Phantom

Founded Year

2021Stage

Series C | AliveTotal Raised

$268.5MValuation

$0000Last Raised

$150M | 6 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+85 points in the past 30 days

About Phantom

Phantom provides a multi-chain crypto wallet and web3 tools. It enables users to buy, trade, store, and manage their cryptocurrency assets, including non-fungible token (NFT) marketplace access, token swapping, and self-custodial security. It serves individuals interested in cryptocurrency and web3 technologies. It was founded in 2021 and is based in San Francisco, California.

Loading...

ESPs containing Phantom

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The web3 wallets market offers a decentralized solution for managing cryptocurrencies that is both user-friendly and secure. Prior to the emergence of web3 wallets, users had to choose between difficult-to-use decentralized options or centralized providers that were vulnerable to hacks and theft. Web3 wallets provide greater control over assets and enable faster innovation due to fewer technical, …

Phantom named as Leader among 15 other companies, including Coinbase, Ledger, and Binance.

Loading...

Research containing Phantom

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Phantom in 3 CB Insights research briefs, most recently on May 29, 2025.

May 29, 2025

The stablecoin market map

Apr 10, 2025 report

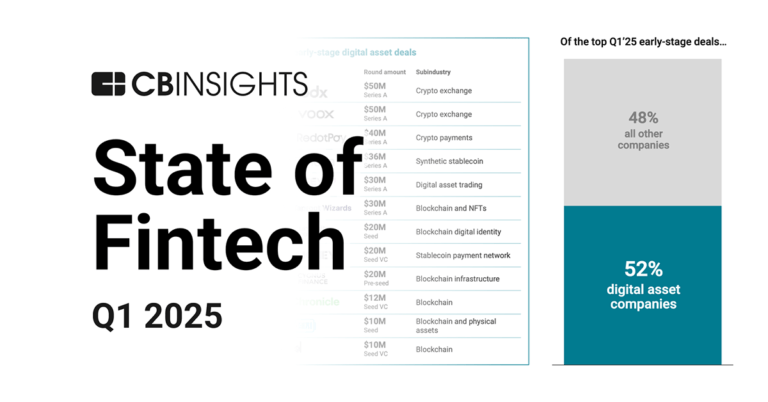

State of Fintech Q1’25 Report

Jul 29, 2022

Where a16z is investing in crypto and blockchainExpert Collections containing Phantom

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Phantom is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,277 items

Blockchain

15,472 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Fintech

9,653 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Stablecoin

433 items

Phantom Patents

Phantom has filed 10 patents.

The 3 most popular patent topics include:

- honeycombs (geometry)

- anonymity networks

- architecture

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

11/4/2022 | 11/12/2024 | House types, Honeycombs (geometry), Motorcycle engine manufacturers, Physical oceanography, House styles | Grant |

Application Date | 11/4/2022 |

|---|---|

Grant Date | 11/12/2024 |

Title | |

Related Topics | House types, Honeycombs (geometry), Motorcycle engine manufacturers, Physical oceanography, House styles |

Status | Grant |

Latest Phantom News

Jun 19, 2025

By emphasizing the fundamental differences between decentralized systems and traditional financial intermediaries, SPI and its partners seek exemptions that could foster innovation and clarity within the U.S. crypto regulatory framework. According to COINOTAG, SPI's proposal highlights that decentralized protocols operate without central custodianship, urging regulators to reconsider applying conventional securities laws to these autonomous blockchain networks. Solana Policy Institute urges SEC to exempt decentralized protocols from traditional securities laws, promoting innovation and clarity in U.S. crypto regulation. ‘, ‘ Advanced Trading Tools Await You! Maximize your potential. Join now and start trading! ‘, ‘ Professional Trading Platform Leverage advanced tools and a wide range of coins to boost your investments. Sign up now! ‘ ]; var adplace = document.getElementById(“ads-bitget”); if (adplace) { var sessperindex = parseInt(sessionStorage.getItem(“adsindexBitget”)); var adsindex = isNaN(sessperindex) ? Math.floor(Math.random() * adscodesBitget.length) : sessperindex; adplace.innerHTML = adscodesBitget[adsindex]; sessperindex = adsindex === adscodesBitget.length – 1 ? 0 : adsindex + 1; sessionStorage.setItem(“adsindexBitget”, sessperindex); } })(); Solana Policy Institute's Proposal: Advocating Regulatory Clarity for Decentralized Protocols The Solana Policy Institute's recent submission to the SEC marks a significant push for regulatory clarity tailored specifically to decentralized protocols. Unlike traditional financial entities such as brokers and custodians, decentralized protocols operate through automated code and community governance, lacking centralized control over user assets. SPI's proposal argues that applying existing securities regulations—designed for centralized intermediaries—to these protocols is both impractical and potentially detrimental to innovation. By advocating for exemptions based on the non-custodial and permissionless nature of these systems, SPI aims to establish a regulatory framework that acknowledges the unique operational characteristics of decentralized finance (DeFi) platforms and blockchain infrastructure. Understanding Decentralized Protocols: Key Characteristics and Regulatory Implications Decentralized protocols are defined by several critical attributes that differentiate them from traditional financial services. Primarily, they are non-custodial , meaning users retain control over their private keys and assets without relying on a central entity. These protocols are typically permissionless , allowing any participant to interact without gatekeeping, and their core logic is often immutable or governed by distributed token holders, ensuring transparency and resistance to unilateral changes. SPI's proposal emphasizes that these features necessitate a distinct regulatory approach, as conventional frameworks fail to capture the operational realities of decentralized systems. This perspective challenges regulators to reconsider how securities laws apply to blockchain-based protocols and encourages the development of policies that support innovation while maintaining appropriate consumer protections. ‘, ‘ Secure and Fast Transactions Diversify your investments with a wide range of coins. Join now! ‘, ‘ The Easiest Way to Invest in Crypto Dont wait to get started. Click now and discover the advantages! ‘ ]; var adplace = document.getElementById(“ads-binance”); if (adplace) { var sessperindex = parseInt(sessionStorage.getItem(“adsindexBinance”)); var adsindex = isNaN(sessperindex) ? Math.floor(Math.random() * adscodesBinance.length) : sessperindex; adplace.innerHTML = adscodesBinance[adsindex]; sessperindex = adsindex === adscodesBinance.length – 1 ? 0 : adsindex + 1; sessionStorage.setItem(“adsindexBinance”, sessperindex); } })(); Challenges and Opportunities in Adapting U.S. Crypto Regulation The SPI's proposal arrives amid ongoing debates about how best to regulate digital assets in the United States. One of the primary challenges lies in defining what constitutes “decentralization” and determining the threshold at which a protocol no longer requires traditional regulatory oversight. The SEC, under Chair Gary Gensler, has historically favored applying existing securities laws broadly to crypto assets, which may conflict with SPI's call for exemptions. Nonetheless, the proposal presents an opportunity to align regulatory frameworks with technological advancements, potentially enhancing the U.S.'s global competitiveness in the blockchain space. Clearer rules could also reduce legal uncertainty for developers and investors, fostering a more robust and responsible DeFi ecosystem. Industry Collaboration and the Path Forward SPI's initiative is supported by prominent Solana ecosystem participants such as Phantom, Superstate, and Orca, illustrating a collaborative industry effort to engage regulators constructively. This coalition aims to educate policymakers on the technical and operational nuances of decentralized protocols, advocating for a regulatory environment that balances innovation with consumer protection. The dialogue initiated by this proposal could serve as a blueprint for other blockchain communities seeking similar clarity. For stakeholders in the crypto space, staying informed and participating in these discussions is crucial to shaping policies that reflect the evolving nature of digital finance. ‘, ‘ The Power of the TRON Ecosystem is Yours! Click now to discover exclusive opportunities! ‘, ‘ Profit Opportunities on the TRON Network Join now to strengthen your investments! ‘ ]; var adplace = document.getElementById(“ads-htx”); if (adplace) { var sessperindex = parseInt(sessionStorage.getItem(“adsindexHtx”)); var adsindex = isNaN(sessperindex) ? Math.floor(Math.random() * adscodesHtx.length) : sessperindex; adplace.innerHTML = adscodesHtx[adsindex]; sessperindex = adsindex === adscodesHtx.length – 1 ? 0 : adsindex + 1; sessionStorage.setItem(“adsindexHtx”, sessperindex); } })(); The Solana Policy Institute's proposal to the SEC represents a crucial step toward refining U.S. crypto regulation by distinguishing decentralized protocols from traditional financial intermediaries. By advocating for exemptions based on the unique characteristics of decentralized systems, SPI and its partners aim to foster innovation, provide legal clarity, and maintain appropriate consumer safeguards. While challenges remain in defining decentralization and securing regulatory buy-in, this initiative underscores the importance of adaptive policy frameworks that accommodate technological progress. As the conversation between industry and regulators continues, the future of decentralized finance in the United States hinges on achieving a balanced and informed approach to crypto oversight. Source: https://en.coinotag.com/solana-policy-institute-proposes-regulatory-clarity-for-decentralized-protocols-to-the-sec/

Phantom Frequently Asked Questions (FAQ)

When was Phantom founded?

Phantom was founded in 2021.

Where is Phantom's headquarters?

Phantom's headquarters is located at 447 Sutter Street, San Francisco.

What is Phantom's latest funding round?

Phantom's latest funding round is Series C.

How much did Phantom raise?

Phantom raised a total of $268.5M.

Who are the investors of Phantom?

Investors of Phantom include Variant Fund, Paradigm, Sequoia Capital, A16z Crypto, Andreessen Horowitz and 8 more.

Who are Phantom's competitors?

Competitors of Phantom include Demox Labs and 3 more.

Loading...

Compare Phantom to Competitors

MetaMask is a self-custodial wallet that serves as a gateway to blockchain applications and web3. The company provides a platform for users to manage digital assets, including a key vault and token wallet, along with tools for decentralized applications. MetaMask also offers resources and support for developers and institutions building on blockchain technology. It is based in San Francisco, California.

Taurus is a company specializing in digital asset infrastructure within the financial technology sector. The company offers a platform for the custody, issuance, and management of cryptocurrencies, tokenized assets, and digital currencies. Taurus provides services including storage solutions, tokenization of various assets, and a trading platform for institutional investors. It was founded in 2018 and is based in Geneva, Switzerland.

Solve.Care was established to revolutionize healthcare delivery, care coordination and benefits administration around the globe. Solve.Care is building an platform that combines decentralization with synchronization to connect stakeholders with each other and redefine care, cost and convenience for everyone.

Emtech focuses on modern central banking in the financial services industry. The company offers digital solutions that power regulatory and currency development for financial ecosystems, including tools for central banks and financial service providers. Its solutions aim to drive inclusive access to a modern and sound financial ecosystem. It was founded in 2019 and is based in New York, New York.

Neo operates as an ecosystem developer for the blockchain, focusing on integrating decentralized web and finance into the management of physical resources. The company offers a compliant, self-governing web3 platform that enables regulated institutions and retail buyers to buy, sell, and trade commodities with verified identities and environmental, social, and governance (ESG) attribute tracking. Neo primarily serves sectors that include energy, mining, agriculture, and trading within the blockchain and decentralized finance industries. It was founded in 2020 and is based in Zug, Switzerland.

vlayer creates data infrastructure for the web3 space, utilizing its technology in the blockchain sector. The company offers tools for developers to extract and integrate real-world data into Ethereum smart contracts, using zero-knowledge proofs to ensure trust and privacy. Its services are aimed at the web3 developer community, enabling the development of applications that require secure data interactions. The company was founded in 2024 and is based in Warsaw, Poland.

Loading...