Investments

39Portfolio Exits

1Funds

1Partners & Customers

1About Shield Capital

Shield Capital is a venture capital firm investing in early-stage companies within the technology sector, including artificial intelligence, autonomy, cybersecurity, and space. The company provides financial support to entrepreneurs developing technologies for commercial use and national security. Shield Capital invests in companies that align with their focus on commercial technology and national security needs. It was founded in 2021 and is based in San Francisco, California.

Expert Collections containing Shield Capital

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find Shield Capital in 1 Expert Collection, including Defense Tech.

Defense Tech

31 items

Includes CVCs, VCs, and

Research containing Shield Capital

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Shield Capital in 1 CB Insights research brief, most recently on Jul 10, 2025.

Jul 10, 2025 report

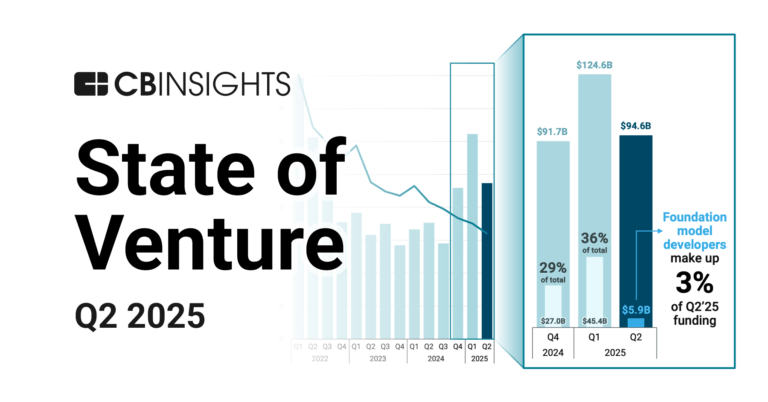

State of Venture Q2’25 ReportLatest Shield Capital News

Jun 13, 2025

Business Insider 2025-06-13T11:47:01Z Impact Link Log in There are startups that are leveraging data work and AI to simplify the process. One is Obviant, a data platform that streamlines information on Pentagon weapons and systems programs. Selling to the US military is complicated. For defense companies and investors, sorting out what the massive Department of Defense behemoth is doing and where its billions of dollars are going can feel like navigating a maze. The US military's vast portfolio of weapons, capabilities, and technologies — both the ones it already has and the ones it wants — is widespread and not easily sourced. Details about those budgets, too, can be confusing and taxing to sort through. This is "a very manual and confusing process to go through because there's no single source of truth about what the data is for the Defense Department contracting and acquisition process ," Michael Brown, the former director of the Defense Innovation Unit, explained. The information can be found scattered across an overwhelming number of documents, websites, organizations, and budgets. A Pentagon data dashboard Obviant's co-founder told BI the program is designed to give a clearer, more comprehensive, and accessible view of the defense landscape. Obviant There are start-ups trying to leverage artificial intelligence and data science to help companies through the maze. One of them is a company called Obviant. Business Insider recently chatted with its leadership. The company is built around a program of the same name that is designed to help make sense of chaotic Department of Defense data. It intends to be a one-stop information shop for defense firms or investors , Brendan Karp, one of the company's founders, said. He said the program can also be useful for government officials, even those involved in these projects, to see the Pentagon's sprawling collection of programs and budgets more clearly. Through extensive data engineering, the team compiled information from thousands of sources and compiled it into one database, providing a cohesive, user-friendly picture of the sweeping defense acquisition landscape, Karp said. The platform shows program performance, breaks down funding and contract data, and highlights which companies are working on what. Obviant's users can search for more general capabilities — electronic warfare , for example, or uncrewed underwater vehicles — to see which branches are working on those systems and what solicitations are out there. And all the data is sourced, be it a document or a congressional hearing. For the latter, it will show users exactly where a program or project was discussed. "Instead of having to figure out how this information is pieced together in isolation," Karp said, "I can have a quicker picture." Obviant uses some artificial intelligence and machine learning processes, but it's largely built on about a year's worth of heads-down data scripting. Karp said the team figured out what trusted sources mattered, how to collect data from them, and how to piece them together for better understanding. AI could be used to maintain the program and further refine its information and models, as well as advance functions like an AI-powered search engine. The user can ask a question — say, "where is the funding for counter-drone systems going?" or "what are the latest updates on Golden Dome ?" — and get detailed answers, project sources, news coverage, comments from officials, and more. Who are programs like this for? Obviant's users include defense companies, investors, researchers, and government offices. Obviant The most obvious audience for software solutions like Obviant would be companies looking into pursuing DoD contracts. They can find potential collaborators, see what companies are already working on, and determine what their business plans should be. Related stories Business Insider tells the innovative stories you want to know Brown, who's now a partner at Shield Capital, one of Obviant's investors, said the platform is a "game-changer for anyone that's in that ecosystem." Forecasting and informed insight into the inner workings of the Defense Department and surrounding industries are useful for firms and investors, but also operations overseeing programs. "I think it's also a very useful tool for the government to see how well the budget lines up with strategy," Brown said of Obviant. There's also potential value for researchers and think tanks. Obviant is designed to be "a single source of truth," Karp said, explaining that government workers definitely benefit from having a clearer understanding of what's actually in their portfolios — and what other offices across the Pentagon could be working on something similar. Those conversations have been heavily focused on what weapons the DoD believes will be important for deterring or fighting future conflicts and the need expressed by officials to get those capabilities in the hands of the warfighter quickly . Recommended video

Shield Capital Investments

39 Investments

Shield Capital has made 39 investments. Their latest investment was in Obviant as part of their Seed VC on June 24, 2025.

Shield Capital Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

6/24/2025 | Seed VC | Obviant | $7.1M | Yes | 4 | |

4/28/2025 | Series B - II | mPower Technology | $21.12M | Yes | 4 | |

4/16/2025 | Seed VC | Pillar Security | $9M | Yes | Elias Manousos, Golden Ventures, Ground Up Ventures, and Undisclosed Angel Investors | 4 |

4/8/2025 | Series B | |||||

3/18/2025 | Series A |

Date | 6/24/2025 | 4/28/2025 | 4/16/2025 | 4/8/2025 | 3/18/2025 |

|---|---|---|---|---|---|

Round | Seed VC | Series B - II | Seed VC | Series B | Series A |

Company | Obviant | mPower Technology | Pillar Security | ||

Amount | $7.1M | $21.12M | $9M | ||

New? | Yes | Yes | Yes | ||

Co-Investors | Elias Manousos, Golden Ventures, Ground Up Ventures, and Undisclosed Angel Investors | ||||

Sources | 4 | 4 | 4 |

Shield Capital Portfolio Exits

1 Portfolio Exit

Shield Capital has 1 portfolio exit. Their latest portfolio exit was Xeol on February 04, 2025.

Shield Capital Fund History

1 Fund History

Shield Capital has 1 fund, including Shield Capital Fund I.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

10/16/2023 | Shield Capital Fund I | $186M | 2 |

Closing Date | 10/16/2023 |

|---|---|

Fund | Shield Capital Fund I |

Fund Type | |

Status | |

Amount | $186M |

Sources | 2 |

Shield Capital Partners & Customers

1 Partners and customers

Shield Capital has 1 strategic partners and customers. Shield Capital recently partnered with L3Harris on March 3, 2022.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

3/29/2022 | Partner | United States | In partnership with Shield Capital , L3Harris Technologies will quickly identify , fund and then guide technology development and solutions that will solve urgent national security needs . | 3 |

Date | 3/29/2022 |

|---|---|

Type | Partner |

Business Partner | |

Country | United States |

News Snippet | In partnership with Shield Capital , L3Harris Technologies will quickly identify , fund and then guide technology development and solutions that will solve urgent national security needs . |

Sources | 3 |

Shield Capital Team

4 Team Members

Shield Capital has 4 team members, including current Chief Financial Officer, Joseph Pignato.

Name | Work History | Title | Status |

|---|---|---|---|

Joseph Pignato | Chief Financial Officer | Current | |

Name | Joseph Pignato | |||

|---|---|---|---|---|

Work History | ||||

Title | Chief Financial Officer | |||

Status | Current |

Loading...