Investments

2278Portfolio Exits

486Funds

154Partners & Customers

10Service Providers

2About Sequoia Capital

Sequoia Capital is a venture capital firm that focuses on supporting startups from inception to initial-public offering (IPO) within sectors. They provide investment funding and strategic support to help companies grow and succeed. Sequoia Capital primarily serves technology-driven sectors and businesses aiming to become market leaders. It was founded in 1972 and is based in Menlo Park, California.

Expert Collections containing Sequoia Capital

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find Sequoia Capital in 14 Expert Collections, including Direct-To-Consumer Brands (Non-Food).

Direct-To-Consumer Brands (Non-Food)

37 items

Startups selling their own branded products directly to consumers via online/mobile channels, rather than relying on department stores or big online marketplaces.

Store tech (In-store retail tech)

56 items

Startups aiming work with retailers to improve brick-and-mortar retail operations.

Synthetic Biology

382 items

Travel Technology (Travel Tech)

39 items

Tech-enabled companies offering services and products focused on tourism. This collection includes booking services, search platforms, on-demand travel and recommendation sites, among others.

Education Technology (Edtech)

58 items

Game Changers 2018

20 items

Research containing Sequoia Capital

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Sequoia Capital in 14 CB Insights research briefs, most recently on May 7, 2025.

Apr 10, 2025 report

State of Fintech Q1’25 Report

Apr 3, 2025

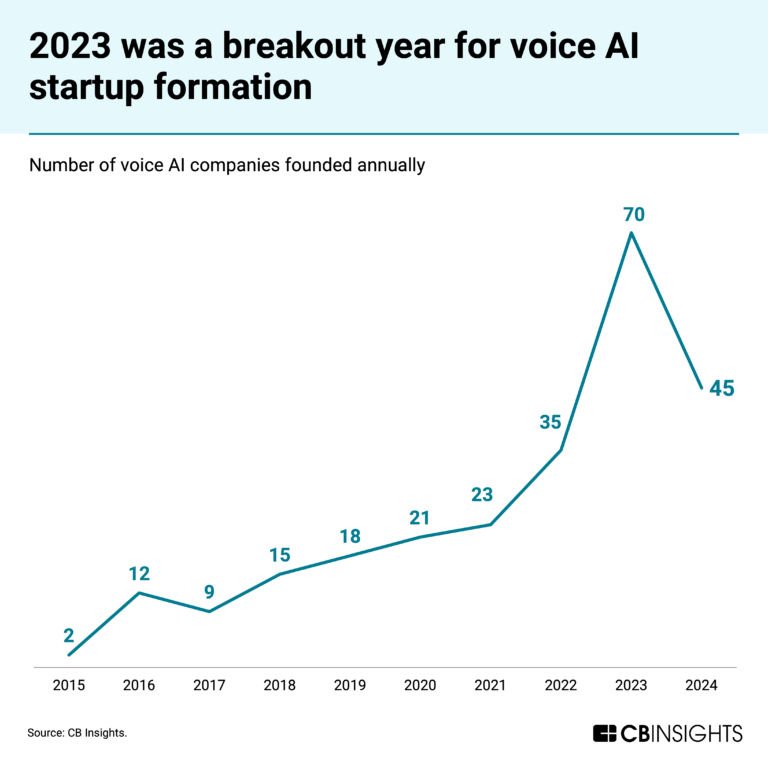

Voice AI’s sweet spot: ordering fries with that

Apr 3, 2025 report

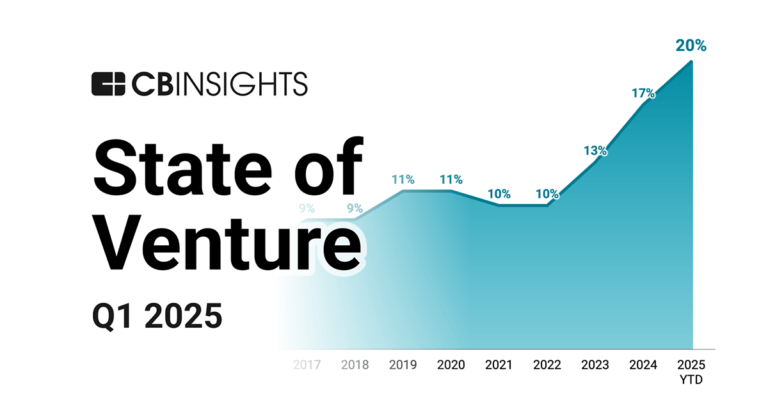

State of Venture Q1’25 Report

Oct 24, 2024 report

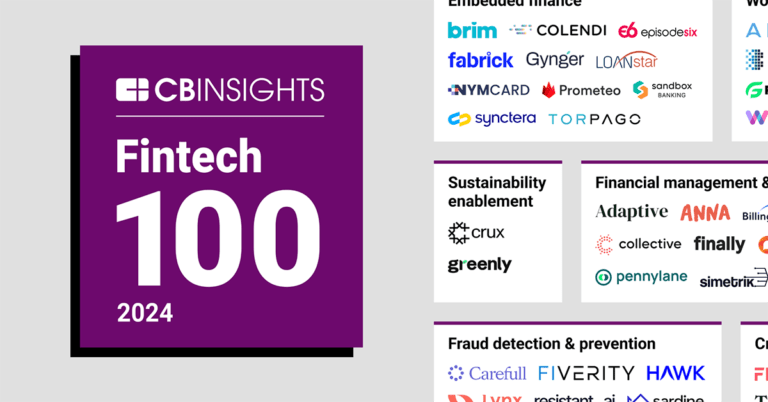

Fintech 100: The most promising fintech startups of 2024

Oct 3, 2024 report

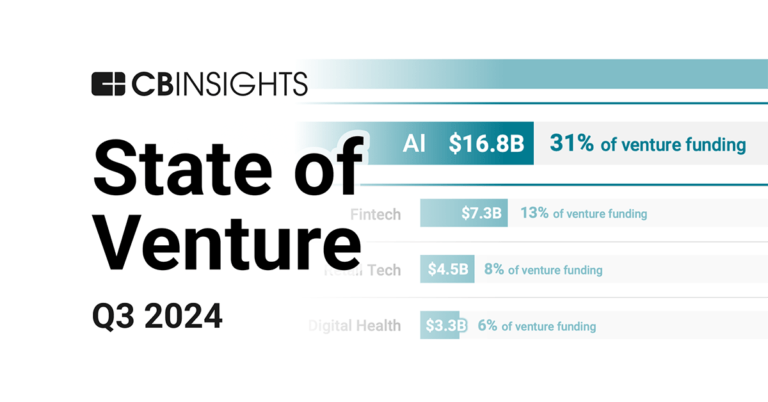

State of Venture Q3’24 ReportLatest Sequoia Capital News

Jul 10, 2025

For today's elite VCs, controversy can be good for deal flow. Kimberly White/Getty, BRENDAN SMIALOWSKI/Getty, NurPhoto/Getty, Tyler Le/BI Impact Link Log in . When Sequoia Capital partner Shaun Maguire went scorched-earth on New York City mayoral hopeful Zohran Mamdani, it marked a new, if familiar, act in tech Twitter theater: a billionaire-adjacent venture capitalist using his megaphone to slam a politician he views as dangerous — and in the process, lighting up both sides of the political spectrum. In a July 4 post, the California-based Maguire wrote that the NYC candidate "comes from a culture that lies about everything" and now seeks to advance "his Islamist agenda." It racked up more than 5 million views, became national news, and prompted two full-throated open letters: one demanding that Sequoia make a public apology, signed by self-identified employees of Microsoft, Google, and Apple, the other offering support , signed by the likes of tech iconoclasts Josh Wolfe and David Marcus. In the investing world, Maguire may have just claimed the crown as its reigning edgelord. And yet: no apology. No deleted tweet. To the contrary, Maguire has only doubled and tripled down on his "Islamist" comments with several follow-up posts and a 29-minute video defending his remarks, while dismissing the open letter as an example of "cancel culture." He also clarified that he thinks only a small portion of Muslims are Islamists. "You only embolden me," he wrote on X. Another post thanks the "haters and losers" among his 10,000 new followers. In another, he wrote, "Just so my enemies understand. I've reverse engineered your entire command structure. I'm going to play nice for now, but am ready to embarrass any of you should you escalate." Maguire and Sequoia did not respond to requests for comment on this story. Here's the thing: As both tech and politics have become more polarized, incendiary behavior may no longer carry consequences for elite venture capitalists. If anything, it may be good for business. From an outsider's perspective, Maguire's broadside may seem beyond the pale of content marketing. But it may just be the next turn of the dial in a post-pandemic tech ecosystem where elites have grown ever more brash and unapologetic. Top investors especially have learned they can be loud, bold, and polarizing, and it won't impact their ability to secure deals. In a market where the demand for capital outweighs the supply, VCs can afford to ruffle feathers. Related stories Business Insider tells the innovative stories you want to know Venture capital is largely "a fame game," says a venture capitalist at a multistage firm with several notable exits. "We all sell the same money. So brand awareness matters a lot, both in seeing and in winning deals." While that's always been true, in today's attention-based economy, where a viral post has the half-life of a mayfly, some VCs are pushing beyond bland thought leadership into outright provocation. See: Paul Graham's moral screeds about woke culture and "founder mode," David Sacks' grievance-saturated podcasting, Marc Andreessen's manifesto drops. Keith Rabois, the managing director of Khosla Ventures, regularly takes aim at what he sees as liberal overreach in tech companies, slams remote work as lazy, and frames elite universities as indoctrination mills. Garry Tan, who sits at the helm of Y Combinator, posted last year that San Francisco politicians should "die slow" in a profanity-laced rant. Tan deleted the post and apologized, saying it was a reference to a Tupac Shakur diss track. Maguire's viral tirade may have boosted his profile well beyond the technosphere — and the blowback could end up being a net positive. Beyond VCs, a broader constellation of "free-speech absolutists" have emerged across tech, chief among them Elon Musk. The X owner's no-holds-barred posting style has given other tech figures implicit permission to say what they really think. And the broader rise of the independent, chest-thumpingly pro-tech media (Pirate Wires, All-In, TBPN) has further emboldened them to launch rhetorical grenades. In that light, Maguire is a particularly potent case study in what happens when an investor decides to go full agitator. In the past year, he's posted conspiratorial claims that "antifa" was behind the attempted assassination of Donald Trump, accused Hunter Biden of stiffing him on rent for a Venice, California, property, and likened DEI policies to "structural racism." Controversy isn't just tolerated in the upper ranks of business and politics. It's increasingly rewarded. Trump posted all the way back to the White House. Public company CEOs are getting bolder, too: Palantir's Alex Karp has openly derided higher education, while Meta's Mark Zuckerberg says big companies need more "masculine energy." But venture capitalists like Maguire operate with even more insulation. They don't need votes or mass-market approval. They need access to deals, institutional capital, and portfolio wins. And so far, none of those seem particularly threatened at Sequoia — social media blow-ups be damned. In fact, recent financings suggest the opposite: Sequoia remains a top-tier draw for startups like Harvey , Decart, and Mercury, and Maguire still writes big checks. He also serves as the firm's stand-in in the Muskverse, supporting its investments in SpaceX, xAI, The Boring Company, and Neuralink. Just through SpaceX, he's generated oodles of paper wealth for Sequoia's limited partners; Bloomberg reported this week that the company is in talks to raise new funding at a $400 billion valuation. There are founders and investors who won't want to work with Maguire because of his ideology, said a principal at an early-stage fund. But many are reluctant to say so publicly, for the same reason he asked not to be named. Speaking out risks severing a critical relationship with Sequoia. For early-stage VCs, that relationship can mean the difference between a modest outcome and a breakout win, especially when Sequoia leads a later round and drives up the valuation. Maguire's viral tirade may have boosted his profile well beyond the technosphere — and the blowback could end up being a net positive. "It might help more than it hurts," said another early-stage investor close to Maguire. "Everybody's talking about him" and "his good investments." The multistage venture capitalist speculated that Maguire's comments might even bolster his standing in certain circles, particularly among Israeli founders, where he recently closed a defense tech investment. As for the entrepreneurs who just want to steer clear of controversy, they can slide into another Sequoia partner's DMs. While there may be a hard line in VC, it appears that Maguire has not crossed it. The Sequoia partner can alienate some people without jeopardizing the machine. And the machine is humming along just fine. Melia Russell is a reporter with Business Insider, covering the intersection of law and technology. Business Insider's Discourse stories provide perspectives on the day's most pressing issues, informed by analysis, reporting, and expertise.

Sequoia Capital Investments

2,278 Investments

Sequoia Capital has made 2,278 investments. Their latest investment was in Harmonic as part of their Series B on July 10, 2025.

Sequoia Capital Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

7/10/2025 | Series B | Harmonic | $100M | No | 3 | |

6/24/2025 | Series B | XBOW | $75M | No | 3 | |

6/24/2025 | Series A | Delphi | $16M | Yes | 49 Palms Ventures, Abstract, Anthropic, Crossbeam, Gokul Rajaram, Menlo Ventures, MVP Ventures, Parable, Proximity Ventures, Soleio, Undisclosed Angel Investors, and Undisclosed Investors | 2 |

6/24/2025 | Seed VC | |||||

6/23/2025 | Seed VC |

Date | 7/10/2025 | 6/24/2025 | 6/24/2025 | 6/24/2025 | 6/23/2025 |

|---|---|---|---|---|---|

Round | Series B | Series B | Series A | Seed VC | Seed VC |

Company | Harmonic | XBOW | Delphi | ||

Amount | $100M | $75M | $16M | ||

New? | No | No | Yes | ||

Co-Investors | 49 Palms Ventures, Abstract, Anthropic, Crossbeam, Gokul Rajaram, Menlo Ventures, MVP Ventures, Parable, Proximity Ventures, Soleio, Undisclosed Angel Investors, and Undisclosed Investors | ||||

Sources | 3 | 3 | 2 |

Sequoia Capital Portfolio Exits

486 Portfolio Exits

Sequoia Capital has 486 portfolio exits. Their latest portfolio exit was Chime on June 12, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

6/12/2025 | IPO | Public | 4 | ||

6/11/2025 | Acquired | 7 | |||

5/28/2025 | Acquired | 3 | |||

Sequoia Capital Acquisitions

5 Acquisitions

Sequoia Capital acquired 5 companies. Their latest acquisition was Faces Canada on August 24, 2017.

Date | Investment Stage | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Total Funding | Note | Sources |

|---|---|---|---|---|---|---|

8/24/2017 | Acq - Fin | 2 | ||||

7/1/2010 | ||||||

9/12/2006 | Private Equity | |||||

10/1/1988 | ||||||

3/6/1986 | Series B |

Date | 8/24/2017 | 7/1/2010 | 9/12/2006 | 10/1/1988 | 3/6/1986 |

|---|---|---|---|---|---|

Investment Stage | Private Equity | Series B | |||

Companies | |||||

Valuation | |||||

Total Funding | |||||

Note | Acq - Fin | ||||

Sources | 2 |

Sequoia Capital Fund History

154 Fund Histories

Sequoia Capital has 154 funds, including Sequoia Crypto Fund.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

7/28/2023 | Sequoia Crypto Fund | $500M | 3 | ||

6/14/2022 | Sequoia SEA Fund I | $850M | 2 | ||

2/27/2021 | Sequoia Capital Seed Fund IV | $195M | 1 | ||

12/24/2020 | Sequoia Capital China GGF Affiliate I | ||||

2/18/2020 | Sequoia Capital China Venture Partners Fund VII |

Closing Date | 7/28/2023 | 6/14/2022 | 2/27/2021 | 12/24/2020 | 2/18/2020 |

|---|---|---|---|---|---|

Fund | Sequoia Crypto Fund | Sequoia SEA Fund I | Sequoia Capital Seed Fund IV | Sequoia Capital China GGF Affiliate I | Sequoia Capital China Venture Partners Fund VII |

Fund Type | |||||

Status | |||||

Amount | $500M | $850M | $195M | ||

Sources | 3 | 2 | 1 |

Sequoia Capital Partners & Customers

10 Partners and customers

Sequoia Capital has 10 strategic partners and customers. Sequoia Capital recently partnered with Kela on March 3, 2025.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

3/17/2025 | Partner | Kela | Israel | 2 | |

10/9/2024 | Partner | United States | Google enters cloud partnership with Sequoia Capital: report Google has entered into a non-exclusive cloud computing agreement with the venture firm Sequoia Capital , according to a report Wednesday by Axios . | 1 | |

8/29/2024 | Partner | United States | 1 | ||

7/30/2024 | Partner | ||||

5/2/2024 | Partner |

Date | 3/17/2025 | 10/9/2024 | 8/29/2024 | 7/30/2024 | 5/2/2024 |

|---|---|---|---|---|---|

Type | Partner | Partner | Partner | Partner | Partner |

Business Partner | Kela | ||||

Country | Israel | United States | United States | ||

News Snippet | Google enters cloud partnership with Sequoia Capital: report Google has entered into a non-exclusive cloud computing agreement with the venture firm Sequoia Capital , according to a report Wednesday by Axios . | ||||

Sources | 2 | 1 | 1 |

Sequoia Capital Team

81 Team Members

Sequoia Capital has 81 team members, including current Chief Financial Officer, Harshal Kamdar.

Name | Work History | Title | Status |

|---|---|---|---|

Harshal Kamdar | PwC, EY, and Colgate-Palmolive | Chief Financial Officer | Current |

Name | Harshal Kamdar | ||||

|---|---|---|---|---|---|

Work History | PwC, EY, and Colgate-Palmolive | ||||

Title | Chief Financial Officer | ||||

Status | Current |

Compare Sequoia Capital to Competitors

Accel is a venture capital firm that invests in and partners with teams from the inception of private companies through their growth phases, primarily in the technology sector. Accel was formerly known as Accel Partners. It was founded in 1983 and is based in Palo Alto, California.

Bessemer Venture Partners works as a venture capital firm with offices in New York, Silicon Valley, Boston, Mumbai, and Herzliya. Bessemer primarily invests in early-stage opportunities but also participates in late-stage financing and occasionally makes seed-stage investments as well. The firm invests in the following areas: cleantech, data security, financial services, healthcare, online retail, and SaaS. Bessemer Venture Partners typically makes investments in the range of $4M–$10M. It was founded in 1911 and is based in San Francisco, California.

Lightspeed Venture Partners operates as an early-stage venture capital firm. It focuses on accelerating disruptive innovations and trends in the enterprise and consumer sectors. It was founded in 2000 and is based in Menlo Park, California.

Kleiner Perkins serves as a venture capital firm with a focus on technology and life sciences sectors. The company invests in innovative and forward-thinking startups, offering financial support and strategic partnerships to help them grow. Kleiner Perkins primarily serves sectors such as software, biotechnology, healthcare, and internet technology. It was founded in 1972 and is based in Menlo Park, California.

New Enterprise Associates is a global venture capital firm focused on technology and healthcare sectors. The company offers funding to entrepreneurs at various stages of company development, from seed stage to IPO. NEA primarily serves the technology and healthcare industries, investing in companies. It was founded in 1977 and is based in Menlo Park, California.

500 Global operates a venture capital firm. It is an early-stage seed fund that invests primarily in consumer and small and medium business (SMB) internet companies and related web infrastructure services. It prefers to invest in media, consumer services, computer hardware, software, commercial services, software-as-a-service, mobile, financial technology, big data, the internet of Things (IoT), and e-commerce sectors. It was founded in 2010 and is based in San Francisco, California.

Loading...