Signifyd

Founded Year

2011Stage

Series E | AliveTotal Raised

$411.2MValuation

$0000Last Raised

$205M | 4 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-33 points in the past 30 days

About Signifyd

Signifyd provides e-commerce fraud protection and prevention services. The company offers services, including revenue protection, abuse prevention, and payment compliance, all aimed at maximizing conversion and eliminating fraud and consumer abuse. Its services primarily cater to the e-commerce industry. Signifyd was founded in 2011 and is based in San Jose, California.

Loading...

Signifyd's Product Videos

ESPs containing Signifyd

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

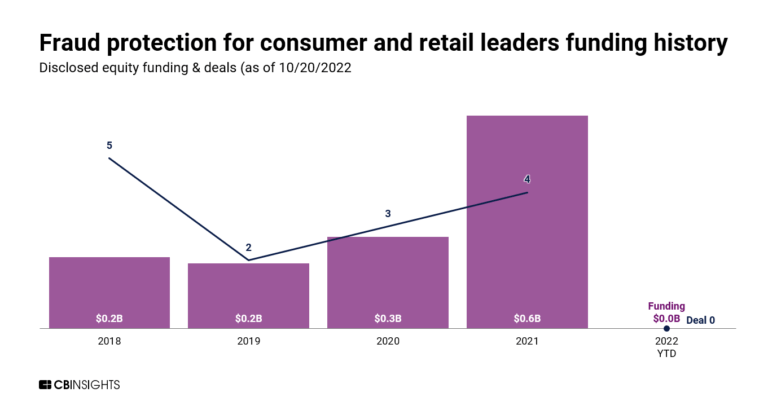

The payments fraud detection & prevention market offers a range of technologies helping businesses detect and block anomalous payment activity. Vendors in this market cater to many different industries, from financial services to e-commerce. These solutions cover a range of different types of financial fraud like chargebacks, ACH, wire, and credit card fraud. Most providers leverage advanced techn…

Signifyd named as Outperformer among 15 other companies, including Mastercard, Oracle, and Fiserv.

Signifyd's Products & Differentiators

Guaranteed Fraud Protection

Guaranteed Fraud Protection pairs order automation with a financial guarantee against fraud chargebacks on all approved orders. This shifts liability away from the merchant, allowing them to optimize for revenue attainment and pay $0 in fraud losses on approved orders – guaranteed.

Loading...

Research containing Signifyd

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Signifyd in 8 CB Insights research briefs, most recently on Mar 18, 2024.

Mar 14, 2024

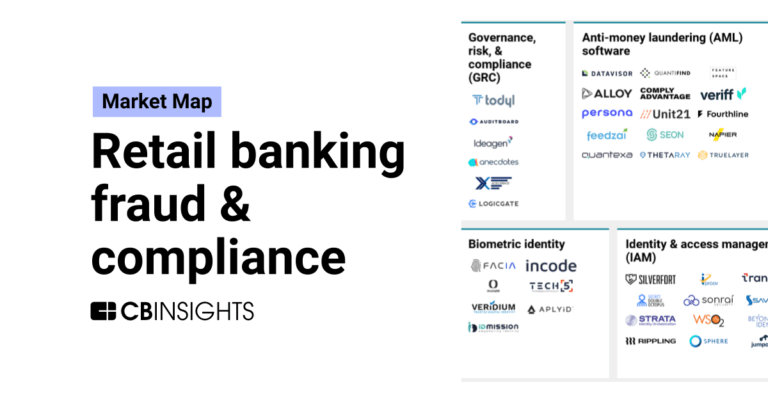

The retail banking fraud & compliance market map

Dec 14, 2023

Cross-border payments market map

Feb 27, 2023 report

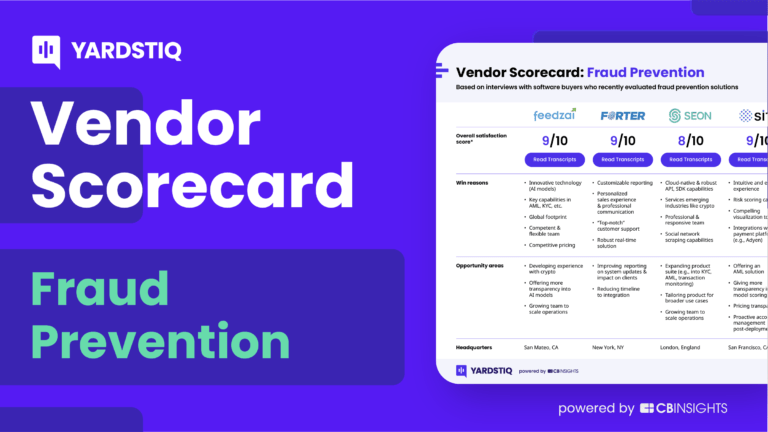

Top fraud prevention companies — and why customers chose themExpert Collections containing Signifyd

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Signifyd is included in 12 Expert Collections, including E-Commerce.

E-Commerce

11,558 items

Companies that sell goods online (B2C), or enable the selling of goods online via tech solutions (B2B).

Unicorns- Billion Dollar Startups

1,276 items

Regtech

1,563 items

Technology that addresses regulatory challenges and facilitates the delivery of compliance requirements. Regulatory technology helps companies and regulators address challenges ranging from compliance (e.g. AML/KYC) automation and improved risk management.

Fintech 100

997 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Payments

3,198 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Tech IPO Pipeline

568 items

Latest Signifyd News

Jun 14, 2025

In fact, 76% of respondents said their businesses had increased the price of goods they sell to mitigate the cost of the new and expected tariffs, according to the poll of U.S. ecommerce professionals conducted for Signifyd by Talker Research. On average, the survey shows, retailers are passing along 51% of the cost of Trump’s import taxes. Overall, the surveyed merchants, in big numbers, have made big moves in the face of tariffs — including layoffs, store closings, moving production and product sources and rebalancing their inventory. “It isn’t surprising that retailers are taking dramatic action in the face of some pretty dramatic tariffs that have been implemented and proposed,” said Signifyd head of storytelling Mike Cassidy, who is overseeing the poll for Signifyd. “What surprised me was the big number of retailers — often in the 70-plus-percent range — that are significantly adjusting critical operations and strategies this early in the game.” The survey also indicates that retailers with online businesses have been scrambling since before the 2024 election to brace for higher import taxes. Signifyd Chief Customer Officer J. Bennett, who has been talking to retailers about their tariff strategies, is available to talk more about the survey results and their implications for the retail industry and the economy. Some additional findings from the survey follow below. For more on the poll and the tariffs' effects on retail see Signifyd’s Merchant Tariff Tracker. The Signifyd Merchant Tariff Survey polled 500 U.S. retail professionals representing merchants with online operations. The survey, conducted between May 27 and June 2, 2025, had a margin of error of plus-or-minus 4.38%. Key Survey Results Below are the percentages of U.S. ecommerce professionals who said that in the face of current or pending Trump Administration tariffs their brands took the designated action. ( Talker Research surveyed 500 U.S. ecommerce professionals

Signifyd Frequently Asked Questions (FAQ)

When was Signifyd founded?

Signifyd was founded in 2011.

Where is Signifyd's headquarters?

Signifyd's headquarters is located at 99 Almaden Boulevard, San Jose.

What is Signifyd's latest funding round?

Signifyd's latest funding round is Series E.

How much did Signifyd raise?

Signifyd raised a total of $411.2M.

Who are the investors of Signifyd?

Investors of Signifyd include CPP Investments, Neuberger Berman, Owl Rock Capital Group, FIS, Resolute Ventures and 16 more.

Who are Signifyd's competitors?

Competitors of Signifyd include Vesta, ClearSale, UrbanFox, Ravelin, Behavox and 7 more.

What products does Signifyd offer?

Signifyd's products include Guaranteed Fraud Protection and 4 more.

Who are Signifyd's customers?

Customers of Signifyd include Walmart, Mango, UrbanStems and Samsung.

Loading...

Compare Signifyd to Competitors

Sift operates in the fields of cybersecurity and financial technology. Its main offerings include a platform that uses machine learning and user identity verification to address fraud, including account takeover, payment fraud, and policy abuse. Sift serves sectors that require digital trust solutions, such as e-commerce, fintech, and online marketplaces. Sift was formerly known as Sift Science. It was founded in 2011 and is based in San Francisco, California.

Forter specializes in identity intelligence for digital commerce, focusing on fraud prevention and customer security across digital platforms. The company provides services including fraud management, payment optimization, chargeback recovery, identity protection, and abuse prevention, aimed at improving security and efficiency in online transactions. Forter's solutions are utilized by sectors within the digital commerce industry to support processes for businesses and consumers. Forter was formerly known as Ryzyco. It was founded in 2013 and is based in New York, New York.

FUGU specializes in payment fraud prevention and operates within the financial technology sector. The company offers a suite of services that analyze transactions throughout the entire lifecycle, from pre-checkout to post-purchase, to identify and prevent various types of fraud, automate Know Your Customer (KYC) verifications, and manage chargebacks. FUGU's solutions are designed to reduce false declines, minimize operational costs, and provide a chargeback guarantee to online sellers and payment service providers. It was founded in 2017 and is based in Tel Aviv, Israel.

Fraud.net specializes in AI-powered fraud detection and prevention for various industries, including financial services and e-commerce. The company offers a suite of services that include real-time transaction monitoring, identity verification, and anti-money laundering (AML) compliance. Fraud.net's solutions cater to sectors such as financial services, e-commerce, travel, and government. It was founded in 2015 and is based in New York, New York.

Shield is a device-first risk AI platform that specializes in fraud prevention and risk intelligence within the digital business sector. The company offers solutions to identify and eliminate fraudulent activities through global standard device identification and actionable risk intelligence. Shield primarily serves industries such as ride-hailing, social media, e-commerce, digital banking, and gaming. Shield was formerly known as CashShield. It was founded in 2008 and is based in Singapore.

Vesta specializes in fraud prevention and payment processing for the telecommunications sector. The company offers AI-driven fraud detection and prevention services, payment processing, and risk management solutions to telecoms. Vesta was formerly known as Carrier Services. It was founded in 1995 and is based in Lake Oswego, Oregon.

Loading...