Sierra

Founded Year

2023Stage

Series C | AliveTotal Raised

$285MValuation

$0000Last Raised

$175M | 8 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+46 points in the past 30 days

About Sierra

Sierra is a conversational artificial intelligence (AI) platform that provides AI agents for customer support across various business sectors. The agents engage in personalized interactions and can be integrated with existing call center technologies. The platform is designed to meet security and compliance requirements and can be tailored to the needs of clients. It was founded in 2023 and is based in San Francisco, California.

Loading...

ESPs containing Sierra

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The autonomous agents & digital coworkers market focuses on developing autonomous software agents and digital assistants capable of performing complex tasks and making decisions with minimal human intervention. These technologies leverage natural language processing (NLP), conversational AI, and machine learning for task automation and process optimization across enterprise functions, including cu…

Sierra named as Leader among 15 other companies, including Cohere, Kore.ai, and Workato.

Loading...

Research containing Sierra

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Sierra in 8 CB Insights research briefs, most recently on May 16, 2025.

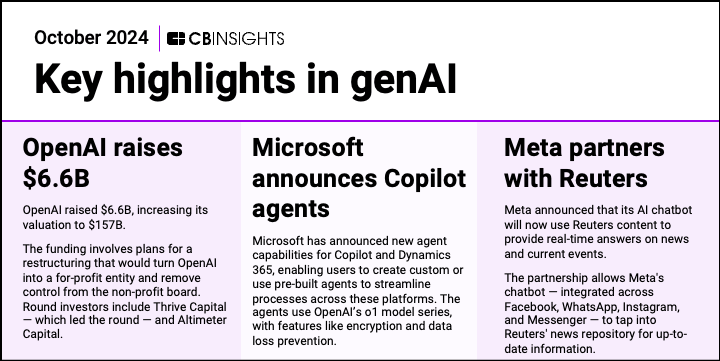

May 16, 2025 report

Book of Scouting Reports: 2025’s AI 100

Apr 24, 2025 report

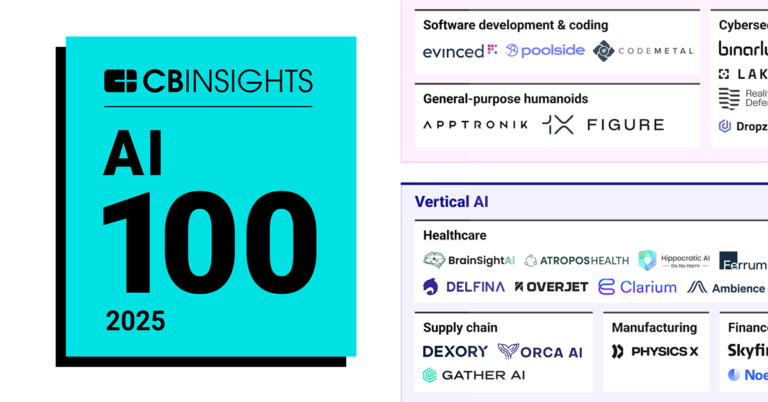

AI 100: The most promising artificial intelligence startups of 2025

Mar 6, 2025

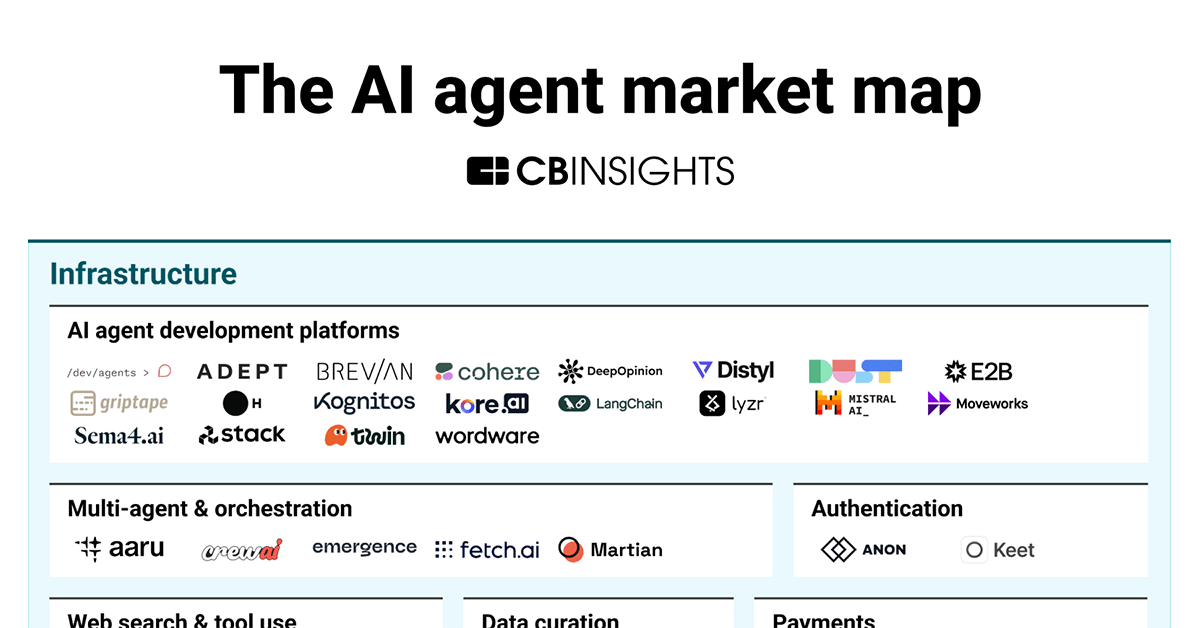

The AI agent market map

Feb 28, 2025

What’s next for AI agents? 4 trends to watch in 2025

Oct 17, 2024

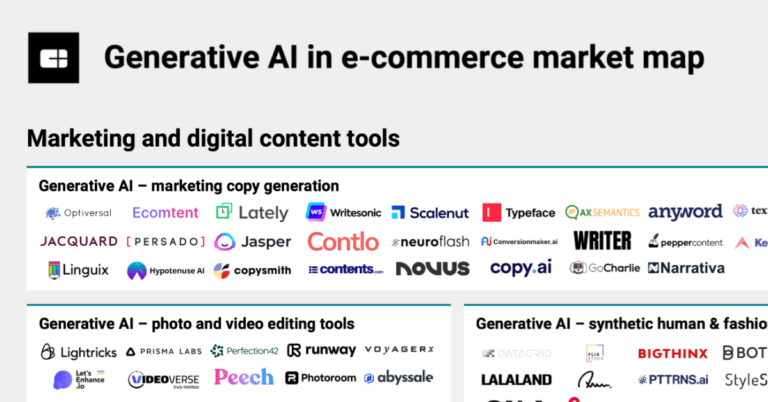

The generative AI for e-commerce market map

Aug 7, 2024

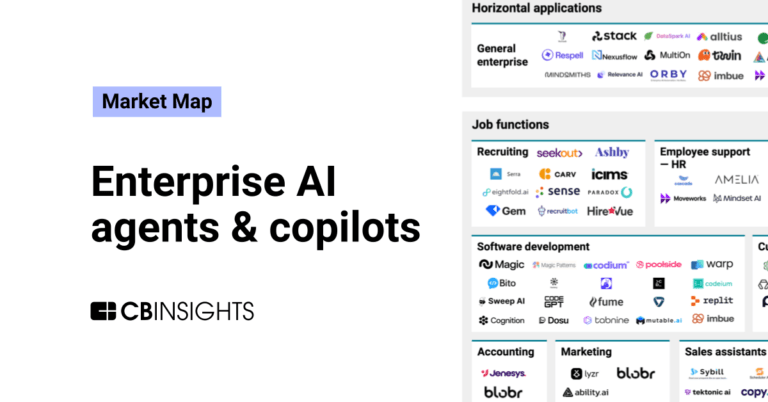

The enterprise AI agents & copilots market mapExpert Collections containing Sierra

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Sierra is included in 8 Expert Collections, including AI 100 (2024).

AI 100 (2024)

100 items

Generative AI

2,314 items

Companies working on generative AI applications and infrastructure.

Artificial Intelligence

10,047 items

Unicorns- Billion Dollar Startups

1,276 items

AI Agents & Copilots Market Map (August 2024)

322 items

Corresponds to the Enterprise AI Agents & Copilots Market Map: https://app.cbinsights.com/research/enterprise-ai-agents-copilots-market-map/

AI agents

374 items

Companies developing AI agent applications and agent-specific infrastructure. Includes pure-play emerging agent startups as well as companies building agent offerings with varying levels of autonomy. Not exhaustive.

Latest Sierra News

Jul 2, 2025

Like Read Time: min “I just get so much more done today with the AI on the team instead of the humans on the team.” — leading CMO to me, last week. Fast as Frack. That’s the new speed of business in the AI era. I’ve been in B2B software now for 20+ years (!). Goodness. I’ve seen cycles. Boom, bust, recovery, boom again. But what’s happening right now? This isn’t just another cycle. This is a fundamental rewiring of how fast things move in tech. Everything — and I mean everything — is Fast as F*ck compared to even 12 months ago. It’s exciting. It’s tiring. And it’s very, very different than ever before. Not just the software (with AI). The pace. This Isn’t 2021 “Fast” (That Was Just Demand) Remember 2021? Everyone thought SaaS was moving at light speed. Companies going from $10M to $100M ARR in 18 months. IPOs every single day — literally an IPO-a-day pace we’d never seen before. Valuations hitting the moon. But here’s the thing: 2021 wasn’t actually fast innovation. It was the same old SaaS products riding a massive demand wave. Zoom was still the same video conferencing tool it was in 2019. Slack was still the same chat app. Shopify was still the same e-commerce platform. The products themselves weren’t fundamentally different or faster to build. What was fast in 2021 was: Customer adoption (pandemic forced digital transformation) Sales cycles (everyone needed SaaS immediately) Revenue growth (unlimited demand for existing solutions) Fundraising (investors throwing money at anything with growth) IPO creation (an IPO-a-day because public markets couldn’t get enough SaaS) The underlying technology stack? Same APIs, same databases, same development cycles. Companies were scaling existing playbooks, not inventing new ones. Even with that IPO-a-day pace, most 2021 IPOs were just riding the demand wave. Toast and Robinhood still traded flat or down from their IPO prices despite being “iconic properties.” 2025 is different. This is innovation speed, not just demand speed. The Great Separation is Real (And The Data is Brutal) The latest Coatue research just dropped some nuclear truth bombs about what’s happening in tech. The Great Separation isn’t coming — it’s here. And the numbers are absolutely wild. Growth companies are trading at 13x revenue multiples. Slow growers? 4-5x. But here’s the kicker: Only 5% of public software companies are growing >25% today, down from 26% in 2021. We’ve gone from 17% median revenue growth in 2021 to just 9% today. Translation: If you’re growing fast, you’re literally in the top 5% of all software companies. Public markets are treating you like the rare unicorn you are. And if you haven’t shipped meaningful AI into production by June 30, 2025? You don’t have a strategy problem. You have a talent problem. The AI Explosion Shows What FAF Really Looks Like Want to see FAF speed in action? The AI coding market exploded from $300M ARR to $1.6B ARR in just 12 months. That’s $1.3B in net-new revenue generated in a single year. But that’s just coding. Look at the broader AI hypergrowth companies redefining what’s possible: The Speed Leaders: Cursor: Hit $100M ARR in 12 months, now at $200M ARR — 10x faster than traditional SaaS Loveable: $1M ARR in 8 days, $10M in 2 months, $60M ARR in 6 months — Europe’s fastest-growing AI startup ever Anthropic: $0→$1B ARR in 21 months, then $1B→$2B→$3B in 7 months total Sierra: $50M ARR and $4.5B valuation with 300%+ growth rate Harvey AI: Surpassed $50M ARR, targeting $100M in 8 months at $3B valuation Mercor: $75M ARR in 2 years with 51% month-over-month growth Artisan: $6m in ARR from AI SDRs in less than 6 months Chatting to Fyxer CEO tonight. “Yeah, we are at $11.5M ARR.” Harry: in how long? These aren’t just riding demand waves like 2021 Zoom or Shopify. These companies are creating entirely new product categories and capabilities that didn’t exist 18 months ago. 100% YoY growth? Super impressive, and this will still compound at an epic rate if it’s durable. But AI B2B companies are hitting 500%+ growth rates and creating billion-dollar categories in months, not years. The 18-Month “Let’s Learn” Window Has Closed ChatGPT launched November 2022. GPT-4 and foundation models exploded through 2023. By early 2024, every serious B2B company had access to the same AI capabilities for pennies on the dollar. That gave everyone 18 months to figure it out. The companies that used those 18 months wisely aren’t just winning — they’re lapping the competition. This is the difference between 2021 and 2025: 2021: Same products, massive demand wave, everyone wins temporarily 2025: New capabilities, fundamental product reimagining, winners take everything In 2021, you could ride the wave with incremental improvements. Add a mobile app, improve your UI, increase seat count. The rising tide lifted all boats. In 2025, if you’re not rebuilding your product around AI capabilities, you’re not just behind — you’re building yesterday’s solution to tomorrow’s problems. The New Rules Are Brutal (But Crystal Clear) Coatue’s 2025 decision matrix is beautifully simple: 🚀 Growing >25% + Profitable? → File your S-1 immediately 🥶 Growing <25% + Profitable? → Play offense aggressively 🏰 Growing >25% + Unprofitable? → Build fortress balance sheet 💀 Growing <25% + Unprofitable? → Reinvent your business No middle ground. No participation trophies. You’re either in the top tier or you’re fighting for scraps. What FAF Actually Looks Like in the Wild Capital Concentration Goes Extreme: OpenAI’s $40B raise in 2025 is larger than the top fundraises from 2018, 2019, 2020, 2021, 2022, 2023, and 2024 combined. Top 10 companies now get 52% of all venture funding (up from 16% in 2015). IPOs Are Back — And Their Performance is Crushing: Recent IPOs are crushing it. 2025 median return: 24% vs -52% for ZIRP era IPOs. Circle (+331%), CoreWeave (+268%), Reddit (+248%). The window is wide open for quality companies. Vertical AI Domination: OpenEvidence serves 1/3 of all US physicians and gets >12x the monthly visits of competitors. Harvey AI serves 34 of the AmLaw 100 firms with 240% YoY growth. Specialized AI tools aren’t just winning — they’re obliterating horizontal solutions. Real Productivity Gains: 30% of Microsoft’s code is now generated by AI while their headcount actually peaked and is declining. Revenue keeps growing. AppLovin doubled revenue per employee from $3.6M to $7.6M while keeping headcount flat. Marc Benioff: AI now handles 30-50% of work at Salesforce. Not future projections — current reality. 83% customer query automation, 2 million lines of AI-generated code, and a hiring freeze for engineers because productivity jumped 30%+. But here’s what “truly great AI” actually looks like in production: Linear’s AI issue triaging: Doesn’t just categorize tickets — predicts resolution time, suggests optimal assignees, saves engineering teams 2-3 hours per sprint. Users report feeling “helpless” in other project management tools. Figma’s AI design suggestions: Don’t feel like a separate feature — they feel like the product got smarter. 60% increase in design handoff conversion rates. The era of just adding a copilot and calling your product “AI” is over. These aren’t AI features bolted onto existing products. They’re AI-native experiences that reimagine what the product can do. The TAM Story: AI is Coming For More Than Just Software Budgets Here’s the mind-bender: The addressable market for AI isn’t just bigger than SaaS — it’s potentially $1+ trillion. We’re not talking about productivity tools. We’re talking about replacing entire job functions: Knowledge Work: 71M workers @ $85K average = $6+ trillion market Medical: $450B+ addressable The TAM isn’t “software” anymore. It’s “human labor.” Should You Be Worried About Your Job? For Many in Tech — Honestly, Yes. It’s Time to Level Up. Let’s stop dancing around this. Jobs in tech aren’t going away, but many are radically changing, or will soon. AI SDRs are already outperforming humans (when well trained). Even little old SaaStr itself is seeing AI SDRs book 30-40% more meetings than human reps. They work 24/7, never have bad days, and get better with every interaction. Traditional SDR roles? Vanishing fast. Sales tools are getting scary good. Gong’s AI can predict deal outcomes with 85%+ accuracy. When Salesforce’s CEO says AI handles 30-50% of their work, he’s not talking about simple automation — he’s talking about complex sales processes. Customer support teams are getting decimated. Salesforce cut support escalations by 50% in just a few weeks. Companies using AI support are seeing 40%+ headcount reductions while improving customer satisfaction. When AI can resolve 83% of customer queries without human intervention, what happens to support reps? Every CEO is looking around and trying to figure out who on the team are the right ones for this Age of AI. Is that you? Here’s what’s really happening: Companies aren’t necessarily cutting half their people, but they’re doing a lot more with AI. A lot more. The same team that handled 1,000 support tickets is now handling 3,000. The same sales team that closed $10M is now closing $25M. The same engineering team that shipped 2 features per quarter is now shipping 6. The shift is from human replacement to human amplification. The best companies aren’t just cutting headcount — they’re reallocating human talent to higher-value work while AI handles the routine stuff. Salesforce isn’t hiring engineers but is hiring 1,000-2,000 more salespeople to sell AI products. The key is being on the side that’s leveraging AI, not being replaced by it. The jobs that survive will be the ones that require creativity, strategy, complex relationship building, and AI orchestration. If your job is primarily data entry, basic analysis, routine customer service, or repetitive sales tasks — yeah, you should be worried. The jobs that thrive will be the ones building AI systems, managing AI workflows, interpreting AI outputs, and doing the uniquely human work that AI can’t replicate. The Adjustment Crisis is Real Here’s what I’m seeing founders struggle with: Mental Health is Breaking: The pressure to move at FAF speed 24/7 is burning people out faster than ever. Traditional planning cycles are dead, but humans still need recovery time. I’m seeing more and more CEOs just … quit. AI is exciting, but it’s tiring. Every day. CEO Resignations Are Up 24%. And At An All-Time High. VCs Making Worse Decisions Faster: FOMO is driving $50M+ rounds on 3-week diligence. When mega private companies have grown 27x in 10 years (from $51B to $1.357T), everyone’s chasing the next unicorn. Traditional Metrics Are Obsolete: Your quarterly growth targets mean nothing when AI companies are rewriting entire industries in months. Have You Actually Adjusted? If you’re still “exploring AI initiatives” or “evaluating use cases”: You’re not behind. You’re becoming irrelevant. Even if your existing customers aren’t leaving. Yet. The uncomfortable truth: We’re seeing market separation. Companies with great AI in production aren’t just growing faster — they’re fundamentally changing customer expectations. Customers who experience Notion’s AI writing don’t just prefer it to other wiki tools — they find other tools frustratingly primitive. Users who work with GitHub Copilot don’t just code faster — they find traditional IDEs limiting and outdated. If you’re a founder: Are you building AI-first or bolting AI onto legacy architecture? Because vertical AI is crushing horizontal, and specialized beats generalist 10x. If you’re growing >25% at $200m+ ARR: It’s time to IPO. The IPO window for quality companies is the best it’s been in years. If you’re growing <25%: You’re competing with 95% of the market for scraps. Time to reinvent or get acquired. If you’re profitable and growing 25%+ at $200m+ ARR: The market is literally rewarding ANY profitable growth right now. Stop waiting for perfect metrics. If your team hasn’t shipped meaningful AI into production — and seen it impact growth: You don’t have a strategy problem. You have a talent problem. Stop trying to retrain existing teams. Hire AI-native talent who think through an AI lens. The Historical Context is Staggering AI is positioned to drive tech to 75%+ of total US market cap — the largest sector concentration in history. Previous waves took tech from <10% to 45%. This wave is different. 2021 felt fast because of the demand explosion. Remote work, digital transformation, zero interest rates — everyone needed SaaS immediately. We had an IPO-a-day pace, record unicorn creation, and public markets that couldn’t get enough SaaS. But the products themselves weren’t revolutionary. They were the same tools, just with more users and higher valuations. 2025 is fast because of capability explosion. AI isn’t just changing how many people use software — it’s changing what software can do. We’re not scaling existing solutions; we’re inventing entirely new ones. Every sector becomes a tech sector. The distinction between “tech” and “non-tech” companies becomes meaningless. The Bottom Line FAF isn’t just about speed for speed’s sake. It’s about survival in the biggest platform shift in history. The companies that figure out how to operate at FAF speed while maintaining quality and culture? They’ll achieve historic returns. The ones that don’t? They’ll become footnotes. The great separation is happening now. AI-first companies with >25% growth are getting 13x revenue multiples. Everyone else is fighting for 4-5x. But here’s the uncomfortable question: Does everyone need to get “cracked” to win in B2B today? When you see Cursor hitting $200M ARR in 12 months, Loveable going from $0 to $75M ARR in 7 months, and Anthropic scaling from $1B to $3B in 7 months — these aren’t just impressive numbers. They represent a fundamentally different pace of execution that feels almost manic compared to traditional SaaS. The founders building these companies are operating at a level of intensity, focus, and speed that would have been considered unsustainable just a few years ago. But in the AI era, this “cracked” pace isn’t optional — it’s table stakes for the companies that want to lead categories. If nothing else, if you aren’t sure you’re moving fast enough today — you probably aren’t. Especially realize this if you’re working outside a tech center where you don’t literally see the change every day. When you’re in San Francisco or New York, the AI transformation is visceral. You see the Anthropic billboards, the OpenAI job postings, the endless AI meet-ups. You feel the energy, the urgency, the pace. But if you’re building a SaaS company in Austin, Denver, or Miami — it’s easy to think you have more time. That this AI wave will roll out slowly like previous tech cycles. That the 2021 playbooks still work. They don’t. The wave isn’t coming to your market later. It’s already here, moving at FAF speed, and your local competitors who “get it” are already pulling ahead. So I’ll ask one more time: Have you adjusted? Because ready or not, FAF is the new normal. And this wave is 10x bigger than anything we’ve seen before. 10 Brutal Truths From Coatue About AI and Who Gets Left Behind: The Great Separation

Sierra Frequently Asked Questions (FAQ)

When was Sierra founded?

Sierra was founded in 2023.

Where is Sierra's headquarters?

Sierra's headquarters is located at 150 Sutter Street, San Francisco.

What is Sierra's latest funding round?

Sierra's latest funding round is Series C.

How much did Sierra raise?

Sierra raised a total of $285M.

Who are the investors of Sierra?

Investors of Sierra include ICONIQ Capital, Greenoaks, Thrive Capital, Sequoia Capital and Benchmark.

Who are Sierra's competitors?

Competitors of Sierra include Klart AI, Ema, Moveworks, Cognigy, AlloBrain and 7 more.

Loading...

Compare Sierra to Competitors

Leena AI provides enterprise artificial intelligence (AI) solutions within the technology sector. The company offers automation for information technology (IT), human resources (HR), and finance processes, leveraging Agentic AI to reduce service tickets and facilitate self-service for employees. Leena AI's products aim to integrate with various enterprise applications. It was founded in 2015 and is based in San Francisco, California.

![[24]7.ai Logo](https://s3-us-west-2.amazonaws.com/cbi-image-service-prd/original/b029c933-1e02-401f-bb6b-777a5d7ed5b5.png)

[24]7.ai provides artificial intelligence (AI)-based customer service products and solutions. It offers solutions such as conversation automation solutions, workforce engagement solutions, campaign management solutions, and more. [24]7.ai was formerly known as 24/7 Customer. It was founded in 2000 and is based in Campbell, California.

Kore.ai focuses on providing artificial intelligence (AI) solutions across various sectors, including AI for work, process, and service. It offers products that include an AI agent platform, tools for building AI applications, and AI agents designed to automate workflows in organizations. Kore.ai serves sectors that involve AI integrations, such as customer experience, employee experience, and process automation. It was founded in 2013 and is based in Orlando, Florida.

Cognigy specializes in conversational artificial intelligence platforms and customer service automation within the technology sector. It offers virtual agents that facilitate customer service interactions through voice and digital chat and support contact center operations. Its solutions are utilized across various industries, including airlines, automotive, financial services, healthcare, insurance, retail, telecommunications, and utilities. The company was founded in 2016 and is based in Dusseldorf, Germany.

Inbenta specializes in conversational AI and automation within the customer service sector. The company offers a suite of products, including AI-enabled chatbots, search tools, and knowledge management systems designed to enhance customer experience and streamline service operations. Inbenta's conversational AI platform is utilized across various industries to automate customer interactions, provide self-service options, and improve overall customer satisfaction. It was founded in 2005 and is based in Allen, Texas.

Intercom provides a customer service platform that utilizes artificial intelligence to assist with customer support. It has developed a support agent named Fin, which responds to customer inquiries, along with tools such as an inbox, ticketing system, and reporting features. Its platform is applicable in sectors like financial services, software and technology, and healthcare. It was founded in 2011 and is based in San Francisco, California.

Loading...