Placer.ai

Founded Year

2018Stage

Series D | AliveTotal Raised

$277.9MValuation

$0000Last Raised

$75M | 1 yr agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+21 points in the past 30 days

About Placer.ai

Placer.ai is a company specializing in location intelligence and foot traffic data within the analytics and data science industry. The company provides an analytics platform for sectors like retail, commercial real estate, and economic development. Placer.ai's services are utilized by professionals in retail, real estate, hospitality, and economic development to make decisions based on consumer behavior and foot traffic patterns. It was founded in 2018 and is based in Covina, California.

Loading...

Placer.ai's Product Videos

ESPs containing Placer.ai

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The retail spatial intelligence & traffic analytics market provides solutions for retailers to gather and analyze customer movement data in physical spaces. These solutions leverage various technologies such as indoor positioning, people counting sensors, and AI-powered computer vision that integrate with existing camera infrastructure to track customer and staff movement patterns. Key features in…

Placer.ai named as Leader among 15 other companies, including CARTO, Gorilla Technology, and RetailNext.

Placer.ai's Products & Differentiators

Platform

The Placer platform is the company's core product offering bringing the proprietary data to customers within easy-to-consume dashboards that enable enhanced accessibility. The core product is being constantly upgraded with new features and product updates hitting on a monthly basis. The ability to bring industry leading accuracy and accessibility together is a core strength for the product and company.

Loading...

Research containing Placer.ai

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Placer.ai in 2 CB Insights research briefs, most recently on Aug 14, 2023.

Aug 14, 2023

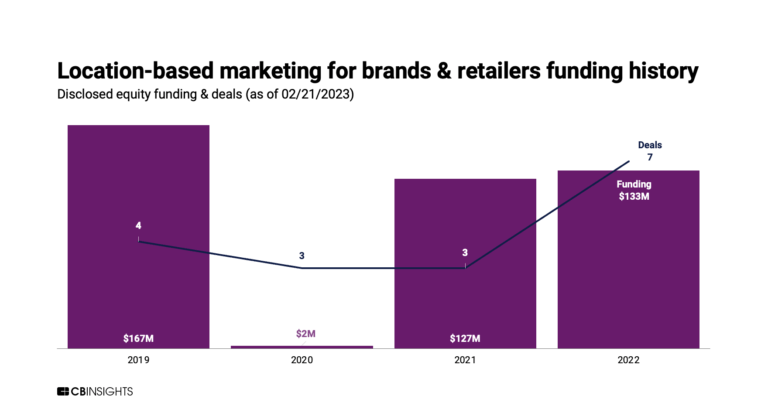

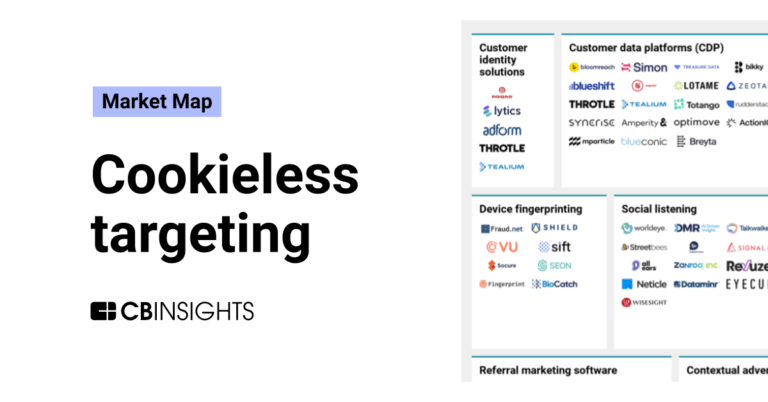

The cookieless targeting market mapExpert Collections containing Placer.ai

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Placer.ai is included in 8 Expert Collections, including Store tech (In-store retail tech).

Store tech (In-store retail tech)

1,852 items

Companies that make tech solutions to enable brick-and-mortar retail store operations.

Unicorns- Billion Dollar Startups

1,276 items

Conference Exhibitors

5,302 items

Targeted Marketing Tech

659 items

This Collection includes companies building technology that enables marketing teams to identify, reach, and engage with consumers seamlessly across channels.

Retail Tech 100

100 items

The most promising B2B tech startups transforming the retail industry.

Retail Media Networks

324 items

Tech companies helping retailers build and operate retail media networks. Includes solutions like demand-side platforms, AI-generated content, digital shelf displays, and more.

Latest Placer.ai News

Jun 30, 2025

Retail traffic has remained steady this year, which bodes well for retailers ahead of back-to-school shopping. That’s according to a new report from Placer.ai, which found that overall retail traffic in 2025 has remained generally on par with 2024 levels. Between January and May 2025, retail visits were 0.4% higher than for the equivalent period in 2024, with April and May 2025 visits up 2.3% and 1.3%, respectively. The strongest year-over-year visit increase in 2025 so far in January – when visits were up 3.4% compared to January 2024. Advertisement - article continues below Image courtesy of Placer.ai. With the consumer remaining “resilient,” according to Placer.ai, certain categories are primed to perform better than others during the back-to-school push. Last year, sportswear & athleisure and footwear retailers saw the largest back to school visit jumps, followed by office supplies and traditional apparel (excluding off-price, department stores, and sportswear & athleisure). These segments all saw slight visit increases in May 2025 and are likely to continue seeing sizable traffic spikes for back to school season this year. However, Placer.ai says that visit data from April and March of this year reveals that the retail categories seeing the strongest visit trends currently are the segments that get a slightly smaller boost from back-to-school – including furniture & home furnishings, off-price retailers, and thrift stores. Placer.ai noted that some of this strength may be attributed to pull-forward of demand or to shoppers' value-orientation (driving visits up for off-price and thrift stores). However, these categories' recent success may also suggest that home furnishings, off-price apparel, and thrift stores could see higher volumes of consumer traffic this year compared to 2024. Image courtesy of Placer.ai. Image courtesy of Placer.ai. A recent report from PwC reveals that nearly three-in-four back-to-school shoppers expect to spend the same or more on back-to-school shopping this fall. More than one-in-three parents anticipate spending more than they did in 2024. Placer.ai also offered a breakdown of predicted back-to-school season success by state. Retail traffic in Oregon, Washington, Idaho, and Montana was 3.0% to 5.1% in May 2025 higher than in May 2024, while Utah's retail chains received a 5.0% year-over-year boost in traffic. Consumers in these states may be particularly primed to spend this summer. Meanwhile, several Eastern states (Ohio, New York, Mississippi, Alabama and Georgia) saw annual declines in May 2025 retail visits, which could suggest that consumer confidence in those states is slightly more muted. “Ahead of the 2025 back to school season, retail traffic data paints the picture of a generally resilient consumer, despite the regional variability,” said Shira Petrack, content manager at Placer.ai. “And while last year's big back-to-school winners will likely perform well again in 2025, more secondary back-to-school categories – including home furnishings, off-price, and thrift stores – may be the ones to come out on top this year.”

Placer.ai Frequently Asked Questions (FAQ)

When was Placer.ai founded?

Placer.ai was founded in 2018.

Where is Placer.ai's headquarters?

Placer.ai's headquarters is located at 440 North Barranca Avenue, Covina.

What is Placer.ai's latest funding round?

Placer.ai's latest funding round is Series D.

How much did Placer.ai raise?

Placer.ai raised a total of $277.9M.

Who are the investors of Placer.ai?

Investors of Placer.ai include Array Ventures, Josh Buckley, Fifth Wall, WndrCo, MMC Technology Ventures and 30 more.

Who are Placer.ai's competitors?

Competitors of Placer.ai include Foursquare, xMap, Plaace, Geoblink, Gravy Analytics and 7 more.

What products does Placer.ai offer?

Placer.ai's products include Platform and 2 more.

Who are Placer.ai's customers?

Customers of Placer.ai include Newmark Merrill.

Loading...

Compare Placer.ai to Competitors

Foursquare provides a geospatial technology platform that focuses on location intelligence and analytics. The company provides various solutions to assist businesses in understanding locations and human mobility, which may influence revenue, marketing, and product strategies. Its tools are used by enterprises to gain insights into consumer behavior. It was founded in 2009 and is based in New York, New York.

GroundTruth is a media platform that operates within the advertising technology sector. The company provides advertising campaigns that utilize consumer behavior data, including location and purchase data, to assess the effectiveness of ads across different screens. GroundTruth primarily serves advertisers aiming to understand customer engagement and enhance store visits and sales through advertising. GroundTruth was formerly known as xAd. It was founded in 2009 and is based in New York, New York.

Cuebiq focuses on offline behavior measurement and analytics within the marketing and advertising technology sectors. The company provides tools for measuring advertising efforts and targeting audiences based on offline behaviors. Cuebiq serves marketers, agencies, data analysts, and technology providers who use location data for decision-making. It is based in New York, New York.

SafeGraph specializes in curating geospatial data for analytics and is a key player in the data services industry. The company offers a comprehensive suite of products, including detailed point of interest (POI) data, building footprint information, and attributes that provide context and precision to geospatial analyses. SafeGraph's data solutions cater to a variety of sectors, such as retail site selection, competitive intelligence, risk assessment, and consumer behavior analysis. It was founded in 2016 and is based in Denver, Colorado.

Adsquare is a location intelligence platform that provides tools for campaign planning, activation, measurement, and attribution, using geospatial data science to support marketing activities. Adsquare serves advertisers, media agencies, and out-of-home advertising operators within the advertising ecosystem. It was founded in 2012 and is based in Hennigsdorf, Germany.

Cosmose helps to understand, predict, and influence people to shop offline. It offers an offline behavioral data technology that helps brands and marketers influence and predict consumers' choices, targets them with online ads, and measures online campaigns' impact on offline visits and sales. It uses AI analytics to track in-store foot traffic and engage with shoppers online. The company was founded in 2014 and is based in Singapore.

Loading...