Rapyd

Founded Year

2016Stage

Series F | AliveTotal Raised

$1.275BValuation

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+81 points in the past 30 days

About Rapyd

Rapyd focused on global payment processing and financial services infrastructure. The company provides products including online payment acceptance, in-store payment solutions, and financial services for businesses, such as global accounts and multi-currency management. Rapyd's platform supports e-commerce transactions, lending, remittances, and offers compliance and risk management solutions. It was founded in 2016 and is based in Essex, United Kingdom.

Loading...

Rapyd's Product Videos

ESPs containing Rapyd

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The embedded payments infrastructure market uses API-based solutions to integrate payment processing into nonbanking digital platforms. These solutions use APIs and software development kits to embed payment functionalities into software applications, websites, IoT devices, and digital ecosystems. Providers offer features such as simplified integration, fraud detection, subscription management, an…

Rapyd named as Challenger among 15 other companies, including Fiserv, Stripe, and Adyen.

Rapyd's Products & Differentiators

Rapyd Collect

A single integration that connects your business to hundreds of payment methods worldwide.

Loading...

Research containing Rapyd

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Rapyd in 14 CB Insights research briefs, most recently on Jun 6, 2025.

Jun 6, 2025

The SMB fintech market map

May 8, 2024

The embedded banking & payments market map

Dec 14, 2023

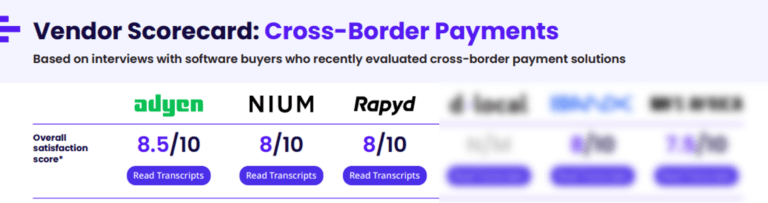

Cross-border payments market map

Expert Collections containing Rapyd

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Rapyd is included in 9 Expert Collections, including E-Commerce.

E-Commerce

11,558 items

Companies that sell goods online (B2C), or enable the selling of goods online via tech solutions (B2B).

Unicorns- Billion Dollar Startups

1,276 items

SMB Fintech

1,648 items

Payments

3,198 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,978 items

Excludes US-based companies

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest Rapyd News

Jul 3, 2025

Writer Expected time to read 2 min Tracxn has released its United Kingdom Tech H1 2025 Funding Report, offering a comprehensive overview of the country's tech investment activity during the first half of the year. The United Kingdom emerged as the second-highest funded country globally in H1 2025, surpassing India and Germany, with the United States being the only country ahead in terms of total funding. Despite a slight decline compared to H1 2024, the region saw strong growth over H2 2024, driven by significant activity in enterprise applications, fintech , and media sectors. A total of $7.8 billion was raised in the United Kingdom in H1 2025, reflecting an 18% increase compared to the $6.6 billion raised in H2 2024. However, this marked a slight decline of 2% when compared to the $8.0 billion raised in H1 2024. Seed Stage funding reached $1.3 billion in H1 2025, a 103% increase from the $623 million raised in H2 2024 and a 47% increase from the $884 million raised in H1 2024. Early Stage funding totalled $2.1 billion, representing a 32% decline from $3.1 billion in H2 2024 and a 47% drop from $3.9 billion in H1 2024. Late stage funding came in at $4.5 billion, rising 55% from $2.9 billion in H2 2024 and 41% from $3.2 billion in H1 2024. Enterprise applications, fintech, and media & entertainment emerged as the top-performing sectors in the United Kingdom tech ecosystem in H1 2025. The enterprise infrastructure sector raised $3.8 billion, a 22% increase over the $3.1 billion raised in H2 2024 and a 4% increase compared to $3.6 billion in H1 2024. The fintech sector secured $2.4 billion in funding, up 49% from $1.6 billion in H2 2024, but down 28% from $3.3 billion in H1 2024. Media & entertainment saw a dramatic increase, raising $1.8 billion –an astounding 3,147% rise compared to the $56.9 million in H2 2024 and a 1,165% rise compared to $146 million in H1 2024. H1 2025 witnessed 14 funding rounds exceeding $100 million, compared to 13 such rounds in both H2 2024 and H1 2024. Notable companies securing $100 million+ in funding included DAZN, Isomorphic Labs , Rapyd, FNZ, and Dojo. DAZN raised $1.0 billion in a Series D round, Isomorphic Labs raised $600 million in a Series D round, and Rapyd secured $500 million in a Series F round. A significant portion of these large rounds originated from enterprise applications, media & entertainment, and fintech. Only one unicorn emerged in H1 2025, marking a 50% drop from the two unicorns recorded in H1 2024 and matching the single unicorn seen in H2 2024. Quantum Base, RedCloud, and Vinanz were among the companies that went public during this period. The United Kingdom saw 227 acquisitions in H1 2025, a 5% decline compared to 240 in H2 2024 and a 1% decrease compared to 229 in H1 2024. Worldpay was acquired by Global Payments for $24.3 billion, making it the highest valued acquisition in H1 2025. This was followed by Siemens' $5.1 billion acquisition of Dotmatics. London-based tech firms dominated the funding landscape , accounting for 77% of the total funding raised by tech companies across the United Kingdom. Edinburgh followed as the second-most funded city, though at a distant second. Mercia, Scottish Enterprise, and Octopus Ventures were the overall top investors in the United Kingdom Tech ecosystem. Fuel Ventures, Y Combinator, and SFC Capital were the most active seed-stage investors in H1 2025. Notion, AlbionVC, and Octopus Ventures led early-stage investments, while BeyondNetZero, Lauxera Capital Partners, and RPS Ventures dominated late-stage funding. Among VCs, United States-based Y Combinator led the most number of investments in H1 2025 with 31 rounds, while United Kingdom-based AlbionVC added three new companies to its portfolio. The United Kingdom tech ecosystem demonstrated solid momentum in H1 2025, achieving global recognition as the second-highest funded country. Strong late-stage activity and increased seed funding were key drivers, with London maintaining its dominance as the primary tech hub. While early-stage investment slowed and unicorn creation declined, sectoral strength in enterprise applications, fintech, and media & entertainment underscored the diversity of investor interest. High-value acquisitions further reinforced the country's significance in the global tech arena. For more startup news , check out the other articles on the website, and subscribe to the magazine for free. Listen to The Cereal Entrepreneur podcast for more interviews with entrepreneurs and big-hitters in the startup ecosystem. Share This Article

Rapyd Frequently Asked Questions (FAQ)

When was Rapyd founded?

Rapyd was founded in 2016.

Where is Rapyd's headquarters?

Rapyd's headquarters is located at Parsonage Road, Essex.

What is Rapyd's latest funding round?

Rapyd's latest funding round is Series F.

How much did Rapyd raise?

Rapyd raised a total of $1.275B.

Who are the investors of Rapyd?

Investors of Rapyd include Target Global, General Catalyst, Durable Capital Partners, Tal Capital, Spark Capital and 20 more.

Who are Rapyd's competitors?

Competitors of Rapyd include Payall, Conduit, Airwallex, Thunes, Nium and 7 more.

What products does Rapyd offer?

Rapyd's products include Rapyd Collect and 3 more.

Who are Rapyd's customers?

Customers of Rapyd include Uber, Google, Hotmart, Rappi and GoTrade (TR8 Securities).

Loading...

Compare Rapyd to Competitors

Checkout.com is a financial technology company that provides payment processing services. The company offers a platform for businesses to accept payments, issue cards, and manage payouts. Checkout.com serves sectors such as e-commerce, fintech, gaming, cryptocurrency, marketplaces, payment facilitators, and travel. Checkout.com was formerly known as Opus Payments. It was founded in 2012 and is based in London, United Kingdom.

Fincra is a payment gateway provider focused on payment processing for businesses across various sectors. The company offers services including virtual accounts, multicurrency accounts, and API integrations for online and offline payments. Fincra serves sectors such as ecommerce, financial institutions, global businesses, and developers. It was founded in 2019 and is based in Toronto, Ontario.

BlueSnap provides flexible payment solutions and delivers a customizable platform to global online businesses such as software publishers, web hosting companies, and online retailers. BlueSnap builds and manages online businesses for software publishers, web hosting companies, and online retailers. A business can choose the BlueSnap hosted application that spans the entire e-commerce lifecycle, or it can deploy the BlueSnap API, which allows retailers to integrate the technology with existing solutions. Using BlueSnap software, retailers can deliver newsletters to customers, coupons and promotions, real-time reporting, and live chat, amongst other features. It was formerly known as Plimus. It was founded in 2001 and is based in Waltham, Massachusetts.

Nium operates within the financial technology sector and provides services including multi-currency accounts, global card issuance, and solutions for sending payouts to over 190 countries, facilitated through their API and platform. Nium serves financial institutions, money transfer operators, and enterprises across sectors such as payroll, marketplaces, spend management, the creator economy, and travel. Nium was formerly known as InstaReM Pte. Ltd.. It was founded in 2014 and is based in Singapore, Singapore.

ClearBank provides regulated banking infrastructure and payment processing services for the financial services industry. The company offers a cloud-based application programming interface (API) that allows financial institutions to access regulated banking services, including account management and payment clearing. ClearBank serves fintechs, banks, credit unions, digital asset platforms, and other financial institutions. ClearBank was formerly known as CB Infrastructure. It was founded in 2015 and is based in London, United Kingdom.

Buckzy Payments operates within the financial technology sector. It provides cross-border payment solutions. The company offers a cross-border payment network and Banking-as-a-Service on an embedded finance platform, which includes APIs for transaction banking and customer journeys. Buckzy serves financial institutions, fintechs, marketplaces, and multinational companies. It was founded in 2018 and is based in Toronto, Canada.

Loading...