Quantexa

Founded Year

2016Stage

Series F | AliveTotal Raised

$547.7MValuation

$0000Last Raised

$175M | 4 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+45 points in the past 30 days

About Quantexa

Quantexa specializes in decision intelligence within the technology sector, providing solutions for data-driven decision-making across various industries. The company offers a platform that integrates artificial intelligence to unify data and resolve entities, performing graph analytics for risk management, customer intelligence, and financial crime prevention. Quantexa serves sectors including banking, insurance, government, telecommunication, health and social care, and the public sector. It was founded in 2016 and is based in London, United Kingdom.

Loading...

ESPs containing Quantexa

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The anti-money laundering (AML) software market helps detect, prevent, and mitigate the risks associated with money laundering and financial crimes. Solutions in this market analyze large volumes of data and identify suspicious activity for further investigation. This allows financial institutions and other regulated entities to monitor transactions, screen customers and counterparties, and conduc…

Quantexa named as Challenger among 15 other companies, including Microsoft, Oracle, and BAE Systems.

Quantexa's Products & Differentiators

Contextual Decision Intelligence

Quantexa’s strategic Contextual Decision Intelligence platform uncovers hidden risk and reveals new, unexpected opportunities across the customer lifecycle. CDI is a new approach to data that gives organizations the ability to connect internal and external data sets at scale to provide a single view, enriched with intelligence about the relationships between people, places and organizations. Powered by market-leading Entity Resolution and Network generation capabilities, our platform dynamically generates the context needed to automate millions of operational decisions, at scale, across multiple business units, including Anti-Money Laundering, Fraud, Credit Risk and Customer Intelligence.

Loading...

Research containing Quantexa

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Quantexa in 5 CB Insights research briefs, most recently on May 16, 2025.

May 16, 2025 report

Book of Scouting Reports: ITC Europe 2025

May 8, 2025 report

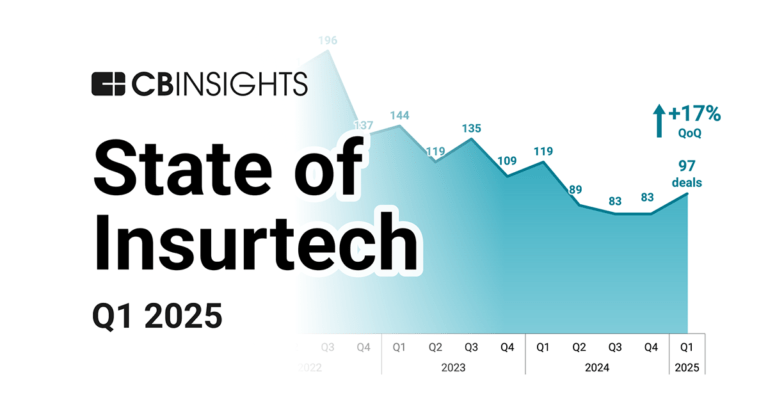

State of Insurtech Q1’25 Report

Mar 14, 2024

The retail banking fraud & compliance market map

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023Expert Collections containing Quantexa

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Quantexa is included in 8 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,276 items

Regtech

1,811 items

Technology that addresses regulatory challenges and facilitates the delivery of compliance requirements. Regulatory technology helps companies and regulators address challenges ranging from compliance (e.g. AML/KYC) automation and improved risk management.

Insurtech

4,553 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Artificial Intelligence

12,337 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Fintech

13,978 items

Excludes US-based companies

Fintech 100

499 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest Quantexa News

Jul 9, 2025

LONDON, July 08, 2025 (GLOBE NEWSWIRE) -- Quantexa , a pioneer in helping enterprises and public sector organizations use Decision Intelligence (DI), today announced the appointment of Steven Guggenheimer , former Corporate Vice President at Microsoft, and *Franck Petitgas, former Global Head of Investment Banking at Morgan Stanley and current member of the UK House of Lords, to its Advisory Board. These strategic additions reflect Quantexa's intensified focus on expanding its global footprint, advancing its Decision Intelligence Platform innovation, and solidifying its leadership position in helping enterprises in highly regulated industries use data, analytics, and AI to drive better decision-making and improved business outcomes. These appointments follow Quantexa's $175 million Series F funding round and a growing customer base that has some of the world's leading banks, insurers, telecoms, and forward-thinking government agencies. Guggenheimer and Petitgas's expertise will help the company scale its vision as it drives AI-powered enterprise transformation and supports nations in their quest to bring AI sovereignty within their borders. Guggenheimer , a 30-year enterprise technology veteran, held senior leadership roles at Microsoft, including Corporate VP of AI & ISV Engagement. He is recognized for building scaled platform strategies, partner ecosystems, and go-to-market engines in cloud and AI. His expertise will be instrumental as Quantexa expands its platform, deepens strategic partnerships, and accelerates commercial growth across key geographies. Petitgas brings global financial and macro strategy insights. With more than three decades at Morgan Stanley, including serving as Global Co-Head of Investment Banking, and subsequently as the adviser on business and investment to the former U. K. Prime Minister, he adds invaluable perspective at the intersection of global finance, regulation, and digital transformation. His experience will support Quantexa's growth with global clients and strategic partners. Vishal Marria, CEO & Founder, Quantexa , said: “We are adding to our powerhouse Advisory Board to match our category-defining ambitions. Steven and Franck bring extraordinary expertise across technology, finance, and policy. Their guidance will help us further accelerate our mission to become the global standard for trusted decision-making in the AI era.” Steven Guggenheimer said: “Quantexa is tackling one of the most important challenges in AI today—turning siloed data into trusted, contextual insights at scale to drive augmented and automated decisioning. The team has the right vision, platform, and momentum to lead this category, and I'm thrilled to support their journey.” Franck Petitgas added: “Quantexa has developed a world class data and AI driven decision-making platform that helps its clients deliver growth and efficiency. I look forward to helping the company scale its impact internationally with global clients and in the capital markets.” To learn more about Quantexa's Leadership, visit: https://www.quantexa.com/about/leadership/ *Appointment was subject to the standard ACOBA approval process. About Quantexa Quantexa is a global AI, data and analytics software company pioneering Decision Intelligence to empower organizations to make trusted operational decisions with data in context. Using the latest advancements in AI, Quantexa's Decision Intelligence platform helps organizations uncover hidden risks and new opportunities by unifying siloed data and turning it into the most trusted, reusable resource. It solves major challenges across data management, customer intelligence, KYC, financial crime, risk, fraud, and security, throughout the customer lifecycle. The Quantexa Decision Intelligence Platform enhances operational performance with over 90% more accuracy and 60 times faster analytical model resolution than traditional approaches. An independently commissioned Forrester TEI study on Quantexa's Decision Intelligence Platform found that customers saw a three-year 228% ROI. Founded in 2016, Quantexa now has over 800 employees and thousands of platform users working with billions of transactions and data points across the world. For more information visit www.quantexa.com or follow us on LinkedIn Media Inquiries C: Stephanie Crisp, Director and Growth Tech Lead, Fight or Flight E: Quantexa@fightorflight.com C: Adam Jaffe, SVP of Corporate Marketing T: +1 609 502 6889 E: adamjaffe@quantexa.com EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Quantexa Frequently Asked Questions (FAQ)

When was Quantexa founded?

Quantexa was founded in 2016.

Where is Quantexa's headquarters?

Quantexa's headquarters is located at 10 York Road, London.

What is Quantexa's latest funding round?

Quantexa's latest funding round is Series F.

How much did Quantexa raise?

Quantexa raised a total of $547.7M.

Who are the investors of Quantexa?

Investors of Quantexa include British Patient Capital, Teachers' Venture Growth, World Economic Forum Global Innovator Community, AlbionVC, Dawn Capital and 14 more.

Who are Quantexa's competitors?

Competitors of Quantexa include Napier, Ripjar, Tookitaki, Automated Data, Resistant AI and 7 more.

What products does Quantexa offer?

Quantexa's products include Contextual Decision Intelligence and 1 more.

Who are Quantexa's customers?

Customers of Quantexa include HSBC, Danske Bank, OFX and Govia Thameslink Railway.

Loading...

Compare Quantexa to Competitors

ComplyAdvantage is involved in fraud and anti-money laundering (AML) risk detection within the financial services sector. It offers services including customer and company screening, ongoing monitoring, transaction and payment screening, and financial crime risk intelligence to assist businesses with compliance obligations. It serves sectors such as banks, cryptocurrency firms, insurance companies, and other entities within the financial industry. It was formerly known as Mimiro. It was founded in 2014 and is based in London, United Kingdom.

Greenlite provides AI-driven solutions for financial compliance, operating within the fintech sector. The company offers automation tools for anti-money laundering (AML) processes, transaction monitoring, and customer due diligence, using artificial intelligence. Greenlite serves the banking, fintech, and credit union industries. It was founded in 2023 and is based in San Francisco, California.

Schwarzthal Tech is building solutions to tackle financial crime using AI and algorithms. The platform provides intelligence solutions based on network assessment, data linkage, flow aggregation, and machine learning.

Sigma Ratings focuses on AI-driven risk intelligence and operates in the financial crime prevention and compliance sectors. The company provides a platform for AML screening, KYC, and counterparty risk assessment, utilizing a database to assist with compliance and risk management. Sigma Ratings serves organizations that need effective risk management and compliance. It was founded in 2016 and is based in New York, New York.

Unit21 focuses on risk and compliance operations in the financial services sector, providing a platform for transaction monitoring, fraud prevention, case management, and consortium data for fraud detection. The company serves financial institutions, fintech companies, marketplaces, neobanks, payment processors, and cryptocurrency businesses. It was founded in 2018 and is based in San Francisco, California.

ThetaRay provides AI-powered solutions for transaction monitoring, customer risk assessment, and financial crime screening within the banking and fintech sectors, focusing on compliance and false positive management. It was founded in 2013 and is based in Hod Hasharon, Israel.

Loading...