Paystand

Founded Year

2013Stage

Series D | AliveTotal Raised

$83MValuation

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+142 points in the past 30 days

About Paystand

Paystand specializes in business-to-business (B2B) payments, leveraging software as a service (SaaS) and blockchain technology within the financial services industry. The company offers a suite of products designed to automate and digitize the entire cash cycle, including accounts receivable and payment processing, while eliminating transaction fees. Its solutions cater to various sectors such as construction, food and beverage, insurance, manufacturing, medical suppliers, and environmental industries. It was founded in 2013 and is based in Scotts Valley, California.

Loading...

Paystand's Product Videos

ESPs containing Paystand

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The accounts receivable (AR) automation market streamlines invoicing and payment collection. Companies can use APIs and software development kits to embed AR functions into their enterprise resource planning software, customer relationship management systems, and other digital platforms. Features include automated invoicing, payment reminders and processing, cash application, and credit management…

Paystand named as Challenger among 15 other companies, including FIS, Blackline, and Sage.

Paystand's Products & Differentiators

B2B Payment Network

Paystand’s B2B Payment Network is a robust payment portal supporting bank transfers, checks, and card payments. Bank-to-bank payments are free, offering fast, secure transfers that cut down processing fees. For businesses handling checks, the check scanning feature digitizes processing, speeding up funds availability. ACH payments streamline recurring transactions and payroll with a secure, cost-effective method. Card payments add flexibility, allowing businesses to accept Visa, Mastercard, and other major cards with security and fraud protection, ensuring fast, reliable transactions.

Loading...

Research containing Paystand

Get data-driven expert analysis from the CB Insights Intelligence Unit.

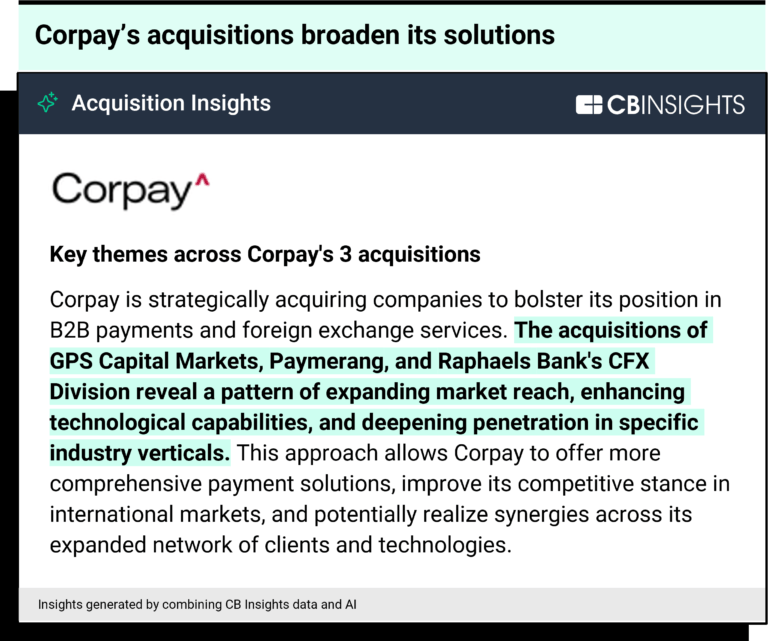

CB Insights Intelligence Analysts have mentioned Paystand in 5 CB Insights research briefs, most recently on Sep 6, 2024.

Aug 23, 2024

The B2B payments tech market map

Dec 14, 2023

Cross-border payments market map

Oct 31, 2022 report

State of Blockchain Q3’22 ReportExpert Collections containing Paystand

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Paystand is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,276 items

Blockchain

9,153 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

SMB Fintech

2,003 items

Payments

3,198 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

9,653 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

250 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Paystand Patents

Paystand has filed 1 patent.

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

3/28/2014 | Payment systems, Payment service providers, Mobile payments, Digital currencies, Online payments | Application |

Application Date | 3/28/2014 |

|---|---|

Grant Date | |

Title | |

Related Topics | Payment systems, Payment service providers, Mobile payments, Digital currencies, Online payments |

Status | Application |

Latest Paystand News

May 20, 2025

Tech deals: Confluence, MaxLinear, One Inc, Zededa, Volantio 20/05/2025 Technology companies such as Confluence, MaxLinear, One Inc, Zededa, Volantio, among others, announced their tech deals or channel partnerships. tech deals Allspring Selects Confluence Allspring Global Investments has adopted Confluence’s Style Analytics to provide institutional investors with transparent, third-party insights into equity portfolios. The solution supports factor-based analysis for competitive intelligence and data-driven client engagement. KTNF Partners with MaxLinear KTNF has formed a strategic partnership with MaxLinear to integrate the Panther Storage Accelerator into its servers, enhancing security and data performance for enterprise, HPC, cloud, and big data environments. AAA Life Insurance Company Selects One Inc AAA Life Insurance Company has selected One Inc’s PremiumPay solution to modernize its digital payment processing. The platform supports flexible, secure transactions through options like Venmo and PayPal, aligning with the company’s broader digital transformation goals. Maersk Selects Zededa Maersk has chosen ZEDEDA’s edge orchestration platform to power its next-gen IoT connectivity infrastructure. This platform enables seamless operation across diverse wireless networks and ensures reliable cargo monitoring across maritime, port, and land operations. Hudbay Minerals Collaborates with ISNetworld Hudbay Minerals is leveraging ISNetworld to manage contractor pre-qualification, replacing internal systems for better compliance tracking and training verification, thereby enhancing safety and operational oversight in mining operations. Cleo Partners with Paystand Cleo and Paystand have announced a strategic partnership to integrate Cleo’s ecosystem integration platform with Paystand’s B2B payment rail, automating order-to-cash processes and reducing manual tasks in accounts receivable. Aeromexico Selects Volantio Aeromexico has selected Volantio’s Re-Commerce Platform to boost post-booking revenue and operational efficiency. The system will integrate with SabreSonic, supporting Aeromexico’s scalable revenue optimization strategies. InfotechLead.com News Desk

Paystand Frequently Asked Questions (FAQ)

When was Paystand founded?

Paystand was founded in 2013.

Where is Paystand's headquarters?

Paystand's headquarters is located at 1800 Green Hills Road, Scotts Valley.

What is Paystand's latest funding round?

Paystand's latest funding round is Series D.

How much did Paystand raise?

Paystand raised a total of $83M.

Who are the investors of Paystand?

Investors of Paystand include NewView Capital, Commerce Ventures, King River Capital, SB Opportunity Fund, Streamlined Ventures and 20 more.

Who are Paystand's competitors?

Competitors of Paystand include Melio, Chargezoom, CoreChain, notch, Balance and 7 more.

What products does Paystand offer?

Paystand's products include B2B Payment Network and 2 more.

Who are Paystand's customers?

Customers of Paystand include Covetous, Motorola Solutions, Thumbtack, Choozle and Allterra Solar.

Loading...

Compare Paystand to Competitors

Billtrust provides accounts receivable automation and order-to-cash solutions within the financial services sector. The company offers services that improve the invoicing process, support multi-channel payments, and allow matching and posting for business-to-business transactions. Billtrust's solutions serve various industries, improving cash application and electronic handling of invoices and payments. It was founded in 2001 and is based in Hamilton, New Jersey.

Stripe provides services for businesses to manage online and in-person payments. It offers products including payment processing application programming interfaces (APIs), payment tools, and solutions for handling subscriptions, invoicing, and financial reports. It serves sectors such as electronic commerce (e-commerce), Software as a Service (SaaS), platforms, marketplaces, and the creator economy. It was formerly known as DevPayments. It was founded in 2010 and is based in South San Francisco, California.

BluePenguin provides digital payment technology within the financial services sector, focusing on accounts payable automation. The company offers a platform that allows businesses to process vendor payments using virtual cards, integrating with existing AP and ERP systems for invoice processing and payment security. BluePenguin's services include solutions for various industries, with the objective of lowering processing costs and improving transaction times. It was founded in 2018 and is based in Alpharetta, Georgia.

SparcPay specializes in accounts payable automation within the financial technology sector. The company provides a platform that captures and analyzes bills, allows review and approval of invoices from any device, and supports digital payments. SparcPay serves corporate, non-profit, accounting, property management, and hospitality sectors. It was founded in 2019 and is based in Toronto, Canada.

Crezco operates in open banking payment solutions within the financial technology sector. The company provides services such as bank transfers, invoice reconciliation, and fraud protection, which are relevant for businesses. Crezco serves sectors like ecommerce, accounting, and international trade. It was founded in 2020 and is based in London, United Kingdom.

Tipalti is a finance automation company that focuses on accounts payable and payment management workflows. The company provides solutions for accounts payable automation, mass payments, procurement, and expense management. Tipalti serves sectors including advertising technology, business services, e-commerce, education, financial services, healthcare, gaming, manufacturing, media, non-profits, software, technology, and travel. It was founded in 2010 and is based in Foster City, California.

Loading...