Kraken

Founded Year

2011Stage

Unattributed VC - II | AliveTotal Raised

$20.07MRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-25 points in the past 30 days

About Kraken

Kraken focuses on digital currency exchange. The company provides a platform for trading various digital currencies, including bitcoin, offering a secure and efficient service for its users. Kraken primarily serves the financial technology industry. It was founded in 2011 and is based in San Francisco, California.

Loading...

ESPs containing Kraken

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

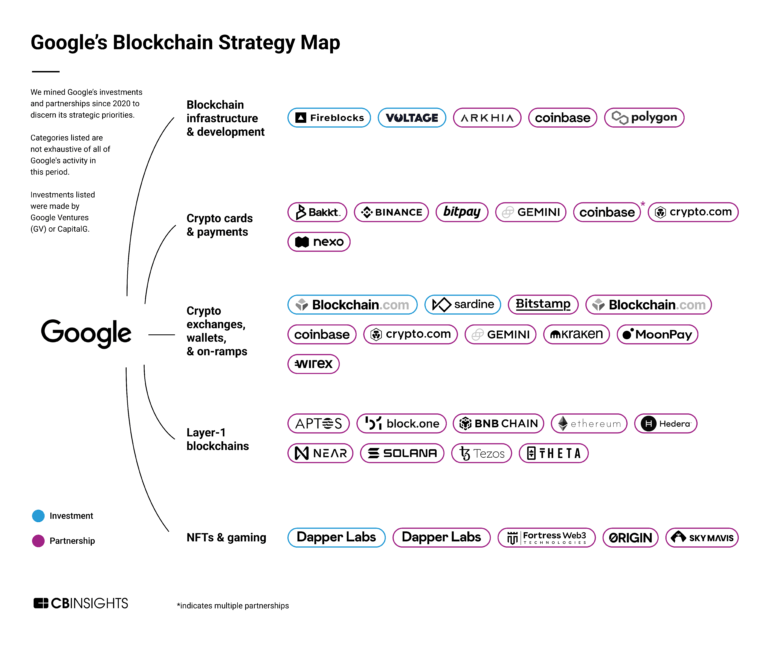

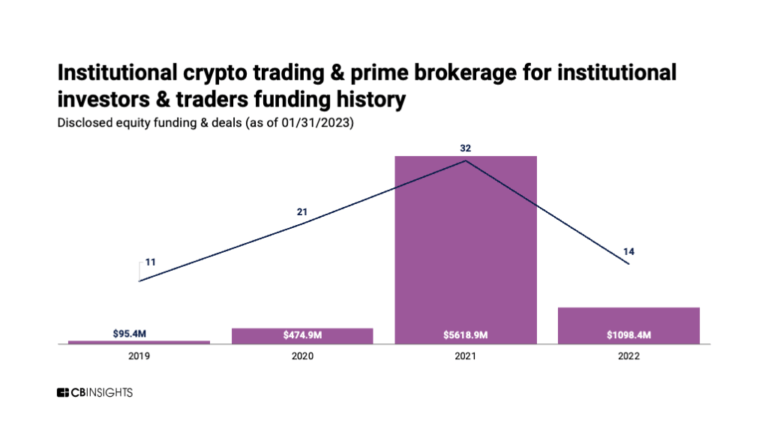

The institutional crypto trading & prime brokerage market provides secure and reliable platforms that manage the operational complexity, security, and scale of cryptocurrency trading for institutional investors. Companies in this market offer solutions that integrate prime brokerage, trade execution, and custody services. These platforms typically feature advanced security measures, institutional-…

Kraken named as Outperformer among 15 other companies, including Coinbase, Binance, and HTX.

Loading...

Research containing Kraken

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Kraken in 6 CB Insights research briefs, most recently on May 29, 2025.

May 29, 2025

The stablecoin market map

May 23, 2025 report

Book of Scouting Reports: Stablecon 2025

Apr 3, 2025 report

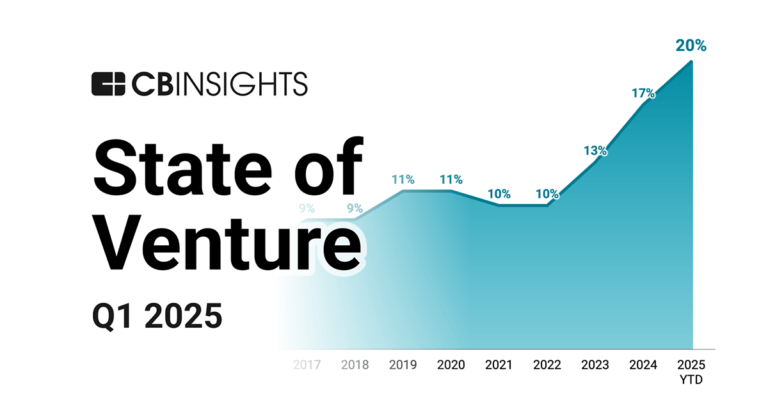

State of Venture Q1’25 Report

Oct 15, 2022

What is institutional staking?Expert Collections containing Kraken

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Kraken is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,276 items

Blockchain

10,041 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Fintech

9,653 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Stablecoin

433 items

Kraken Patents

Kraken has filed 27 patents.

The 3 most popular patent topics include:

- industrial gases

- chemical processes

- renewable energy

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

10/27/2022 | 1/28/2025 | Automotive transmission technologies, Rotation, Engine technology, Gears, Mechanical power transmission | Grant |

Application Date | 10/27/2022 |

|---|---|

Grant Date | 1/28/2025 |

Title | |

Related Topics | Automotive transmission technologies, Rotation, Engine technology, Gears, Mechanical power transmission |

Status | Grant |

Latest Kraken News

Jul 6, 2025

Steven Pettigrove, Luke Higgins and Emma Assaf of the Piper Alderman Blockchain Group bring you the latest legal, regulatory and project updates in Blockchain and Digital Law. FATF calls for stronger AML action on virtual assets On 26 June 2025, the Financial Action Task Force (FATF) released its sixth update on how countries are applying anti-money laundering and counter-terrorism financing (AML/CTF) rules to virtual assets (VAs) and virtual asset service providers (VASPs). The update shows that many jurisdictions, especially those with large crypto sectors, have made progress over the past year. More countries now have laws in place that reflect FATF's Recommendation 15 and its 2019 Interpretative Note, which sets out how AML/CTF rules should apply to the crypto sector. Some countries are also taking more action on supervision and enforcement. However, FATF says there is still important work to do. Licensing and registration of VASPs remains inconsistent, and many jurisdictions continue to face difficulties identifying the individuals and companies that are behind VASP activities. Offshore VASPs also remain a challenge, especially for risk management purposes. FATF reports that 99 jurisdictions have either adopted or are in the process of adopting the "Travel Rule," which requires key information to be shared with cross-border crypto transfers. To help with this, FATF has also recently published new guidance with examples of good supervision practices The report also includes updated data from the top 20 largest jurisdictions in terms of their crypto-asset activity. FATF notes that getting full compliance from these countries (which make up around 98% of global crypto activity) would significantly reduce global risks in the sector. Several blockchain analytics firms, including Chainalysis, TRM Labs, Lukka, and Merkle Science, helped inform the report. FATF additionally highlights some of the risks relating to the criminal abuse of crypto-assets. These include an increase in the use of stablecoins by nefarious actors. In particular, stablecoins have been used more often in activity linked to North Korea, terrorist financing, and drug trafficking. Interestingly, it appears that criminals are shifting away from other crypto-tokens to stablecoins for their illegal transactions. FATF also refers to the widely reported heist by the North Korean regime, stealing $1.46 billion in crypto from the exchange ByBit . With only 3.8% of the stolen funds being recovered so far, this serves as an unfortunate but prime example of the need for robust international cooperation. Finally, the report warns of the growing role of crypto-assets in scams and fraud. FATF notes that in 2024, there was an estimated USD $51 billion worth of fraud-related crypto activity. FATF stresses the need for both governments and private companies to respond to these threats, particularly as scams become more sophisticated. Blockchain technology offers useful tools for transparency, but there must be consistent global rules to keep the system secure. This rules should nevertheless be fit for purpose for digital assets, focusing on the specific risk vectors and considering how new technologies can more efficiently help reduce illicit finance. The latest FATF update is a reminder that these threats continue to evolve and that regulators will need to remain agile in targeting the harms caused by financial crime. Australia is currently taking steps to implement its own VASP framework which is expected to come into force in March 2026. The FATF update can be accessed here Et voila! Robinhood to tokenise Stocks and ETFs in EU At the Ethereum Community Conference in Cannes, France, Robinhood announced the launch of over 200 tokenised stocks and ETFs including private companies such as SpaceX and OpenAI for customers in the European Union. These tokenised equities aim to offer 24/5 trading access, dividend support and zero commissions or added spreads from Robinhood (though other fees may apply). Initially issued on Arbitrum, the tokens are expected to migrate to Robinhood's own Layer 2 blockchain currently under development. In addition to tokenised equities, Robinhood introduced several new offerings including crypto perpetual futures for EU customers and crypto staking for US users, starting with Ethereum and Solana. Other features include deposit bonuses, a crypto rewards credit card, an AI-powered investment assistant, smart exchange routing, tax lot tracking and advanced trading charts. A Robinhood spokesperson stated that "[t]hese tokens give retail investors indirect exposure to private markets, opening up access, and are enabled by Robinhood's ownership stake in a special purpose vehicle". However, in a post on X, OpenAI stated that it is not a partner, was not involved in and does not endorse the OpenAI tokens: Last month, Kraken launched its own tokenised stock offering for select jurisdictions called xStocks. FTX and Binance have pioneered similar offerings in the past. The tokenisation of stocks raises a number of regulatory and consumer protection considerations. Tokenised stocks are likely to be treated as derivatives under Australian law, may not track the underlying stock price and will not generally have the same voting or dividend rights. The owner of a tokenised stock will generally have no claim on the underlying asset and may be subject to redemption restrictions such as KYC and fees. In the case of xStocks, it appears only select users who complete KYC with Kraken can mint and redeem tokenised equities. The tokens are issued by a special purpose vehicle ( SPV ) based in Jersey and offered under a digital asset license in Bermuda. Kraken itself does not custody the underlying stocks. Token holders receive a legal right to redeem the token for its cash value but no ownership rights of the underlying stock, voting or dividend rights. Redemption and withdrawal fees may also impact their attractiveness as an investment instrument. The issuer can only buy or sell the underlying stock during normal market hours, but tokenised stocks trade 24/7. According to one commentator, this could create pricing dislocations outside of market hours (particularly on weekends) when market makers are unable to hedge their positions. To manage the risk, they may widen spreads significantly or withdraw liquidity entirely. This could expose traders who buy during low-liquidity periods to sharp losses if the equity market opens lower and the token price rapidly re-aligns with the off-chain price. These risks are compounded by regulatory uncertainty and restrictions, particularly for US traders, as shown by Binance's decision to discontinue its stock tokens For the time being, Robinhood does not allow its users to self-custody their tokenised stocks, trade or collateralise them in DeFi. Kraken does allow self-custody which means that these instruments could start to be used in DeFi across a range of applications. Robinhood plans to launch on Arbitrum and move to its own layer 2 blockchain partly to reduce the gas fees incurred by traders. Although the goal of tokenised stocks is to expand access and allow anyone to participate in the digital economy, some argue that they only appeal to crypto-native traders and are poorly suited to a sophisticated, global equities market. And while tokenised stocks offer benefits such as 24/7 trading, enhanced market access, fractional ownership and faster settlement, they face regulatory and structural limitations that must be addressed to fully realise their potential. Robinhood's announcement is nevertheless an early bet on the future tokenisation of financial markets, and gives an insight in the global, composable nature of those markets and the potential consumer and systemic risks of that future. Hong Kong takes LEAP in race for digital asset leadership On 26 June 2025, the Hong Kong Government released a second Policy Statement on digital assets ( DA ) building on their initial statement of October 2022. The statement introduces the "LEAP" framework: L egal and regulatory streamlining, E xpanding the suite of tokenised products, A dvancing use cases and cross-sectoral collaboration and P eople and partnership development. According to the Secretary for Financial Services and the Treasury, Mr Christopher Hui, LEAP aims to create "a trusted, sustainable and deeply integrated DA ecosystem embedded within the real economy". Legal and regulatory streamlining The Government intends to establish a unified regulatory framework covering DA exchanges, stablecoin issuers and DA dealing and custodian service providers. The Securities and Futures Commission ( SFC ) will be the lead authority for licensing and registration of DA dealing and custodian service providers, while the Hong Kong Monetary Authority ( HKMA ) will regulate banks and their DA-related activities. The Financial Services and the Treasury Bureau ( FSTB ) and the HKMA will conduct a legal review to facilitate the tokenisation of real-world assets ( RWAs ) and financial instruments, covering areas such as settlement, registration and record-keeping. The statement also affirmed that Hong Kong would implement international standards including IOSCO's policy recommendations, the Financial Stability Board's crypto-asset framework, the OECD's Crypto-Asset Reporting Framework and the Basel Committee's prudential treatment of crypto-asset exposures. Expanding the suite of tokenised products The Government plans to 'regularise' the issuance of tokenised Government bonds, building on its earlier green bond pilot issuances. This includes exploring different currencies, tenors and innovative features to provide a consistent supply of high-quality digital bonds. Under the HKMA and SFC's Project Ensemble , the Government aims to promote use cases including the tokenisation of money market funds and revenue streams from assets such as electric vehicle charging stations. It also plans to expand tokenisation efforts across sectors like precious metals, non-ferrous metals and renewable energy. The Government has proposed extending profits tax concessions currently available to privately offered funds and family-owned investment holding vehicles to include specified DA transactions with changes expected to take effect from 2025/26 (subject to legislative approval). Advancing use cases and cross-sectoral collaboration A new licensing regime for stablecoin issuers will come into effect on 1 August 2025. The Government has invited proposals on how they can test usage of licensed stablecoins. Cyberport, Hong Kong's digital technology incubator, will also launch a funding scheme to support blockchain and DA projects with a focus on high-impact applications that can serve as benchmarks for future use cases. People and partnership development The Government aims to position Hong Kong as a global centre of excellence for DA knowledge-sharing and international cooperation. It will work with industry and academics to build a talent pool of entrepreneurs, researchers and technologists as well as conducting joint research initiatives and training programs. Speaking at the Wealth Management Expo on 21 June 2025, the Financial Secretary, Mr Paul Chan, cited 'financial innovation' as a key reason Hong Kong is positioned to become the world's leading cross-border asset management centre within two to three years. He noted that ten virtual-asset trading-platform licences have already been granted and a further eight applications are under review, while the stablecoin framework coming into force on 1 August makes Hong Kong one of the first jurisdictions with statutory regulation of stablecoins. The Policy Statement marks a step forward for Hong Kong in the race to lead digital asset innovation and shape the future of digital markets. Alongside the announcement, the FTSB and SEC has released a consultation on its proposed regulations for DA OTC transactions and custody . More broadly, these developments reflect a global consensus on the need for oversight and regulation for DAs as they become increasingly mainstream in the financial system. The full policy statement can be accessed here The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

Kraken Frequently Asked Questions (FAQ)

When was Kraken founded?

Kraken was founded in 2011.

Where is Kraken's headquarters?

Kraken's headquarters is located at 100 Pine Street, Suite 1250, San Francisco.

What is Kraken's latest funding round?

Kraken's latest funding round is Unattributed VC - II.

How much did Kraken raise?

Kraken raised a total of $20.07M.

Who are the investors of Kraken?

Investors of Kraken include Bossa Invest, RIT Capital Partners, Electric Capital, Socially Financed, The 6ixth Event and 19 more.

Who are Kraken's competitors?

Competitors of Kraken include Circle, BurjX, Bitpanda, Bitstamp, Binance.US and 7 more.

Loading...

Compare Kraken to Competitors

Binance develops a cryptocurrency exchange platform. It specializes in trading various digital assets. The company offers services such as spot market trading, futures and options trading, as well as peer-to-peer transactions. Binance also provides tools for margin trading, automated trading bots, and educational resources. It was founded in 2017 and is based in George Town, Cayman Islands.

Gemini is a cryptocurrency exchange and custodian that specializes in digital asset services. The company offers a platform for buying, selling, storing, and staking various cryptocurrencies, as well as trading cryptocurrency derivatives. Gemini serves a diverse market, including individual and institutional investors, fintechs, and banks. Gemini was formerly known as Gemini Trust Company. It was founded in 2015 and is based in New York, New York.

Crypto.com is a cryptocurrency trading platform and financial services provider in the fintech sector. The company provides services for buying, selling, and trading Bitcoin, Ethereum, and over 350 other cryptocurrencies, as well as decentralized finance services like staking and various crypto financial products. Crypto.com serves individuals and businesses involved in cryptocurrency transactions and investments. Crypto.com was formerly known as Monaco. It was founded in 2016 and is based in Singapore.

CoinDCX is a cryptocurrency investment platform that operates in the financial technology sector. The company offers a crypto exchange with a focus on user experience and security, providing access to a variety of crypto-based financial products and services. CoinDCX caters to the needs of the Indian crypto community by offering solutions for crypto investing, trading, and literacy. It was founded in 2018 and is based in Mumbai, India.

OKX is a cryptocurrency exchange platform that specializes in spot and derivatives trading within the financial ecosystem. The company offers a variety of services including cryptocurrency buying, selling, and trading, as well as providing a wallet for digital asset storage. OKX also provides advanced trading tools and features such as futures, options, and perpetual contracts to cater to a diverse range of trading strategies. OKX was formerly known as OKEx. It was founded in 2017 and is based in Mahe, Seychelles.

BurjX provides cryptocurrency trading exchange and broker-dealer solutions. It develops a platform for trading digital assets, managing digital asset wallets, and facilitating financial transactions. It was founded in 2022 and is based in New York, New York.

Loading...