Pear Therapeutics

Founded Year

2013Stage

Asset Sale | AssetsPurchasedTotal Raised

$334.94MRevenue

$0000About Pear Therapeutics

Pear Therapeutics focuses on developing and commercializing software-based medicines, known as prescription digital therapeutics (PDTs), within the healthcare sector. The company offers clinically validated software-based therapeutics designed to provide better outcomes for patients, engagement and tracking tools for clinicians, and cost-effective solutions for payers. Pear Therapeutics primarily serves the healthcare industry, focusing on patients with substance use disorder, opioid use disorder, and chronic insomnia. It was founded in 2013 and is based in Boston, Massachusetts. In April 2023 Pear Therapeutics filed for bankruptcy.

Loading...

Loading...

Research containing Pear Therapeutics

Get data-driven expert analysis from the CB Insights Intelligence Unit.

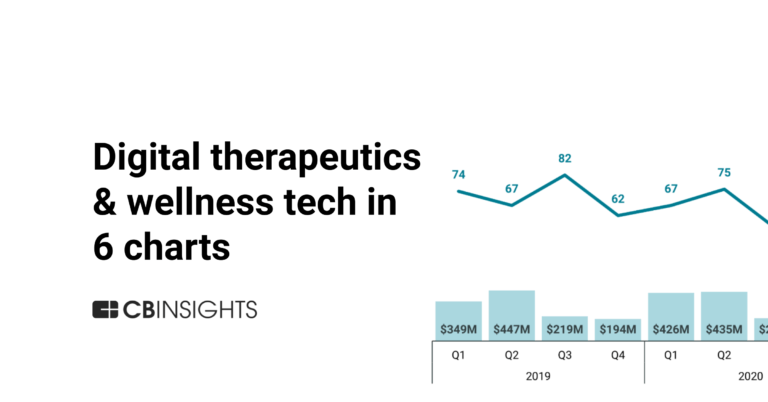

CB Insights Intelligence Analysts have mentioned Pear Therapeutics in 3 CB Insights research briefs, most recently on Jan 25, 2024.

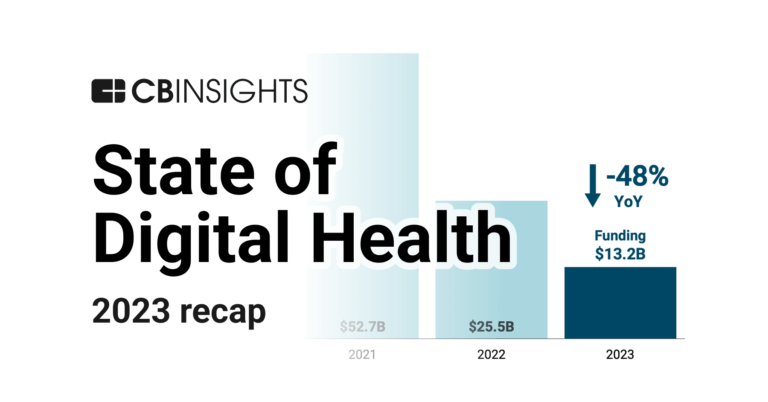

Jan 25, 2024 report

State of Digital Health 2023 ReportExpert Collections containing Pear Therapeutics

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Pear Therapeutics is included in 3 Expert Collections, including Digital Health 50.

Digital Health 50

300 items

The most promising digital health startups transforming the healthcare industry

Digital Health

11,408 items

The digital health collection includes vendors developing software, platforms, sensor & robotic hardware, health data infrastructure, and tech-enabled services in healthcare. The list excludes pureplay pharma/biopharma, sequencing instruments, gene editing, and assistive tech.

Precision Medicine Tech Market Map

160 items

This CB Insights Tech Market Map highlights 160 precision medicine companies that are addressing 9 distinct technology priorities that pharmaceutical companies and healthcare providers face.

Pear Therapeutics Patents

Pear Therapeutics has filed 14 patents.

The 3 most popular patent topics include:

- cognitive behavioral therapy

- monoclonal antibodies

- psychiatric diagnosis

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

4/11/2023 | 2/27/2024 | Data security, Monoclonal antibodies, Cryptographic hash functions, Health informatics, Medical terminology | Grant |

Application Date | 4/11/2023 |

|---|---|

Grant Date | 2/27/2024 |

Title | |

Related Topics | Data security, Monoclonal antibodies, Cryptographic hash functions, Health informatics, Medical terminology |

Status | Grant |

Latest Pear Therapeutics News

Jul 3, 2025

Attention Deficit Hyperactivity Disorder (ADHD) market is anticipated that the market, which was valued at USD 16.23 Billion in 2024, CAGR of 5.9%” — DataM Intelligence DELAWARE, DE, UNITED STATES, July 4, 2025 / EINPresswire.com / -- The global Attention Deficit Hyperactivity Disorder (ADHD) market is anticipated to reach USD 18.3 billion by 2025, as a result of increased awareness, advancements in pharmaceutical and digital therapies, and enhanced insurance coverage, according to DataM Intelligence. It is anticipated that the market, which was valued at USD 16.23 Billion in 2024, will experience a compound annual growth rate (CAGR) of 5.9% and reach USD 27.04 Billion by 2033. Download Latest Edition Insights sample report: https://www.datamintelligence.com/download-sample/attention-deficit-hyperactivity-disorder-adhd-market?einhp ADHD is a neurodevelopmental disorder that may impact both toddlers and adults. It manifests as hyperactivity, impulsivity, and inattention. In recent years, there has been a rise in the number of diagnoses and therapies, as stakeholders have innovated on numerous fronts. Attention Deficit Hyperactivity Disorder (ADHD) Market Drivers DataM Intelligence identifies several core drivers behind this robust growth: 1. Enhanced Diagnosis and Awareness: Greater public understanding and improved screening protocols in schools and primary care are uncovering previously undiagnosed cases. 2. Innovative Pharmacotherapies: The launch of long-acting stimulants, non-stimulant options, and novel mechanisms of action is expanding treatment choices and adherence. 3. Digital Health Interventions: Digital therapeutics—apps for behavior training and symptom monitoring—are receiving regulatory clearance, augmenting traditional drug treatments. 4. Adult ADHD Recognition: Growing acknowledgment that ADHD persists into adulthood has opened new patient segments and treatment pathways. 5. Insurance Coverage Expansion: Broader reimbursement for ADHD diagnostics and treatments, especially in North America and Europe, is reducing patient costs and facilitating access. Attention Deficit Hyperactivity Disorder (ADHD) Regional Outlook North America In 2024, North America accounted for over 39.8% of the total market share in the ADHD market. Regional leadership is being driven by a robust healthcare infrastructure, early adoption of digital therapies, and extensive insurance coverage. Europe Europe has the second-largest proportion, thanks to national screening programs, government-funded mental health initiatives, and rising public-private collaborations to incorporate digital technologies into care pathways. Asia-Pacific The Asia-Pacific region is the fastest-growing market, as per DataM Intelligence. This growth is being driven by expanded healthcare access in China and India, greater urban awareness campaigns, and burgeoning digital health businesses that are addressing ADHD. Attention Deficit Hyperactivity Disorder (ADHD) Market Segmentation By Treatment Type: • Pharmacological: Stimulants (methylphenidate, amphetamines) and non-stimulants (atomoxetine, guanfacine). • Digital Therapeutics: App-based cognitive training and behavior modification tools. • Behavioral Therapies: Parent and classroom-based interventions. By Age Group: • Pediatric (6–17 years) • Adult (18+ years) By End User: • Hospitals and Clinics • Home Care Settings • Specialty Mental Health Centers Industry Momentum: Collaborations & Growth 2023–2025 • Akili Interactive & Pfizer (April 2024): Expanded their partnership to co-market the digital therapeutic EndeavorRx, aiming at pediatric ADHD patients in Europe. • Shire Acquisition of Neurovance (June 2024): Bolstered Shire's non-stimulant portfolio by acquiring late-stage assets targeting adult ADHD. • Pear Therapeutics & Takeda (January 2025): Signed a licensing deal for co-developing a prescription digital therapy tailored to Japanese regulatory standards. • Eli Lilly & Arbor Pharmaceuticals (September 2024): Partnered to launch a novel long-acting amphetamine formulation in the U.S. market, promising 16-hour symptom control. • Novartis & Samsung Health (March 2025): Collaborated to integrate ADHD symptom-tracking algorithms into wearable devices, enabling real-time medication effect monitoring. Speak to Our Analyst and Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/attention-deficit-hyperactivity-disorder-adhd-market Latest Developments • Long Acting Injectables: Phase II trials of monthly injectable formulations aim to improve adherence among adults with irregular daily routines. • AI Enhanced Diagnostics: Artificial intelligence tools now analyze behavioral data and clinical records to flag potential ADHD cases during routine pediatric visits. • Cultural Adaptation of Digital Therapies: Developers are localizing gamified cognitive training apps for non English markets, addressing linguistic and cultural nuances. • Combination Therapies: Emerging clinical studies are evaluating the synergistic effect of stimulants plus digital cognitive training for faster symptom improvement. Country-Specific Updates United States (Feb 2025): Qelbree XR, the first chewable, extended-release non-stimulant for juvenile and adult ADHD, has been approved by the FDA. The medication was developed by Supernus Pharmaceuticals, and it has demonstrated an acceptable safety profile and high efficacy. Japan (Apr 2025): Nippon Biotherapeutics' digital ADHD treatment was granted Sakigake designation by the MHLW, which expedited its approval. Cognitive activities are implemented in software designed for school-aged children in accordance with Japan's stringent digital health regulations. Gain expert insights on market trends, challenges, and future outlook. Buy the Full Report Now and strengthen your strategy with DataM Intelligence: https://www.datamintelligence.com/buy-now-page?report=major-depressive-disorder-market?einhp DataM Intelligence Insight According to DataM Intelligence analysis, Innovative medicines, verified digital technologies, and increased adult care are the hallmarks of a dynamic period in the ADHD industry. Pharmaceutical producers and digital health enterprises are well-positioned to enhance the outcomes of millions of individuals worldwide as diagnosis rates increase and treatment options expand. The future of ADHD management appears individualized and optimistic, as cross-sector alliances and supportive policies foster innovation. Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription ✅ Technology Roadmap Analysis ✅ Sustainability Impact Analysis ✅ KOL / Stakeholder Insights ✅ Pipeline Analysis For Drugs Discovery ✅ Positioning, Pricing & Market Access Snapshots ✅ Market Volatility & Emerging Risks Analysis ✅ Competitive Landscape Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg Related Reports: Rare Neurological Disease Drugs Market is Set to Reach US$ 269.7 Bn by 2031 Major Depressive Disorder Market is expected to reach US$ 14.57 Bn by 2033 Sai Kumar DataM Intelligence 4market Research LLP sai.k@datamintelligence.com Visit us on social media: LinkedIn X Legal Disclaimer: EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Pear Therapeutics Frequently Asked Questions (FAQ)

When was Pear Therapeutics founded?

Pear Therapeutics was founded in 2013.

Where is Pear Therapeutics's headquarters?

Pear Therapeutics's headquarters is located at 200 State Street, Boston.

What is Pear Therapeutics's latest funding round?

Pear Therapeutics's latest funding round is Asset Sale.

How much did Pear Therapeutics raise?

Pear Therapeutics raised a total of $334.94M.

Who are the investors of Pear Therapeutics?

Investors of Pear Therapeutics include WELT, Harvest Bio, Nox Health, Click Therapeutics, SoftBank and 18 more.

Who are Pear Therapeutics's competitors?

Competitors of Pear Therapeutics include Click Therapeutics, Cara Care, Lionrock, Akili Interactive, Valera Health and 7 more.

Loading...

Compare Pear Therapeutics to Competitors

Lyra Health operates in workforce mental health care within the health benefits industry. The company provides a digital platform that connects employees to mental health providers and tools, utilizing artificial intelligence (AI) for provider matching and offering evidence-based support. Lyra Health serves employers seeking to provide mental health benefits and support employee well-being. It was founded in 2015 and is based in Burlingame, California.

DynamiCare Health is a digital platform that specializes in substance use recovery within the healthcare sector. The company offers a digital recovery platform that provides remote substance testing, recovery coaching, and financial incentives for maintaining sobriety. DynamiCare Health primarily serves individuals seeking support for addiction recovery. It was founded in 2016 and is based in Boston, Massachusetts.

Mobio Interactive specializes in digital therapeutics and remote patient monitoring within the mental healthcare sector. The company offers an AI-native mobile platform that uses proprietary technologies to measure and treat mental health conditions, providing personalized therapy based on objective biomarkers. The platform primarily serves health systems, pharmaceutical companies, and insurance payors. It was founded in 2015 and is based in Singapore.

Pivot is a digital health company that focuses on tobacco cessation and behavioral change within the healthcare sector. The company offers a comprehensive suite of solutions, including digital programs, mobile applications, and personalized coaching designed to help individuals quit tobacco and improve their well-being. Pivot primarily serves employers, health plans, consultants, and brokers looking to integrate wellness solutions into their offerings. It was founded in 2015 and is based in San Carlos, California.

Monument is an online platform that specializes in alcohol treatment and recovery services. The company offers a range of services, including virtual support groups, therapy, and medication management, to assist individuals in reducing or stopping alcohol consumption. Monument's treatment options are accessible online, providing a flexible and supportive environment for those seeking help with alcohol dependence. It was founded in 2018 and is based in New York, New York.

Marigold Health is a company that provides peer support for mental health and substance use recovery within the behavioral health sector. The company has a social network where individuals can engage in peer support groups, access wellness and goal planning tools, and participate in theme-based chat groups. Marigold Health serves the behavioral health and substance use recovery sectors and works with existing care teams. It was founded in 2017 and is based in Boston, Massachusetts.

Loading...