Payhawk

Founded Year

2018Stage

Series B - II | AliveTotal Raised

$236.84MValuation

$0000Last Raised

$100M | 3 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-16 points in the past 30 days

About Payhawk

Payhawk provides corporate spend management solutions within the financial technology sector. It offers a platform that includes corporate cards, expense management, accounts payable, and accounting software for business payments and financial control. Payhawk's services aim to automate expense reporting and reconciliation and provide visibility and control over company spending, while also integrating with existing financial systems. It was founded in 2018 and is based in London, United Kingdom.

Loading...

Payhawk's Product Videos

ESPs containing Payhawk

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

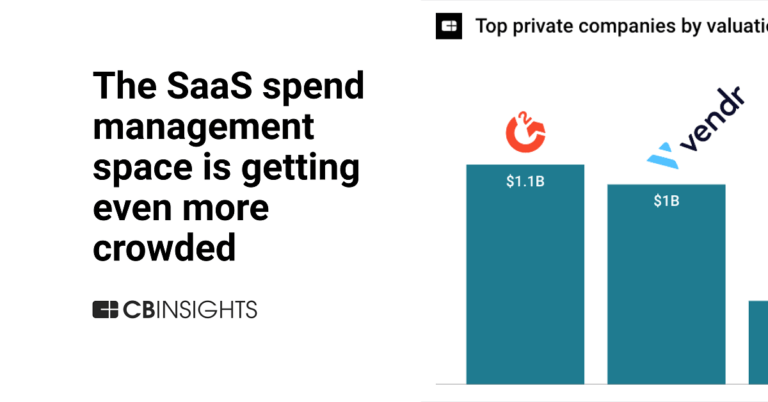

The spend management platforms market helps businesses control and optimize their expenditures through integrated software solutions, including corporate cards, expense management systems, procurement software, accounts payable automation, and budget tracking tools. These platforms use APIs, cloud-based infrastructure, and AI-powered analytics to provide real-time visibility into spending patterns…

Payhawk named as Outperformer among 15 other companies, including Coupa, Ramp, and Pleo.

Payhawk's Products & Differentiators

Payhawk

• Integrated global solution for managing company spending • Corporate bank accounts in multiple currencies with dedicated IBANs • Global company cards • Mobile app for employees • Powerful and flexible software for the finance accounting team • Best-in-class direct integrations with ERP mean no manual data transfer (especially Xero and Oracle NetSuite)

Loading...

Research containing Payhawk

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Payhawk in 10 CB Insights research briefs, most recently on Aug 23, 2024.

Aug 23, 2024

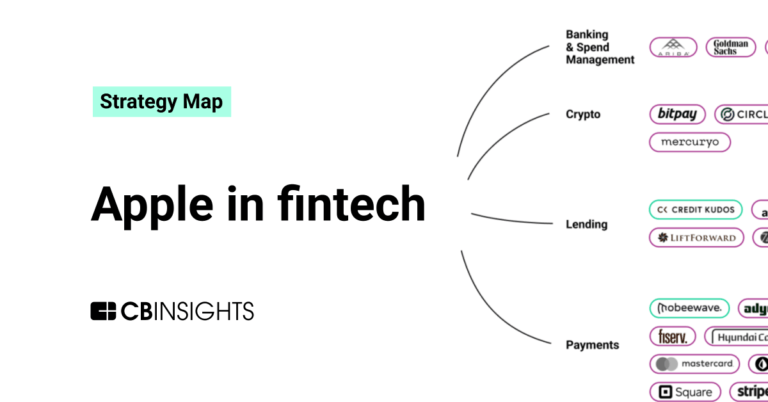

The B2B payments tech market map

Oct 11, 2022

The Transcript from Yardstiq: Klarna vs. Afterpay

Oct 4, 2022

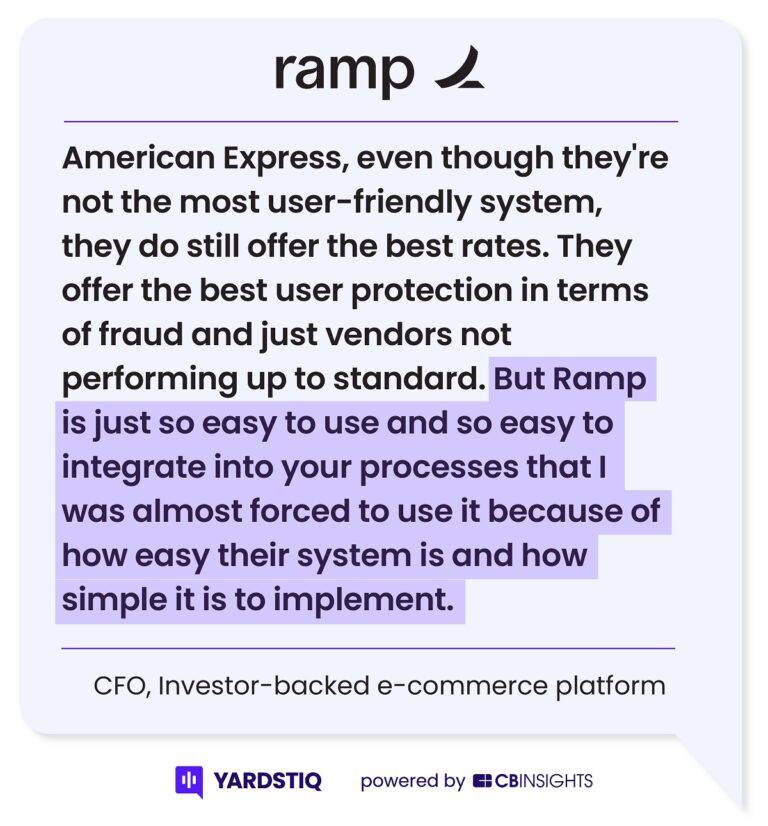

The Transcript from Yardstiq: Ramp vs. BrexExpert Collections containing Payhawk

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Payhawk is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,276 items

SMB Fintech

1,648 items

Payments

3,198 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,978 items

Excludes US-based companies

Fintech 100

449 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Fintech 100 (2024)

100 items

Latest Payhawk News

Jun 13, 2025

By Puja Sharma Share Payhawk , a platform offering an expense management solution for businesses in 32 countries, has signed a strategic partnership with Novutech , a consulting firm specialising in digital transformation for businesses across Europe and a NetSuite expert. This collaboration is part of a shared commitment to provide customers with more integrated, automated and efficient expense management solutions. According to McKinsey, only 20% of companies manage to capture more than half the projected benefits from ERP systems. Leading ERP vendors recognise the limitations of the “one size fits all” model of establishing an ERP within their clients’ business. They are shifting towards modularity, which means taking advantage of the best in class plug-ins to get an ERP set up that works in the right way. Among the market’s main differentiators, Payhawk stands out for its numerous ERP integrations and its ability to offer real-time control and visibility. With Novutech as a Payhawk user, their team quickly realised the tangible benefits of the platform: previously, they had been using manual processes to manage expense reports, which was very time-consuming for employees and meant that expenses took longer to process. Today, expense management is much faster, employees use company cards, data is entered automatically thanks to OCR technology, and native integration with NetSuite enables real-time synchronisation. “Today’s finance teams are being asked to provide strategic insights while still bogged down by manual reconciliation and data entry,” said Valentin Gerbi, Country Director of France at Payhawk. “This partnership with Novutech is particularly meaningful because they experienced firsthand how our real-time NetSuite integration transformed their own financial operations. Now they can bring that same efficiency to their entire client base, helping finance teams shift from processing to analysing.” As a partner in the digital transformation of finance, Novutech shares Payhawk’s vision of simplifying financial management through automation. Its team of NetSuite-certified experts, combining technical expertise and business knowledge, is ideally placed to implement Payhawk for new customers. Through this partnership, the two companies are joining forces to offer an even more consistent and comprehensive offering tailored to the current needs of finance departments. Among the concrete benefits: Customised NetSuite solutions by Novutech to manage key business processes Native integration that greatly simplifies accounting reconciliation processes with 99.7% of expenses exported to NetSuite with zero manual intervention Comprehensive expense management by Payhawk with real-time visibility and control of all company expenses (expense reports, supplier invoices, corporate cards, budgets). These benefits are now shared by Novutech customers across Europe, who enjoy a reliable solution and tailored support. “Our combined expertise enables us to help companies streamline their financial operations by providing them with unparalleled visibility into their spending. What makes Payhawk particularly compelling for our clients is their credit functionality, which eliminates the hassle of deposits, and their true credit cards that are accepted everywhere. Combined with their powerful AI receipt recognition and seamless, real-time integration with NetSuite, this creates a real differentiator in the market that delivers tangible value from day one,” added Maxime Lothe, CEO of Novutech. Previous Article

Payhawk Frequently Asked Questions (FAQ)

When was Payhawk founded?

Payhawk was founded in 2018.

Where is Payhawk's headquarters?

Payhawk's headquarters is located at 53-64 Chancery Lane, London.

What is Payhawk's latest funding round?

Payhawk's latest funding round is Series B - II.

How much did Payhawk raise?

Payhawk raised a total of $236.84M.

Who are the investors of Payhawk?

Investors of Payhawk include Earlybird Venture, Bek Ventures, QED Investors, Greenoaks, Repeat and 14 more.

Who are Payhawk's competitors?

Competitors of Payhawk include Husk, Yokoy, Brex, Spendesk, Pleo and 7 more.

What products does Payhawk offer?

Payhawk's products include Payhawk and 4 more.

Who are Payhawk's customers?

Customers of Payhawk include ATU, Luxair, Heroes, Payflow and Gtmhub.

Loading...

Compare Payhawk to Competitors

Spendesk provides financial management tools for businesses. It offers tools including corporate cards, automated invoice handling, procure-to-pay solutions, integrated budgeting features, virtual cards for payments, and expense claim management. It serves various sectors of the economy, including manufacturing, retail, green energy, and marketing. It was founded in 2016 and is based in Paris, France.

Pleo focuses on business spend management within the financial technology sector. The company offers company cards with individual spending limits and provides a platform to manage expenses, reimbursements, invoices, and budgets. It serves businesses looking to manage their spending and financial processes. The company was founded in 2015 and is based in København N, Denmark.

Soldo provides spend management solutions within the financial services sector. The company offers a platform that connects with financial systems to manage corporate spending through company cards, a mobile app for tracking expenses, and tools for financial compliance. Soldo serves businesses that need to manage their expense processes and gain insights into their spending. Soldo was formerly known as PX Technology. It was founded in 2014 and is based in London, United Kingdom.

Moss is a company that provides spend management solutions within the financial technology sector. The company has a platform that allows businesses to manage expenses, handle month-end financial closing, and connect with existing human resources and accounting systems. Moss serves finance teams that require expense management tools. It was founded in 2019 and is based in Berlin, Germany.

Brex provides spend management solutions across various sectors. The company offers products including corporate cards, expense management, travel, bill pay, and banking services aimed at assisting businesses in managing spending and financial processes. Brex serves startups, mid-size companies, and enterprises with its range of financial products. Brex was formerly known as Veyond. It was founded in 2017 and is based in Salt Lake City, Utah.

Mooncard operates as a software-as-a-service (SaaS) company that focuses on business expenses and corporate spend management. The company offers smart payment cards linked to accounting and management software, which automate expense reports and simplify the daily lives of employees. It primarily serves companies of all sizes across various sectors. The company was founded in 2016 and is based in Paris, France.

Loading...