Perfios

Founded Year

2008Stage

Series D - II | AliveTotal Raised

$443.18MValuation

$0000Last Raised

$80M | 1 yr agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-63 points in the past 30 days

About Perfios

Perfios provides credit decisioning and analytics solutions for the banking, financial services, and insurance (BFSI) sectors. The company offers products that automate onboarding, due diligence, and financial data analysis for financial institutions. It was founded in 2008 and is based in Bangalore, India.

Loading...

Perfios's Product Videos

ESPs containing Perfios

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

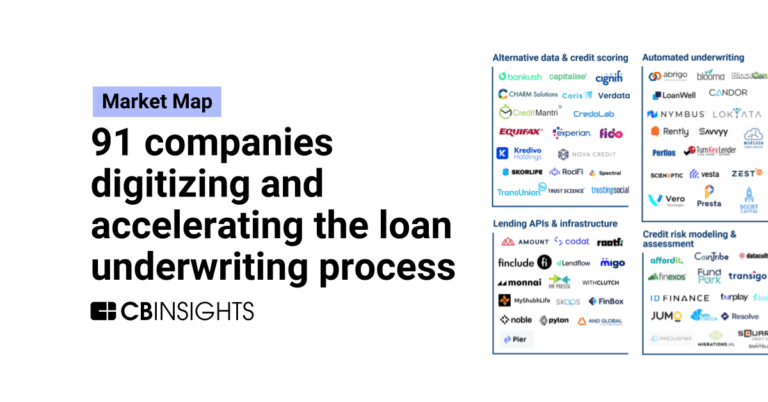

The loan underwriting market involves the process of evaluating and analyzing a borrower's creditworthiness to determine their eligibility for a loan. Technology vendors in this business-to-business market offer solutions that automate manual processes, reduce fraud rates, and provide data-driven insights for risk mitigation and decision-making. These solutions leverage technologies AI and Machine…

Perfios named as Highflier among 14 other companies, including Blend, Scienaptic, and Tavant.

Perfios's Products & Differentiators

TrustArmour

An advanced fraud prevention solution that tackles identity theft, account takeovers, and synthetic identity risks. With a focus on digital footprints, device fingerprinting, and behavioural assessments, Perfios offers robust protection against a variety of frauds.

Loading...

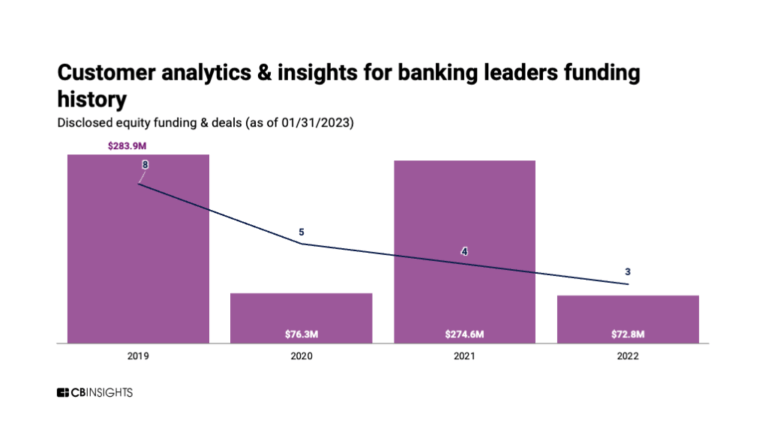

Research containing Perfios

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Perfios in 4 CB Insights research briefs, most recently on Aug 23, 2024.

Oct 18, 2023 report

State of Fintech Q3’23 ReportExpert Collections containing Perfios

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

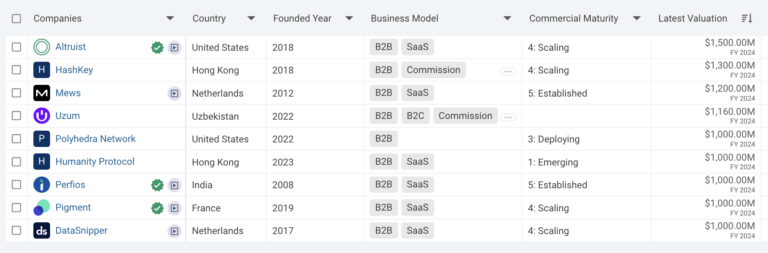

Perfios is included in 8 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,276 items

Regtech

1,453 items

Technology that addresses regulatory challenges and facilitates the delivery of compliance requirements. Regulatory technology helps companies and regulators address challenges ranging from compliance (e.g. AML/KYC) automation and improved risk management.

Wealth Tech

2,424 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Fintech 100

498 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Digital Lending

2,661 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Artificial Intelligence

12,322 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Latest Perfios News

May 16, 2025

Onboards Lion Mortgage as the first customer for the product “Switch” Press Release PHOTO DUBAI, United Arab Emirates--(BUSINESS WIRE)-- Perfios, a leading global B2B SaaS FinTech, today announced the launch of ‘Switch’, an AI-powered solution for mortgage operational excellence, at Dubai FinTech Summit 2025. This innovative platform aims to empower all stakeholders of the mortgage industry by transforming traditional mortgage processes and enabling a frictionless mortgage process. With 5+ years in the UAE, Perfios has established a strong presence in the banking sector with its flagship products adopted by top banks in the UAE. Perfios now onboards Lion Mortgage, a leading Mortgage Broker in the UAE, as the first client to adopt Perfios' Switch platform. Switch, built on Perfios' proven Credit Gateway and Nexus 360 technology, is an out-of-the-box independent platform that delivers an intelligent, automated mortgage cycle management system. The platform seamlessly connects multiple key stakeholders in the mortgage journey, starting with the broker, developer, valuer, and banks, while offering comprehensive features, including: Automated Lead Management Real-time Updates and Reporting Integrated Solutions for Bank Statement Analysis, KYC, and more Speaking at the unveiling ceremony at DFS, Pramod Veturi, International CEO, Perfios, said, “Switch is a thoughtfully engineered platform that brings intelligence, speed, and transparency to the mortgage process, solving some of the most persistent pain points in the industry. Its AI-driven architecture enables smarter decision-making and operational efficiency for all banks, brokers and network partners. We’re delighted to welcome Lion Mortgage as our first customer. This partnership marks a strong beginning for Switch, extends our relationships from Banks to Mortgage stakeholders, and also reflects the trust leading institutions place in our technology. We're happy to officially launch Switch at the Dubai FinTech Summit, a global stage for financial innovation!” Gaurav Gambhir, MD, Lion Mortgage, expressed enthusiasm about being the first to adopt Switch: “At Lion Mortgage, we are committed to staying ahead of the curve by embracing technologies that enhance operational efficiency and elevate client experience. Switch, with its AI-driven workflows, real-time insights, and integration-ready design, has empowered us to deliver measurable value driven outcomes during the trial period of the last 3 months. These include a significantly enhanced client experience through superior service delivery, a notable reduction in error rate and turn around time, a productivity boost and a 25% increase in business volumes. We view this as a strategic leap forward in redefining the way mortgages are delivered in the UAE.” Perfios has been at the forefront of enabling global financial inclusion by empowering financial institutions with real-time credit decisioning, analytics, onboarding automation, due diligence, monitoring, and more. The launch of Switch in the UAE market further strengthens this commitment, representing a strategic expansion that builds on Perfios' success in serving over 1000+ financial institutions across 19 countries. The platform's scalable architecture ensures seamless adaptability across different geographies while maintaining strict compliance with local regulations, making it a truly global solution for operations excellence. About Perfios: Founded in 2008, Perfios is a global B2B SaaS company serving the Banking, Financial Services and Insurance industry in 19 countries, empowering 1000+ financial institutions. Through their pioneering software platforms and products, Perfios helps financial institutions to take big leaps by shaping their origination, onboarding, decisioning, underwriting and monitoring processes at scale and speed. Perfios delivers 8.2 billion data points to banks and financial institutions every year to facilitate faster decisioning, and significantly accelerates access to credit and financial services for their clients' customers. Headquartered in Bangalore, with offices worldwide and with 75+ products and platforms, and over 500+ APIs, in Perfios, their clients have a confident and a robust start-to-end tech platform. About Lion Mortgage: Lion Mortgage is a leading independent mortgage solutions provider based in Dubai. Established in 2013 by seasoned bankers, each bringing over 20 years of experience from top-tier financial institutions, the firm has helped over 8,000 UAE residents and international clients secure home financing with confidence. With a client-first philosophy and deep market expertise, Lion Mortgage delivers tailored mortgage advisory services that simplify the financing process, ensuring clarity, compliance, and peace of mind. The company is driven by a commitment to long-term financial wellbeing, consistently delivering exceptional client and partner experiences, operational excellence, and performance all enabled by smart, forward-thinking technology. Send us your press releases to pressrelease.zawya@lseg.com Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release. The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk. To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages. © ZAWYA 2025 ZAWYA NEWSLETTERS Get insights and exclusive content from the world of business and finance that you can trust, delivered to your inbox. Subscribe to our newsletters:

Perfios Frequently Asked Questions (FAQ)

When was Perfios founded?

Perfios was founded in 2008.

Where is Perfios's headquarters?

Perfios's headquarters is located at 66/525, Hosur Road, above Star Hyper, Chikku Lakshmaiah Layout, Adugodi, Bangalore.

What is Perfios's latest funding round?

Perfios's latest funding round is Series D - II.

How much did Perfios raise?

Perfios raised a total of $443.18M.

Who are the investors of Perfios?

Investors of Perfios include Teachers' Venture Growth, Kedaara Capital, Stride Ventures, Visa Accelerator Program, Bessemer Venture Partners and 7 more.

Who are Perfios's competitors?

Competitors of Perfios include Yodlee, LENDOX, Plaid, Scienaptic, Bureau and 7 more.

What products does Perfios offer?

Perfios's products include TrustArmour and 4 more.

Loading...

Compare Perfios to Competitors

MX operates within the financial services sector. It offers products for connecting, understanding, and utilizing financial data, including account aggregation, financial insights, and data enhancement services. MX serves financial institutions and financial technology companies, allowing them to provide money management experiences to consumers. MX was formerly known as MoneyDesktop. It was founded in 2010 and is based in Lehi, Utah.

MOGOPLUS is a company that provides insights and analytics solutions for the financial services industry. They analyze banking transaction data to assist enterprises in making customer decisions. MOGOPLUS serves financial institutions, credit unions, and digital credit providers with their lending and credit insights. It is based in London, England.

MoneyThumb specializes in financial document conversion and analysis for the lending and accounting sectors. The company offers solutions that convert PDF bank statements into actionable financial data and assess creditworthiness using advanced analysis tools. MoneyThumb's products are designed to facilitate fraud detection, integrate with accounting systems, and support personal finance management by converting financial transaction data into various formats. It was founded in 2014 and is based in Encinitas, California.

Able specializes in AI-driven document management and process automation for the commercial lending sector. The company offers a platform that automates the collection and organization of borrower information, creates instant document checklists, and provides a collaborative workspace for all parties involved in a loan transaction. Able primarily serves the financial services industry, enhancing the efficiency of loan processing and document management. It was founded in 2020 and is based in San Francisco, California.

Atomic provides direct deposit switching, income and employment verification, and payment method updating through application program interface (API) and software development kit (SDK) integrations. The company aims to improve the accessibility of financial products and services for consumers. It was founded in 2019 and is based in Salt Lake City, Utah.

Yapily is an open banking infrastructure platform that specializes in providing secure connectivity between customers and banks across Europe. The company offers services that enable access to financial data and the initiation of payments, aiming to facilitate the creation of personalized financial experiences. Yapily primarily serves industries such as payment services, i-gaming, accounting, lending and credit, crypto, property technology (PropTech), investing, and digital banking. Yapily was formerly known as Acacia Connect. It was founded in 2017 and is based in London, United Kingdom.

Loading...