Plug and Play Ventures

Investments

2177Portfolio Exits

253Funds

4Partners & Customers

10About Plug and Play Ventures

Plug and Play Ventures is a global technology accelerator and venture fund. Plug and Play Ventures participates in Seed, Angel and Series A funding where they often co-invest with strategic partners. Through years of experience and as part of its network, the firm has put together a world-class group of serial entrepreneurs, strategic investors, and industry leaders who actively assist the firm with successful and growing investment portfolio.

Expert Collections containing Plug and Play Ventures

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find Plug and Play Ventures in 2 Expert Collections, including Store tech (In-store retail tech).

Store tech (In-store retail tech)

56 items

Startups aiming work with retailers to improve brick-and-mortar retail operations.

Travel Technology (Travel Tech)

39 items

Tech-enabled companies offering services and products focused on tourism. This collection includes booking services, search platforms, on-demand travel and recommendation sites, among others.

Research containing Plug and Play Ventures

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Plug and Play Ventures in 5 CB Insights research briefs, most recently on Oct 24, 2024.

Oct 24, 2024 report

Fintech 100: The most promising fintech startups of 2024

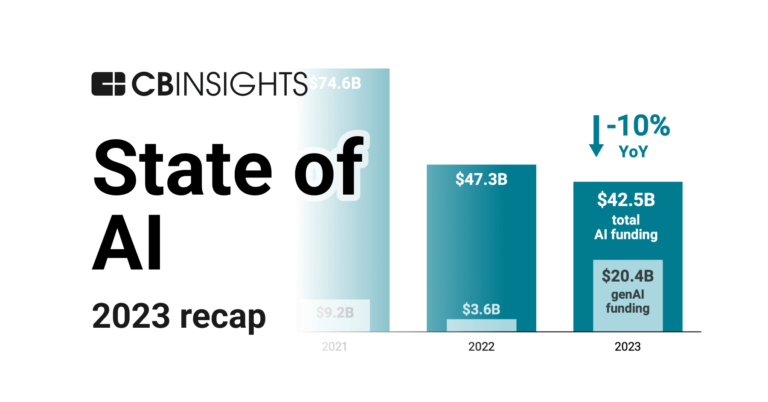

Feb 1, 2024 report

State of AI 2023 Report

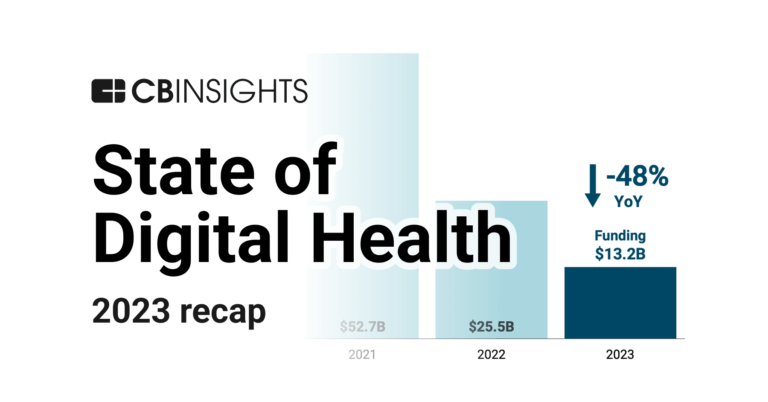

Jan 25, 2024 report

State of Digital Health 2023 Report

Jan 4, 2024 report

State of Venture 2023 ReportLatest Plug and Play Ventures News

Apr 11, 2025

Plug and Playの投資部門であるPlug and Play Ventures は、投資件数において世界で最も活発なベンチャーキャピタルの1つです。これまでに2,000社以上の投資実績を有し、多数のユニコーン企業を輩出してきました。 投資先一例:PayPal, SoundHound, Course Hero, Dropbox, LendingClub, Honey, Guardant Health, N26, Rappi, Hippo, Apply Board, Kustomer, BigIDなど。 年間約250社に投資を行っており、これまでのポートフォリオ企業のうち、31社がユニコーン企業となりました。日本では2019年から本格的に投資活動をスタートし、アクセラレータープログラムへの採択の如何や事業領域を問わず、国内スタートアップを対象に投資を実施しています。 Plug and Play投資先ユニコーン企業30社

Plug and Play Ventures Investments

2,177 Investments

Plug and Play Ventures has made 2,177 investments. Their latest investment was in Stairling as part of their Pre-Seed on June 23, 2025.

Plug and Play Ventures Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

6/23/2025 | Pre-Seed | Stairling | $1.73M | Yes | 199 Ventures, Fabrice Lepine, Guillaume Moubeche, HOOK, Kima Ventures, and Source Ventures | 2 |

6/19/2025 | Seed VC - III | Winalist | $1.14M | No | Portugal Ventures, Undisclosed Investors, and Vessoa Private Equity | 2 |

6/5/2025 | Series A | Thread AI | $20M | Yes | Greycroft, Homebrew, Index Ventures, Meritech Capital Partners, and Scale Venture Partners | 2 |

6/1/2025 | Seed VC | |||||

5/28/2025 | Seed VC - II |

Date | 6/23/2025 | 6/19/2025 | 6/5/2025 | 6/1/2025 | 5/28/2025 |

|---|---|---|---|---|---|

Round | Pre-Seed | Seed VC - III | Series A | Seed VC | Seed VC - II |

Company | Stairling | Winalist | Thread AI | ||

Amount | $1.73M | $1.14M | $20M | ||

New? | Yes | No | Yes | ||

Co-Investors | 199 Ventures, Fabrice Lepine, Guillaume Moubeche, HOOK, Kima Ventures, and Source Ventures | Portugal Ventures, Undisclosed Investors, and Vessoa Private Equity | Greycroft, Homebrew, Index Ventures, Meritech Capital Partners, and Scale Venture Partners | ||

Sources | 2 | 2 | 2 |

Plug and Play Ventures Portfolio Exits

253 Portfolio Exits

Plug and Play Ventures has 253 portfolio exits. Their latest portfolio exit was Frich on July 02, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

7/2/2025 | Acquired | Hokan Group | 2 | ||

6/27/2025 | Acq - Talent | 4 | |||

6/5/2025 | Asset Sale | 2 | |||

Date | 7/2/2025 | 6/27/2025 | 6/5/2025 | ||

|---|---|---|---|---|---|

Exit | Acquired | Acq - Talent | Asset Sale | ||

Companies | |||||

Valuation | |||||

Acquirer | Hokan Group | ||||

Sources | 2 | 4 | 2 |

Plug and Play Ventures Fund History

4 Fund Histories

Plug and Play Ventures has 4 funds, including Plug and Play Supply Chain Fund I.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

4/19/2022 | Plug and Play Supply Chain Fund I | $25.5M | 1 | ||

Plug & Play Growth Fund | |||||

Plug & Play Umbrella Fund | |||||

Plug & Play Future Commerce Fund I |

Closing Date | 4/19/2022 | |||

|---|---|---|---|---|

Fund | Plug and Play Supply Chain Fund I | Plug & Play Growth Fund | Plug & Play Umbrella Fund | Plug & Play Future Commerce Fund I |

Fund Type | ||||

Status | ||||

Amount | $25.5M | |||

Sources | 1 |

Plug and Play Ventures Partners & Customers

10 Partners and customers

Plug and Play Ventures has 10 strategic partners and customers. Plug and Play Ventures recently partnered with The Rawlings Group on June 6, 2024.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

6/17/2024 | Partner | United States | We 're confident the unique insights provided by the Plug and Play Ventures team and new relationships available to Rawlings through this relationship will further our success and growth in the healthcare ecosystem , '' said Ryan Little , CEO of The Rawlings Company . | 1 | |

6/1/2023 | Partner | Netherlands | The joint partnership was officially announced at Plug and Play Travel Vienna 's EXPO on June 1 , 2023 , in the AirportCity Space at the Vienna International Airport , where one of Plug and Play programs is based and where SkyTeam will become an official partner . | 1 | |

11/15/2022 | Partner | Netherlands, Gibraltar, United Kingdom, and United States | `` AllianceBlock is excited about our partnership with Plug and Play Crypto . | 1 | |

8/23/2022 | Partner | ||||

6/15/2022 | Partner |

Date | 6/17/2024 | 6/1/2023 | 11/15/2022 | 8/23/2022 | 6/15/2022 |

|---|---|---|---|---|---|

Type | Partner | Partner | Partner | Partner | Partner |

Business Partner | |||||

Country | United States | Netherlands | Netherlands, Gibraltar, United Kingdom, and United States | ||

News Snippet | We 're confident the unique insights provided by the Plug and Play Ventures team and new relationships available to Rawlings through this relationship will further our success and growth in the healthcare ecosystem , '' said Ryan Little , CEO of The Rawlings Company . | The joint partnership was officially announced at Plug and Play Travel Vienna 's EXPO on June 1 , 2023 , in the AirportCity Space at the Vienna International Airport , where one of Plug and Play programs is based and where SkyTeam will become an official partner . | `` AllianceBlock is excited about our partnership with Plug and Play Crypto . | ||

Sources | 1 | 1 | 1 |

Compare Plug and Play Ventures to Competitors

500 Global operates a venture capital firm. It is an early-stage seed fund that invests primarily in consumer and small and medium business (SMB) internet companies and related web infrastructure services. It prefers to invest in media, consumer services, computer hardware, software, commercial services, software-as-a-service, mobile, financial technology, big data, the internet of Things (IoT), and e-commerce sectors. It was founded in 2010 and is based in San Francisco, California.

Rice AI Venture Accelerator Program, which advances early-stage artificial intelligence innovation and commercialization within different sectors. The program provides AI research, resources, and a network of early-stage AI startups, serving Fortune 500 companies and public sector organizations looking to integrate AI into their operations. It was founded in 2025 and is based in Houston, Texas.

LaunchPad is a venture builder that identifies and maximizes tech-related opportunities across Southeast Asia. It supports ventures in the pre-seed to seed stages, putting in the initial investment, which typically ranges from US$50,000 to US$100,000. It was founded in 2015 and is based in Petaling Jaya, Malaysia.

AngelList specializes in providing a suite of services and software for the venture capital and private equity sectors. The company's main offerings include tools for venture fund management, rolling fund administration, and syndicate capital raising, as well as equity management solutions for high-growth companies. AngelList's platform is designed to streamline fund management and investor relations, offering features such as cap table automation, investor onboarding, and portfolio management. It was founded in 2010 and is based in San Francisco, California.

MassChallenge is a startup accelerator that supports early-stage entrepreneurs. It awards cash prizes to winning startups with zero equity taken. It also offers additional benefits for startups, including mentorship and training, free office space, access to funding, legal advice, media attention, and in-kind support. The company was founded in 2009 and is based in Boston, Massachusetts.

Accel is a venture capital firm that invests in and partners with teams from the inception of private companies through their growth phases, primarily in the technology sector. Accel was formerly known as Accel Partners. It was founded in 1983 and is based in Palo Alto, California.

Loading...