Investments

86Portfolio Exits

32Funds

1About REV Venture Partners

REV Venture Partners is a venture capital partnership that invests in companies within Big Data, Digital Health, Internet, and Enterprise Technology. The company provides funding to early to mid-stage companies and participates in board activities. REV Venture Partners serves sectors that utilize data solutions and analytics. REV Venture Partners was formerly known as Reed Elsevier Ventures. It was founded in 2000 and is based in London, United Kingdom.

Research containing REV Venture Partners

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned REV Venture Partners in 1 CB Insights research brief, most recently on Apr 29, 2025.

Apr 29, 2025 report

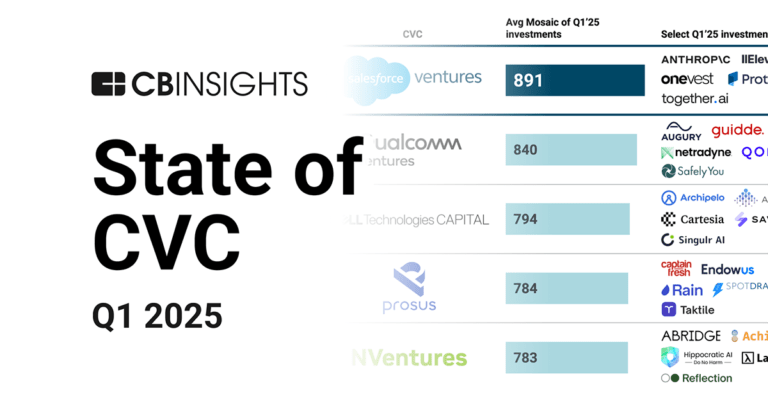

State of CVC Q1’25 ReportLatest REV Venture Partners News

Mar 10, 2022

USA - English News provided by Share this article Share this article TEL AVIV, Israel, March 10, 2022 /PRNewswire/ -- Cybersixgill, the premier vendor of real-time and actionable threat intelligence, announced today the company has raised $35 million in Series B funding led by More Provident and Pension Funds and REV Venture Partners. Additional participating investors include CrowdStrike Falcon Fund, Elron Ventures, SonaeIM, and OurCrowd. Sharon Wagner, CEO of Cybersixgill, at company headquarters in Tel Aviv, Israel. This latest investment brings the company's total investment to $56 million. The funds will be used to build on customer momentum, continue innovation of Cybersixgill's threat intelligence solutions, expand global footprint and grow sales and marketing. "We are extremely pleased to be working with world-renowned cybersecurity investors and tech leaders committed to fueling innovation and delivering the best cybersecurity solutions on the market," said Sharon Wagner, CEO of Cybersixgill. "As cybercrime rises faster and the velocity of ransomware attacks increases, the need for accurate and timely threat intelligence has never been greater. Through automation and machine learning, we have built the largest threat intelligence data lake that arms our customers with the earliest signals to stop attacks and secure their overall cybersecurity posture." Cybersixgill has experienced accelerated growth, quadrupling its revenue and doubling its global footprint in the last three years. Cybersixgill's solutions harness the power of automatic collection and extraction of threat intelligence sourced from social media, instant messaging, and clear, deep, and dark webs to create a threat and risk intelligence data backbone that provides the context needed for customers to implement preemptive security responses that stop breaches in their tracks. "We are thrilled to be investing in the outstanding team at Cybersixgill. This financing round will enable them to further strengthen their leading threat intelligence solutions whilst aggressively expanding their customer base," said Kevin Brown, Founder Partner, REV. About Cybersixgill Founded in 2014, Cybersixgill brings agility to cyber threat intelligence, with fully automatic threat intelligence solutions to help organizations proactively detect and protect against phishing, data leaks, fraud, malware, and vulnerability exploitation - enhancing cyber resilience and minimizing risk exposure in real-time. The company has hundreds of customers in North America, EMEA, and APAC, including global enterprises, financial institutions, MSSPs, government and law enforcement agencies. For more information visit https://www.cybersixgill.com / and follow us on Twitter and LinkedIn . About REV REV Venture Partners is a global venture capital partnership. REV was an early investor in inter alia Palantir, Babbel and Recorded Future. REV is backed by one of the world's largest content, technology, and analytics companies, RELX PLC (owner of LexisNexis & Elsevier). Media Contacts:

REV Venture Partners Investments

86 Investments

REV Venture Partners has made 86 investments. Their latest investment was in Harvey as part of their Series E on June 23, 2025.

REV Venture Partners Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

6/23/2025 | Series E | Harvey | $300M | No | Coatue, Conviction Capital, DST Global, Elad Gil, Elemental, Google Ventures, Kleiner Perkins, Kris Fredrickson, OpenAI, Sequoia Capital, and SV Angel | 4 |

4/10/2025 | Series B | XY Miners | $300M | Yes | Coatue, Conviction Capital, Elad Gil, Google Ventures, Kleiner Perkins, OpenAI, Sequoia Capital, and Undisclosed Investors | 4 |

2/12/2025 | Series D | Harvey | $300M | Yes | 4 | |

10/25/2023 | Series A | |||||

6/2/2022 | Series A |

Date | 6/23/2025 | 4/10/2025 | 2/12/2025 | 10/25/2023 | 6/2/2022 |

|---|---|---|---|---|---|

Round | Series E | Series B | Series D | Series A | Series A |

Company | Harvey | XY Miners | Harvey | ||

Amount | $300M | $300M | $300M | ||

New? | No | Yes | Yes | ||

Co-Investors | Coatue, Conviction Capital, DST Global, Elad Gil, Elemental, Google Ventures, Kleiner Perkins, Kris Fredrickson, OpenAI, Sequoia Capital, and SV Angel | Coatue, Conviction Capital, Elad Gil, Google Ventures, Kleiner Perkins, OpenAI, Sequoia Capital, and Undisclosed Investors | |||

Sources | 4 | 4 | 4 |

REV Venture Partners Portfolio Exits

32 Portfolio Exits

REV Venture Partners has 32 portfolio exits. Their latest portfolio exit was Cybersixgill on November 14, 2024.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

11/14/2024 | Acquired | 3 | |||

10/24/2024 | Acquired | 7 | |||

6/26/2023 | Acquired | 3 | |||

Date | 11/14/2024 | 10/24/2024 | 6/26/2023 | ||

|---|---|---|---|---|---|

Exit | Acquired | Acquired | Acquired | ||

Companies | |||||

Valuation | |||||

Acquirer | |||||

Sources | 3 | 7 | 3 |

REV Venture Partners Fund History

1 Fund History

REV Venture Partners has 1 fund, including Reed Elsevier Ventures.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

11/8/2000 | Reed Elsevier Ventures | Multi-Stage Venture Capital | Closed | $100M | 1 |

Closing Date | 11/8/2000 |

|---|---|

Fund | Reed Elsevier Ventures |

Fund Type | Multi-Stage Venture Capital |

Status | Closed |

Amount | $100M |

Sources | 1 |

REV Venture Partners Team

5 Team Members

REV Venture Partners has 5 team members, including , .

Name | Work History | Title | Status |

|---|---|---|---|

Tony Askew | Founder | Current | |

Name | Tony Askew | ||||

|---|---|---|---|---|---|

Work History | |||||

Title | Founder | ||||

Status | Current |

Loading...