Qonto

Founded Year

2016Stage

Incubator/Accelerator | AliveTotal Raised

$708.82MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+48 points in the past 30 days

About Qonto

Qonto offers business banking solutions. The company provides an online business account that includes payment features, invoicing, bookkeeping, expense management, and financing options for businesses. Qonto serves self-employed individuals, freelancers, micro-businesses, small and medium-sized enterprises (SMEs), and associations. It was founded in 2016 and is based in Paris, France.

Loading...

ESPs containing Qonto

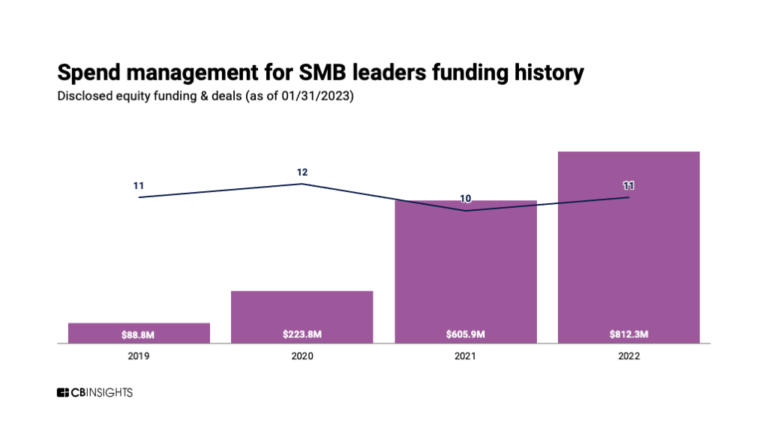

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The spend management platforms market helps businesses control and optimize their expenditures through integrated software solutions, including corporate cards, expense management systems, procurement software, accounts payable automation, and budget tracking tools. These platforms use APIs, cloud-based infrastructure, and AI-powered analytics to provide real-time visibility into spending patterns…

Qonto named as Highflier among 15 other companies, including Coupa, Ramp, and Pleo.

Qonto's Products & Differentiators

Qonto

Qonto is the European leader for Business Finance and Expense Management : we offer the most complete solution to run efficiently financial business tasks from everyday payments, to finance and accounting management to expense management.

Loading...

Research containing Qonto

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Qonto in 5 CB Insights research briefs, most recently on Jun 6, 2025.

Jun 6, 2025

The SMB fintech market map

Aug 23, 2024

The B2B payments tech market map

Oct 26, 2023

The CFO tech stack market map

Oct 4, 2022 report

The Fintech 250: The most promising fintech companies of 2022Expert Collections containing Qonto

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Qonto is included in 7 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,276 items

SMB Fintech

1,648 items

Payments

3,198 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,978 items

Excludes US-based companies

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Digital Banking

1,153 items

Challenger bank offer digitally native banking products (checking and savings account at the most basic) and either leverage partner banks or are fully-licensed banks themselves.

Latest Qonto News

Jul 3, 2025

9:00 PM PDT · July 2, 2025 “Is Qonto a real bank?” is one of the top suggested questions in Google searches about the French fintech startup. The answer is no, but it could change: Qonto has filed for a banking license in France, CEO Alexandre Prot revealed. Qonto, which targets European freelancers and SMBs, currently operates with a payment institution license it obtained in 2018, and which already enabled it to introduce a form of buy now, pay later (BNPL). But a credit institution license would let it offer broader lending, savings, and investment options to its target customers. Since its current license is valid across the EU, Qonto has already been able to expand into several European markets, and recently reached the milestone of 600,000 customers. But lacking a credit license is a hindrance for its goal to reach 2 million customers by 2030. While offering a more comprehensive solution seems like a natural move to compete with incumbent banks, obtaining a license and rolling out credit is not easy. That explains why Qonto’s SMB fintech competitors have approached this issue in different ways, and why Qonto isn’t exactly playing catch-up. Memo Bank was founded as a bank from the outset, and offers lending to SMBs, but that makes it an outlier. Finom operates with an electronic money institution (EMI) license , but it only just started testing the kind of lending that this regulatory middle ground allows. Revolut has a full Lithuanian license, but other than BNPL, it has yet to roll out credit options to businesses — although it plans to do so this year . Still, the marketing power of well-funded competitors that operate both in B2C and B2B may have been a sign that Qonto needed to accelerate, especially as Revolut recently loudly announced plans to seek a French license and turn Paris into its Western Europe HQ . Not mentioning competitors, Prot said that Qonto’s timing was driven by “having achieved profitability ahead of schedule in 2023.” Techcrunch event Save $450 on your TechCrunch All Stage pass Build smarter. Scale faster. Connect deeper. Join visionaries from Precursor Ventures, NEA, Index Ventures, Underscore VC, and beyond for a day packed with strategies, workshops, and meaningful connections. Save $200+ on your TechCrunch All Stage pass Build smarter. Scale faster. Connect deeper. Join visionaries from Precursor Ventures, NEA, Index Ventures, Underscore VC, and beyond for a day packed with strategies, workshops, and meaningful connections. Boston, MA|July 15 The son of former BNP Paribas President Baudouin Prot , Qonto’s CEO had obviously already thought about pursuing a credit license — and that’s not just a guess. During a press briefing, Prot confirmed that he and co-founder Steve Anavi seriously considered the idea at one point, but ultimately dismissed it because it would have required too much time and additional fundraising. Having been profitable since 2023 means that this hurdle now won’t require Qonto to raise more funding than the $552 million it secured in 2022 at a $5 billion valuation. Prot recently said that “the main, or the only reason, why we could raise additional capital is if we do a large or very large M&A deal, paid mostly in cash.” In its eight years of existence, Qonto has made two acquisitions: It took over its German competitor Penta in 2022, and it bought accounting and financial automation platform Regate in 2024. The latter is a reflection of Qonto’s positioning beyond banking and as an integrated finance management solution, with an offering that also includes tools for invoicing and bookkeeping. This approach helped it grow in the B2B segment across Europe. Prot declined to give a full breakdown of its 600,000 customers, but he said that Germany is now Qonto’s largest market after France. In unspecified order, Spain and Italy come next, followed by the markets it entered in late 2024 : Austria, Belgium, the Netherlands, and Portugal. Still, Prot operates under the assumption that some customers won’t choose Qonto unless it is a credit institution. That’s because this would grant them additional guarantees on their deposits, and because they want credit to be an option if they ever need it, which some already do. Qonto validated that demand for credit with its Pay Later service; launched in 2024, it has already facilitated €50 million in financing, according to the company (approximately $59 million). But the offer is limited by its current license — both for Qonto, which can only lend from its own equity, and for its customers, who can’t borrow for longer than 12 months. To help its customers access other types of loans, Qonto also put together a “financing hub” with third-party fintech partners including Defacto , Karmen , Riverbank , and Silvr . Prot said Qonto plans to keep it for at least a few more years. And some of these offerings are more specific than what the company may want to get into. Still, becoming a credit institution in its own right would unlock new revenue for Qonto, both from the margin on credits and more upside from deposits, which it would be able to use for lending. Prot declined to disclose revenue figures but said that revenue increased by 30% in the last year. However, Prot said that this additional revenue wasn’t the main factor at play. Acquiring new customers aside, Qonto also sees this as an opportunity to depend less on others and launch new products faster. In the same vein, it recently built an in-house card processor to increase acceptance rates while reducing its reliance on third parties. With a team of 1,600 people, Qonto now hopes that it will have the bandwidth to work on new product developments, such as the AI-enabled “Qonto Intelligence” layer, while also enhancing its banking infrastructure and risk management teams. The latter is also aimed to demonstrate its readiness to France’s banking supervisor, with which it plans to work closely to obtain its license. The process may still take years, but it is also part of a broader “growing up” effort for Qonto, which recently added several senior profiles to its board of directors. These steps could also help lay the groundwork for a future IPO, though that remains a longer-term prospect. Topics

Qonto Frequently Asked Questions (FAQ)

When was Qonto founded?

Qonto was founded in 2016.

Where is Qonto's headquarters?

Qonto's headquarters is located at 18 Rue de Navarin, Paris.

What is Qonto's latest funding round?

Qonto's latest funding round is Incubator/Accelerator.

How much did Qonto raise?

Qonto raised a total of $708.82M.

Who are the investors of Qonto?

Investors of Qonto include Leading European Tech Scaleups, Crowdcube, Valar Ventures, Alven Capital, DST Global and 17 more.

Who are Qonto's competitors?

Competitors of Qonto include Finom, Revolut, Allica Bank, Spendesk, Wamo and 7 more.

What products does Qonto offer?

Qonto's products include Qonto.

Who are Qonto's customers?

Customers of Qonto include Payfit, Adveris, Back market, Happn and Heetch.

Loading...

Compare Qonto to Competitors

Lili focuses on providing business finance solutions. The company offers a range of services, including business banking, smart bookkeeping, invoice and payment management, and tax planning tools. It primarily serves the fintech industry. The company was founded in 2018 and is based in New York, New York.

Novo is a fintech company that provides online business banking solutions for small businesses. The company offers checking accounts, business credit cards, bookkeeping services, and tools for invoicing, budgeting, and financial integrations. Novo serves small businesses, freelancers, self-employed individuals, and consultants with various financial management tools. It was founded in 2016 and is based in Miami, Florida.

Oxygen is a financial technology company. It offers services such as cashback rewards, virtual cards, early payroll access, and tools for business incorporation and invoicing. Oxygen primarily serves consumers, freelancers, solopreneurs, and small to medium-sized businesses with its financial products. It was founded in 2017 and is based in Princeton, New Jersey.

Tide serves as a financial technology company that provides business banking services and financial management tools for small and medium-sized enterprises (SMEs). The company offers services including digital business accounts, invoicing, accounting, savings solutions, loans, and company registration services. Tide primarily serves the SME sector with various products. It was founded in 2015 and is based in London, United Kingdom.

Bunq focuses on providing financial services. The company offers a range of banking products, including savings accounts, full bank accounts, and multi-currency banking, all accessible through a mobile application. Bunq primarily serves individual consumers and businesses looking for modern, hassle-free banking solutions. It was founded in 2012 and is based in Amsterdam, Netherlands.

NorthOne provides an online business account with integrated features designed to simplify business banking, including real-time money transfers, automatic budgeting tools, and connections to accounting, payment, and payroll tools, primarily serving small businesses across various sectors. It was formerly known as Ferst Digital. The company was founded in 2016 and is based in New York, New York.

Loading...