Shift Technology

Founded Year

2014Stage

Series D - II | AliveTotal Raised

$319.72MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+43 points in the past 30 days

About Shift Technology

Shift Technology specializes in AI decision-making solutions for the insurance industry. The company offers a suite of products that automate and optimize decisions in areas such as fraud detection, claims processing, and underwriting risk assessment. Its AI-driven tools are designed to enhance operational efficiency and improve the policyholder experience. It was founded in 2014 and is based in Paris, France.

Loading...

Shift Technology's Product Videos

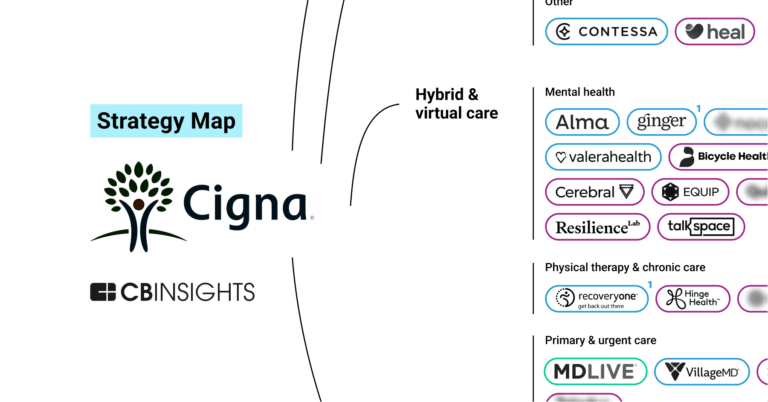

ESPs containing Shift Technology

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The insurance fraud detection market provides automated solutions for identifying and preventing fraudulent activity across the insurance lifecycle. Vendors leverage artificial intelligence, machine learning, and data analytics to help insurers improve operational efficiency, reduce claims processing costs, and enhance customer experiences. These platforms integrate internal and external data sour…

Shift Technology named as Leader among 15 other companies, including Verisk, FICO, and Genpact.

Shift Technology's Products & Differentiators

Shift Underwriting Risk

Mitigate premium leakage and policy fraud to enhance profitability

Loading...

Research containing Shift Technology

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Shift Technology in 5 CB Insights research briefs, most recently on Dec 18, 2023.

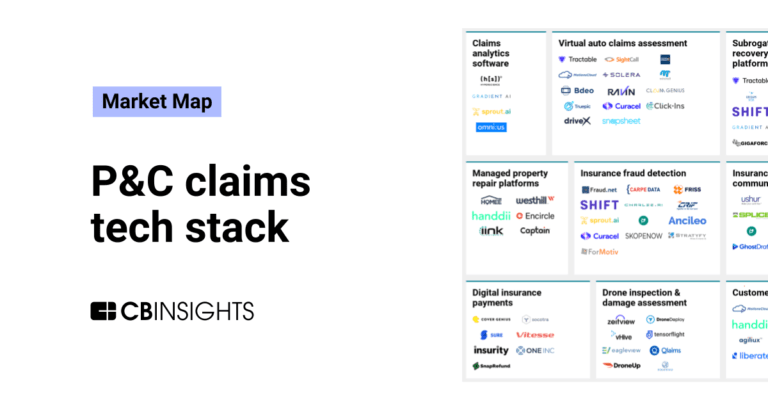

Dec 18, 2023

The P&C claims tech stack market map

Oct 4, 2022 report

The Fintech 250: The most promising fintech companies of 2022Expert Collections containing Shift Technology

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Shift Technology is included in 8 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,276 items

AI 100 (All Winners 2018-2025)

99 items

Winners of CB Insights' annual AI 100, a list of the 100 most promising AI startups in the world.

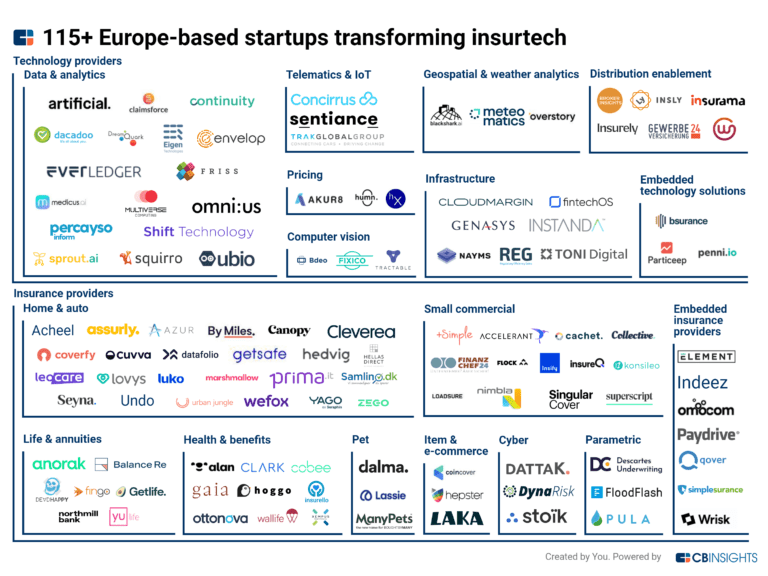

Insurtech

4,553 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Artificial Intelligence

12,322 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Fintech

13,978 items

Excludes US-based companies

Fintech 100

499 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest Shift Technology News

Jun 2, 2025

Solution Deployed to Fight Auto & Property Insurance Fraud Boston, MA And Paris, France /PRNewswire/ - Shift Technology , a provider of AI-powered decision optimization solutions for the global insurance industry, today announced that Shelter Insurance has gone live on Shift Claims Fraud to help mitigate exposure to auto & property insurance fraud risk. The insurer is also a member of the recently announced Insurance Data Network (IDN) . As a mutual insurer, Shelter is owned by its policyholders as opposed to shareholders. As such, the company has long been known for its commitment to customer service and its continuous innovation in the service of delivering exceptional policyholder experiences. Viewing claims fraud as an activity that adversely affects legitimate customers and the insurer's combined ratio, Shelter turned to Shift to help them apply artificial intelligence (AI) to the challenge of finding suspicious claims and determining how best to investigate their veracity. "What is insidious about insurance fraud is that it impacts nearly every aspect of the insurance business, from the policyholder experience to profitability to the premiums our insureds pay," Mark Jones, Director of Litigation and SIU, Shelter Insurance. "Through our work with Shift we are able to identify a greater number of suspicious claims, separate them from legitimate claims, thoroughly investigate, and conclude it as quickly, accurately, and fairly as possible. This is incredibly beneficial to the business and our customers." According to industry estimates, P&C claims fraud costs U.S. insurers almost $90B per year. Shift Claims Fraud Detection uses the power of AI to help insurers find hidden fraud during the claims process and then make the best determination about how to investigate. Shift's AI-based approach to fraud detection reduces false positives, identifies cases of both individual fraud and more sophisticated network fraud schemes, and delivers clear contextual guidance and supporting documentation to speed investigations. These factors taken together ensure exceptional operational efficiency and efficacy in claims fraud mitigation. "As auto insurance fraud becomes more sophisticated, insurers must look for solutions that give them advantages over bad actors." explained Barrett Callaghan, Head of Global Markets and Customer Success, Shift Technology. "Shelter truly understands the value technology can bring to their fraud fighting initiatives and we are proud to be supporting their efforts." About Shelter Insurance Shelter Insurance® and its subsidiaries provide property, casualty, and life insurance products in 20 states— Alabama, Arkansas, Arizona, Colorado, Georgia, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Mississippi, Missouri, Nebraska, Ohio, Oklahoma, Oregon, South Carolina, Tennessee, and Virginia. It also provides reinsurance products around the world. J.D. Power has ranked Shelter #1 in Customer Satisfaction in the Central Region six of the last seven years. In addition, Forbes named Shelter the World's Best Auto Insurance Company on their list of World's Best Insurance Companies 2024. Shelter was also named #10 in the world for homeowners insurance. About Shift Technology Shift Technology is the trusted AI partner to the world's leading insurers. The company's innovative and explainable AI solutions help insurers reduce fraud and risk, streamline claims processes, and enhance customer experiences. By combining deep insurance expertise with cutting-edge technology, Shift delivers significant business impact and ROI. Learn more at www.shift-technology.com . Source: Shift Technology Copyright 2025 PR Newswire. All Rights Reserved This website uses cookies to ensure you get the best experience on our website. Learn more Got it!

Shift Technology Frequently Asked Questions (FAQ)

When was Shift Technology founded?

Shift Technology was founded in 2014.

Where is Shift Technology's headquarters?

Shift Technology's headquarters is located at 2-14 rue Gerty Archimede, Paris.

What is Shift Technology's latest funding round?

Shift Technology's latest funding round is Series D - II.

How much did Shift Technology raise?

Shift Technology raised a total of $319.72M.

Who are the investors of Shift Technology?

Investors of Shift Technology include Guidewire, IRIS, Accel, General Catalyst, Bessemer Venture Partners and 10 more.

Who are Shift Technology's competitors?

Competitors of Shift Technology include Quantexa, Qantev, omni:us, Gradient AI, Sprout.ai and 7 more.

What products does Shift Technology offer?

Shift Technology's products include Shift Underwriting Risk and 2 more.

Who are Shift Technology's customers?

Customers of Shift Technology include Amica, Elephant, Central Insurance, Markerstudy and Direct Assurance.

Loading...

Compare Shift Technology to Competitors

FRISS focuses on risk assessment automation for property and casualty (P&C) insurance carriers. The company offers a platform that provides real-time analytics to understand and evaluate the inherent risks in customer interactions, aiming to enhance trust and efficiency in insurance processes. FRISS's solutions enable insurers to automate underwriting, accelerate claims processing, and conduct structured investigations into suspicious activities. It was founded in 2006 and is based in Mason, Ohio.

Carpe Data provides predictive data analytics and artificial intelligence solutions for the insurance industry. The company offers services for fraud detection, claims processing, and small commercial underwriting using data science techniques and AI. Carpe Data serves the insurance sector with products aimed at improving the efficiency and accuracy of claims and underwriting operations. It was founded in 2016 and is based in Santa Barbara, California.

Qantev specializes in AI-driven claims management for the health and life insurance sectors. Its main offerings include an automated claims platform that streamlines processing, detects fraud, waste, and abuse, and optimizes healthcare provider networks. It was founded in 2018 and is based in Paris, France.

Charlee.ai specializes in artificial intelligence and predictive analytics within the insurance sector. The company offers solutions that analyze claims and predict litigation and severity, utilizing natural language processing to enhance claims workflows and manage reserves effectively. Charlee.ai's predictive analytics solutions are tailored to the insurance industry, including personal, commercial, and workers' compensation sectors. Charlee.ai was formerly known as Infinilytics. It was founded in 2016 and is based in Pleasanton, California.

Tractable focuses on artificial intelligence in the automotive and property insurance sectors. The company provides solutions for damage appraisal, assisting in the assessment and protection of vehicles and homes. Tractable's technology aims to improve claims processes, from reporting to settlement, and to support the appraisal of automotive parts. It was founded in 2014 and is based in London, United Kingdom.

CLARA Analytics operates in the insurance sector, focusing on claims management. The company provides machine learning products that assist in claims processing by analyzing medical notes, bills, and other claim-related documents. It was founded in 2017 and is based in Sunnyvale, California.

Loading...