. Putting these approaches on par with other carbon sequestration solutions, the spokesperson said, “will scale green concrete, alternative jet fuel, materials that displace plastic, and other green circular economies.” The company did have concerns about penalties for supply-chain goods coming from abroad, and the bill's “drastic rollback of incentives for renewable energy, such as wind and solar.” “Our hope is that the final bill allows for an all-of-the-above energy policy,” said the CarbonQuest spokesperson, “and that the rules make the tax credits workable and meaningful.”

Sila Frequently Asked Questions (FAQ)

When was Sila founded?

Sila was founded in 2011.

Where is Sila's headquarters?

Sila's headquarters is located at 2470 Mariner Square Loop, Alameda.

What is Sila's latest funding round?

Sila's latest funding round is Series G.

How much did Sila raise?

Sila raised a total of $1.406B.

Who are the investors of Sila?

Investors of Sila include Bessemer Venture Partners, Sutter Hill Ventures, Coatue, Perry Creek Capital, U.S. Department of Energy and 17 more.

Who are Sila's competitors?

Competitors of Sila include Ionic Mineral Technologies, 3DC, CTNS, Polarium, NanoGraf and 7 more.

Loading...

Compare Sila to Competitors

Addionics specializes in battery technology within the energy sector. The company offers rechargeable batteries with an architecture applicable to current and emerging lithium-ion battery (LIB) technology. Addionics serves sectors that require advanced energy storage solutions, leveraging both hardware innovations in smart 3D current collectors and software-driven AI optimization for performance attributes. It was founded in 2017 and is based in London, United Kingdom.

EnPower operates as a battery company that focuses on advancing lithium-ion technology in the energy sector. The company specializes in developing multilayer electrode batteries that offer charging capabilities and enhanced cycle life without significant degradation. EnPower primarily serves markets that demand battery technology for applications such as electric mobility. EnPower was formerly known as Big Delta Systems. It was founded in 2014 and is based in Indianapolis, Indiana.

CTNS operates as a company involved in secondary battery technology within the energy sector. It offers services for the development, manufacturing, and management of secondary battery packs, focusing on energy storage and management solutions. It was founded in 2017 and is based in Changwon-si, South Korea.

Group14 specializes in advanced silicon battery technology within the energy storage sector. The company's main offering includes a patented silicon-carbon composite material, known as SCC55, which enhances rechargeable batteries by enabling them to charge more quickly and last longer than traditional lithium-ion batteries. It primarily serves sectors that require rechargeable batteries, such as the automotive, consumer electronics, and aviation industries. The company was founded in 2015 and is based in Woodinville, Washington.

Clarios specializes in the production of batteries for a variety of vehicles. The company manufactures batteries annually, including advanced low-voltage systems, lithium-ion, and smart batteries, catering to the automotive and commercial sectors. Its products are integral to powering vehicles with features such as heated seats and cutting-edge safety systems, as well as supporting heavy-duty and leisure vehicles. Clarios was formerly known as Johnson Controls Power Solutions. The company was founded in 2019 and is based in Glendale, Wisconsin.

Enevate Corporation develops silicon-dominant lithium-ion battery technology for the electric vehicle sector. The company provides solutions that support fast charging, energy density, low temperature performance, and safety for electric vehicles. Enevate's technology can be integrated into existing manufacturing facilities, which may lead to lower costs and a reduced CO2 footprint during battery production. Enevate was formerly known as Carbon Micro Battery Corporation. It was founded in 2005 and is based in Irvine, California.

Loading...