PatSnap

Founded Year

2007Stage

Series E | AliveTotal Raised

$352.32MValuation

$0000Last Raised

$300M | 4 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+114 points in the past 30 days

About PatSnap

Patsnap provides intelligence within the technology and legal industries. Its offerings include analytics and insights for intellectual property and research and development, utilizing a domain-specific large language model. The company serves sectors that require innovative data and IP management, including law firms, life sciences, and high-tech industries. It was founded in 2007 and is based in London, United Kingdom.

Loading...

ESPs containing PatSnap

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

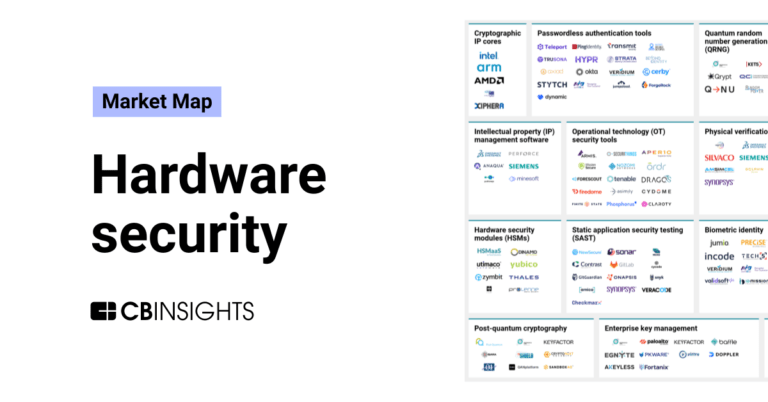

The intellectual property (IP) management software market enables businesses to streamline the process of organizing and protecting their intellectual property, such as patents, trademarks, copyrights, and trade secrets. IP management software includes features such as document management, search and tracking capabilities, compliance management, and collaboration tools. It caters to enterprises an…

PatSnap named as Leader among 13 other companies, including Siemens, Dassault Systemes, and Keysight Technologies.

PatSnap's Products & Differentiators

Analytics

Patsnap Analytics is a comprehensive IP intelligence platform designed to support innovation cultures of excellence by enabling organizations to perform accurate global patent searches and analyses to help identify, protect, manage and maximize success of their technologies. Empower IP and R&D teams alike with an intuitive and user-friendly product to drive innovation and draw powerful conclusions from patent data.

Loading...

Research containing PatSnap

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned PatSnap in 3 CB Insights research briefs, most recently on Feb 20, 2024.

Feb 20, 2024

The hardware security market map

Oct 10, 2023

The legal tech market mapExpert Collections containing PatSnap

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

PatSnap is included in 3 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,277 items

Market Research & Consumer Insights

734 items

This collection is comprised of companies using tech to better identify emerging trends and improve product development. It also includes companies helping brands and retailers conduct market research to learn about target shoppers, like their preferences, habits, and behaviors.

Drug Discovery Tech Market Map

221 items

This CB Insights Tech Market Map highlights 220 drug discovery companies that are addressing 12 distinct technology priorities that pharmaceutical companies face.

PatSnap Patents

PatSnap has filed 7 patents.

The 3 most popular patent topics include:

- rotating disc computer storage media

- computational linguistics

- computer storage media

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

11/22/2021 | 8/6/2024 | 3D imaging, Artificial neural networks, Rotating disc computer storage media, Image processing, 3D computer graphics | Grant |

Application Date | 11/22/2021 |

|---|---|

Grant Date | 8/6/2024 |

Title | |

Related Topics | 3D imaging, Artificial neural networks, Rotating disc computer storage media, Image processing, 3D computer graphics |

Status | Grant |

Latest PatSnap News

Jun 2, 2025

OsakaWayne Studios/Getty, Anna Pogrebkova, Tyler Le/BI Southeast Asian tech startups are increasingly targeting the US market for growth and opportunity. Traditionally, startups from the area focused locally, but AI is driving a shift to the US. Founders are finding that a physical presence in the US has become a necessity as business grows. Yoeven Khemlani knew he wanted to build a product for engineers like him. The Singaporean's friends told him they were spending tons of time maintaining code, web scraping, and translating their work for different markets. In July 2024, he launched JigsawStack, a company to create small models that could automate those tasks. One country — not his own — quickly became the source of his customers. "We saw a huge uptake of users and realized a lot of the early-stage customers that we got were from the US," Khemlani said. JigsawStack, which raised $1.5 million in pre-seed rounds from the venture capital firm Antler's Southeast Asia fund in October and February, is part of a growing group of Southeast Asian startups building products for US-based customers, rather than those in their backyard. For these software startups, the US's rising isolationism isn't threatening their customer base — yet. But sweeping tariffs on China may push up the cost of hardware they need to import into the US, such as servers. "Traditionally, Southeast Asian startups honed in on local or regional markets to solve unique, homegrown challenges," said Jussi Salovaara, a cofounder of Antler who leads investments in Asia. The ride-hailing apps Grab and GoJek — two of the region's best-known startups, now publicly listed — are examples of how founders in the early 2010s built for local needs. "However, as the ecosystem matures, founders are now setting their sights on the US, encouraged by a blend of opportunity and necessity," Salovaara said, adding that he'd seen more of these US-focused startups in the past three years in Southeast Asia. Southeast Asia is growing, but it doesn't have the US's firepower Southeast Asia, a group of 11 countries east of the Indian subcontinent and south of China, has seen skyrocketing economic growth over the past decade. Since 2015, the region's GDP has climbed more than 62% to $4.12 trillion, boosted by a growing middle and upper class. Between 2015 and 2021, the number of venture capital deals within the region more than tripled to 1,800, PitchBook data shows. Activity peaked in 2021 — a similar pattern to startup funding globally. Despite the region's growth, more Southeast Asia startups are choosing to focus on building products for the US, not for those around them. Founders and business experts note that the American market is more concentrated, more mature, and less price sensitive, all of which make it an attractive playing ground for new entrants. Plus, the US is leading in artificial intelligence, the major driver of today's global tech industry. "We're in an AI-first world where currently the US is at the epicenter of driving groundbreaking advancements," said Shailendra Singh, a managing director with Peak XV, the VC firm previously known as Sequoia Capital India & Southeast Asia. "This," he added, "is why we put in a lot of focus and effort on building global go-to-market operating teams in the US." And American businesses are happy to have them. "SEA startups are often positioned to offer high-quality, cost-competitive solutions that can undercut US-based alternatives, making them appealing to American businesses in need of cost-effective innovation," Antler's Salovaara said. To be sure, the model isn't unique to Southeast Asia. Nataliya Wright, an entrepreneurship professor at Columbia Business School, researched startups founded from 2000 to 2015 for a forthcoming paper on scaling. She found that software startups from small countries in Europe, for instance, typically focused on the US from the get-go. Southeast Asian countries such as Thailand and Vietnam, however, are considered midsize markets, with populations in the tens of millions. Startups from midsize markets tended to start with a local focus, assuming there would be enough customers. "A US orientation," Wright told Business Insider, "would suggest a departure from that model." 11 unique markets Working only within the region is tough. Southeast Asia is home to a huge diversity of languages, business practices, and household incomes. "You're spending five times more because you're entering five different markets," Khemlani, the JigsawStack founder, said about working in the region. The US and tech hubs like San Francisco allow startups to find an abundance of customers in one place, or at least in one country. "We don't have the resources to do two streams of marketing," Khemlani said. Khemlani founded JigsawStack in 2024.Yoeven Khemlani/Antler Having some American customers is good for fundraising, too, said Wright, the Columbia Business School professor. This is because of a bias called "foreign discounting" — VCs based in startup hubs such as Silicon Valley overlook or undervalue startups founded elsewhere, Wright said. When foreign startups show they have US customers, it helps cancel out that bias and could give them a leg up in future fundraising rounds. VCs say founders from the region have advantages. Singh, the Peak XV managing director, said Indian and Southeast Asian startups often have an underdog mindset. "They feel a startup in Silicon Valley is more polished and has better access to capital and talent, so they want to overcompensate by working harder, learning faster, and often they're understated and very hungry for success," he said. Hotbed for innovation Realfast is a Singaporean Peak XV-backed startup that builds AI agents for IT systems. Its cofounder, Sidu Ponnappa, has found that the US is the deepest market for its product. "Everything from deal velocity to deal size operates at a completely different level in the US," Ponnappa said. "Can you do the same thing for other markets? Yes, but it's always lower margin." Patsnap's founder, Jeffrey Tiong, and Guan Dian.PatSnap Guan Dian, who heads the Asia Pacific operations of Patsnap, a software maker for research and development projects that's backed by Vertex Ventures, said the company's founders always thought the US would be a priority market. While the startup has customers in 50 countries, more than half of its 5,000 customers are in the US. She said the company refined its branding to emphasize AI-powered features for industries such as biotech and advanced manufacturing, which dominate US patent filings. Cost consciousness among Southeast Asian customers is another reason founders are reaching abroad. "Southeast Asia is a little bit more price sensitive, and we tend to get a bit more into negotiation," Khemlani said. Cheaper labor means local customers try low-tech solutions or building themselves first, but that's starting to change as AI models get more complex and expensive, Khemlani said. 'Should we move our headquarters to America?' Founders don't want to fully decamp to the US, though, thanks to the ease of doing business in places such as Singapore. For startups including Multiplier, an HR platform backed by Tiger Global and Peak XV, Singapore's strong geopolitical relations with virtually every country are a big advantage over the US. "We do business with China and Taiwan, we do business with India and Pakistan, we do business with America and China," said Sagar Khatri, Multiplier's CEO and cofounder. "We've evaluated time and time again: Should we move our headquarters to America? And the answer has always been no," Khatri said. Amritpal Singh, Sagar Khatri, and Vamsi Krishna co-founded Multiplier.Multiplier The founders who spoke with BI also touted Singapore's tax policy — it doesn't tax capital gains — and government grants for tech companies. Some startups are splitting their people, moving one cofounder to the US while the other stays in Southeast Asia. For JigsawStack, being in the US is essential for networking. Khemlani, the founder, spent six months in the US last year and moved permanently this year to scale the startup. "You can't sell to the US when you're not there," he said. "Just going for an event or a hackathon in the US makes such a big difference in your sales." Read the original article on Business Insider

PatSnap Frequently Asked Questions (FAQ)

When was PatSnap founded?

PatSnap was founded in 2007.

Where is PatSnap's headquarters?

PatSnap's headquarters is located at Chiswick Park, 566 Chiswick High Street, London.

What is PatSnap's latest funding round?

PatSnap's latest funding round is Series E.

How much did PatSnap raise?

PatSnap raised a total of $352.32M.

Who are the investors of PatSnap?

Investors of PatSnap include HongShan, Shunwei Capital, Tencent, SoftBank, Vertex Ventures China and 7 more.

Who are PatSnap's competitors?

Competitors of PatSnap include PatentWatch, Cypris, Wert Intelligence, International Products Generated, ResoluteAI and 7 more.

What products does PatSnap offer?

PatSnap's products include Analytics and 4 more.

Who are PatSnap's customers?

Customers of PatSnap include Banner Witcoff, Vyriad, TuSimple, BOA and Oxiteno.

Loading...

Compare PatSnap to Competitors

Amplified uses artificial intelligence within the intellectual property sector to assist in patent research. The company offers a platform that organizes and analyzes global patent and scientific information, enabling research, documentation, and collaboration for teams. Amplified serves corporate research and development and IP teams, as well as patent law firms, by offering tools for searching and analyzing patent data. It was founded in 2017 and is based in San Francisco, California.

InQuartik provides intellectual property software within the patent analytics industry. The company offers tools for patent work, including automated prior art searches, patent portfolio evaluations, and monitoring of ETSI standard essential patents. InQuartik's solutions address patent litigation, due diligence, freedom to operate, and patent portfolio analysis needs. It is based in Los Angeles, California.

Dolcera is a company that specializes in intellectual property, market research, and competitive strategy. The company offers services such as patent analysis, market research, and business research, with a focus on providing insights for decision making in the intellectual property space. Dolcera primarily serves corporations in various industries, including technology, life sciences, and consumer products. It is based in San Mateo, California.

Relecura Inc is a company that focuses on artificial intelligence (AI) and its application in the innovation landscape, operating within the technology and AI industry. The company offers an AI platform that provides solutions for managing patents and technical data, automating competitor analysis, identifying emerging technologies and companies, and supporting strategic decision-making with real-time data. Relecura primarily sells to sectors such as corporations, law firms, technology companies, IP services firms, R&D organizations, and academic institutions. It is based in Bengaluru, India.

RPX provides patent risk solutions within the legal and intellectual property sectors. It offers services including defensive patent buying, acquisition syndication, patent intelligence, and advisory services. It serves sectors such as automotive, consumer electronics, financial services, media, mobile communications, networking, and semiconductors. It was founded in 2008 and is based in San Francisco, California.

PioneerIP provides automation tools for patent infringement searches within the intellectual property management sector. The company offers web-based tools for monitoring patent infringements, analyzing patent applications for conflicts, and identifying licensing and litigation opportunities. PioneerIP serves inventors, in-house IP counsels, patent attorneys, and investors. It was founded in 2024 and is based in Concord, Canada.

Loading...