Satispay

Founded Year

2013Stage

Series E | AliveTotal Raised

$530.49MLast Raised

$63.9M | 8 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+52 points in the past 30 days

About Satispay

Satispay focuses on simplifying payments through its mobile application within the digital payments industry. The company offers a platform for individuals to send and receive money, pay in stores and online, and save with features like cashback. It was founded in 2013 and is based in Luxembourg City, Luxembourg.

Loading...

Loading...

Research containing Satispay

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Satispay in 2 CB Insights research briefs, most recently on Jan 19, 2023.

Oct 24, 2022 report

State of Retail Tech Q3’22 ReportExpert Collections containing Satispay

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Satispay is included in 6 Expert Collections, including Store tech (In-store retail tech).

Store tech (In-store retail tech)

1,796 items

Companies that make tech solutions to enable brick-and-mortar retail store operations.

Unicorns- Billion Dollar Startups

1,276 items

Payments

3,198 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech 100

500 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Fintech

13,978 items

Excludes US-based companies

Tech IPO Pipeline

257 items

The tech companies we think could hit the public markets next, according to CB Insights data.

Latest Satispay News

Jun 19, 2025

Tech.eu Tech.eu Insights creates insight and guides strategies with its comprehensive content and reports. Browse popular Insights content. Italy’s tech ecosystem: Innovation, growth, and emerging opportunities Italy's tech scene is growing, driven by fintech, software, and space. Key hubs include Milan, Turin, and Rome, while late-stage funding and regional gaps remain key challenges. The Italian tech ecosystem in 2024 showed strong performance, with companies raising over €1.3 billion , despite a slight decrease from €1.4 billion in 2023. This drop, however, reflects the overall stability of the ecosystem, as evidenced by the impressive €504 million raised in the Q1 2025 alone. Key sectors like fintech, software, and space demonstrate Italy's growing strength in innovation-driven industries, signalling advancements in financial technology, digital transformation, and space exploration. Major cities such as Milan, Turin, and Rome have become vibrant hubs for tech and entrepreneurship, with Milan emerging as a central player, attracting both national and international investments. However, Italy's ecosystem still faces challenges , particularly in securing late-stage capital, which is essential for scaling successful startups. While government-backed national funds are supporting early-stage ventures, there is a regional disparity, with northern Italy attracting a larger share of investment and resources. To realise its full potential and become a leading European tech hub, Italy must address these funding gaps and regional disparities, ensuring equitable growth across its diverse and innovative sectors. Here are 10 companies to watch in 2025. 1 Amount raised in 2024: €150M D-Orbit is an aerospace company specialising in space logistics and orbital transportation services. The company provides end-to-end solutions for satellite deployment, in-orbit servicing, and end-of-life decommissioning. D-Orbit's flagship product, the ION Satellite Carrier, is an orbital transfer vehicle designed to deliver satellites to precise orbits efficiently, reducing launch costs and time to operation. D-Orbit also offers hosted payload services, allowing customers to test hardware in space without owning satellites. Committed to sustainability, D-Orbit has developed the D3 (D-Orbit Decommissioning Device) system to safely dispose of satellites at the end of their operational life, addressing the growing concern of space debris. In 2024, the company raised €150 million across two funding rounds to support the expansion of its space logistics services into in-orbit servicing and space-based cloud computing, while also strengthening its operations in the U.S., Europe, and the United Kingdom. 2 Amount raised in 2024: €144.4M Bending Spoons is a leading mobile app development company known for creating innovative, high-quality apps that enhance user experiences. Driven by data-informed design and advanced technology, the company creates products spanning productivity, entertainment, and wellness. With a strong commitment to quality and user engagement, Bending Spoons combines creative vision with technical excellence to serve millions of users around the globe. Bending Spoons emphasises technological innovation, leveraging advanced artificial intelligence and engineering to enhance its products. As of 2024, Bending Spoons secured €144.4 million in equity funding, achieving a valuation of $2.55 billion. 3 Amount raised in 2024: €105M Alps Blockchain is a technology company specialising in the production of computing power for the blockchain through the creation and management of data centres powered by renewable energy sources. The company designs, builds, and operates state-of-the-art infrastructure to actively contribute to the development and efficiency of the blockchain. Alps Blockchain has introduced in Italy a service that involves installing blockchain-dedicated infrastructure within hydroelectric plants, converting water power into computational energy and integrating seamlessly with existing systems. This approach has led to the establishment of over 30 mining farms across Europe, South America, and the Middle East. In 2024, Alps Blockchain secured €105 million in debt financing to fuel its growth and international expansion, strengthening current operations while exploring opportunities in new markets. 4 Amount raised in 2024: €60M Satispay is a fintech company offering a mobile payment platform that enables users to conduct transactions directly from their smartphones. The app allows individuals to pay in stores and online, transfer money to contacts, and manage savings through features like cashback and digital piggy banks. Satispay operates independently of traditional credit and debit card networks, connecting directly to users' bank accounts. In 2024, Satispay secured €60 million in funding, further expanding its footprint in the European fintech sector and striving to simplify digital payments for both consumers and businesses. 5 Amount raised in 2024: €36M xFarm is an agritech company specialising in digital farm management solutions. The company offers a comprehensive platform that enables farmers to monitor and optimise various aspects of their operations, including field management, irrigation, crop protection, machinery, livestock, and economic planning. Utilising data from sensors and satellites, xFarm provides actionable insights to enhance productivity and sustainability. The platform supports over 500,000 farms across more than 100 countries, covering approximately 9 million hectares and 414 different crops. In 2024, xFarm raised €36 million in Series C funding to expand its services in Europe, Asia, and Latin America and to develop new fintech products tailored for the agricultural sector. 6 Amount raised in 2024: €35M BizAway is an corporate travel management platform, offering an all-in-one solution designed to simplify and optimize business travel. The platform allows businesses to book and manage travel seamlessly, featuring tools for itinerary planning, approval workflows, expense tracking, and travel policy enforcement. Additionally, BizAway offers 24/7 multilingual customer support and robust travel risk management services, including real-time alerts and dynamic tracking. In 2024, BizAway secured €35 million in funding to accelerate growth in its current markets and expand into new ones. The company continues to innovate in the corporate travel sector, aiming to deliver cost-effective, sustainable, and user-friendly solutions for businesses of all sizes. 7 LimoLane is a platform for chauffeur-driven car rentals (NCC). The company offers premium mobility solutions in over 500 cities worldwide. Designed for both businesses and individuals, LimoLane allows quick and secure bookings via app or web, ensuring a stylish and stress-free travel experience. Its app automates B2B mobility requests by integrating directly with clients' workflows. The services include airport transfers, event mobility, city transfers, and bus rentals with drivers. LimoLane stands out for its high-quality service, transparent pricing, and 24/7 customer support. Its clients include numerous businesses and event organisers seeking reliable and personalised transportation solutions. In 2024, LimoLane secured €35 million in funding, which will support the company’s continued expansion in Europe through increased investments and strengthened collaborations with the event industry. 8 Amount raised in 2024: $25M Cyber Guru is a cybersecurity company, specialising in human-centric security awareness training. The company offers an AI-powered platform designed to transform user behaviour, turning individuals from the weakest link into the first line of defence against cyber threats. The platform provides a comprehensive suite of training modules, including phishing simulations, board-level NIS2 compliance training, and tailored programs for public administrations. Utilising advanced methodologies and machine learning, Cyber Guru delivers engaging and effective learning experiences that promote secure digital behaviours across organisations. In 2024, the company raised $25 million in Series B funding to expand its platform and further enhance its offerings. 9 Amount raised in 2024: $25M HUI is a SaaS company that offers an all-in-one business management platform designed to streamline operations for freelancers, startups, and corporations. The platform includes tools such as HUI.desk for managing functions, processes, and resources, and HUI.play for personalising profiles and facilitating networking. HUI aims to support smart working and business acceleration through its comprehensive suite of applications. In July 2024, HUI secured a $25 million equity commitment from Nimbus Capital, reflecting strong investor confidence in its business model and growth prospects. HUI's mission is to empower businesses by providing a comprehensive platform that enhances efficiency, fosters collaboration, and supports sustainable growth in the modern digital economy. 10

Satispay Frequently Asked Questions (FAQ)

When was Satispay founded?

Satispay was founded in 2013.

Where is Satispay's headquarters?

Satispay's headquarters is located at 53, Boulevard Royal, Luxembourg City.

What is Satispay's latest funding round?

Satispay's latest funding round is Series E.

How much did Satispay raise?

Satispay raised a total of $530.49M.

Who are the investors of Satispay?

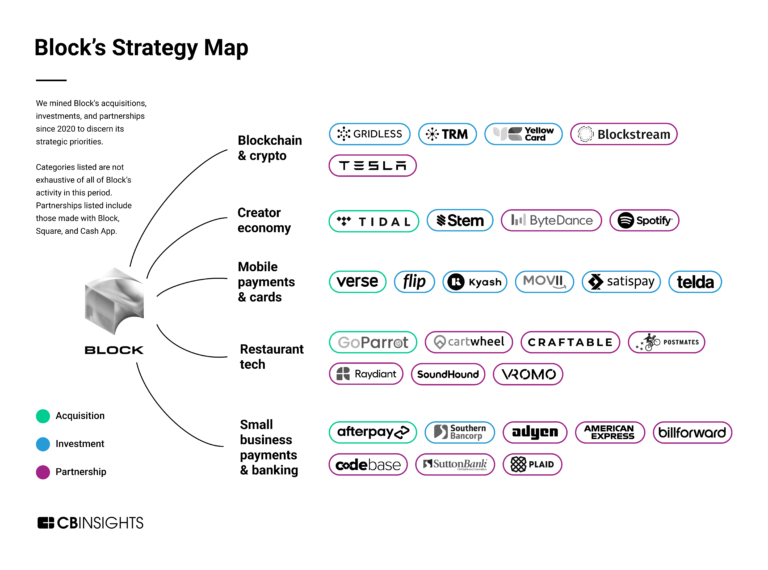

Investors of Satispay include Greyhound Capital, Lightrock, Addition, Copper Street Capital, Block and 19 more.

Who are Satispay's competitors?

Competitors of Satispay include ToneTag, Papara, Klarna, PayNearMe, YapStone and 7 more.

Loading...

Compare Satispay to Competitors

Pine Labs is a merchant platform that provides payment solutions across various business sectors. The company offers services, including in-store and online payment processing, customer loyalty programs, prepaid and gifting services, and analytics. Pine Labs serves sectors such as electronics, lifestyle, automobile, grocery, healthcare, and hospitality. It was founded in 1998 and is based in Noida, India.

PayNearMe develops technology to facilitate the end-to-end customer payment experience. It offers a billing and payment platform. Its platform helps users pay with cash for a range of goods and services from companies in e-commerce, property management, consumer finance, and transportation, enabling businesses and government agencies as well as retail stores to digitize cash collection processes. PayNearMe was formerly known as Handle Financial. The company was founded in 2009 and is based in Santa Clara, California.

Veem offers a payment platform for businesses to send and receive money globally. It provides flexible digital payments, competitive exchange rates, payment tracking, and workflow automation. It serves various industries such as e-commerce, freelancers, manufacturing, and others. The company was formerly known as Align Commerce. It was founded in 2014 and is based in San Francisco, California.

Previse specializes in financial transaction analytics and AI-driven insights within the fintech industry. The company offers a platform that connects, matches, and monitors data to provide insights for businesses. Previse's solutions cater to enterprises, financial institutions, and fintechs, focusing on automating payment processes, managing credit risk, and improving decision-making. It was founded in 2016 and is based in London, England.

PingPong provides cross-border payment solutions for e-commerce businesses. The company offers services including multi-currency receiving accounts, international supplier payments, and tools for marketplace payouts and foreign exchange cost reduction. PingPong serves the e-commerce industry, offering financial solutions to aid in payment processes. It was founded in 2015 and is based in San Mateo, California.

Cellulant develops an electronic payment service connecting customers with banks and utility services to create a payment ecosystem. It offers a single application program interface payments platform that provides locally relevant and alternative payment methods for global, regional, and local merchants. Its platform enables businesses to collect payments online and offline while allowing anyone to pay from their mobile money, local and international cards, and directly from their bank. It was founded in 2004 and is based in Nairobi, Kenya.

Loading...