Sift

Founded Year

2011Stage

Secondary Market | AliveTotal Raised

$156.52MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-63 points in the past 30 days

About Sift

Sift operates in the fields of cybersecurity and financial technology. Its main offerings include a platform that uses machine learning and user identity verification to address fraud, including account takeover, payment fraud, and policy abuse. Sift serves sectors that require digital trust solutions, such as e-commerce, fintech, and online marketplaces. Sift was formerly known as Sift Science. It was founded in 2011 and is based in San Francisco, California.

Loading...

ESPs containing Sift

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

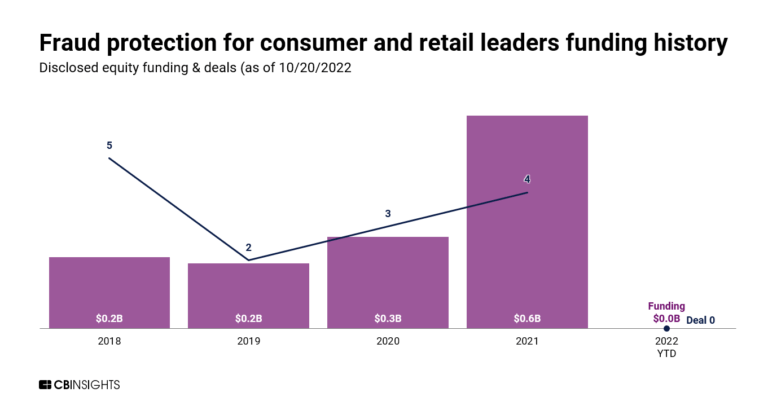

The device fingerprinting market, also referred to as device intelligence, offers customers a tool for identifying and authenticating devices accessing their systems or platforms. Device fingerprinting involves creating unique digital profiles based on various device attributes such as hardware, software, network configuration, and behavior patterns. This helps enhance security measures by detecti…

Sift named as Outperformer among 12 other companies, including Socure, Signifyd, and SEON.

Sift's Products & Differentiators

Payment Fraud

Sift’s Payment Fraud solution helps businesses detect and prevent fraudulent transactions. It detects and blocks risky transactions, shuts off fraudulent currency movement, and proactively prevents alternative payment abuse.

Loading...

Research containing Sift

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Sift in 6 CB Insights research briefs, most recently on Mar 14, 2024.

Mar 14, 2024

The retail banking fraud & compliance market map

Aug 14, 2023

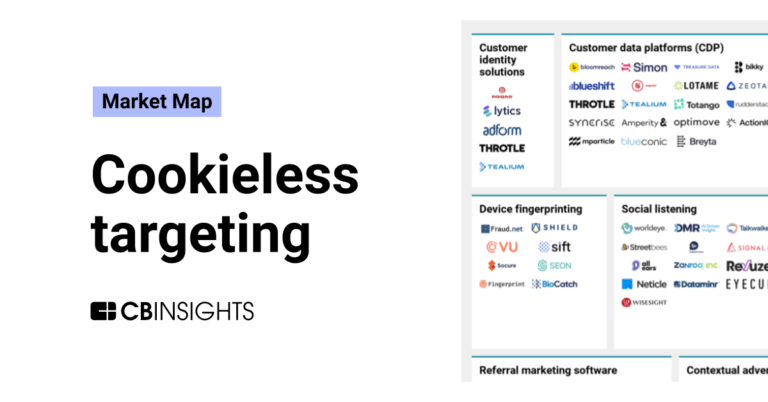

The cookieless targeting market map

Feb 27, 2023 report

Top fraud prevention companies — and why customers chose themExpert Collections containing Sift

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Sift is included in 12 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,276 items

Regtech

1,721 items

Technology that addresses regulatory challenges and facilitates the delivery of compliance requirements. Regulatory technology helps companies and regulators address challenges ranging from compliance (e.g. AML/KYC) automation and improved risk management.

Digital Lending

2,567 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Payments

3,198 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech 100

250 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Tech IPO Pipeline

568 items

Sift Patents

Sift has filed 46 patents.

The 3 most popular patent topics include:

- computer security

- machine learning

- social networking services

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

5/29/2024 | 4/8/2025 | Machine learning, Association football forwards, Classification algorithms, Artificial neural networks, Trees (data structures) | Grant |

Application Date | 5/29/2024 |

|---|---|

Grant Date | 4/8/2025 |

Title | |

Related Topics | Machine learning, Association football forwards, Classification algorithms, Artificial neural networks, Trees (data structures) |

Status | Grant |

Latest Sift News

Jun 30, 2025

AI-Generated Fraud Surges 62% YoY Even as Consumer Concern Drops June 30, 2025 Digital Trust Index Exposes Dangerous Confidence Gap as 70% of Consumers Report That Scams Harder to Detect Sift, the AI-powered fraud platform delivering identity trust for leading global businesses, today released its Q2 2025 Digital Trust Index, revealing a troubling disconnect between consumer confidence and actual vulnerability to AI-generated fraud. The report exposes a dangerous “confidence paradox” where scam sophistication is outpacing consumer awareness, creating unprecedented risks for businesses and their customers. The Confidence Paradox: When Familiarity Breeds Vulnerability Despite growing familiarity with GenAI, the data reveals a concerning trend: 27% of those targeted by GenAI have been successfully scammed, a 62% increase from 2024. This surge occurs even as consumer concern about AI fraud has dropped significantly—from 79% in 2024 to just 61% today, an 18-point decrease that signals dangerous complacency. Scam sophistication is outpacing consumer defenses. According to the Sift-commissioned survey, 70% of consumers say scams have become harder to detect in the past year. Yet paradoxically, overall fear of AI-powered fraud is declining, creating a perfect storm for cybercriminals. Generational Divide: Digital Natives Most at Risk The report reveals a striking generational paradox. Gen Z and Millennials—the demographics most comfortable with AI technology—report the highest confidence in identifying scams (52% and 44%, respectively) yet are successfully victimized at alarming rates (30% and 23%). In contrast, Gen X and Baby Boomers express lower confidence (30% and 13%) but demonstrate more cautious online behavior, resulting in lower scam success rates (19% and 12%). Enterprise Risk: Consumer Data Practices Expose Businesses Beyond individual fraud, the report uncovers significant enterprise security risks. Despite widespread privacy concerns, 31% of consumers admit to entering personal or sensitive information into GenAI tools. Among this group, the most commonly shared data includes email addresses (55%), phone numbers (49%), home addresses (44%), and financial information (33%). Most alarmingly, 14% admitted to sharing company trade secrets, creating dual exposure for both individuals and their employers. Behavioral Patterns Reveal Cybercriminal Operations Analysis of Sift’s Global Data Network, which processes over 1 trillion events annually, reveals distinct behavioral signatures that differentiate fraudsters from legitimate users. Key findings include: Fraudsters use 36% more payment methods than legitimate users Criminal networks employ 20% fewer IP addresses, suggesting coordinated operations Peak fraud activity occurs during late-night hours (10 p.m. to 5 a.m. local time) when many fraud teams are offline The Business Imperative “AI-generated scams and deepfakes are proliferating with speed and concerning sophistication, leaving even the most informed consumers at risk,” said Kevin Lee, SVP of Customer Experience, Trust & Safety at Sift. “Businesses must fight fire with fire—using AI to secure identity trust at every customer touchpoint, which ultimately creates better consumer experiences, mitigates fraud, and fosters profitable growth.” The full findings from Sift’s Q2 2025 Digital Trust Index are available here Explore AITechPark for the latest advancements in AI, IOT, Cybersecurity, AITech News, and insightful updates from industry experts! GlobeNewswire GlobeNewswire is one of the world's largest newswire distribution networks, specializing in the delivery of corporate press releases financial disclosures and multimedia content to the media, investment community, individual investors and the general public. previous post

Sift Frequently Asked Questions (FAQ)

When was Sift founded?

Sift was founded in 2011.

Where is Sift's headquarters?

Sift's headquarters is located at 525 Market Street, San Francisco.

What is Sift's latest funding round?

Sift's latest funding round is Secondary Market.

How much did Sift raise?

Sift raised a total of $156.52M.

Who are the investors of Sift?

Investors of Sift include Fabrica Ventures, Union Square Ventures, Insight Partners, Stripes Group, Spark Capital and 18 more.

Who are Sift's competitors?

Competitors of Sift include Vesta, ClearSale, UrbanFox, Ravelin, Justt and 7 more.

What products does Sift offer?

Sift's products include Payment Fraud and 2 more.

Who are Sift's customers?

Customers of Sift include Atom Tickets, DoorDash, Paula's Choice, Uphold and Patreon.

Loading...

Compare Sift to Competitors

Signifyd provides e-commerce fraud protection and prevention services. The company offers services, including revenue protection, abuse prevention, and payment compliance, all aimed at maximizing conversion and eliminating fraud and consumer abuse. Its services primarily cater to the e-commerce industry. Signifyd was founded in 2011 and is based in San Jose, California.

Forter specializes in identity intelligence for digital commerce, focusing on fraud prevention and customer security across digital platforms. The company provides services including fraud management, payment optimization, chargeback recovery, identity protection, and abuse prevention, aimed at improving security and efficiency in online transactions. Forter's solutions are utilized by sectors within the digital commerce industry to support processes for businesses and consumers. Forter was formerly known as Ryzyco. It was founded in 2013 and is based in New York, New York.

BioCatch provides behavioral biometrics for the financial services industry, concentrating on fraud prevention. The company offers solutions that analyze online users' physical and cognitive digital behavior to protect against various forms of fraud and financial crime. BioCatch serves the banking and financial services sectors with its fraud detection and prevention services. It was founded in 2011 and is based in Tel Aviv, Israel.

Shield is a device-first risk AI platform that specializes in fraud prevention and risk intelligence within the digital business sector. The company offers solutions to identify and eliminate fraudulent activities through global standard device identification and actionable risk intelligence. Shield primarily serves industries such as ride-hailing, social media, e-commerce, digital banking, and gaming. Shield was formerly known as CashShield. It was founded in 2008 and is based in Singapore.

Feedzai focuses on fraud and financial crime prevention within the financial technology sector. The company provides a platform that uses machine learning and big data to identify fraud, ensure compliance, and handle risk for financial institutions. Feedzai's solutions address the needs of retail banks, commercial banks, payment service providers, merchant acquirers, and government entities. It was founded in 2011 and is based in Coimbra, Portugal.

Qlarant focuses on quality improvement, fraud detection, and data science within the healthcare, human services, government, and insurance and financial services sectors. The company offers services such as quality improvement programs, fraud, waste, abuse prevention, advanced data analytics, and predictive modeling to identify and resolve risks. Qlarant also supports underserved communities through grant awards from its foundation. It was founded in 1973 and is based in Easton, Maryland.

Loading...