Investments

76Portfolio Exits

9Funds

2Research containing SE Ventures

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned SE Ventures in 1 CB Insights research brief, most recently on Apr 29, 2025.

Apr 29, 2025 report

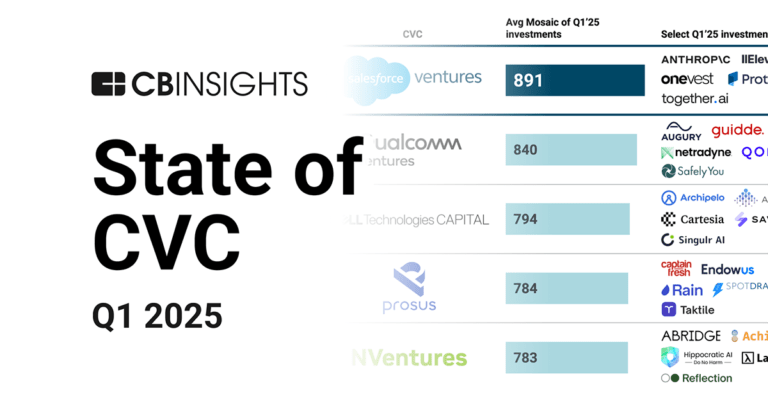

State of CVC Q1’25 ReportLatest SE Ventures News

Jun 26, 2025

The round was led by Sageview Capital, a growth-oriented investment firm focused on supporting innovative technology-enabled businesses, with participation from SE Ventures, the specialist venture fund backed by Schneider Electric, and all existing investors Teamworthy, 8VC, and MK Capital. As part of the investment, Caitlin Vorlicek, Principal at Sageview Capital, and Mike Crowe, former CIO of Colgate-Palmolive, will be joining the board of directors. “We're proud to partner with Sageview at this pivotal moment for Uncountable,” said Noel Hollingsworth, co-founder and CEO of Uncountable. “Their expertise in scaling SaaS platforms and commitment to long-term collaboration makes them an ideal partner as we help the world's most innovative companies transform how they build and launch new products.” Uncountable offers a cloud-based solution purpose-built for R&D environments, enabling enterprises to unify experimental data, accelerate product development cycles, and deploy AI-driven optimization tools. The company has driven profitable growth over the past 9 years, scaling to 90 employees and serving 120+ industry-leading customers including Sika, Beiersdorf, Mondelez, and Clariant. The investment will enable Uncountable to deepen its AI and machine learning capabilities, expand enterprise partnerships in QA/QC/PLM environments, and further scale customer support to meet growing demand across regulated and data-intensive industries. “Uncountable is addressing a significant upgrade cycle in R&D departments, where the ability to leverage AI depends on addressing the existing lack of unified data systems across laboratories,” said Caitlin Vorlicek, Principal at Sageview Capital. The company, founded by Noel Hollingsworth, Jason Hirshman, and Will Tashman, supports innovation at global leaders in chemicals, materials, cosmetics, food, energy, and pharmaceuticals, by addressing one of the core bottlenecks in modern R&D: fragmented, siloed data systems. “R&D is undergoing a generational shift, and companies that fail to modernize their data infrastructure will fall behind,” said Jason Hirshman. “Our mission has always been to empower scientists and engineers with tools that unify their workflows and unlock the full potential of AI. With Sageview's and SE Ventures' backing, we're accelerating that mission—bringing intelligent, scalable solutions to some of the world's most complex innovation challenges.” “Noel, Jason, and Will are exceptional visionaries who have solved not only the data challenge, but also the AI capabilities that modern R&D departments need to compete with today's accelerating pace of innovation,” added Vorlicek. “We are thrilled to support Uncountable's continued momentum and scale through our network and go-to-market expertise.” “At SE Ventures, we back founders driving transformational change in industrial markets,” said Varun Jain, General Partner at SE Ventures. “Uncountable has built a system of record that R&D teams love and scaled the business with impressive capital efficiency. With Schneider Electric's deep footprint in Uncountable's core markets, we're excited to bring strategic value in addition to our investment and help power their next phase of growth.” About Uncountable Uncountable provides a Unified R&D Laboratory Informatics Platform that revolutionizes how global R&D enterprises explore, analyze, and share scientific data – helping accelerate the pace of innovation. Founded in 2016, Uncountable's all-in-one AI-powered solution helps enterprise R&D organizations modernize and streamline data management and analysis – providing scientists, chemists, and researchers with a single and easily accessible web-based platform that comes fully integrated with all the critical data systems and tools used in the laboratory, including electronic lab notebooks (ELNs), laboratory information management systems (LIMS), product lifecycle management (PLM), quality management systems (QMS), advanced visualization and reporting tools, and more. To learn more visit www.uncountable.com About Sageview Capital LP Sageview Capital is a private investment firm focused on partnering with industry-defining innovators to build enduring software and tech-enabled businesses. With over $2.0 billion in assets under management, Sageview Capital collaborates with entrepreneurs on a custom approach, leveraging its decades of experience, operational expertise, and network in scaling many successful companies. The firm invests for the long-term and has guided many of its portfolio companies to IPO or acquisition—and beyond. For more information, visit https://www.sageviewcapital.com About SE Ventures SE Ventures is a $1B+ venture capital firm based in Menlo Park. A team of specialist investors and operators, SE Ventures backs bold entrepreneurs in Industrial & Climate Tech and drives commercial acceleration for portfolio startups by tapping into the deep domain expertise and global customer base of its LP, Schneider Electric. For more information, visit www.seventures.com Contacts Media Contacts For Uncountable: Juliah Ma Millard Director of Marketing Uncountable Marketing@uncontable.com For Sageview: Jadis Armbruster Edelman Smithfield Jadis.Armbruster@edelmansmithfield.com For SE Ventures: Mike Zucconi BAM Agency michael@bambybig.agency (c)2025 Business Wire, Inc., All rights reserved.

SE Ventures Investments

76 Investments

SE Ventures has made 76 investments. Their latest investment was in Enter as part of their Series B - II on June 24, 2025.

SE Ventures Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

6/24/2025 | Series B - II | Enter | $23.22M | Yes | Coatue, Foundamental, noa, Partech, and Target Global | 1 |

6/19/2025 | Series B | Ostrom | $22.95M | No | 3 | |

6/18/2025 | Series B | Maven AGI | $50M | Yes | Cisco Investments, Dell Technologies Capital, E14 Fund, Lux Capital, and M13 | 2 |

6/17/2025 | Series A | |||||

4/8/2025 | Seed VC - II |

Date | 6/24/2025 | 6/19/2025 | 6/18/2025 | 6/17/2025 | 4/8/2025 |

|---|---|---|---|---|---|

Round | Series B - II | Series B | Series B | Series A | Seed VC - II |

Company | Enter | Ostrom | Maven AGI | ||

Amount | $23.22M | $22.95M | $50M | ||

New? | Yes | No | Yes | ||

Co-Investors | Coatue, Foundamental, noa, Partech, and Target Global | Cisco Investments, Dell Technologies Capital, E14 Fund, Lux Capital, and M13 | |||

Sources | 1 | 3 | 2 |

SE Ventures Portfolio Exits

9 Portfolio Exits

SE Ventures has 9 portfolio exits. Their latest portfolio exit was Oosto on January 20, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

1/20/2025 | Acquired | 4 | |||

Date | 1/20/2025 | ||||

|---|---|---|---|---|---|

Exit | Acquired | ||||

Companies | |||||

Valuation | |||||

Acquirer | |||||

Sources | 4 |

SE Ventures Fund History

2 Fund Histories

SE Ventures has 2 funds, including SE Ventures Fund II.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

11/17/2022 | SE Ventures Fund II | $500M | 1 | ||

12/4/2018 | SE Ventures Fund I |

Closing Date | 11/17/2022 | 12/4/2018 |

|---|---|---|

Fund | SE Ventures Fund II | SE Ventures Fund I |

Fund Type | ||

Status | ||

Amount | $500M | |

Sources | 1 |

SE Ventures Team

5 Team Members

SE Ventures has 5 team members, including current Vice President, Grégoire Viasnoff.

Name | Work History | Title | Status |

|---|---|---|---|

Grégoire Viasnoff | Schneider Electric, and Airbus | Vice President | Current |

Name | Grégoire Viasnoff | ||||

|---|---|---|---|---|---|

Work History | Schneider Electric, and Airbus | ||||

Title | Vice President | ||||

Status | Current |

Loading...