Ramp

Founded Year

2019Stage

Series D - III | AliveTotal Raised

$2.027BValuation

$0000Last Raised

$200M | 1 mo agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+28 points in the past 30 days

About Ramp

Ramp develops a financial operations platform. The company offers a suite of services including corporate cards, expense management, accounts payable solutions, and accounting automation. Its platform serves startups, small businesses, mid-market companies, and enterprises across various sectors. The company was founded in 2019 and is based in New York, New York.

Loading...

ESPs containing Ramp

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

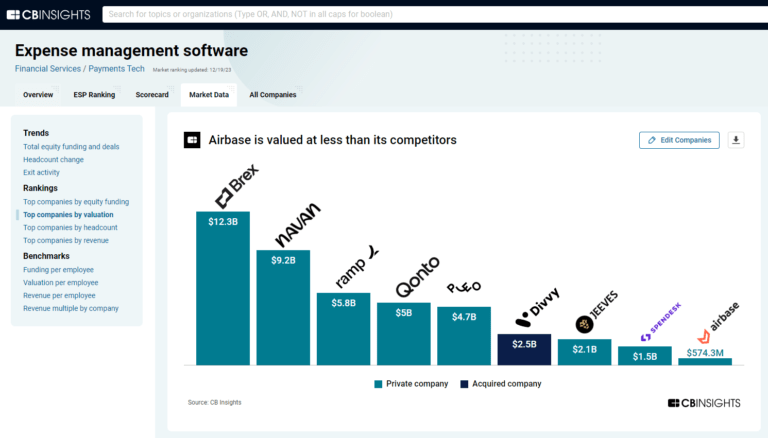

The spend management platforms market helps businesses control and optimize their expenditures through integrated software solutions, including corporate cards, expense management systems, procurement software, accounts payable automation, and budget tracking tools. These platforms use APIs, cloud-based infrastructure, and AI-powered analytics to provide real-time visibility into spending patterns…

Ramp named as Leader among 15 other companies, including Coupa, Pleo, and Brex.

Ramp's Products & Differentiators

Ramp Card

Smart corporate cards - both physical and virtual - with embedded software controls.

Loading...

Research containing Ramp

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Ramp in 20 CB Insights research briefs, most recently on Jun 6, 2025.

Jun 6, 2025

The SMB fintech market map

May 29, 2025

The stablecoin market map

Aug 23, 2024

The B2B payments tech market map

Oct 26, 2023

The CFO tech stack market map

Oct 18, 2023 report

State of Fintech Q3’23 ReportExpert Collections containing Ramp

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Ramp is included in 7 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,276 items

SMB Fintech

2,003 items

Payments

3,198 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

9,653 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

599 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Generative AI

2,314 items

Companies working on generative AI applications and infrastructure.

Latest Ramp News

Jul 3, 2025

硅谷风投押宝熟人局,撑起AI百亿估值神话与泡沫 美国风险投资中,主导投资者为现有资方再投资的金额 这种投资模式给初创企业带来两大明显优势: Accel针对企业软件公司Linear的投资案例就颇具代表性。Accel早在2023年就投资了Linear,并成为其董事会成员。今年4月,在Linear尚未启动新的融资前,Accel提出“不新增董事会席位、减少股权稀释”的投资方案,最终在6月份主导了Linear的8200万美元投资,对后者估值为12.5亿美元。 02 投资集中化, AI成核心押注领域 如果这一趋势持续下去,现有资方再投资的数量可能会大幅增加,甚至追平2024年全年纪录(1004轮)。 在相同AI初创公司中,曾主导或共同主导多轮投资的风险投资公司 Thrive也在集中投资编程助手Cursor开发商Anysphere。今年5月,Thrive主导了对Anysphere的9亿美元融资,而在去年12月,该公司也曾主导过一轮对Anysphere的投资。 03 热情不退,风险未减 实际上,这种重复集中押注的策略的确暗藏风险。当被投企业表现优异时自然皆大欢喜,但若公司业绩不佳或倒闭,后期轮次的高估值投资反而会放大损失。 网络安全公司Lacework就是典型案例:Sutter Hill Ventures自2015年种子轮开始连续四轮加注,将其估值推高至83亿美元,但最终却以2亿美元的“骨折价“黯然出售。 同样令人唏嘘的还有虚拟会议平台Hopin,Institutional Venture Partners主导的三轮投资将其捧上80亿美元估值神坛,但随着疫情结束,市场需求急剧下降,最终该公司以远低于原估值的价格出售了部分业务。 但失败案例并未阻挡投资机构的热情。越来越多风投开始效仿Founders Fund的策略,集中投资于同样的公司。除了持续加码Anduril外,该基金还主导了Ramp的五轮融资,后者最新估值已达160亿美元。 Ramp的早期投资者、Redpoint Ventures的管理合伙人洛根·巴勒特(Logan Bartlett)表示:“每个赛道真正的优质标的屈指可数,既然已经押中宝,自然要让投资价值最大化。” 本文来自 “腾讯科技” ,作者:金鹿,36氪经授权发布。 该文观点仅代表作者本人,36氪平台仅提供信息存储空间服务。

Ramp Frequently Asked Questions (FAQ)

When was Ramp founded?

Ramp was founded in 2019.

Where is Ramp's headquarters?

Ramp's headquarters is located at 28 West 23rd Street, New York.

What is Ramp's latest funding round?

Ramp's latest funding round is Series D - III.

How much did Ramp raise?

Ramp raised a total of $2.027B.

Who are the investors of Ramp?

Investors of Ramp include Founders Fund, D1 Capital Partners, Thrive Capital, General Catalyst, Lux Capital and 45 more.

Who are Ramp's competitors?

Competitors of Ramp include Capital on Tap, Glean AI, Center, Brex, Extend and 7 more.

What products does Ramp offer?

Ramp's products include Ramp Card and 4 more.

Who are Ramp's customers?

Customers of Ramp include Mode Analytics.

Loading...

Compare Ramp to Competitors

Brex provides spend management solutions across various sectors. The company offers products including corporate cards, expense management, travel, bill pay, and banking services aimed at assisting businesses in managing spending and financial processes. Brex serves startups, mid-size companies, and enterprises with its range of financial products. Brex was formerly known as Veyond. It was founded in 2017 and is based in Salt Lake City, Utah.

Pleo focuses on business spend management within the financial technology sector. The company offers company cards with individual spending limits and provides a platform to manage expenses, reimbursements, invoices, and budgets. It serves businesses looking to manage their spending and financial processes. The company was founded in 2015 and is based in København N, Denmark.

Mesh focuses on travel and expense management for enterprises operating within the financial technology sector. The company offers a platform that provides solutions for travel management, spend management, and expense management, aiming to provide real-time visibility, control, and insights into all expenses. Mesh primarily serves modern global enterprises. It was founded in 2018 and is based in New York, New York.

Rho focuses on providing financial services and operates within the finance and technology sectors. The company offers a financial platform that includes services such as commercial banking, corporate cards, expense management, and accounts payable automation. Rho primarily serves organizations looking to manage their finances. Rho was formerly known as Rho Business Banking. It was founded in 2018 and is based in New York, New York.

Torpago specializes in providing a corporate credit card and expense-tracking platform. The company helps businesses manage expenses and has established a white-label program partnership with banks and credit unions. It serves the banking and financial services industries with modern credit experiences. It was founded in 2019 and is based in Burlingame, California.

Navan is a corporate travel management and expense management platform operating in the business travel sector. The company provides services for booking business travel and managing expenses, including tools for travel booking automation and expense report automation. Navan serves sectors such as energy and utilities, industrial and manufacturing, professional services, real estate and construction, retail and e-commerce, and technology and software. Navan was formerly known as TripActions. It was founded in 2015 and is based in Palo Alto, California.

Loading...