Plaid

Founded Year

2013Stage

Unattributed VC | AliveTotal Raised

$1.31BValuation

$0000Last Raised

$575M | 3 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+68 points in the past 30 days

About Plaid

Plaid connects users to financial data and services. It provides products that link users' financial accounts to applications, verify identities, and support secure money movement. Its solutions include fraud prevention, credit underwriting, and personal finance insights. It was founded in 2013 and is based in San Francisco, California.

Loading...

ESPs containing Plaid

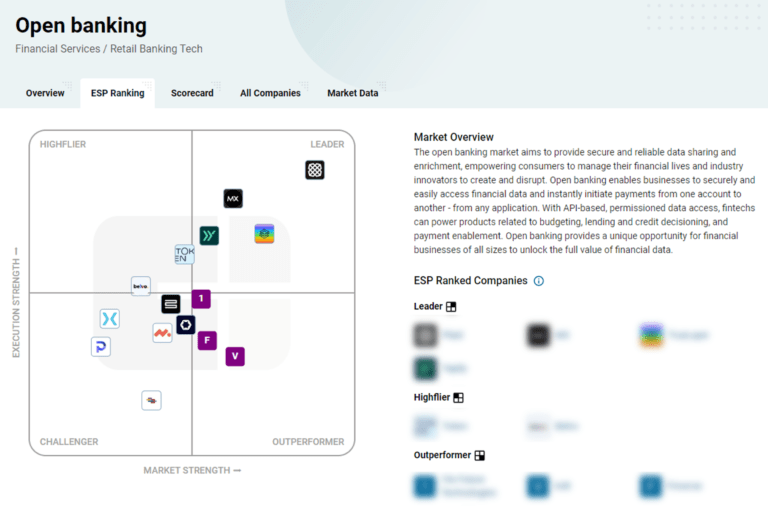

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The lending APIs & infrastructure market provides end-to-end solutions for digital lending operations, including loan management systems, risk management tools, and compliance management capabilities. These platforms enable financial institutions to originate, process, and service loans through API-driven architecture that supports integration with existing systems. The market encompasses core ban…

Plaid named as Challenger among 15 other companies, including Oracle, Fiserv, and FIS.

Plaid's Products & Differentiators

Transacttions

Retrieve typically 24 months of transaction data, including enhanced geolocation, merchant, and category information. Stay up-to-date by receiving notifications via a webhook whenever there are new transactions associated with linked accounts.

Loading...

Research containing Plaid

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Plaid in 14 CB Insights research briefs, most recently on Sep 27, 2024.

May 8, 2024

The embedded banking & payments market map

Jan 4, 2024

The core banking automation market map

Expert Collections containing Plaid

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Plaid is included in 8 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,276 items

Fintech 100

997 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Digital Lending

2,567 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Payments

3,198 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Tech IPO Pipeline

825 items

Fintech

9,653 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Plaid Patents

Plaid has filed 70 patents.

The 3 most popular patent topics include:

- data management

- payment systems

- banking technology

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

6/16/2022 | 3/25/2025 | Data management, Computer security, Payment systems, Computer network security, Internet privacy | Grant |

Application Date | 6/16/2022 |

|---|---|

Grant Date | 3/25/2025 |

Title | |

Related Topics | Data management, Computer security, Payment systems, Computer network security, Internet privacy |

Status | Grant |

Latest Plaid News

Jul 3, 2025

By PYMNTS | July 3, 2025 | Real-time payments are expanding as financial institutions (FIs), FinTechs and central banks introduce new solutions to meet growing demand. Innovations in North America, Europe and Latin America are making instant settlement a standard expectation across industries. Get the Full Story Complete the form to unlock this article and enjoy unlimited free access to all PYMNTS content — no additional logins required. yesSubscribe to our daily newsletter, PYMNTS Today. By completing this form, you agree to receive marketing communications from PYMNTS and to the sharing of your information with our sponsor, if applicable, in accordance with our Privacy Policy and Terms and Conditions . Δ Plaid is one of the latest players advancing this trend. In June, the company added instant pay-in support via the RTP® network to its Plaid Transfer product. Businesses can now request and receive customer payments in real time. This allows for accelerated cash flow and improved security without exposing sensitive banking details. This enhancement reduces payment failures and eliminates the delays often associated with ACH transfers. ACI Worldwide is also helping reshape global payments with ACI Connetic, a cloud-native payments hub . The hub was designed to simplify operations for banks and FIs. The platform supports real-time settlement through major European systems like TARGET2, SEPA Instant RT1 and TIPS, while offering cross-border capabilities through SWIFT. Artificial intelligence (AI)-driven fraud detection further enhances transaction security. In Brazil, PPRO has integrated Pix Automático into its platform. The move enables merchants and payment service providers (PSPs) to offer seamless recurring payments through the country’s instant payment system, Pix. This integration allows businesses to support subscription-based services and automated billing for utilities with a single upfront customer consent — eliminating the need for repeated payment approvals. For the 60 million Brazilians without credit cards, this enhancement reduces friction and expands access to digital financial services, supporting financial inclusion while helping merchants improve customer retention. Montenegro’s central bank has also made strides by launching RTS/X. The banks’ new payment platform provides near-instant settlement for transactions up to 1,000 euros (about $1,200). Built on ISO 20022 standards, RTS/X ensures secure, irreversible payments, and there are plans to expand availability to weekends. The upcoming TIPS Clone, a collaboration with Banca d’Italia, is set to further enhance Montenegro’s real-time capabilities in 2026. This edition highlights these developments, signaling a future where instant payments are no longer optional — but essential. Download the World Map The Real-Time Payments World Map By completing this form, I have read and acknowledged the Terms and Conditions and agree that PYMNTS may contact me at the email address above. Δ About the Real-Time Payments World Map The “Real-Time Payments World Map,” a collaboration with The Clearing House , explores the latest developments fueling the rapid expansion of instant transactions worldwide. Recommended

Plaid Frequently Asked Questions (FAQ)

When was Plaid founded?

Plaid was founded in 2013.

Where is Plaid's headquarters?

Plaid's headquarters is located at San Francisco.

What is Plaid's latest funding round?

Plaid's latest funding round is Unattributed VC.

How much did Plaid raise?

Plaid raised a total of $1.31B.

Who are the investors of Plaid?

Investors of Plaid include New Enterprise Associates, Ribbit Capital, BlackRock, Franklin Templeton, Fidelity and 27 more.

Who are Plaid's competitors?

Competitors of Plaid include Yodlee, Solaris, Finix, Nymbus, Bud and 7 more.

What products does Plaid offer?

Plaid's products include Transacttions and 4 more.

Loading...

Compare Plaid to Competitors

Yapily is an open banking infrastructure platform that specializes in providing secure connectivity between customers and banks across Europe. The company offers services that enable access to financial data and the initiation of payments, aiming to facilitate the creation of personalized financial experiences. Yapily primarily serves industries such as payment services, i-gaming, accounting, lending and credit, crypto, property technology (PropTech), investing, and digital banking. Yapily was formerly known as Acacia Connect. It was founded in 2017 and is based in London, United Kingdom.

Powens is an open finance platform that provides embedded finance and payment experiences within the financial services industry. The company offers solutions including data and document aggregation, identity verification, and various accounts and payment services aimed at supporting financial operations. Powens serves banking groups, insurance firms, software vendors, tech companies, and telecommunications and utilities companies. Powens was formerly known as Budget Insight. It was founded in 2012 and is based in Paris, France. Powens operates as a subsidiary of Arkea.

Railsr is a global embedded finance platform that provides Banking as a Service (BaaS) and Cards as a Service (CaaS) in the financial technology sector. The company offers services including digital wallets, banking, and card solutions, which are integrated into customer experiences for financial transactions. It serves fintech startups, scale-ups, sports clubs, and brands that implement embedded finance experiences. Railsr was formerly known as Embedded Finance Limited. It was founded in 2016 and is based in London, United Kingdom. In April 2025, Railsr merged with Equals Money.

TrueLayer is an open banking platform that specializes in the financial services industry. The company offers a suite of products that enable instant bank payments, fast and verified payouts, streamlined user onboarding, and variable recurring payments, all designed to facilitate safer and more efficient financial transactions. TrueLayer primarily serves sectors such as e-commerce, gaming, financial services, travel, and cryptocurrency markets. TrueLayer was formerly known as Finport. It was founded in 2016 and is based in London, United Kingdom.

Fabrick is a open finance platform. The company offers payment solutions that enable and foster a fruitful exchange between players that discover, collaborate, and create solutions for end customers. Fabrick was founded in 2018 and is based in Biella, Italy.

Yodlee provides data aggregation and analytics for the financial services industry. The company offers services such as financial data aggregation, account verification, transaction data enrichment, and financial wellness solutions, powered by APIs and analytics. Yodlee's products assist financial institutions and FinTech companies in developing financial applications and services. It was founded in 1999 and is based in Berwyn, Pennsylvania.

Loading...