ServiceNow

Founded Year

2003Stage

PIPE | IPOTotal Raised

$94.02MMarket Cap

209.17BStock Price

1044.69Revenue

$0000About ServiceNow

ServiceNow provides a cloud-based platform and solutions aimed at digitizing and unifying organizations across various sectors. Its offerings assist businesses in managing workflows and improving connections between employees and customers. Its solutions are applicable to industries looking to improve operational efficiency and service delivery. ServiceNow was formerly known as Glidesoft. It was founded in 2003 and is based in Santa Clara, California.

Loading...

ESPs containing ServiceNow

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The customer relationship management (CRM) market focuses on managing, nurturing, and optimizing customer relationships. CRM solutions allow businesses to build stronger relationships with their customers, better understand their needs, and create more effective marketing and sales strategies. By utilizing CRM, businesses can increase customer satisfaction, reduce customer churn, and boost custome…

ServiceNow named as Leader among 15 other companies, including Microsoft, Salesforce, and HubSpot.

Loading...

Research containing ServiceNow

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned ServiceNow in 4 CB Insights research briefs, most recently on Mar 26, 2025.

Mar 26, 2025

Nvidia’s next big bet? Physical AI

Mar 21, 2025 report

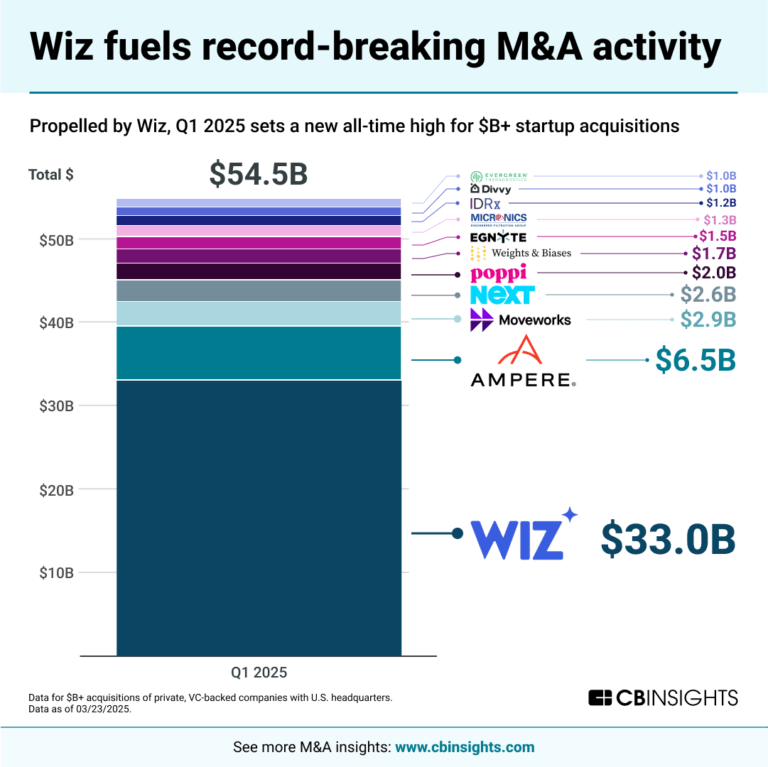

7 tech M&A predictions for 2025Expert Collections containing ServiceNow

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

ServiceNow is included in 7 Expert Collections, including Construction Tech.

Construction Tech

1,490 items

Companies in the construction tech space, including additive manufacturing, construction management software, reality capture, autonomous heavy equipment, prefabricated buildings, and more

Regtech

1,811 items

Technology that addresses regulatory challenges and facilitates the delivery of compliance requirements. Regulatory technology helps companies and regulators address challenges ranging from compliance (e.g. AML/KYC) automation and improved risk management.

Conference Exhibitors

5,302 items

Advanced Manufacturing

6,695 items

Companies in the advanced manufacturing tech space, including companies focusing on technologies across R&D, mass production, or sustainability

Job Site Tech

942 items

Companies in the job site tech space, including technologies to improve industries such as construction, mining, process engineering, forestry, and fieldwork

Renewable Energy

4,803 items

ServiceNow Patents

ServiceNow has filed 1320 patents.

The 3 most popular patent topics include:

- data management

- information technology management

- database management systems

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

2/25/2022 | 4/8/2025 | Information technology management, Production and manufacturing, Systems engineering, Process management, Quality | Grant |

Application Date | 2/25/2022 |

|---|---|

Grant Date | 4/8/2025 |

Title | |

Related Topics | Information technology management, Production and manufacturing, Systems engineering, Process management, Quality |

Status | Grant |

Latest ServiceNow News

Jul 7, 2025

Top Manufacturing Stocks To Consider – July 5th Posted by MarketBeat News on Jul 7th, 2025 Oracle, Taiwan Semiconductor Manufacturing, BigBear.ai, Salesforce, ServiceNow, Exxon Mobil, and Synopsys are the seven Manufacturing stocks to watch today, according to MarketBeat’s stock screener tool. Manufacturing stocks are the inventories held by a production business at various stages of the manufacturing process—raw materials, work-in-progress (partially completed goods) and finished goods ready for sale. They are recorded as current assets on the balance sheet and represent the resources tied up in production. Effective management of manufacturing stocks helps ensure a smooth production flow while minimizing storage and financing costs. These companies had the highest dollar trading volume of any Manufacturing stocks within the last several days. Get alerts: Oracle (ORCL) Oracle Corporation offers products and services that address enterprise information technology environments worldwide. Its Oracle cloud software as a service offering include various cloud software applications, including Oracle Fusion cloud enterprise resource planning (ERP), Oracle Fusion cloud enterprise performance management, Oracle Fusion cloud supply chain and manufacturing management, Oracle Fusion cloud human capital management, Oracle Cerner healthcare, Oracle Advertising, and NetSuite applications suite, as well as Oracle Fusion Sales, Service, and Marketing. Want More Great Investing Ideas? Taiwan Semiconductor Manufacturing (TSM) Taiwan Semiconductor Manufacturing Company Limited, together with its subsidiaries, manufactures, packages, tests, and sells integrated circuits and other semiconductor devices in Taiwan, China, Europe, the Middle East, Africa, Japan, the United States, and internationally. It provides a range of wafer fabrication processes, including processes to manufacture complementary metal- oxide-semiconductor (CMOS) logic, mixed-signal, radio frequency, embedded memory, bipolar CMOS mixed-signal, and others. TSM traded up $1.89 on Friday, hitting $235.49. 7,779,584 shares of the company’s stock traded hands, compared to its average volume of 15,449,890. The company’s 50 day simple moving average is $200.39 and its 200-day simple moving average is $191.46. The firm has a market cap of $1.22 trillion, a price-to-earnings ratio of 30.27, a P/E/G ratio of 1.22 and a beta of 1.29. Taiwan Semiconductor Manufacturing has a one year low of $133.57 and a one year high of $237.58. The company has a current ratio of 2.39, a quick ratio of 2.18 and a debt-to-equity ratio of 0.22. BigBear.ai (BBAI) BigBear.ai Holdings, Inc. provides artificial intelligence-powered decision intelligence solutions. It offers national security, supply chain management, and digital identity and biometrics solutions. The company also provides data ingestion, data enrichment, data processing, artificial intelligence, machine learning, predictive analytics, and predictive visualization solutions and services. Shares of BigBear.ai stock traded up $0.17 during midday trading on Friday, reaching $7.73. The company had a trading volume of 201,359,253 shares, compared to its average volume of 49,656,135. The company has a current ratio of 1.66, a quick ratio of 1.66 and a debt-to-equity ratio of 0.55. The company has a market capitalization of $2.25 billion, a price-to-earnings ratio of -9.90 and a beta of 3.46. The stock has a fifty day simple moving average of $4.22 and a 200 day simple moving average of $4.23. BigBear.ai has a 1-year low of $1.17 and a 1-year high of $10.36. Salesforce (CRM) Salesforce, Inc. provides Customer Relationship Management (CRM) technology that brings companies and customers together worldwide. The company's service includes sales to store data, monitor leads and progress, forecast opportunities, gain insights through analytics and artificial intelligence, and deliver quotes, contracts, and invoices; and service that enables companies to deliver trusted and highly personalized customer support at scale. CRM stock traded up $2.37 during midday trading on Friday, hitting $271.58. The company’s stock had a trading volume of 5,031,804 shares, compared to its average volume of 6,543,873. The company has a debt-to-equity ratio of 0.14, a current ratio of 1.07 and a quick ratio of 1.07. Salesforce has a twelve month low of $230.00 and a twelve month high of $369.00. The company’s fifty day moving average price is $272.28 and its 200 day moving average price is $291.78. The stock has a market capitalization of $259.63 billion, a P/E ratio of 42.50, a PEG ratio of 2.47 and a beta of 1.36. ServiceNow (NOW) ServiceNow, Inc. provides end to-end intelligent workflow automation platform solutions for digital businesses in the North America, Europe, the Middle East and Africa, Asia Pacific, and internationally. The company operates the Now platform for end-to-end digital transformation, artificial intelligence, machine learning, robotic process automation, process mining, performance analytics, and collaboration and development tools. NOW traded up $36.27 on Friday, reaching $1,046.03. The company had a trading volume of 1,205,886 shares, compared to its average volume of 1,486,285. The company has a debt-to-equity ratio of 0.15, a quick ratio of 1.12 and a current ratio of 1.12. The stock has a market cap of $216.51 billion, a P/E ratio of 142.12, a P/E/G ratio of 4.80 and a beta of 0.94. ServiceNow has a fifty-two week low of $678.66 and a fifty-two week high of $1,198.09. The company’s fifty day moving average is $1,003.94 and its 200 day moving average is $963.64. Exxon Mobil (XOM) Exxon Mobil Corporation engages in the exploration and production of crude oil and natural gas in the United States and internationally. It operates through Upstream, Energy Products, Chemical Products, and Specialty Products segments. The Upstream segment explores for and produces crude oil and natural gas. NYSE XOM traded up $1.10 during trading on Friday, reaching $112.15. The company’s stock had a trading volume of 11,223,580 shares, compared to its average volume of 15,759,096. The company has a current ratio of 1.24, a quick ratio of 0.90 and a debt-to-equity ratio of 0.12. The firm has a market capitalization of $483.33 billion, a price-to-earnings ratio of 14.87, a price-to-earnings-growth ratio of 2.16 and a beta of 0.50. Exxon Mobil has a 12 month low of $97.80 and a 12 month high of $126.34. The firm has a 50 day moving average price of $107.32 and a 200 day moving average price of $108.51. Synopsys (SNPS) Synopsys, Inc. provides electronic design automation software products used to design and test integrated circuits. It operates in three segments: Design Automation, Design IP, and Software Integrity. The company offers Digital and Custom IC Design solution that provides digital design implementation solutions; Verification solution that offers virtual prototyping, static and formal verification, simulation, emulation, field programmable gate array (FPGA)-based prototyping, and debug solutions; and FPGA design products that are programmed to perform specific functions. NASDAQ SNPS traded up $23.65 during trading on Friday, reaching $546.76. The company’s stock had a trading volume of 2,020,024 shares, compared to its average volume of 1,177,053. The company has a current ratio of 7.02, a quick ratio of 6.85 and a debt-to-equity ratio of 1.01. The firm has a market capitalization of $84.83 billion, a price-to-earnings ratio of 39.48, a price-to-earnings-growth ratio of 3.62 and a beta of 1.12. Synopsys has a 12 month low of $365.74 and a 12 month high of $624.80. The firm has a 50 day moving average price of $489.89 and a 200 day moving average price of $478.16.

ServiceNow Frequently Asked Questions (FAQ)

When was ServiceNow founded?

ServiceNow was founded in 2003.

Where is ServiceNow's headquarters?

ServiceNow's headquarters is located at 2225 Lawson Lane, Santa Clara.

What is ServiceNow's latest funding round?

ServiceNow's latest funding round is PIPE.

How much did ServiceNow raise?

ServiceNow raised a total of $94.02M.

Who are the investors of ServiceNow?

Investors of ServiceNow include Intel Capital, Target Partners, Investinor, Alliance Venture, Greylock Partners and 4 more.

Who are ServiceNow's competitors?

Competitors of ServiceNow include Coda, Accelo, Dock Health, Zendesk, Officio.work and 7 more.

Loading...

Compare ServiceNow to Competitors

ClickUp is a project management and productivity platform designed to facilitate team collaboration and efficiency across various industries. The company offers tools including task management, goal tracking, document sharing, and artificial intelligence (AI) powered features to manage workflows and productivity. ClickUp primarily serves sectors that require project management solutions, such as marketing, product development, engineering, and agencies. It was founded in 2016 and is based in San Diego, California.

Smartsheet develops an enterprise work management platform. The company offers a suite of services that enable project management, workflow automation, and the scaling of solutions, all within a single platform. Smartsheet primarily serves sectors that require project and portfolio management, marketing and creative management, and strategic transformation. Smartsheet was formerly known as Navigo Technologies. It was founded in 2005 and is based in Bellevue, Washington.

Teamwork specializes in project management and professional services automation within the service industry. The company's platform offers tools for managing client work, including project planning, time tracking, resource allocation, and profitability reporting. It primarily serves sectors that engage in client work, such as information technology services, agencies, consulting services, and architecture and engineering firms. The company was founded in 2007 and is based in Cork, Ireland.

Pipedrive is a sales CRM and pipeline management software company that provides a platform for tracking sales pipelines, managing leads, and automating sales processes. The company's services include CRM dashboards, sales insights, analytics, and a marketplace for integrations, catering to sales teams in different industries. It was founded in 2010 and is based in New York, New York.

Bernini Labs operates as a technology company. It focuses on and develops a vertical software as a service (SaaS) product. The company's main offering is a specialized software-as-a-service solution designed for a specific industry or business need. It is based in Atlanta, Georgia.

Bird is an artificial intelligence (AI) powered Customer Relationship Management (CRM) platform that focuses on customer engagement across channels, including email, SMS, and WhatsApp. The company offers communication tools and integrates AI-driven agents to assist marketing, sales, support, and financial operations. Bird's platform aims to facilitate customer journeys, optimize marketing campaigns, and support customer interactions and financial transactions for businesses. Bird was formerly known as MessageBird. It was founded in 2011 and is based in Amsterdam, Netherlands.

Loading...