Pine Labs

Founded Year

1998Stage

Unattributed - IV | AliveTotal Raised

$1.127BValuation

$0000Last Raised

$50M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-10 points in the past 30 days

About Pine Labs

Pine Labs is a merchant platform that provides payment solutions across various business sectors. The company offers services, including in-store and online payment processing, customer loyalty programs, prepaid and gifting services, and analytics. Pine Labs serves sectors such as electronics, lifestyle, automobile, grocery, healthcare, and hospitality. It was founded in 1998 and is based in Noida, India.

Loading...

ESPs containing Pine Labs

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

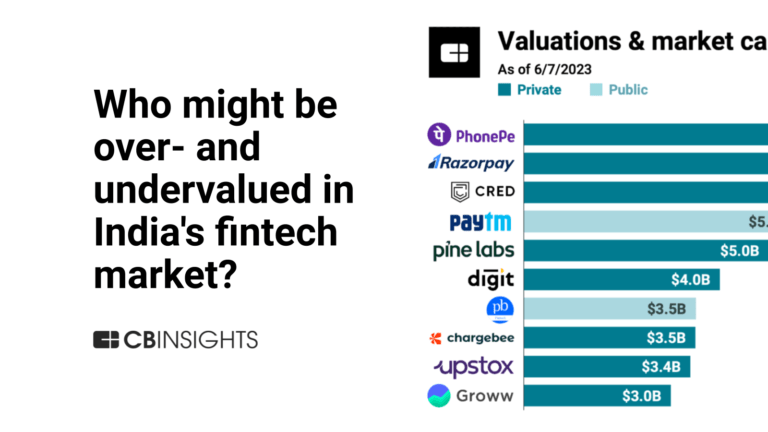

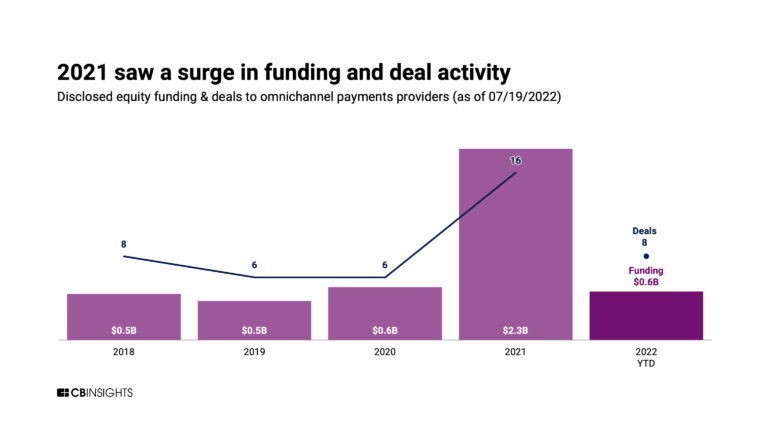

The omnichannel point-of-sale (POS) market, also called unified POS, provides integrated payment acceptance across digital and physical retail sales channels. These solutions provide the hardware and software to sync sales data, allowing for centralized transaction and inventory visibility. Some providers also offer customer service, shopper marketing, or sales analytics features. As more shopping…

Pine Labs named as Challenger among 15 other companies, including Fiserv, Stripe, and Shopify.

Loading...

Research containing Pine Labs

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Pine Labs in 3 CB Insights research briefs, most recently on Jun 14, 2023.

Expert Collections containing Pine Labs

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Pine Labs is included in 8 Expert Collections, including Store tech (In-store retail tech).

Store tech (In-store retail tech)

1,830 items

Companies that make tech solutions to enable brick-and-mortar retail store operations.

Unicorns- Billion Dollar Startups

1,276 items

SMB Fintech

1,648 items

Payments

3,397 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech 100

999 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Fintech

13,978 items

Excludes US-based companies

Latest Pine Labs News

Jul 7, 2025

Around 10 new-age companies are expected to raise Rs 18,000 crore through their upcoming IPOs. These IPOs include both fresh issues and offer-for-sale (OFS) components, giving early investors a chance to exit with good returns. Strong Exit for Venture Capital Firms These listings will give early-stage investors much-needed liquidity, especially those who stayed through tough market conditions and funding slowdowns. IPO: SmartWorks Coworking Spaces To Raise ₹583 Crore; Open For Public Subscription From July 10 To July 14 If most filings lead to successful listings, VC exits in 2025 could match or beat the record levels seen in 2024. Last year, venture investors earned USD 4.06 billion through IPO exits — up from USD 2.06 billion in 2023 and USD 1.5 billion in 2022. Startups That Have Filed DRHP with SEBI Startups that have filed draft papers with SEBI since late last year include: - Meesho (Rs 4,250 crore) - Pine Labs (Rs 2,600 crore) - Groww - PhysicsWallah (Rs 4,600 crore – India's first listed edtech if approved) - Urban Company (Rs 1,900 crore) - Wakefit (Rs 468 crore) - Curefoods (Rs 800 crore) - Shiprocket & Shadowfax (Rs 2,000–Rs 2,500 crore each) - IndiQube (Rs 850 crore) Gaja Capital Plans IPO, Files Draft Papers With Sebi Some filings are confidential. Most include OFS by investors like Lightspeed, Tiger Global, WestBridge, Temasek, Elevation Capital, Excel, and Peak XV. Sector Representation and Recent Success These companies represent sectors like fintech, e-commerce, edtech, logistics, food, and co-working. This surge follows the successful IPO of MobiKwik, which listed at a 58 percent premium in December 2024. The listing of Smartworks is also scheduled to open on July 10, 2025, adding to the IPO momentum.

Pine Labs Frequently Asked Questions (FAQ)

When was Pine Labs founded?

Pine Labs was founded in 1998.

Where is Pine Labs's headquarters?

Pine Labs's headquarters is located at Candor TechSpace, 4th & 5th Floor, Noida.

What is Pine Labs's latest funding round?

Pine Labs's latest funding round is Unattributed - IV.

How much did Pine Labs raise?

Pine Labs raised a total of $1.127B.

Who are the investors of Pine Labs?

Investors of Pine Labs include Vitruvian Partners, Alpha Wave Global, State Bank of India, Invesco, Fidelity Investments and 24 more.

Who are Pine Labs's competitors?

Competitors of Pine Labs include ToneTag, Papara, Innoviti, Satispay, Klarna and 7 more.

Loading...

Compare Pine Labs to Competitors

PayNearMe develops technology to facilitate the end-to-end customer payment experience. It offers a billing and payment platform. Its platform helps users pay with cash for a range of goods and services from companies in e-commerce, property management, consumer finance, and transportation, enabling businesses and government agencies as well as retail stores to digitize cash collection processes. PayNearMe was formerly known as Handle Financial. The company was founded in 2009 and is based in Santa Clara, California.

Lemonway is a payment institution that specializes in providing payment processing and wallet management solutions for marketplaces, crowdfunding platforms, and e-commerce websites. The institution offers a modular payment system that enables clients to handle transactions, from collection to disbursement, with a focus on KYC/AML regulatory compliance. Lemonway primarily serves the e-commerce industry, crowdfunding platforms, and other online marketplaces. It was founded in 2007 and is based in Paris, France.

Klarna provides payment solutions and shopping services. The company offers price comparison, installment payments, and consumer financing for online shopping. Klarna serves the ecommerce industry, providing services to both consumers and retailers. Klarna was formerly known as Kreditor . It was founded in 2005 and is based in Stockholm, Sweden.

Cellulant develops an electronic payment service connecting customers with banks and utility services to create a payment ecosystem. It offers a single application program interface payments platform that provides locally relevant and alternative payment methods for global, regional, and local merchants. Its platform enables businesses to collect payments online and offline while allowing anyone to pay from their mobile money, local and international cards, and directly from their bank. It was founded in 2004 and is based in Nairobi, Kenya.

Previse specializes in financial transaction analytics and AI-driven insights within the fintech industry. The company offers a platform that connects, matches, and monitors data to provide insights for businesses. Previse's solutions cater to enterprises, financial institutions, and fintechs, focusing on automating payment processes, managing credit risk, and improving decision-making. It was founded in 2016 and is based in London, England.

TouchBistro focuses on providing an all-in-one point of sale (POS) and restaurant management system in the restaurant industry. The company offers a range of services, including front-of-house, back-of-house, and guest engagement solutions, which help restaurateurs streamline their operations, manage their menu, sales, staff, and more. Its services are designed to increase sales, improve guest experiences, and save time and money. It was founded in 2011 and is based in Toronto, Canada.

Loading...