Pleo

Founded Year

2015Stage

Incubator/Accelerator | AliveTotal Raised

$471.62MRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+24 points in the past 30 days

About Pleo

Pleo focuses on business spend management within the financial technology sector. The company offers company cards with individual spending limits and provides a platform to manage expenses, reimbursements, invoices, and budgets. It serves businesses looking to manage their spending and financial processes. The company was founded in 2015 and is based in København N, Denmark.

Loading...

Pleo's Product Videos

ESPs containing Pleo

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The spend management platforms market helps businesses control and optimize their expenditures through integrated software solutions, including corporate cards, expense management systems, procurement software, accounts payable automation, and budget tracking tools. These platforms use APIs, cloud-based infrastructure, and AI-powered analytics to provide real-time visibility into spending patterns…

Pleo named as Leader among 15 other companies, including Coupa, Ramp, and Brex.

Pleo's Products & Differentiators

Smart company cards

Commercial Mastercards (physical, virtual, Apple Pay, Google Pay) distributed across a business to whoever needs to buy something for work.

Loading...

Research containing Pleo

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Pleo in 4 CB Insights research briefs, most recently on Jun 6, 2025.

Jun 6, 2025

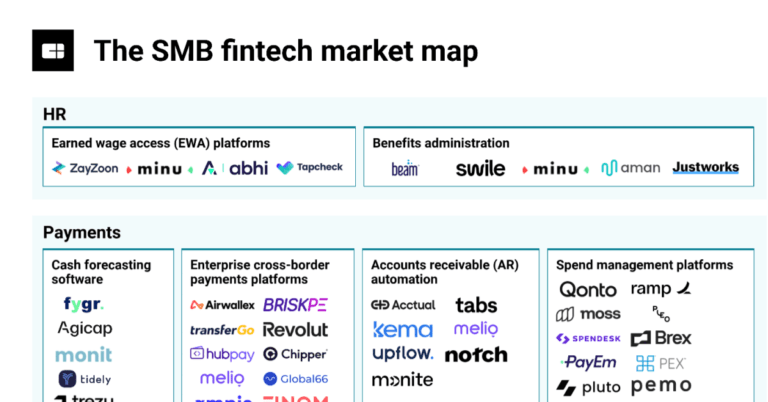

The SMB fintech market map

Aug 23, 2024

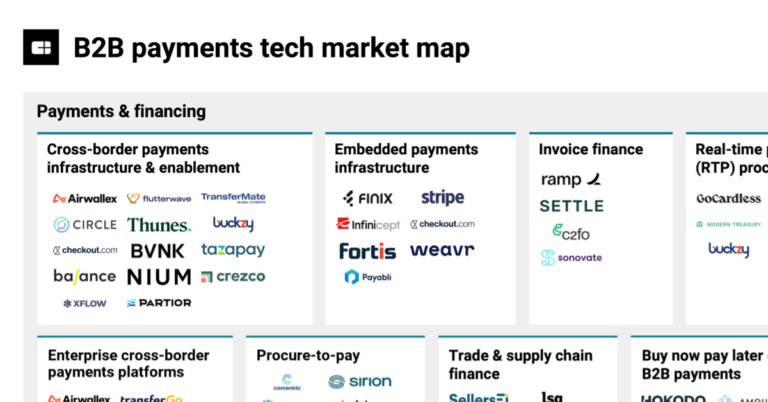

The B2B payments tech market mapExpert Collections containing Pleo

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Pleo is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,276 items

Payments

3,198 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,978 items

Excludes US-based companies

Fintech 100

499 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest Pleo News

Jun 20, 2025

9 Best Expense Management Software in 2025 Like Read Time: min Leveraging technology is what separates good companies from great ones. Businesses that invest in technology and understand how to maximize their digital tools’ potential can become more efficient and grow faster. In today’s competitive business landscape, it’s critical to ensure every expense is justified. That is why investing in the best expense management software is vital to stay ahead of the curve. Expense software automates your expenses, effectively eliminating manual data entry, and saves you time. We’ve outlined the top 9 expense management software on the market in 2025. You’ll learn about what key features to look for and compare which expense software is best for your team. What is Expense Management Software? The top expense management software in 2025 simplifies how you track your finances, generate custom reports, and control your business expenses. These platforms are designed to improve your efficiency by eliminating the need to manually input data. The right expense management software automates expense approvals and reimbursements, enables receipt scanning, and saves you time managing your budget. With a centralized platform, you’ll be able to gain real-time visibility into your finances and make smarter and well-informed decisions. Best Expense Management Software Comparison Platform Can integrate with other Zoho modules (Zoho Books, Zoho CRM, etc.) Customize your approval workflow Key Features of Expense Management Tools Investing in a business expenses platform provides several benefits for both companies and employees. From a business perspective, an efficient expense management tool helps: Automate processes: Automating expense recording and the categorization of expenses means less manual work and fewer human errors. This frees up your HR team’s time and allows them to focus on making more strategic decisions. Compliance: Prevent fraudulent activities from occurring by configuring your software to adhere to company policies, tax regulations, and other financial rules to ensure compliance. Additionally, it ensures you are abiding by reimbursement policies and being transparent with other finances in the company. Financial reporting & analytics: Provide real-time insights into business spending to help you make well-informed decisions to allocate budgets and make any cuts. Expense software makes it easier to identify opportunities to reduce expenses or optimize resources. Employees also benefit from having an expense management software. Digitize receipts: Employees can scan and digitally upload their receipt details, making the expense reporting process quicker than ever. Once scanned, your platform will automatically input all necessary information (transaction date, expense type, and amount). Quick reimbursement process: Thanks to receipt capture, submitting expenses accelerates the reimbursement process, leading to faster approvals. Meaning you’ll get your money back in a timely manner, and your managers have one less thing they need to worry about. Simple reporting: Tracking expenses and organizing your business expenses for your finance team is easier than before. No more need for manual work, automate how you submit expense reports. Top 9 Best Expense Management Software 1. Factorial: Business Management Software with Core Expense Management Functions Factorial is a robust platform that syncs HR functions, workforce management, and expense tracking in one, easy-to-use tool. The perfect solution for all companies that digitizes and automates manual work so you can save time. In fact, Factorial saves you 10 minutes for each receipt you manage! If you’ve ever been on a business trip, you know getting 6 receipts is easy… and without Factorial, categorizing and manually inputting the data from those receipts would take one hour. Additionally, its integrated expense software safely and securely automates the entire approval and reporting process. That way, you don’t have to deal with physical receipts, bills, or Excel spreadsheets, and streamline your approval system. Factorial’s key features are: Scanning and uploading receipts Reimburse your team directly through payroll Supports 170+ currencies (USD, EUR, GBP, AED, etc.) In addition to digitizing your expense management process, you can also automate your essential HR functions. From attendance tracking to shift scheduling to managing PTO requests, Factorial is your go-to platform for all things business-related. That’s why Factorial is one of the best tools for managing your expenses, because it is connected with everything else. 2. Expensify This platform comes with a wide range of features that support expense management and financial reporting. With Expensify, the process of reporting business expenses is streamlined and automated through their receipt capture feature. By centralizing and digitizing your receipts, you eliminate the need to keep paper documents and reduce the amount of manual work involved in expense tracking. Additionally, Expensify has a built-in AI, Concierge, that handles a wide range of tasks. This feature significantly reduces the amount of admin work needed from both employers and employees. However, if you are a global team, this platform may not support all your needs. Expensify is primarily US-based and lacks features to support global payouts. 3. Pleo What makes Pleo’s expense software unique is its smart company cards. These cards can be tailored to each employee’s role and spending limits. This allows managers to have better control of their business expenses to prevent overspending and misuse of company funds. Additionally, Pleo has all the necessary expense management features, including real-time data, receipt scanning, and reimbursement capabilities. Overall, Pleo is a great tool to help gain control and visibility over employee spending and financial decisions. However, this software is ideal for EU companies and has limited capabilities for other international companies. 4. Emburse Professional Emburse is a great option for companies of all sizes. Its expense management features are user-friendly and easy to adopt. Reimbursing expenses is seamless with their credit card integration. Transactions made from an employee’s corporate credit card will automatically be uploaded to the platform and matched with its corresponding receipts. Ultimately, streamlining expense claims, minimizing human errors, and speeding up reimbursement time. Additionally, you can review and edit to ensure 100% accuracy in your financial reports. Through these reports, you can analyze how budgets are being spent and make cuts or smarter decisions with your company’s money. In general, Emburse offers a comprehensive expense management solution. Its platforms provides teams with valuable insights into their spending patterns, more control over their spending, and reduces the risk of fraud or misuse of company expenses. 5. SAP’s Concur Expense SAP’s Concur Expense is a popular option that provides features like expense tracking, automations for workflows, and processes reimbursements. Its platform offers a robust suite that allows you to customize your workflows to match your company policies. You can also create multi-tiered approval chains to prevent any misuse of company funds. The downside is that Concur Expense doesn’t offer corporate cards; however, a key feature of Concur Expense is its ability to integrate with travel booking systems. This is particularly useful for companies where frequent travel and expense reporting are common. With this particular integration, travel expenses are automatically uploaded and inputted, making the process more efficient. This means you’ll have real-time data on your travel expenses without waiting. 6. Spendesk Spendesk offers smart company cards, receipt scanning, and automatic expense categorization. Its platform was designed to provide you with more expense data and add transparency to your business spending. Like other expense tools, you can integrate your accounting software, such as QuickBooks, to have everything in one centralized platform. With their receipt capture, you’re able to simplify expense reporting and also ensure all transactions are accurately documented. In turn, streamlining how you reimburse expenses to your team. Unfortunately, Spendesk doesn’t support spend and reimbursements in currencies outside of USD, EUR, or GBP, meaning it isn’t aligned with global teams. 7. Brex This is one of the best expense management software for US-focused companies. Its AI-powered assistant reviews your expenses and ensures it’s aligned with your spending policies. This prevents any overspending from occurring and ensures your team is on track to hit their objectives. Additionally, Brez has powerful integration capabilities that allows businesses to sync their financial reporting to their expense management software. This reduces tedious, manual data entry and the risk of mistakes. Moreover, you’ll be able to identify opportunities to cut costs and have real-time visibility into your spending. 8. Paylocity Paylocity is a popular choice for employers looking for a unified expense management solution with core HR functions. This platform provides expense tracking features that make it easy and quick for employees to submit expenses. With the mobile app, uploading receipts and submitting them for reimbursement speeds up the process and avoids delays from occurring. Moreover, employers benefit from the visibility they gain from reporting tools and automatic approval workflows. Paylocity is well-suited for companies that want to centralize their business processes and combine finances with HR. 9. Zoho Expense Zoho Expense can be the right solution if you are looking for an easy-to-use software that, at the same time, provides all the essential features to digitize the business expense management process. The free plan already guarantees some basic features, such as scanning and archiving receipts, creating expense reports and reports, integration with accounting and exporting data in different formats. Choosing the Best Expense Management Software Knowing what platform to invest in can be confusing at first. But with our list of the best expense software on the market in 2025, you’ll be able to make a confident decision. Take into consideration the following when choosing an expense tool: Features: What features do they offer (receipt capture, automations, real-time notifications, etc.)? Cost savings: Will this platform provide me with meaningful and valuable information to help optimize my business costs? Usability: Is the interface easy to navigate? Will employees and managers both benefit? Integration: How well does it integrate with your other tools? Does it integrate with your accounting software Policy enforcement: Will you be able to customize spending limits? How will they be enforced? Ensure you are investing in a solution that streamlines your financial processes and optimizes spending across teams. These solutions will make tracking and controlling your employee expenses easier so you can focus less on finances and more on making a strategic impact.

Pleo Frequently Asked Questions (FAQ)

When was Pleo founded?

Pleo was founded in 2015.

Where is Pleo's headquarters?

Pleo's headquarters is located at Ravnsborg Tværgade 5C, København N.

What is Pleo's latest funding round?

Pleo's latest funding round is Incubator/Accelerator.

How much did Pleo raise?

Pleo raised a total of $471.62M.

Who are the investors of Pleo?

Investors of Pleo include Leading European Tech Scaleups, HSBC Innovation Banking, Founders, Creandum, Kinnevik and 15 more.

Who are Pleo's competitors?

Competitors of Pleo include Capital on Tap, Pliant, Yokoy, Brex, Mobilexpense and 7 more.

What products does Pleo offer?

Pleo's products include Smart company cards and 4 more.

Loading...

Compare Pleo to Competitors

Spendesk provides financial management tools for businesses. It offers tools including corporate cards, automated invoice handling, procure-to-pay solutions, integrated budgeting features, virtual cards for payments, and expense claim management. It serves various sectors of the economy, including manufacturing, retail, green energy, and marketing. It was founded in 2016 and is based in Paris, France.

Brex provides spend management solutions across various sectors. The company offers products including corporate cards, expense management, travel, bill pay, and banking services aimed at assisting businesses in managing spending and financial processes. Brex serves startups, mid-size companies, and enterprises with its range of financial products. Brex was formerly known as Veyond. It was founded in 2017 and is based in Salt Lake City, Utah.

Payhawk provides corporate spend management solutions within the financial technology sector. It offers a platform that includes corporate cards, expense management, accounts payable, and accounting software for business payments and financial control. Payhawk's services aim to automate expense reporting and reconciliation and provide visibility and control over company spending, while also integrating with existing financial systems. It was founded in 2018 and is based in London, United Kingdom.

Soldo provides spend management solutions within the financial services sector. The company offers a platform that connects with financial systems to manage corporate spending through company cards, a mobile app for tracking expenses, and tools for financial compliance. Soldo serves businesses that need to manage their expense processes and gain insights into their spending. Soldo was formerly known as PX Technology. It was founded in 2014 and is based in London, United Kingdom.

Ramp develops a financial operations platform. The company offers a suite of services including corporate cards, expense management, accounts payable solutions, and accounting automation. Its platform serves startups, small businesses, mid-market companies, and enterprises across various sectors. The company was founded in 2019 and is based in New York, New York.

Moss is a company that provides spend management solutions within the financial technology sector. The company has a platform that allows businesses to manage expenses, handle month-end financial closing, and connect with existing human resources and accounting systems. Moss serves finance teams that require expense management tools. It was founded in 2019 and is based in Berlin, Germany.

Loading...